S&P 500 1,111.48 +.28%

NASDAQ 1,925.82 +.75%

Leading Sectors

Software +1.73%

Biotech +1.4%

Retail +1.31%

Lagging Sectors

Papers -1.27%

Airlines -1.49%

Oil Service -1.81%

Other

Crude Oil 53.46 -2.69%

Natural Gas 6.79 +1.21%

Gold 417.60 -.60%

Base Metals 113.12 -1.23%

U.S. Dollar 87.10 +.01%

10-Yr. T-note Yield 4.06% +.14%

VIX 14.94 -.66%

Put/Call .79 -10.23%

NYSE Arms 1.16 -17.14%

Market Movers

MMC -8.8% on continuing worries over Spitzer probe.

CHKP +16.4% after beating 3Q estimates and raising 4Q/04 guidance.

MMM -4.4% after missing 3Q estimates, lowering 4Q guidance and Prudential downgrade to Neutral.

ODSY -43.0% after cutting 3Q/04 forecasts and announcing Dept. of Justice civil investigation.

SEM +23.0% after agreeing to be taken private for $1.82 billion excluding debt.

JQH +15.4% after saying it had received a proposal from Barcelo Crestline Corp. to acquire it for $13.00 in cash per class A share.

APOL +4.5% on Morgan Stanley upgrade to Overweight, target $85.

PLMO +7.9% on JP Morgan upgrade to Overweight.

ICUI -16.5% after missing 3Q estimates.

CHE -8.6% and HALTED, boosting forecast, indicated $53-56.

BGG -6.9% after lowering 1Q/05 forecast.

MNC -8.8% after cutting 3Q forecast.

TZOO -5.8% after American Technology downgrade to Sell.

ASD -4.2% after missing 3Q estimates and lowering 4Q forecast.

GIVN -3.7% on negative Barron's mention.

Economic Data

NAHB Housing Market Index for October rose to 72 versus estimates of 68 and a reading of 67 in September.

Recommendations

Goldman Sachs reiterated Outperform on INTC, AMD, MDT, MET, FS and IGT. Goldman reiterated Underperform on EK and FRX. Citi SmithBarney reiterated Buy on MDT, target $62. Citi reiterated Buy on GDT, target $55. Citi reiterated Buy on AMGN, target $90. Citi raised VECO to Buy, target $26. Citi reiterated Buy on FON, target $22. Citi reiterated Buy on L, target $11.50. Citi reiterated Buy on WB, target $53. Citi reiterated Buy on WMT, target $65. Citi reiterated Buy on PEG, target $45. OSUR raised to Outperform at Thomas Weisel, target $11. VRTS rated Outperform at CSFB, target $25. PLMO raised to Overweight at JP Morgan. VRX rated Buy at Merrill Lynch, target $32. PEP raised to Buy at Merrill, target $55. KZL raised to Outperform at Bear Stearns, target $54.

Mid-day News

U.S. stocks are mostly higher mid-day on a decline in energy prices. Kraft Foods is considering selling Oscar Mayer meats and Post cereals, the NY Post reported. Increased terrorist attacks in Iraq are aimed at U.S. President Bush personally, as terrorists seek to keep him from getting re-elected, Russian President Putin said, the Itar-Tass news agency reported. Blue Coat Systems, whose devices thwart computer viruses and filter Internet content, is enhancing its proxy servers with software to block spyware and adware programs, which disrupt computer users' Internet activity, the Wall Street Journal reported. Video-game makers have created a format that allows advertisers to insert changeable information into "virtual billboards" within the game, the Wall Street Journal reported. Fannie Mae's plan to report third quarter earnings by Nov. 15 instead of its typical mid-October timeframe suggests the company will have to restate profit, the Financial Times said. Kojo Annan, the son of United Nations Secretary-General Kofi Annan, is among people and companies under investigation by a federal grand jury looking into the massive corruption in Iraq's $64 billion UN oil-for-food program, the NY Post reported. Lexmark Intl., the No.2 maker of computer printers, said third-quarter profit rose 50% on a tax benefit and sales of higher-profit machines, Bloomberg reported. SynCardia Systems won FDA approval to sell an artificial heart, the first such device available for commercial use in the U.S., Bloomberg said. Kmart Holding named Yum! Brands executive Lewis as CEO, replacing Julian Day, to improve retail operations, Bloomberg said. Harmony Gold Mining made a hostile offer to buy Gold Fields for $8.2 billion in stock to create the world's largest producer of the precious metal, Bloomberg reported. Crude oil is dropping after reaching $55.33/bbl. in NY amid concern that rising prices will reduce the growth of demand for petroleum products, Bloomberg reported.

