Weekend Headlines

Bloomberg:

Wall Street Journal:

ValueWalk:

Business Insider:

IBD:

LA Times:

New York Post:

Washington Post:

CNN:

FXStreet:

Reuters:

USA Today:

AP:

Telegraph:

The Guardian:

Welt am Sonntag:

Bild:

NZZ am Sonntag:

Der Spiegel:

Handelsblatt:

WirtschaftsWoche:

FAZ:

Journal du Dimanche:

El Pais:

ABC:

CTV:

The Economic Times:

Yonhap News:

Jiji:

Daily Telegraph:

Sydney Morning Herald:

AsianInvestor:

Shanghai Securities News:

Xinhua:

21st Century Business Herald:

China Daily:

China Securities Journal:

Shanghai Securities News:

Hexun:

Sunday's Zaman:

Weekend Recommendations

Barron's:

Citigroup:

Night Trading

- Asian indices are . to +% on average.

- Asia Ex-Japan Investment Grade CDS Index 144.0 .

- Asia Pacific Sovereign CDS Index 111.0 basis point.

Morning Preview Links

Earnings of Note

Company/Estimate

- (WWW)/.20

- (GPC)/.91

- (CPLA)/.77

- (DUK)/.95

- (MDT)/.91

- (KO)/.46

- (OII)/.84

- (PNRA)/1.94

- (TEX)/.49

- (FLS)/1.05

- (CRMT)/.70

- (FLR)/.98

- (CF)/4.41

- (ADI)/.49

Economic Releases

8:30 am EST

- Empire Manufacturing for February is estimated to fall to 9.0 versus 12.51 in January.

9:00 am EST

- Net Long-Term TIC Flows for December are estimated at $30.0B versus -$29.3B in November.

10:00 am EST

- The NAHB Housing Market Index for February is estimated at 56 versus 56 in January.

Upcoming Splits

- (ANDE) 3-for-2

- (OTEX) 2-for-1

Other Potential Market Movers

- The Reserve Bank of Australia minutes, BoJ decision, German ZEW Index and UK inflation data could also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by consumer and real estate shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 75% net long heading into the week.

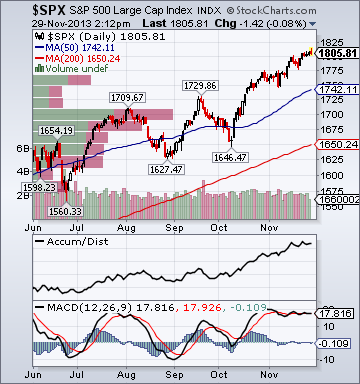

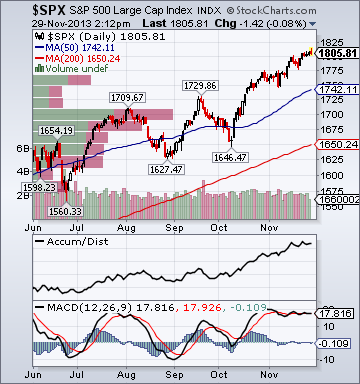

S&P 500 1,805.75 +.55%*

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,142.89 +2.08%

- S&P 500 High Beta 29.40 +.77%

- Wilshire 5000 18,947.90 +.67%

- Russell 1000 Growth 840.95 +1.10%

- Russell 1000 Value 906.51 unch.

- S&P 500 Consumer Staples 441.58 -.02%

- Morgan Stanley Cyclical 1,432.60 +1.39%

- Morgan Stanley Technology 867.77 +1.16%

- Transports 7,235.69 +.87%

- Bloomberg European Bank/Financial Services 106.88 +2.25%

- MSCI Emerging Markets 42.20 +1.07%

- HFRX Equity Hedge 1,147.54 +.37%

- HFRX Equity Market Neutral 949.60 -.02%

Sentiment/Internals

- NYSE Cumulative A/D Line 195,776 +1.48%

- Bloomberg New Highs-Lows Index 615 +466

- Bloomberg Crude Oil % Bulls 31.03 n/a

- CFTC Oil Net Speculative Position 313,160 n/a

- CFTC Oil Total Open Interest 1,620,640 n/a

- Total Put/Call .80 -14.89%

- ISE Sentiment 164.0 +13.89%

- Volatility(VIX) 13.69 +8.61%

- S&P 500 Implied Correlation 54.37 -3.83%

- G7 Currency Volatility (VXY) 8.21 +1.73%

- Emerging Markets Currency Volatility (EM-VXY) 8.83 +2.79%

- Smart Money Flow Index 12,086.81 +.61%

- ICI Money Mkt Mutual Fund Assets $2.678 Trillion +.57%

- ICI US Equity Weekly Net New Cash Flow $3.973 Billion -26.9%

Futures Spot Prices

- Reformulated Gasoline 267.05 -1.53%

- Heating Oil 303.65 +1.51%

- Bloomberg Base Metals Index 185.80 -1.0%

- US No. 1 Heavy Melt Scrap Steel 360.67 USD/Ton unch.

