BOTTOM LINE: Sales of new homes in the US unexpectedly rose in May to the highest level this year, Bloomberg reported. The number of unsold new homes decreased to a 5.5-month supply at the current sales pace versus 5.8-months worth the prior month. The median price of a new home rose 3.1% over the last 12 months to $235,300. Sales increased 6% in the South, 5.3% in the West and 2.7% in the Midwest. Sales fell 7.9% in the Northeast. Sales of new home have slowed 10% during the first four months of this year. This report is more evidence that housing is just slowing to more healthy sustainable levels, rather than the “hard-land” that bears suggest.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, June 26, 2006

New Home Sales Much Better Than Estimates

- New Home Sales in May rose to 1234K versus estimates of 1145K and 1180K in April.

Sunday, June 25, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- Iraq’s Prime Minister Nuri al-Maliki today presented a national reconciliation plan to parliament aimed at stemming insurgent and sectarian violence in which he offered amnesty to rebels who haven’t been involved in “terrorist” acts.

- The world’s central bankers, meeting in Basel, Switzerland, said their economies are strong enough to withstand a slump in equity markets caused by concern about higher interest rates.

- Warren Buffett, with an estimated personal wealth of $44 billion, will give away 85% of his fortune starting in July, most of it to the Bill and Melinda Gates Foundation, Fortune magazine said.

- Currency traders and analysts are growing less bearish on the US dollar after it climbed to an eight-week high.

- Arcelor SA backed a new takeover bid of about $33.7 billion from Mittal Steel, ending five months of opposition to the steel industry’s biggest-ever transaction.

- Iran, the world’s fourth-largest oil producer, may use oil as a weapon if the Islamic Republic’s interests come under attack, Oil Minister Vaziri-Hamaneh said.

- China’s economy will expand faster this year than in 2005 as investment and exports continue to grow, the central bank’s research bureau said.

- Moscow and Seoul leapfrogged Tokyo to become the world’s most expensive cities, a survey by Mercer Human Resource Consulting showed. New York was the highest-placed US city, rising three places to 10th.

- Commodity index funds have become the dominant players in the global commodities markets, according to Malcolm Southwood of Goldman Sachs JBWere. More than $90 billion is invested in these funds, which have been responsible for the leap in commodity prices over the past year. 74.2% of the $90 billion is invested in energy.

c/net News.com:

- Nanosolar is only a few years old, but it has laid plans to take on multinational corporations, such as BP Plc and Sharp, in the solar industry.

NY Times:

- Verizon Communications’(VZ) Airfone unit will stop providing on-board phone services to airlines later this year to focus on Internet, mobile phone and television services.

- North Korea’s possible pursuit of a long-range missile test may be an example of the Asian nation taking a page from Iran’s diplomatic strategy to use threats to gain concessions from the US.

- NetJets Inc., an operator of private jets owned by Warren Buffett’s Berkshire Hathaway(BRK/A), has encountered difficulties, including increasing competition and pricing pressures.

- General George Casey Jr., the top US commander in Iraq, has put together a plan reducing the number of American troops in the country by the end of next year.

- Johnson & Johnson(JNJ), maker of Tylenol and Neutrogena, is close to an agreement to buy the consumer products-unit of Pfizer(PFE) for more than $16 billion.

- Iaqi school enrollment has grown each year since the US-led liberation, with 7.4% more students enrolled now than in 2002. Even in the war-torn Anbar province, high school enrollment has risen 37%.

Washington Post:

- Some Washington-area hospitals are expanding at record levels and adding amenities such as in-room Internet service, flat-screen TVs and plush furniture to attract patients in the quickly growing region.

Rocky Mountain News:

- Exxon Mobil(XOM) will use a new drilling method to increase natural-gas production at Colorado’s Piceance Development Project.

USA Today:

- US lottery-ticket sales are rising on the popularity of scratch tickets, including those that cost as much as $30 each.

Financial Times:

- Goldman Sachs(GS) has banned the use of “outperform” and “underperform” as part of its analysts’ stock recommendations. Goldman analysts must now use unambiguous “buy” and “sell” terms and set price targets for all the companies they cover.

- Wal-Mart Stores(WMT) is planning to start its own private label credit card in China, becoming the first overseas retailer to do so.

Telegraph:

- Blackwood Distillers, a UK spirits company, plans to team up with New York hedge fund managers to trade whiskey futures.

Asahi Television:

- Japanese Finance Minister Sadakazu Tanigaki said keeping interest rates near zero is important as mild deflation persists in the world’s second-largest economy.

Ghana News Agency:

- Ghana will receive $544 million under the US government’s Millennium Challenge Account, citing Paa Kwesi Nduom, the African nation’s public sector minister. The Millennium Challenge Account was established by President Bush to speed development in poorer countries.