BOTTOM LINE: The Portfolio is higher mid-day on strength in my wireless, internet and retail longs. I added a few new longs this morning, bringing the Portfolio's market exposure to 100% net long. One of my new longs is ARO and I am using a stop-loss of $28 on this position. The tone of the market is mildly positive. I continue to expect technology stocks to outperform at least through year-end. It is a big positive to see gasoline futures with a significant decline. On the negative-side, measures of investor anxiety are falling and the advance/decline line is relatively weak. I expect U.S. stocks to rise modestly from currently levels into the afternoon on short-covering and optimism over a possible peak in energy prices.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, October 18, 2004

Monday Watch

Earnings of Note

Company/Estimate

MMM/.98

CHKP/.25

CKFR/.26

DPH/-.12

ET/.18

FRX/.76

IBM/1.14

ITT/1.15

LXK/.97

LNCR/.69

MCHP/.29

SWK/.71

TXN/.27

Splits

NUE 2-for-1

Economic Data

NAHB Housing Market Index for October estimated at 68 versus 68 in September.

Weekend Recommendations

Wall Street Week w/Fortune had guests that were positive on IMGC, CEG, ZMH and IACI. Cashin' In had guests that were positive on IPR, TROW, TXN and mixed on C. Louis Rukeyser's Wall Street had guests that were positive on NOVL, SIRI, XMSR, MSFT, TWX, SEE and IMA. Barron's had positive comments on NVS, ACN, ISTA, DOVP and negative comments on GIVN, MNKD, INTC. Goldman Sachs reiterated Outperform on AMGN, ALL, AIG, RE, ENG, UDR, ASN and MUR. Goldman reiterated Underperform on PPS, PSA, EQR and MMC.

Weekend News

Abercrombie & Fitch agreed to stop using Australian wool after being pressured by an animal rights group, People for the Ethical Treatment of Animals, the Australian Broadcasting Corp. said. Citigroup and American Express blocked their credit cards in the U.K. from being used to pay for online gambling to prevent fraud and reduce indebtedness, the Financial Times reported. Hundreds of British soldiers may be moved to Baghdad within a few weeks to help boost U.S.-led operations in the run-up to Iraq's elections in January, the London-based Times reported. About 70,000 refugees in Sudan's western Darfur region have died from malnutrition and disease, the NY Times reported, citing the World Health Organization. Senator Kerry and President Bush's campaign commercials use the most ominous imagery seen in presidential ads in a generation, the NY Times said, citing analysts and historians. California's Bay Area residents are experiencing the cleanest air quality in 35 years, the San Jose Mercury News reported. Iraq's power grid now has more megawatts than before the U.S.-led invasion, which should boost Iraqis trust in their government, the NY Times reported. South Korea plans to extend the deployment of its troops in Iraq by a year, Yonhap news reported. Airbus SAS CEO Forgeard said he is seeking a U.S. partner to help in a $23 billion bid to supply the U.S. Air Force with aircraft-refueling tanker planes, the Sunday Telegraph said. Merrill Lynch and Morgan Stanley may be forced to merge with larger commercial firms as the two investment banks' share prices have declined by 20% from their 2004 highs, the NY Times reported. More than 25,000 poll watchers are being mobilized across the U.S. to scrutinize the Nov.2 presidential election for voting irregularities, the LA Times reported. Ford will offer Sirius Satellite Radio as an option in more of its cars and trucks, the NY Times said. Afghan President Karzai maintained his lead over the main opposition candidate Qanooni in early results from the Oct. 9 presidential election, Bloomberg reported. An estimated 75% of the more than 10 million Afghans eligible to vote took part in the country's first direct presidential election, just three years after the Taliban were ousted in the U.S.-led war on terror, Bloomberg said. SBC Communications is offering new and existing customers of its high-speed Internet service free wireless Web access through April to boost demand for its offerings, Bloomberg reported.

Late-Night Trading

Asian indices are mostly lower, -.50% to +.25% on average.

S&P 500 indicated +.01%.

NASDAQ 100 indicated +.21%

BOTTOM LINE: I expect U.S. stocks to open modestly higher in the morning on short-covering and follow-through on Friday's rally. The Portfolio is 75% net long heading into the week.