- China Iron Ore Spot 136.40 USD/Ton -.07%

- UBS-Bloomberg Agriculture 1,387.01 +.10%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 2.7% +30 basis points

- Philly Fed ADS Real-Time Business Conditions Index .0642 +4.05%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 119.77 +.14%

- Citi US Economic Surprise Index 6.90 +.2 point

- Citi Emerging Markets Economic Surprise Index -15.0 -.7 point

- Fed Fund Futures imply 34.0% chance of no change, 66.0% chance of 25 basis point cut on 12/18

- US Dollar Index 80.65 +.02%

- Euro/Yen Carry Return Index 145.11 +1.41%

- 10-Year US Treasury Yield 2.74% unch.

- Federal Reserve's Balance Sheet $3.864 Trillion n/a

- U.S. Sovereign Debt Credit Default Swap 30.45 +1.90%

- Illinois Municipal Debt Credit Default Swap 186.0 -2.47%

- Western Europe Sovereign Debt Credit Default Swap Index 60.0 -4.0%

- Asia Pacific Sovereign Debt Credit Default Swap Index 107.20 +5.38%

- Emerging Markets Sovereign Debt CDS Index 234.34 +1.89%

- Israel Sovereign Debt Credit Default Swap 106.0 -2.0%

- Egypt Sovereign Debt Credit Default Swap 629.85 -5.29%

- China Blended Corporate Spread Index 350.50 -2.5 basis points

- 10-Year TIPS Spread 2.16% -4 basis points

- TED Spread 18.25 +1.25 basis points

- 2-Year Swap Spread 9.75 unch.

- 3-Month EUR/USD Cross-Currency Basis Swap -3.5 -1.75 basis points

- N. America Investment Grade Credit Default Swap Index 69.56 -.11%

- European Financial Sector Credit Default Swap Index 97.65 -4.28%

- Emerging Markets Credit Default Swap Index 293.18 +1.55%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 110.0 +7.0 basis points

- M1 Money Supply $2.587 Trillion n/a

- Commercial Paper Outstanding 1,059.20 +.50%

- 4-Week Moving Average of Jobless Claims 331,800 -6,700

- Continuing Claims Unemployment Rate 2.1% -10 basis points

- Average 30-Year Mortgage Rate 4.29% +7 basis points

- Weekly Mortgage Applications 449.60 -.33%

- Bloomberg Consumer Comfort -33.70 +.9 point

- Weekly Retail Sales +3.50% +10 basis points

- Nationwide Gas $3.28/gallon +.04/gallon

- Baltic Dry Index 1,719 +14.67%

- China (Export) Containerized Freight Index 1,066.22 +.08%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 37.50 unch.

- Rail Freight Carloads 267,759 +.42%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (24)

- BONT, UVE, ENTA, KCG, ENT, SPLK, WETF, IIIN, TWC, JOSB, WDAY, CSII,

ANIK, DAKT, TIF, POST, FBRC, BERY, LGND, NLSN, WAIR, CBF, BKS and MENT

Weekly High-Volume Stock Losers (14)

- DLTR, ROST, ADT, OGE, GME, GEOS, LL, LQDT, NUAN, TFM, BRLI, DLLR, TLYS and BLOX

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Equity Market Tone:

- Advance/Decline Line: Higher

- Sector Performance: Most Sectors Rising

- Market Leading Stocks: Performing In Line

Equity Investor Angst:

- Volatility(VIX) 13.01 +.23%

- Euro/Yen Carry Return Index 145.36 +.15%

- Emerging Markets Currency Volatility(VXY) 8.83 -.23%

- S&P 500 Implied Correlation 53.58 -.78%

- ISE Sentiment Index 165.0 +35.25%

Credit Investor Angst:

- North American Investment Grade CDS Index 69.65 +1.29%

- European Financial Sector CDS Index 97.02 +2.10%

- Western Europe Sovereign Debt CDS Index 61.0 -.79%

- Emerging Market CDS Index 293.39 n/a

- 2-Year Swap Spread 9.25 +.75 basis point

- TED Spread 18.25 +.5 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -3.5 unch.

