Style Underperformer:

Sector Underperformers:

- 1) Gold & Silver -1.92% 2) Oil Tankers -1.51% 3) Social Media -.86%

Stocks Falling on Unusual Volume:

- SNN, CSWC, CSGP, ENBL, XONE, USLV, GLP, EVEP, BCPC, AMBA, GLNG, MZOR, MAIN, ARDX, SNI, PRTA, NGG, SXE, SAIA, IFN, PBYI, FARO, ANET, BT and QIWI

Stocks With Unusual Put Option Activity:

- 1) JNPR 2) TWC 3) MON 4) SWN 5) IEV

Stocks With Most Negative News Mentions:

- 1) SWKS 2) COP 3) AET 4) CAVM 5) RFMD

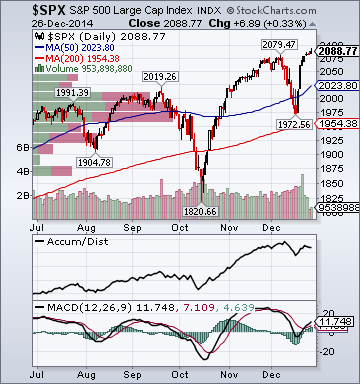

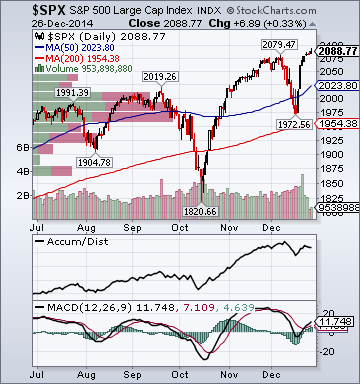

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Gaming +1.62% 2) Steel +1.33% 3) Utilities +.89%

Stocks Rising on Unusual Volume:

Stocks With Unusual Call Option Activity:

- 1) BURL 2) AEO 3) MPC 4) RAD 5) TMUS

Stocks With Most Positive News Mentions:

- 1) GOOG 2) IMKTA 3) NVDA 4) LIVE 5) CRY

Charts:

Weekend Headlines

Bloomberg:

- The 94% Plunge That Shows Abenomics Is Losing Global Investors. Foreign

investors have had just about enough of Abenomics. After pumping record

amounts of cash into Japanese shares last year, they’ve hardly added to

holdings in 2014. Inflows are down 94 percent this year to 898

billion yen ($7.5 billion), on pace for the smallest annual amount since

the 2008 global

financial crisis. The month of April 2013 alone registered

almost three times as much foreign investment in the stock

market as all of 2014.

- Ukraine Tightens Controls Along Borders With Russia, Rebel Areas. Ukraine

halted transportation links with Crimea, which was annexed by Russia in

March, and stepped up checks along its borders on concern that

saboteurs might attempt

to enter the country from breakaway areas. “Very intensive saboteur and reconnaissance actions are

being carried out now,” Ukrainian military spokesman Andriy Lysenko told reporters today in Kiev. “This measure is

temporary. It won’t be permanent.”

- China’s Industrial Profits Drop Most in Two Years Amid Slowdown.

China’s industrial profits fell the most in two years last month, the

latest data to show a deepening slowdown in the world’s second-biggest

economy as pressure grows on the nation’s central bank to ease monetary

conditions. Total profits of China’s industrial enterprises in

November dropped 4.2 percent from a year earlier, the National Bureau of

Statistics said today in Beijing. That followed October’s 2.1

percent decline and a 0.4 percent increase in September. It’s

the biggest slide since August 2012, when profits slumped 6.2

percent.

- AirAsia Drops Most Since 2011 After Flight to Singapore Vanishes.

AirAsia Bhd. (AIRA) shares headed for the biggest tumble in three years

after the Malaysian budget carrier’s flight QZ8501 disappeared en route

from Indonesia to Singapore yesterday. The stock slid as much as 13 percent to 2.56 ringgit and was 8.2 percent lower at 9:38 a.m. local time.