Company/Estimate

MMM/.98

CHKP/.25

CKFR/.26

DPH/-.12

ET/.18

FRX/.76

IBM/1.14

ITT/1.15

LXK/.97

LNCR/.69

MCHP/.29

SWK/.71

TXN/.27

Splits

NUE 2-for-1

Economic Data

NAHB Housing Market Index for October estimated at 68 versus 68 in September.

Weekend Recommendations

Wall Street Week w/Fortune had guests that were positive on IMGC, CEG, ZMH and IACI. Cashin' In had guests that were positive on IPR, TROW, TXN and mixed on C. Louis Rukeyser's Wall Street had guests that were positive on NOVL, SIRI, XMSR, MSFT, TWX, SEE and IMA. Barron's had positive comments on NVS, ACN, ISTA, DOVP and negative comments on GIVN, MNKD, INTC. Goldman Sachs reiterated Outperform on AMGN, ALL, AIG, RE, ENG, UDR, ASN and MUR. Goldman reiterated Underperform on PPS, PSA, EQR and MMC.

Weekend News

Abercrombie & Fitch agreed to stop using Australian wool after being pressured by an animal rights group, People for the Ethical Treatment of Animals, the Australian Broadcasting Corp. said. Citigroup and American Express blocked their credit cards in the U.K. from being used to pay for online gambling to prevent fraud and reduce indebtedness, the Financial Times reported. Hundreds of British soldiers may be moved to Baghdad within a few weeks to help boost U.S.-led operations in the run-up to Iraq's elections in January, the London-based Times reported. About 70,000 refugees in Sudan's western Darfur region have died from malnutrition and disease, the NY Times reported, citing the World Health Organization. Senator Kerry and President Bush's campaign commercials use the most ominous imagery seen in presidential ads in a generation, the NY Times said, citing analysts and historians. California's Bay Area residents are experiencing the cleanest air quality in 35 years, the San Jose Mercury News reported. Iraq's power grid now has more megawatts than before the U.S.-led invasion, which should boost Iraqis trust in their government, the NY Times reported. South Korea plans to extend the deployment of its troops in Iraq by a year, Yonhap news reported. Airbus SAS CEO Forgeard said he is seeking a U.S. partner to help in a $23 billion bid to supply the U.S. Air Force with aircraft-refueling tanker planes, the Sunday Telegraph said. Merrill Lynch and Morgan Stanley may be forced to merge with larger commercial firms as the two investment banks' share prices have declined by 20% from their 2004 highs, the NY Times reported. More than 25,000 poll watchers are being mobilized across the U.S. to scrutinize the Nov.2 presidential election for voting irregularities, the LA Times reported. Ford will offer Sirius Satellite Radio as an option in more of its cars and trucks, the NY Times said. Afghan President Karzai maintained his lead over the main opposition candidate Qanooni in early results from the Oct. 9 presidential election, Bloomberg reported. An estimated 75% of the more than 10 million Afghans eligible to vote took part in the country's first direct presidential election, just three years after the Taliban were ousted in the U.S.-led war on terror, Bloomberg said. SBC Communications is offering new and existing customers of its high-speed Internet service free wireless Web access through April to boost demand for its offerings, Bloomberg reported.

Late-Night Trading

Asian indices are mostly lower, -.50% to +.25% on average.

S&P 500 indicated +.01%.

NASDAQ 100 indicated +.21%

BOTTOM LINE: I expect U.S. stocks to open modestly higher in the morning on short-covering and follow-through on Friday's rally. The Portfolio is 75% net long heading into the week.

Sunday, October 17, 2004

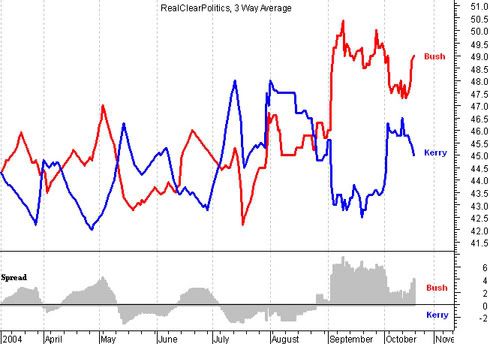

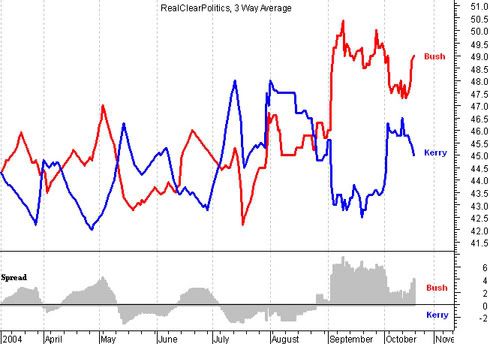

Chart of the Week

2004 Presidential Race - RealClearPolitics Poll Average

RCP Poll Average (10/13 - 10/16): Bush 49.0%, Kerry 45.0%, Nader 1.7% | Bush +4.0