Economic Gauges:

- 3-Month T-Bill Yield .06% unch.

- Yield Curve 247.0 +2 basis points

- China Import Iron Ore Spot $136.40/Metric Tonne unch.

- Citi US Economic Surprise Index 6.90 -1.7 points

- Citi Emerging Markets Economic Surprise Index -15.0 +1.0 point

- 10-Year TIPS Spread 2.16 unch.

Overseas Futures:

- Nikkei Futures: Indicating +67 open in Japan

- DAX Futures: Indicating +5 open in Germany

Portfolio:

- Higher: On gains in my tech/biotech sector longs

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 50% Net Long

Style Underperformer:

Sector Underperformers:

- 1) REITs -.90% 2) Homebuilders -.53% 3) Airlines -.30%

Stocks Falling on Unusual Volume:

- FTNT, THOR, CRM, WTI, JKS, PXD, HI and HITT

Stocks With Unusual Put Option Activity:

- 1) HL 2) TJX 3) HCA 4) OXY 5) EBAY

Stocks With Most Negative News Mentions:

- 1) F 2) PXD 3) MA 4) FTNT 5) TSLA

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Gold & Silver +1.96% 2) Steel +1.68% 3) Construction +.81%

Stocks Rising on Unusual Volume:

Stocks With Unusual Call Option Activity:

- 1) TJX 2) FTNT 3) LTD 4) ARAY 5) AMD

Stocks With Most Positive News Mentions:

- 1) WFM 2) WMT 3) AMZN 4) AAPL 5) M

Charts:

Night Trading

- Asian equity indices are -.25% to +.25% on average.

- Asia Ex-Japan Investment Grade CDS Index 132.0 +.25 basis point.

- Asia Pacific Sovereign CDS Index 107.25 +1.25 basis points.

- NASDAQ 100 futures +.42%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

Upcoming Splits

Other Potential Market Movers

- The China Manufacturing PMI, Italy/Spain bond auctions and the Eurozone CPI could also impact trading today.

BOTTOM LINE: Asian indices are mostly lower, weighed down by industrial and commodity shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing mixed. The Portfolio is 75% net long heading into the day.

Broad Equity Market Tone:

- Advance/Decline Line: Higher

- Sector Performance: Most Sectors Rising

- Market Leading Stocks: Performing In Line

Equity Investor Angst:

- Volatility(VIX) 12.98 +3.51%

- Euro/Yen Carry Return Index 144.43 +.78%

- Emerging Markets Currency Volatility(VXY) 8.83 +1.85%

- S&P 500 Implied Correlation 54.0 +.24%

- ISE Sentiment Index 122.0 -16.44%

- Total Put/Call .80 +6.67%

Credit Investor Angst:

- North American Investment Grade CDS Index 68.99 +.95%

- European Financial Sector CDS Index 94.69 -1.92%

- Western Europe Sovereign Debt CDS Index 61.67 +2.78%

- Emerging Market CDS Index 293.39 +.52%

- 2-Year Swap Spread 8.5 +.25 basis point

- TED Spread 17.75 +.75 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -3.5 -.75 basis point

Economic Gauges:

- 3-Month T-Bill Yield .06% -1 basis point

- Yield Curve 245.0 +4 basis points

- China Import Iron Ore Spot $136.0/Metric Tonne +.07%

- Citi US Economic Surprise Index 8.60 +5.4 points

- Citi Emerging Markets Economic Surprise Index -16.50 -.8 point

- 10-Year TIPS Spread 2.16 -1 basis point

Overseas Futures:

- Nikkei Futures: Indicating +200 open in Japan

- DAX Futures: Indicating +3 open in Germany

Portfolio:

- Higher: On gains in my tech/medical/retail sector longs

- Disclosed Trades: Covered some of my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 75% Net Long

Style Underperformer:

Sector Underperformers:

- 1) Oil Service -1.42% 2) Energy -.66% 3) Utilities -.63%

Stocks Falling on Unusual Volume:

- BRLI, BLOX, ADI, ZUMZ, TIVO, BRSS, LH, CHTR, OGE, NBL, DY, SBNY, TRP, DGX, CBRL, ACMP, LL, TAL, ENB, GNRC, OMCL, JKS, MTD, STMP, TREX and DLLR