Iran News:

- China plans to help build a $1 billion aluminum plant in Iran’s North Khorasan province, citing an Iranian official.

AFP:

- Vendanta Resources Plc plans to almost triple production at its Zambian unit, Konkola Copper Mines, to 6 million metric tons a year.

- Iraq is producing more than 2.5 million barrels of oil a day, the highest since the government of Saddam Hussein was toppled in April 2003, citing oil minister Hussain Shahrittani. Iraq may increase its production to as much as 2.7 million barrels a day by the end of this year and to 4.3 million barrels a day by 2010, citing Shahristani.

Weekend Recommendations

Barron's:

- Had positive comments on (FNF), (GOOG), (JBLU), (GRMN) and (PLA).

- Had negative comments on (SLE), (AAPL), (KBH), (PHM), (MDC) and (BYD).

Night Trading

Asian indices are -.50% to +.25% on average.

S&P 500 indicated +.01%

NASDAQ 100 indicated +.02%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (LEN)/1.86

- (PHH)/1.40

- (SCS)/.14

- (WAG)/.38

- (HWAY)/.21

Upcoming Splits

- (FTO) 2-for-1

Economic Releases

10:00 am EST

- New Home Sales for May are estimated to fall to 1150K versus 1198K in April.

Bloomberg:

- Iraq’s Prime Minister Nuri al-Maliki today presented a national reconciliation plan to parliament aimed at stemming insurgent and sectarian violence in which he offered amnesty to rebels who haven’t been involved in “terrorist” acts.

- The world’s central bankers, meeting in Basel, Switzerland, said their economies are strong enough to withstand a slump in equity markets caused by concern about higher interest rates.

- Warren Buffett, with an estimated personal wealth of $44 billion, will give away 85% of his fortune starting in July, most of it to the Bill and Melinda Gates Foundation, Fortune magazine said.

- Currency traders and analysts are growing less bearish on the US dollar after it climbed to an eight-week high.

- Arcelor SA backed a new takeover bid of about $33.7 billion from Mittal Steel, ending five months of opposition to the steel industry’s biggest-ever transaction.

- Iran, the world’s fourth-largest oil producer, may use oil as a weapon if the Islamic Republic’s interests come under attack, Oil Minister Vaziri-Hamaneh said.

- China’s economy will expand faster this year than in 2005 as investment and exports continue to grow, the central bank’s research bureau said.

- Moscow and Seoul leapfrogged Tokyo to become the world’s most expensive cities, a survey by Mercer Human Resource Consulting showed. New York was the highest-placed US city, rising three places to 10th.

- Commodity index funds have become the dominant players in the global commodities markets, according to Malcolm Southwood of Goldman Sachs JBWere. More than $90 billion is invested in these funds, which have been responsible for the leap in commodity prices over the past year. 74.2% of the $90 billion is invested in energy.

c/net News.com:

- Nanosolar is only a few years old, but it has laid plans to take on multinational corporations, such as BP Plc and Sharp, in the solar industry.

NY Times:

- Verizon Communications’(VZ) Airfone unit will stop providing on-board phone services to airlines later this year to focus on Internet, mobile phone and television services.

- North Korea’s possible pursuit of a long-range missile test may be an example of the Asian nation taking a page from Iran’s diplomatic strategy to use threats to gain concessions from the US.

- NetJets Inc., an operator of private jets owned by Warren Buffett’s Berkshire Hathaway(BRK/A), has encountered difficulties, including increasing competition and pricing pressures.

- General George Casey Jr., the top US commander in Iraq, has put together a plan reducing the number of American troops in the country by the end of next year.

- Johnson & Johnson(JNJ), maker of Tylenol and Neutrogena, is close to an agreement to buy the consumer products-unit of Pfizer(PFE) for more than $16 billion.

- Iaqi school enrollment has grown each year since the US-led liberation, with 7.4% more students enrolled now than in 2002. Even in the war-torn Anbar province, high school enrollment has risen 37%.

Washington Post:

- Some Washington-area hospitals are expanding at record levels and adding amenities such as in-room Internet service, flat-screen TVs and plush furniture to attract patients in the quickly growing region.

Rocky Mountain News:

- Exxon Mobil(XOM) will use a new drilling method to increase natural-gas production at Colorado’s Piceance Development Project.

USA Today:

- US lottery-ticket sales are rising on the popularity of scratch tickets, including those that cost as much as $30 each.

Financial Times:

- Goldman Sachs(GS) has banned the use of “outperform” and “underperform” as part of its analysts’ stock recommendations. Goldman analysts must now use unambiguous “buy” and “sell” terms and set price targets for all the companies they cover.

- Wal-Mart Stores(WMT) is planning to start its own private label credit card in China, becoming the first overseas retailer to do so.