Bottom Line: The above graph is an average of all the major Presidential polls from RealClearPolitics.com. It is my contention that the Presidential election is having a much more profound effect on the economy than is generally believed. Historically bitter and divisive rhetoric, 24-7 negative media coverage, domestic terrorism fears and uncertainty over the very different directions the candidates plan to lead the country are having a significant impact on the psychology of consumers and corporate decision-makers.

RCP Poll Average (10/13 - 10/16): Bush 49.0%, Kerry 45.0%, Nader 1.7% | Bush +4.0

Bottom Line: The above graph is an average of all the major Presidential polls from RealClearPolitics.com. It is my contention that the Presidential election is having a much more profound effect on the economy than is generally believed. Historically bitter and divisive rhetoric, 24-7 negative media coverage, domestic terrorism fears and uncertainty over the very different directions the candidates plan to lead the country are having a significant impact on the psychology of consumers and corporate decision-makers.

Weekly Outlook

There are a number of important economic reports and significant corporate earnings reports scheduled for release this week. Economic reports include Net Foreign Security Purchases(Mon.), Housing Market Index(Mon.), Consumer Price Index(Tues.), CPI Ex Food & Energy(Tues.), Housing Starts(Tues.), Building Permits(Tues.), Initial Jobless Claims(Thur.), Continuing Claims(Thur.), Leading Indicators(Thur.) and Philly Fed.(Thur.). The CPI, Housing Starts, Jobless Claims, Leading Indicators and Philly Fed. all have market-moving potential.

Intl. Business Machines(IBM-Mon.), Lexmark Intl.(LXK-Mon.), Texas Instruments(TXN-Mon.), 3M(MMM-Mon.), Altria(MO-Tues.), Electronic Arts(ERTS-Tues.), Motorola(MOT-Tues.), Taser Intl.(TASR-Tues.), Boston Scientific(BSX-Tue.), McDonald's(MCD-Tues.), JP Morgan(JPM-Wed.), EBay(EBAY-Wed.), Harrah's Entertainment(HET-Wed.), Honeywell(HON-Wed.), United Technologies(UTX-Wed.), Microsoft(MSFT-Thur.), SBC Communications(SBC-Thur.), Caterpillar(CAT-Thur.), Merck(MRK-Thur.), American Intl. Group(AIG-Thur.), Coca Kola(KO-Thur.) and Amazon(AMZN-Fri.) are some of the more important companies that release quarterly earnings this week. There are also some other events that have market-moving potential. The Semi Book-to-Bill report(Mon.), Fed's Poole speaking(Tues.), Fed's Greenspan speaking(Tues.), Fed's Poole speaking(Thur.) could also impact trading this week.

Bottom Line: I expect U.S. stocks to finish the week mixed-to-weaker as worries over earnings, energy prices, lawsuits and politics offset diminishing domestic terrorism fears, optimism over future economic growth and an improvement of the big picture in Iraq. I continue to believe the major indices are consolidating recent gains before another more significant move higher, beginning within the next 10 days. Oil above $60/bbl., a major terrorist attack or a delay in the outcome of the Presidential election would change my positive view for this quarter. My short-term trading indicators are giving mixed signals and the Portfolio is 75% net long heading into the week.

Intl. Business Machines(IBM-Mon.), Lexmark Intl.(LXK-Mon.), Texas Instruments(TXN-Mon.), 3M(MMM-Mon.), Altria(MO-Tues.), Electronic Arts(ERTS-Tues.), Motorola(MOT-Tues.), Taser Intl.(TASR-Tues.), Boston Scientific(BSX-Tue.), McDonald's(MCD-Tues.), JP Morgan(JPM-Wed.), EBay(EBAY-Wed.), Harrah's Entertainment(HET-Wed.), Honeywell(HON-Wed.), United Technologies(UTX-Wed.), Microsoft(MSFT-Thur.), SBC Communications(SBC-Thur.), Caterpillar(CAT-Thur.), Merck(MRK-Thur.), American Intl. Group(AIG-Thur.), Coca Kola(KO-Thur.) and Amazon(AMZN-Fri.) are some of the more important companies that release quarterly earnings this week. There are also some other events that have market-moving potential. The Semi Book-to-Bill report(Mon.), Fed's Poole speaking(Tues.), Fed's Greenspan speaking(Tues.), Fed's Poole speaking(Thur.) could also impact trading this week.