Stocks With Unusual Put Option Activity:

- 1) MNST 2) HYG 3) HPQ 4) MGM 5) JCP

Stocks With Most Negative News Mentions:

- 1) MBI 2) ADI 3) EBAY 4) NBL 5) CSX

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Computer Hardware +1.36% 2) Gaming +.89% 3) Oil Tankers +.81%

Stocks Rising on Unusual Volume:

- FWLT, HPQ, TTS, HFC, GMCR, INSM, BKS, RKUS and MPC

Stocks With Unusual Call Option Activity:

- 1) BLOX 2) HFC 3) HPQ 4) MPC 5) BYD

Stocks With Most Positive News Mentions:

- 1) HPQ 2) CVS 3) AMR 4) AAPL 5) JCP

Charts:

Evening Headlines

Bloomberg:

- U.S. Bombers Fly Through China Air Zone in Boost for Ally Japan.

Two unarmed American B-52 bombers flew through disputed areas of the

East China Sea covered by China’s new air defense zone, a show of

support for Japan as Prime Minister Shinzo Abe seeks to expand his

nation’s military. China’s

creation of the zone on Nov. 23 may spur Abe to take a more hard-line

stance as his government studies changing how it interprets the

U.S.-imposed pacifist constitution to deploy the country’s armed forces

more freely. Abe is undertaking a review for a 10-year defense plan to

be announced next month that may see Japan’s government add ballistic

missile defense ships and refueling planes.

- Record Spread Blowout Sparks Mini-Crisis Warning: China Credit. Chinese companies’ borrowing costs are climbing at a record pace

relative to the government’s, increasing the risk of defaults and prompting state newspapers to warn of a limited debt crisis. The

extra yield investors demand to hold three-year AAA corporate bonds

instead of government notes surged 35 basis points last week to 182

basis points, the biggest increase since data became available in

September 2007, Chinabond indexes show. That exceeds the similar spread

in India of 120 basis points. The benchmark seven-day repurchase rate

has averaged 4.47 percent in November, the highest since a record cash

crunch in June and up from 3.21 percent a year earlier.

- China’s Nanjing, Hangzhou Raise Second Home Down Payment to 70%. China’s eastern cities of Nanjing and Hangzhou raised the minimum down payment required for second

homes to 70 percent from 60 percent as more cities tighten

property policies because of surging prices. The cities will continue to ban mortgage lending for third

homes and will maintain a 30 percent down payment for buyers of

first homes, the central bank’s Nanjing and Hangzhou branches

said in separate statements on their websites yesterday. Nanjing

will increase housing land supply by 10 percent from the average

in the past five years, the city’s housing authority said in a

statement yesterday.

- Broom-Waving Voters Aim to Sweep Away India’s Elite. By Indian standards, Arvind Kejriwal is an unusual politician: he doesn’t use a police escort, he won’t

field candidates who face murder charges and he publishes the names of

those who contribute to his party’s funds.

- Asian Stocks Swing Between Losses and Gains; BHP(BHP) Declines.

Asia’s benchmark stock index swung between gains and losses after U.S.

consumer confidence unexpectedly dropped this month and as an advance

among information technology shares was offset by declines at

raw-material companies. Industrial Bank of Korea sank 4.2 percent after

the South Korea government sold more than 13 million shares in the

lender. BHP Billiton Ltd. lost 1.6 percent in Sydney after copper prices

fell for the first time in more than a week. Rakuten Inc. surged 7.7

percent in Tokyo, leading IT firms higher, after the website

operator said it will increase its dividend. The MSCI Asia Pacific Index was little changed at 141.60 as

of 11:33 a.m. in Hong Kong, having swung between a loss of 0.2

percent and a gain of 0.1 percent.

- Rubber Drops as U.S. Confidence Data Weaken Demand Outlook.

Rubber fell for a second day after U.S. consumer confidence

unexpectedly dropped this month, weakening the demand outlook for the

commodity used in tires. Futures for delivery in May on the Tokyo Commodity Exchange

dropped as much as 0.6 percent to 256.6 yen a kilogram ($2,531 a

metric ton), nearing a two-week low reached yesterday, and

traded at 257.3 yen at 11:42 a.m. local time. The most-active

contract has lost 15 percent this year.