Shares were cut to a trading sell from buy at Hong Leong Investment

Bank Bhd., which lowered its price target to 2.64 ringgit from 3.15

ringgit. AirAsia X Bhd., the long-haul arm of AirAsia, fell 6.6

percent. The FTSE Bursa Malaysia KLCI Index lost 0.6 percent.

- Asian Stocks Climb as Oil Rises While Euro Maintains Loss.

Asian stocks rose with markets from Sydney to Hong Kong resuming

trading following the Christmas holiday break. The euro traded near a

two-year low while oil advanced. The MSCI Asia Pacific Index climbed 0.1 percent by 10:15 a.m. in Tokyo.

Japan’s Topix index gained 0.2 percent, set for its highest close since

Dec. 9. The Kospi gauge fell 0.5 percent in Seoul as Samsung

Electronics Co. traded without the right to a dividend. AirAsia Bhd

(AIRA) tumbled as much as 13 percent after one

of its planes went missing.

- Iron‑Ore Slump Failing to End Glut as Mines Expand. The collapse in global iron-ore prices isn’t chasing Gina Rinehart away

from the red soil of Western Australia that made her a billionaire. Like

producers in Brazil and some in China, she can still profit from the

metal.

- Copper Near Four-Year Low Amid Signs of Slowdown in China. Copper in London traded near a four-year low

after Chinese industrial profits fell and before a manufacturing

gauge for the country, the largest metals consumer. The London

Metal Exchange resumed trading after the Christmas break.

Copper dropped as much as 1.1 percent after closing at the

lowest since June 2010 on Dec. 24.

Wall Street Journal:

- Fees Get Leaner on Private Equity. Under Pressure From Investors, Regulators, Firms Give Up Claim on Some Revenue. Facing pressure from investors and heightened scrutiny from federal

regulators, some of the largest private-equity firms are giving up their

claim to fees that generated hundreds of millions of dollars for them

over the years.

Fox News:

- Families wait as search resumes for missing AirAsia plane carrying 162.

A massive search is underway for the missing AirAsia plane carrying

162 people that disappeared on Sunday just after the pilot requested a

change in course to avoid bad weather. Rescuers are scouring the Java

Sea after their search was halted at night fall late Sunday, Indonesia’s

transport ministry told the Star in Malaysia.

New York Times:

- As Medicaid Rolls Swell, Cuts in Payments to Doctors Threaten Access to Care.

Just as millions of people are gaining insurance through Medicaid, the

program is poised to make deep cuts in payments to many doctors,

prompting some physicians and consumer advocates to warn that the

reductions could make it more difficult for Medicaid patients to obtain

care. The Affordable Care Act provided a big increase in Medicaid

payments for primary care in 2013 and 2014. But the increase expires on

Thursday — just weeks after the Obama administration told the Supreme

Court that doctors and other providers had no legal right to challenge

the adequacy of payments they received from Medicaid. The impact will

vary by state, but a study by the Urban Institute, a nonpartisan

research organization, estimates that doctors who have been receiving

the enhanced payments will see their fees for primary care cut by 43

percent, on average.

Reuters:

- North Korean Internet, 3G mobile network "paralyzed" - Xinhua. North Korea's

Internet and 3G mobile networks were paralyzed again on Saturday

evening, China's official Xinhua news agency reported on Saturday, with

the North Korean government blaming the United States for systemic

instability in the country's networks.

Financial Times:

- China zombie factories kept open to give illusion of prosperity.

“If you cut down the big tree, all the small trees around it will die,”

says 69-year-old Wang Peiqing, referring to the collapse of Highsee

Iron and Steel Group, which operated the foundries before its recent

closure devastated the economy of a once-prosperous corner of Shanxi

province in central China. “The entire region relied on the steel mill;

now the young people have to go and look for work across China.” Highsee

stopped paying its 10,000 employees six months ago. Local officials

estimate the plant supported indirectly the

livelihood of about a quarter of Wenxi county’s population of 400,000.