Bottom Line: I expect U.S. stocks to finish the week mixed-to-weaker as worries over earnings, energy prices, lawsuits and politics offset diminishing domestic terrorism fears, optimism over future economic growth and an improvement of the big picture in Iraq. I continue to believe the major indices are consolidating recent gains before another more significant move higher, beginning within the next 10 days. Oil above $60/bbl., a major terrorist attack or a delay in the outcome of the Presidential election would change my positive view for this quarter. My short-term trading indicators are giving mixed signals and the Portfolio is 75% net long heading into the week.

Market Week in Review

S&P 500 1,108.20 -1.24%

Click here for the Weekly Wrap by Briefing.com

Bottom Line: Market action last week was mostly negative as insurance and base metal stocks led the major indices lower. Considering energy's continuing rise, a tightening of the Presidential polls, the debacle in the insurance sector and mixed economic data, the major indices relatively muted declines likely disappointed the Bears. NY Attorney General Spitzer's attacks on the insurance industry, while warranted, unfortunately resulted in major losses for investors and will likely cause future job losses in the industry. It is becoming harder and harder to find sectors to investment in that are not under major legal duress, which is a significant burden on the U.S. economy. In my opinion, executives need to be held more personally liable for their illegal actions and the companies themselves less liable, to minimized job losses and investor pain. The carnage in the base metal stocks, as a result of reports that China's economy is slowing, appears overdone to me. Barring a recession brought on by higher energy prices, which I do not currently anticipate, these stocks shouldn't head substantially lower from current levels. On the positive side, most measures of investor anxiety rose, interest rates fell, the CRB Index declined, technology stocks outperformed and the advance/decline line only fell modestly.

Click here for the Weekly Wrap by Briefing.com

Bottom Line: Market action last week was mostly negative as insurance and base metal stocks led the major indices lower. Considering energy's continuing rise, a tightening of the Presidential polls, the debacle in the insurance sector and mixed economic data, the major indices relatively muted declines likely disappointed the Bears. NY Attorney General Spitzer's attacks on the insurance industry, while warranted, unfortunately resulted in major losses for investors and will likely cause future job losses in the industry. It is becoming harder and harder to find sectors to investment in that are not under major legal duress, which is a significant burden on the U.S. economy. In my opinion, executives need to be held more personally liable for their illegal actions and the companies themselves less liable, to minimized job losses and investor pain. The carnage in the base metal stocks, as a result of reports that China's economy is slowing, appears overdone to me. Barring a recession brought on by higher energy prices, which I do not currently anticipate, these stocks shouldn't head substantially lower from current levels. On the positive side, most measures of investor anxiety rose, interest rates fell, the CRB Index declined, technology stocks outperformed and the advance/decline line only fell modestly.

Saturday, October 16, 2004

Economic Week in Review

ECRI Weekly Leading Index 131.00 -.61%

The Import Price Index for September rose .2% versus estimates of a .5% increase and a 1.4% increase in August. The Trade Balance for August was -$54.0B versus estimates of -$51.4B and -$50.5B in July. The increase in the trade deficit came on higher spending for imported oil, relatively strong U.S. economic growth and a decline in goods purchased by foreign countries. Inflation may be less of a concern for Federal Reserve officials after economic reports suggested pressure from high oil prices is not filtering through to other costs, Bloomberg reported. "Once demand picks up, it's possible you'll see some price moves but there seems to be a lot of restraint by U.S. businesses," said Michael Gregory, a senior economist at BMO Nesbitt Burns. "Much of the movement in core import prices is behind us," said Joshua Shapiro, chief U.S. economist at MFR Inc. "The dollar hasn't had any really big movements recently. U.S. growth is clearly better than most places."

Initial Jobless Claims for last week were 352K versus estimates of 340K and 337K the prior week. Continuing Claims were 2845K versus estimates of 2859K and 2856K prior. "This level is still consistent with solid job creation," said Wesley Beal, an economist at IDEAglobal. "This election seems to be causing more angst about the economy among business leaders than previous ones," said Chris Rupkey, senior economist at Bank of Tokyo-Mitsubishi. "Managers are concerned and they may be waiting until the dust settles before they bring in new hires." "We continue to have a labor market recovery for job seekers," said Steve Pogorzelski, President of Monster.com North America, the operator of the world's largest job-posting Web site. "We are still seeing strong online posting demand."