- Merkel Agrees SPD Coalition to Raise Spending Without New Taxes. Chancellor

Angela Merkel clinched a coalition agreement with the Social Democrats

that calls for a national minimum wage and pledges to increase spending

on pensions and infrastructure without raising taxes. More than two

months after Merkel won national elections, the accord reached shortly

before 5 a.m. in Berlin today after 17 hours of negotiations, sets

Merkel on track for a third term leading Europe’s biggest economy until

2017. The coalition isn’t a done deal yet.

“The principle that every member state is liable for its

own debt must be maintained,” according to a draft of the

agreement. “All forms of collectivizing state debt would

endanger the necessary orientation of national policies in every

member state.” A note from London-based Teneo Intelligence said “the real

risk going forward is an ever-greater unwillingness of the new

coalition to mutualize the fallout from Europe’s persistent

banking problems.”

- Slump-Watchers Dump Yield Curve for 1970s Tool: Cutting Research.

The U.S. Treasury yield curve has

lost its forecasting power and investors wanting to divine the

possibility of a U.S. recession should turn to a little-known

equation from the 1970s. That’s the recommendation of Morgan Stanley

economist Ellen Zentner, who told clients in a Nov. 18 report that the Federal

Reserve’s near-zero interest rate and asset-buying is holding

down U.S. bond rates. That means the yield curve would struggle

to invert, crimping its effectiveness as an indicator of

business cycles, she wrote.

- Gensler Gives Wall Street Two Months to Meet Cross-Border Policy. The top U.S. derivatives regulator

gave Wall Street two months to abide by a new policy imposing

Dodd-Frank Act rules on banks when they arrange trades

domestically and then book them overseas. The Commodity Futures Trading Commission today postponed a

Nov. 14 advisory that undermined a legal interpretation Wall

Street had found buried in a footnote, number 513, in an earlier

agency document. Banks relied on the footnote to keep swap deals

off electronic platforms and away from the agency’s rules that

were put in place in the wake of the 2008 financial crisis.

Wall Street Journal:

- Health Website Deadline Nears. Administration's Promise That It Would Work for Most by Saturday Is Up for Review.

With the clock ticking toward a Saturday deadline, Obama administration

officials promise that the HealthCare.gov website will work better.

Exactly how much better? That is hard to say. The

measure of success, repeated by an array of administration officials,

is that the online marketplace intended to be used by millions of

Americans to obtain health insurance would be working smoothly for the

"vast majority of users" by Saturday, the last day of November.

- Volatile Loan Securities Are Luring Fund Managers Again. Collateralized Loan Obligations Offer High Returns—And Risk. Investment funds aimed at individual

investors are barreling into collateralized loan obligations, a complex

and volatile type of security that was shaken by the financial crisis. Lured

by annual returns of as high as 20%, some mutual-fund managers are

buying CLOs through investment funds that purchase stakes in loans to

companies with low credit ratings. Another type of loan investment fund,

business-development companies, also have begun buying CLOs, according

to securities filings.

- Sohrab Ahmari: An Iranian Insider's View of the Geneva Deal. 'If the right to enrich is accepted, which it has been, then everything that we have wanted has been realized.' "In that message," Mr. Fazlinejad says, "the

imam made it clear that our military war against the arrogance in the

form of Iraq's regime is over. . . . But he advised the youth and the

political activists to 'safeguard the revolutionary hatred and grievance

in your hearts, look upon your enemies with fury and know that you will

be victorious.' " Khomeini's

statement, Mr. Fazlinejad says, "was a message of peace, signaling a

permanent cease-fire. But at the same time it asserted the vitality of

our struggle against the capitalist order. If anyone gets the sense from

these negotiations, as [Foreign Minister] Mr. Zarif has, that we are

getting closer to the West, he is as mistaken as Mr. Zarif."

Barron's:

- Hewlett-Packard(HPQ) Up 7%: FYQ4 Beats; Year EPS View In-Line.

Hewlett-Packard (HPQ) this afternoon reported fiscal Q4 revenue that

topped analysts’ estimates by over a billion dollars, and profit per

share that beat by a penny, with the outlook for this

quarter’s, and the full year’s profit more or less in line with

analysts’ estimates.

- Analog Devices(ADI) Off 4%: FYQ4 Rev Misses, Q1 View Misses.

Shares of chip maker Analog Devices (ADI) are down $1.82, or almost 4%,

at $35.51, in late trading, after the company this afternoon reported

fiscal Q4 revenue that missed analysts’ expectations, but beat on the

bottom line, and projected this quarter’s revenue to miss consensus

substantially.