Across

the vast expanses of China, similar experiences are playing out, with

thousands of companies in heavy industrial sectors plagued by chronic

overcapacity that should be going bust instead being propped up by local

governments.

Telegraph:

Welt:

- Merkel Adviser Opposes ECB Govt Bond Purchases at Present. There

is no reason for the ECB to currently buy government bonds, citing

Christoph Schmidt, head of German Chancellor Angela Merkel's council of

economic advisers, as saying in an interview. Points to high risk of

buying government bonds; says France, Italy could postpone again

necessary reforms.

FAS:

- Weidmann: ECB Mustn't Bow to Markets' Bond-Buying Pressure. ECB

Governing Council member Jens Weidmann says in interview it shouldn't be

decisive for the bank's decision-making that markets have been pushing

for and expect ECB bond purchases. Weidmann, who's also Bundesbank

President said: Cheap oil is acting like a stimulus package, "so why put

monetary policy measures on top of that?" The euro region's central

banks would be liable together for any losses from bond purchases, and

in the end the taxpayers would foot the bill.

Shanghai Securities News:

- China Researcher Sees No Economic Hard Landing Next Year.

Infrastructure investment will continue to support China's economic

growth, citing former PBOC adviser Yu Yongding. Growth will fall

"significantly" as the economy enters a new development phase, Yu said.

Night Trading

- Asian indices are unch. to +1.25% on average.

- Asia Ex-Japan Investment Grade CDS Index 103.50 unch.

- Asia Pacific Sovereign CDS Index 64.5 unch.

- NASDAQ 100 futures +.20%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

10:30 am EST

- Dallas Fed Manufacturing Activity for December is estimated to fall to 9.0 versus 10.5 in November.

Upcoming Splits

Other Potential Market Movers

- The German Retail Sales report could

also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by real estate

and commodity shares in the region. I expect US stocks to open

modestly higher and to weaken into the afternoon, finishing mixed. The

Portfolio is 50% net long heading into the week.

Global Week Ahead by BusinessDesk.

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on global

growth worries, rising European/Emerging Markets/US High-Yield debt

angst, earnings concerns, profit-taking, technical selling and yen

strength. My intermediate-term trading indicators are giving neutral

signals and the Portfolio is 50% net long heading into the week.

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,215.21 +1.93%

- S&P 500 High Beta 34.55 +1.29%

- Wilshire 5000 21,712.70 +1.44%

- Russell 1000 Growth 975.23 +1.29%

- Russell 1000 Value 1,041.78 +1.50%

- S&P 500 Consumer Staples 509.71 +1.35%

- Solactive US Cyclical 142.83 +1.80%

- Morgan Stanley Technology 1,036.03 +1.81%

- Transports 9,199.65 +2.75%

- Bloomberg European Bank/Financial Services 104.41 +4.17%

- MSCI Emerging Markets 39.05 +1.89%

- HFRX Equity Hedge 1,178.18 +1.30%

- HFRX Equity Market Neutral 987.91 +.28%

Sentiment/Internals

- NYSE Cumulative A/D Line 232,014 +1.04%

- Bloomberg New Highs-Lows Index 53 +189

- Bloomberg Crude Oil % Bulls 31.43 n/a

- CFTC Oil Net Speculative Position 284,079 n/a

- CFTC Oil Total Open Interest 1,475,862 n/a

- Total Put/Call .72 -17.24%

- OEX Put/Call 2.06 +142.35%

- ISE Sentiment 96.0 +41.18%

- Volatility(VIX) 14.50 -13.74%

- S&P 500 Implied Correlation 64.52 +.58%

- G7 Currency Volatility (VXY) 9.74 +2.96%

- Emerging Markets Currency Volatility (EM-VXY) 10.79 -1.91%

- Smart Money Flow Index 17,222.46 -1.21%

- ICI Money Mkt Mutual Fund Assets $2.713 Trillion +.76%

- ICI US Equity Weekly Net New Cash Flow -$4.179 Billion

Futures Spot Prices

- Reformulated Gasoline 150.87 -1.97%

- Heating Oil 190.79 -2.47%

- Bloomberg Base Metals Index 180.99 -.17%

- US No. 1 Heavy Melt Scrap Steel 309.0 USD/Ton unch.