The Monthly Budget Statement for September was $24.4B versus estimates of $22.0B and $23.4B in August. The U.S. budget deficit rose to $412.6 billion, below mid-year estimates of $445 billion, in the year ended Sept. 30, as government tax receipts rose more than expected on faster U.S. economic growth, Bloomberg said. The budget deficit is now 3.75% of U.S. GDP, 36.2% lower than the all-time record set in 1983, Bloomberg reported. "If the financial markets felt that the government as a major borrower was not going to be a responsible manager of the fiscal affairs of this country, the market would already exact a price," said Treasury Secretary Snow. "The fact that interest rates are as low as they are is a vote of confidence that we will deal with the deficit."

The Producer Price Index for September rose .1% versus estimates of a .1% increase and a .1% decline in August. PPI Ex Food & Energy rose .3% in September versus estimates of a .2% gain and a .1% decline in August. The PPI averaged a .4% gain from January through June. So far this year, producer prices are rising at a 3.4% annual rate compared with a 4.3% increase at the same time last year, Bloomberg said. "Increased competition is making it tougher for companies to pass through cost increases to consumers," said William Zadrozny, CEO of Siemens Financial Services.

Advanced Retail Sales for September rose 1.5%, the most in 6 months, versus estimates of a .7% gain and a .2% fall in August. Retail Sales Less Autos for September rose .6% versus estimates of a .3% rise and a .2% gain in August. The biggest rise in auto sales in 3 years paced the increase in all retail spending last month, Bloomberg reported. Sales of cars and light trucks jumped to 17.5 million vehicles at an annual rate in September, a 5.4% increase from August. The average retail price for all grades of gasoline, while high at $2.04/gallon, is still lower than six months ago, Bloomberg reported. As well, sales at general merchandise stores, which include department stores, rose 1.1% last month, the most in 8 months. Retail sales account for almost half of all consumer spending, which in turn accounts for about two-thirds of the U.S. economy, Bloomberg said.

Empire Manufacturing for October came in at 17.43 versus estimates of 25.0 and a reading of 27.26 in September. Readings above zero indicate expansion and the survey has now shown growth since April 2003. In February, it reached an all-time record of 42.1, Bloomberg reported. The survey is a "confidence" measure as participants are asked to score a variety of indicators as "better" or "worse" than the prior month. As a result, it is likely affected by the negative political environment and concerns over the direction of the U.S. government, Bloomberg said. Moreover, the survey's hiring index for the next six months rose to 33.7 in October from 27.2 the previous month.

Industrial Production for September rose .1% versus estimates of a .3% increase and a .1% decline in August. Capacity Utilization for September was 77.2% versus estimates of 77.5% and 77.2% in August. Four hurricanes that swept across the southeast U.S. over a six week period in August and September reduced industrial production by about .3 percentage points last month, the Fed said. "These numbers are not as weak as the headline number suggests and that's good news because there will be a bounce-back," said Ken Mayland, president of ClearView Economics. "Retail sales say consumer demand is there," which is good for factory production," Mayland said.

The preliminary University of Michigan Consumer Confidence reading for October was 87.5 versus estimates of 94.0 and a reading of 94.2 in September. "Whatever consumers are saying, household spending remains strong and pretty sustained," said Michael Englund, chief economist at Action Economics. Sales of homes and autos remain very high, Bloomberg reported. Apple Computer's sales of its iPod digital music players surged 500% in the three months ended Sept. 25, Bloomberg said. As well, McDonald's said U.S. sales rose 11% in September. Finally, Wal-Mart Stores CEO Scott said, "We expect a strong finish to the year." Historically bitter political rhetoric filling the airwaves is likely depressing sentiment temporarily, Bloomberg reported.

Bottom Line: Overall, last week's economic data were mixed. Measures continue to show that inflation is contained. While commodity prices remain elevated, their rate of increase has slowed substantially from earlier months. The CRB Index, a broad-based measure of commodity prices, is trading at the same level it was 8 months ago. Energy remains the main area of concern and I continue to believe prices will begin heading lower once the effects of the record-setting hurricanes diminish and more supply reaches U.S. shores. This should occur at the end of this month or the first part of November. The labor market will improve upon the conclusion of the election. Small-business owners, the main job creators in the U.S., are extremely concerned about the outcome of the election and are likely holding off on new hiring to an extent. The increase in GDP growth I foresee during this quarter will also spur hiring.