MarketWatch.com:

CNBC:

Zero Hedge:

Business Insider:

NY Times:

- New Boom in Subprime Loans, for Smaller Businesses. A small, little-known company from Missouri borrows hundreds of

millions of dollars from two of the biggest names in Wall Street

finance. The loans are rated subprime. What’s more, they carry few of

the standard protections seen in ordinary debt, making them particularly

risky bets. But investors clamor to buy pieces of the loans, one of which pays

annual interest of at least 8.75 percent. Demand is so strong, some

buyers have to settle for less than they wanted. A scene from the years leading up to the financial crisis in 2008? No, last month.

- I.M.F. Shifts Its Approach to Bailouts. The International Monetary Fund, convinced that Europe erred in forcing

debtor countries like Greece and Portugal to bear nearly all the pain of

recovery on their own, is pushing hard for a plan that would impose

upfront losses on bondholders the next time a country in the euro area

requests a bailout.

Reuters:

- Network gear maker Infoblox(BLOX) warns on 2nd qtr; shares slide. Network equipment maker Infoblox Inc

forecast second-quarter results below analysts'

expectations, sending its shares down 18 percent in extended

trading.

Infoblox's shares have almost tripled in the past year,

spurred by strong demand for its automation products that help

telecom companies manage internet traffic more efficiently.

Kyodo:

- U.S., Japan to Cooperate Closely on China Defense Zone. U.S.,

Japan share the same concern over China's announcement of an air defense

zone in East China Sea, citing teleconference between U.S. Secretary of

State John Kerry and Japanese Foreign Minister Fumio Kishida.

Sina:

- China's Changsha Raises Downpayment for 2nd Homes. The Chinese

city of Changsha in the southern province of Hunan raised the down

payment required for 2nd home purchases, from 60% currently, citing a city gov't statement dated Nov. 25.

CCTV:

- China Says It Has Ability to Control Air-Defense Zone. China

Defense Ministry Spokesman Geng Yansheng says that the nation has the

ability to effectively manage, control the air-defense identification

zone. U.S. planes' flight along the air-defense zone was under Chinese

military surveillance, citing Geng.

Evening Recommendations

Night Trading

- Asian equity indices are -.25% to +.50% on average.

- Asia Ex-Japan Investment Grade CDS Index 131.75 +2.0 basis points.

- Asia Pacific Sovereign CDS Index 106.0 +5.0 basis points.

- NASDAQ 100 futures +.04%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

8:30 am EST

- Initial Jobless Claims are estimated to rise to 330K versus 323K the prior week.

- Continuing Claims are estimated to fall to 2850K versus 2876K prior.

- Durable Goods Orders for October are estimated to fall -2.0% versus a +3.7% gain in September.

- Durables Ex Transports for October are estimated to rise +.5% versus a -.1% decline in September.

- Cap Goods Orders Non-defense Ex Air for October are estimated to rise +.9% versus a -1.1% decline in September.

- Chicago Fed National Activity Index for October is estimated to fall to .1 versus .14 in September.

9:45 am EST

- Chicago Purchasing Manager for November is estimated to fall to 60.0 versus 65.9 in October.

9:55 am EST

- Final Univ. of Michigan Consumer Confidence for November is estimated to rise to 73.1 versus 72.0 in October.

10:00 am EST

- The Leading Index for October is estimated unch. versus a +.7% gain in September.

10:30 am EST

- Bloomberg

consensus estimates call for a weekly crude oil inventory gain of

+423,000 barrels versus a +375,000 barrel gain the prior week. Gasoline

supplies are estimated to rise by +383,000 barrels versus a -345,000

barrel decline the prior week. Distillate inventories are estimated to

fall by -1,194,000 barrels versus a -4,795,000 barrel decline the prior

week. Finally, Refinery Utilization is estimated to rise +.3% versus a

-.1% decline the prior week.

Upcoming Splits

Other Potential Market Movers

- The

UK GDP report, Italian Senate to vote on expelling Berlusconi, German

Consumer Confidence, $29B 7Y T-Note auction, weekly Bloomberg Consumer

Comfort Index and the weekly MBA mortgage applications report could also

impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by industrial and financial

shares in the region. I expect US stocks to open modestly higher

and to weaken into the afternoon, finishing modestly lower. The

Portfolio is 50% net long heading into the day.