Telegraph:

- Blackwood Distillers, a UK spirits company, plans to team up with New York hedge fund managers to trade whiskey futures.

Asahi Television:

- Japanese Finance Minister Sadakazu Tanigaki said keeping interest rates near zero is important as mild deflation persists in the world’s second-largest economy.

Ghana News Agency:

- Ghana will receive $544 million under the US government’s Millennium Challenge Account, citing Paa Kwesi Nduom, the African nation’s public sector minister. The Millennium Challenge Account was established by President Bush to speed development in poorer countries.

Iran News:

- China plans to help build a $1 billion aluminum plant in Iran’s North Khorasan province, citing an Iranian official.

AFP:

- Vendanta Resources Plc plans to almost triple production at its Zambian unit, Konkola Copper Mines, to 6 million metric tons a year.

- Iraq is producing more than 2.5 million barrels of oil a day, the highest since the government of Saddam Hussein was toppled in April 2003, citing oil minister Hussain Shahrittani. Iraq may increase its production to as much as 2.7 million barrels a day by the end of this year and to 4.3 million barrels a day by 2010, citing Shahristani.

Weekend Recommendations

Barron's:

- Had positive comments on (FNF), (GOOG), (JBLU), (GRMN) and (PLA).

- Had negative comments on (SLE), (AAPL), (KBH), (PHM), (MDC) and (BYD).

Night Trading

Asian indices are -.50% to +.25% on average.

S&P 500 indicated +.01%

NASDAQ 100 indicated +.02%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (LEN)/1.86

- (PHH)/1.40

- (SCS)/.14

- (WAG)/.38

- (HWAY)/.21

Upcoming Splits

- (FTO) 2-for-1

Economic Releases

10:00 am EST

- New Home Sales for May are estimated to fall to 1150K versus 1198K in April.

BOTTOM LINE: Asian Indices are mostly lower, weighed down by exporting shares in the region. I expect US stocks to open modestly lower and to rise into the afternoon, finishing mixed. The Portfolio is 75% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - New Home Sales

Tues. - Existing Home Sales, Consumer Confidence, Richmond Fed. Manufacturing Index

Wed. - None of note

Thur. - Final 1Q GDP, Final 1Q GDP Price Index, Final 1Q Personal Consumption, Final 1Q Core PCE, Initial Jobless Claims, Continuing Claims, FOMC Rate Decision

Fri. - Personal Income, Personal Spending, PCE Core, Univ. of Mich. Consumer Confidence, Chicago Purchasing Manager

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Lennar Corp.(LEN), Steelcase(SCS), Walgreen(WAG)

Tues. - Flowserve(FLS), Freddie Mac(FRE), HB Fuller(FUL), Nike(NKE)

Wed. - 3Com Corp.(COMS), Arrow International(ARRO), Biomet(BMET), ConAgra Foods(CAG), Herman Miller(MLHR), McCormick & Co.(MKC), Micron Technology(MU), Paychex Inc.(PAYX), Red Hat Inc.(RHAT)

Thur. - Accenture(ACN), American Greetings(AM), CA Inc.(CA), Constellation Brands(STZ), General Mills(GIS), Monsanto(MON), Palm Inc.(PALM), Worthington Industries(WOR)

Fri. - None of note

Other events that have market-moving potential this week include:

Mon. - Jeffries Life Sciences Conference

Tue. - Jeffries Life Sciences Conference, Banc of America Gaming Conference, William Blair Growth Stock Conference

Wed. - William Blair Growth Stock Conference, Banc of America Gaming Conference, Jeffries Life Sciences Conference

Thur. - Banc of America Gaming Conference, William Blair Growth Stock Conference

Fri. - None of note

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - New Home Sales

Tues. - Existing Home Sales, Consumer Confidence, Richmond Fed. Manufacturing Index

Wed. - None of note

Thur. - Final 1Q GDP, Final 1Q GDP Price Index, Final 1Q Personal Consumption, Final 1Q Core PCE, Initial Jobless Claims, Continuing Claims, FOMC Rate Decision

Fri. - Personal Income, Personal Spending, PCE Core, Univ. of Mich. Consumer Confidence, Chicago Purchasing Manager

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Lennar Corp.(LEN), Steelcase(SCS), Walgreen(WAG)

Tues. - Flowserve(FLS), Freddie Mac(FRE), HB Fuller(FUL), Nike(NKE)

Wed. - 3Com Corp.(COMS), Arrow International(ARRO), Biomet(BMET), ConAgra Foods(CAG), Herman Miller(MLHR), McCormick & Co.(MKC), Micron Technology(MU), Paychex Inc.(PAYX), Red Hat Inc.(RHAT)

Thur. - Accenture(ACN), American Greetings(AM), CA Inc.(CA), Constellation Brands(STZ), General Mills(GIS), Monsanto(MON), Palm Inc.(PALM), Worthington Industries(WOR)