The budget deficit remains an over-hyped problem by the bears and the media. As a % of GDP, the deficit is much smaller than in 1983, at the very beginning of a multi-decade secular bull move in U.S. stocks. As well, tax receipts have risen 5.5% over the last 12 months, notwithstanding the tax cuts. The increase in the deficit is a result of government spending outpacing receipts. However, considering the massive overcapacity generated during the latter part of the 90's in most sectors, it is highly probably the U.S. needed the dramatic increase in government spending and tax cuts to boost demand and burn off some of the excess capacity. Instead of one of the mildest recessions on record, massive job losses and bankruptcies would have likely resulted in a multi-year deep recession.

The much-better-than-expected retail sales report is a big positive. While auto incentives did spur demand, an auto is still a very large purchase and shows the consumer has confidence in their financial condition. As well, home sales remain near very high levels. I expect this holiday shopping season to beat expectations, notwithstanding higher energy prices. Once again, the bears and media are painting a more negative picture of the U.S. consumer than is actually the case. I continue to believe that investors are underestimating the negative impact the current election is having on economic activity. It is highly unusual to turn on the news and hear anything positive. Negative stories on Iraq, oil or jobs dominate reporting, while very few positives are reported. This is definitely affecting psychology and will likely subside to an extent in November. Moreover, fears of domestic terrorism, higher taxes and more regulations are also affecting decision-makers.

The Import Price Index for September rose .2% versus estimates of a .5% increase and a 1.4% increase in August. The Trade Balance for August was -$54.0B versus estimates of -$51.4B and -$50.5B in July. The increase in the trade deficit came on higher spending for imported oil, relatively strong U.S. economic growth and a decline in goods purchased by foreign countries. Inflation may be less of a concern for Federal Reserve officials after economic reports suggested pressure from high oil prices is not filtering through to other costs, Bloomberg reported. "Once demand picks up, it's possible you'll see some price moves but there seems to be a lot of restraint by U.S. businesses," said Michael Gregory, a senior economist at BMO Nesbitt Burns. "Much of the movement in core import prices is behind us," said Joshua Shapiro, chief U.S. economist at MFR Inc. "The dollar hasn't had any really big movements recently. U.S. growth is clearly better than most places."

Initial Jobless Claims for last week were 352K versus estimates of 340K and 337K the prior week. Continuing Claims were 2845K versus estimates of 2859K and 2856K prior. "This level is still consistent with solid job creation," said Wesley Beal, an economist at IDEAglobal. "This election seems to be causing more angst about the economy among business leaders than previous ones," said Chris Rupkey, senior economist at Bank of Tokyo-Mitsubishi. "Managers are concerned and they may be waiting until the dust settles before they bring in new hires." "We continue to have a labor market recovery for job seekers," said Steve Pogorzelski, President of Monster.com North America, the operator of the world's largest job-posting Web site. "We are still seeing strong online posting demand."

The Monthly Budget Statement for September was $24.4B versus estimates of $22.0B and $23.4B in August. The U.S. budget deficit rose to $412.6 billion, below mid-year estimates of $445 billion, in the year ended Sept. 30, as government tax receipts rose more than expected on faster U.S. economic growth, Bloomberg said. The budget deficit is now 3.75% of U.S. GDP, 36.2% lower than the all-time record set in 1983, Bloomberg reported. "If the financial markets felt that the government as a major borrower was not going to be a responsible manager of the fiscal affairs of this country, the market would already exact a price," said Treasury Secretary Snow. "The fact that interest rates are as low as they are is a vote of confidence that we will deal with the deficit."

The Producer Price Index for September rose .1% versus estimates of a .1% increase and a .1% decline in August. PPI Ex Food & Energy rose .3% in September versus estimates of a .2% gain and a .1% decline in August. The PPI averaged a .4% gain from January through June. So far this year, producer prices are rising at a 3.4% annual rate compared with a 4.3% increase at the same time last year, Bloomberg said. "Increased competition is making it tougher for companies to pass through cost increases to consumers," said William Zadrozny, CEO of Siemens Financial Services.