- China Iron Ore Spot 66.94 USD/Ton -3.22%

- UBS-Bloomberg Agriculture 1,256.61 +.08%

Economy

- ECRI Weekly Leading Economic Index Growth Rate -3.3% -20 basis points

- Philly Fed ADS Real-Time Business Conditions Index .6459 unch.

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 125.61 -.31%

- Citi US Economic Surprise Index 38.60 +7.1 points

- Citi Eurozone Economic Surprise Index 3.30 +4.1 points

- Citi Emerging Markets Economic Surprise Index -13.90 -1.1 points

- Fed Fund Futures imply 50.0% chance of no change, 50.0% chance of 25 basis point cut on 1/28

- US Dollar Index 90.03 +.93%

- Euro/Yen Carry Return Index 153.14 +.31%

- Yield Curve 151.0 -1.0 basis point

- 10-Year US Treasury Yield 2.25% +9.0 basis points

- Federal Reserve's Balance Sheet $4.462 Trillion unch.

- U.S. Sovereign Debt Credit Default Swap 16.04 +.08%

- Illinois Municipal Debt Credit Default Swap 182.0 +1.99%

- Western Europe Sovereign Debt Credit Default Swap Index 26.68 -9.47%

- Asia Pacific Sovereign Debt Credit Default Swap Index 64.44 -5.04%

- Emerging Markets Sovereign Debt CDS Index 300.86 -1.24%

- Israel Sovereign Debt Credit Default Swap 74.84 -.88%

- Iraq Sovereign Debt Credit Default Swap 377.21 -.22%

- Russia Sovereign Debt Credit Default Swap 438.87 -2.83%

- China Blended Corporate Spread Index 338.50 -1.38%

- 10-Year TIPS Spread 1.68% -1.0 basis point

- TED Spread 25.5 +3.25 basis points

- 2-Year Swap Spread 18.5 -4.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -14.25 -.25 basis point

- N. America Investment Grade Credit Default Swap Index 63.95 -1.77%

- America Energy Sector High-Yield Credit Default Swap Index 633.0 +1.0%

- European Financial Sector Credit Default Swap Index 62.29 -5.60%

- Emerging Markets Credit Default Swap Index 325.54 -.29%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 88.0 unch.

- M1 Money Supply $2.892 Trillion unch.

- Commercial Paper Outstanding 1,074.0 unch.

- 4-Week Moving Average of Jobless Claims 290,250 -8,500

- Continuing Claims Unemployment Rate 1.8% unch.

- Average 30-Year Mortgage Rate 3.83% +3 basis points

- Weekly Mortgage Applications 363.10 +.86%

- Bloomberg Consumer Comfort 43.1 +1.4 points

- Weekly Retail Sales +4.40% +40 basis points

- Nationwide Gas $2.32/gallon -.13/gallon

- Baltic Dry Index 782.0 -5.44%

- China (Export) Containerized Freight Index 1,044.99 +.83%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 32.50 -7.14%

- Rail Freight Carloads 272,961 -2.63%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (23)

- IMDZ, PETX, ZFGN, OVAS, VRNS, RDUS, INGN, VSAR, ENTA, VNDA, MDLY, MGNX, CIVI, MCS, INCR, CTAS, FMI, EXAM, ALLY and SPOK

Weekly High-Volume Stock Losers (12)

- WGO, MLHR, ICON, ATRA, DERM, ACHN, DNKN, CAMP, GILD, WOR, FINL and OCN

Weekly Charts

ETFs

Stocks

*5-Day Change