Advanced Retail Sales for September rose 1.5%, the most in 6 months, versus estimates of a .7% gain and a .2% fall in August. Retail Sales Less Autos for September rose .6% versus estimates of a .3% rise and a .2% gain in August. The biggest rise in auto sales in 3 years paced the increase in all retail spending last month, Bloomberg reported. Sales of cars and light trucks jumped to 17.5 million vehicles at an annual rate in September, a 5.4% increase from August. The average retail price for all grades of gasoline, while high at $2.04/gallon, is still lower than six months ago, Bloomberg reported. As well, sales at general merchandise stores, which include department stores, rose 1.1% last month, the most in 8 months. Retail sales account for almost half of all consumer spending, which in turn accounts for about two-thirds of the U.S. economy, Bloomberg said.

Empire Manufacturing for October came in at 17.43 versus estimates of 25.0 and a reading of 27.26 in September. Readings above zero indicate expansion and the survey has now shown growth since April 2003. In February, it reached an all-time record of 42.1, Bloomberg reported. The survey is a "confidence" measure as participants are asked to score a variety of indicators as "better" or "worse" than the prior month. As a result, it is likely affected by the negative political environment and concerns over the direction of the U.S. government, Bloomberg said. Moreover, the survey's hiring index for the next six months rose to 33.7 in October from 27.2 the previous month.

Industrial Production for September rose .1% versus estimates of a .3% increase and a .1% decline in August. Capacity Utilization for September was 77.2% versus estimates of 77.5% and 77.2% in August. Four hurricanes that swept across the southeast U.S. over a six week period in August and September reduced industrial production by about .3 percentage points last month, the Fed said. "These numbers are not as weak as the headline number suggests and that's good news because there will be a bounce-back," said Ken Mayland, president of ClearView Economics. "Retail sales say consumer demand is there," which is good for factory production," Mayland said.

The preliminary University of Michigan Consumer Confidence reading for October was 87.5 versus estimates of 94.0 and a reading of 94.2 in September. "Whatever consumers are saying, household spending remains strong and pretty sustained," said Michael Englund, chief economist at Action Economics. Sales of homes and autos remain very high, Bloomberg reported. Apple Computer's sales of its iPod digital music players surged 500% in the three months ended Sept. 25, Bloomberg said. As well, McDonald's said U.S. sales rose 11% in September. Finally, Wal-Mart Stores CEO Scott said, "We expect a strong finish to the year." Historically bitter political rhetoric filling the airwaves is likely depressing sentiment temporarily, Bloomberg reported.

Bottom Line: Overall, last week's economic data were mixed. Measures continue to show that inflation is contained. While commodity prices remain elevated, their rate of increase has slowed substantially from earlier months. The CRB Index, a broad-based measure of commodity prices, is trading at the same level it was 8 months ago. Energy remains the main area of concern and I continue to believe prices will begin heading lower once the effects of the record-setting hurricanes diminish and more supply reaches U.S. shores. This should occur at the end of this month or the first part of November. The labor market will improve upon the conclusion of the election. Small-business owners, the main job creators in the U.S., are extremely concerned about the outcome of the election and are likely holding off on new hiring to an extent. The increase in GDP growth I foresee during this quarter will also spur hiring.

The budget deficit remains an over-hyped problem by the bears and the media. As a % of GDP, the deficit is much smaller than in 1983, at the very beginning of a multi-decade secular bull move in U.S. stocks. As well, tax receipts have risen 5.5% over the last 12 months, notwithstanding the tax cuts. The increase in the deficit is a result of government spending outpacing receipts. However, considering the massive overcapacity generated during the latter part of the 90's in most sectors, it is highly probably the U.S. needed the dramatic increase in government spending and tax cuts to boost demand and burn off some of the excess capacity. Instead of one of the mildest recessions on record, massive job losses and bankruptcies would have likely resulted in a multi-year deep recession.

The much-better-than-expected retail sales report is a big positive. While auto incentives did spur demand, an auto is still a very large purchase and shows the consumer has confidence in their financial condition. As well, home sales remain near very high levels. I expect this holiday shopping season to beat expectations, notwithstanding higher energy prices. Once again, the bears and media are painting a more negative picture of the U.S. consumer than is actually the case. I continue to believe that investors are underestimating the negative impact the current election is having on economic activity. It is highly unusual to turn on the news and hear anything positive. Negative stories on Iraq, oil or jobs dominate reporting, while very few positives are reported. This is definitely affecting psychology and will likely subside to an extent in November. Moreover, fears of domestic terrorism, higher taxes and more regulations are also affecting decision-makers.

Subscribe to:

Posts (Atom)