Fri. - None of note

Other events that have market-moving potential this week include:

Mon. - Jeffries Life Sciences Conference

Tue. - Jeffries Life Sciences Conference, Banc of America Gaming Conference, William Blair Growth Stock Conference

Wed. - William Blair Growth Stock Conference, Banc of America Gaming Conference, Jeffries Life Sciences Conference

Thur. - Banc of America Gaming Conference, William Blair Growth Stock Conference

Fri. - None of note

BOTTOM LINE: I expect US stocks to finish the week modestly higher on a lifting of uncertainty surrounding the FOMC policy statement, short-covering, bargain hunting and a decline in long-term rates. My trading indicators are still giving mostly bearish signals and the Portfolio is 75% net long heading into the week.

Saturday, June 24, 2006

Market Week in Review

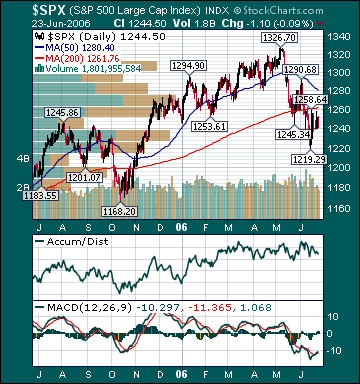

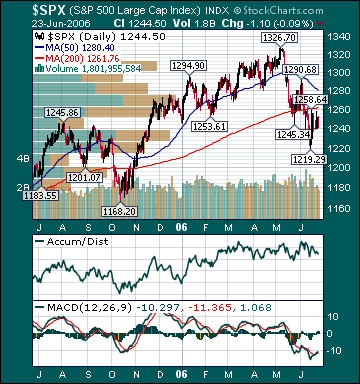

S&P 500 1,244.50 -.56%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was mildly bearish. The advance/decline line fell, most sectors declined and volume was below average on the week. Measures of investor anxiety were lower. The AAII % Bulls rose to 34.40%, but is still below average levels. The % Bears fell to 41.6% and is still above average levels. Most other measures of investor sentiment are still near levels associated with meaningful market bottoms.

The average 30-year mortgage rate rose to 6.71% which is 150 basis points above all-time lows set in June 2003. I still believe housing is in the process of slowing to more healthy sustainable levels. I still see little evidence of a nationwide “hard landing” for housing at this point.

The benchmark 10-year T-note yield rose 10 basis points on the week as global stock markets further stabilized and US economic data were mostly positive. I still believe inflation concerns have peaked for the year as investors continue to anticipate slower economic growth, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose less than expectations even as refinery utilization increased. Unleaded Gasoline futures rose and are now 26.6% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 13.9% from 36% late last year. I continue to believe the elevated level of gas prices related to shortage speculation and crude oil production disruption speculation will further dampen fuel demand over the coming months, sending gas prices back to reasonable levels.

Natural gas inventories rose around expectations this week, however supplies are 35.1% above the 5-year average, an all-time record high for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have plunged 60.6% since December 2005 highs.

US oil inventories are still approaching 9-year highs. Since December 2003, global oil demand is down 1.19%, while global supplies have increased 5.19%. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. As the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should head meaningfully lower over the intermediate-term. This will likely begin to happen during the next quarter.

Gold rose for the week on worries over North Korea and short-covering. The US dollar surged as the current account deficit shrank, more Fed rate hikes were priced in and shorts covered.

Transportation stocks outperformed for the week on improving fundamentals in the Airline sector and a positive earnings report from FedEx(FDX). The forward p/e on the S&P 500 has contracted relentlessly over the last few years and now stands at a very reasonable 14.5. The average US stock, as measured by the Value Line Geometric Index(VGY), is down .2% this year. The Russell 2000 Index is still up 3.0% year-to-date, notwithstanding the recent correction. In my opinion, the current pullback has provided longer-term investors very attractive opportunities in many stocks that have been punished indiscriminately. However, the most overvalued economically sensitive and emerging market stocks should continue to underperform over the intermediate-term as the manias for those shares subside. I continue to believe a chain reaction of events has begun that will eventually result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels. Problematic inflation, substantially higher long-term rates, a significant US dollar decline, a “hard-landing” in housing, a plunge in consumer spending and ever higher oil prices appear to be mostly factored into stock prices at this point. I view any one of these as unlikely and the occurrence of all as highly unlikely. Upcoming earnings reports will likely provide a positive catalyst for stocks over the near-term.

Over the coming months, a Fed pause, lower commodity prices, decelerating inflation readings, lower long-term rates, increased consumer confidence, increasing demand for US stocks and the realization that economic growth is only slowing should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I still believe the S&P 500 will return a total of around 15% for the year. The ECRI Weekly Leading Index fell this week and is forecasting healthy, but decelerating, US economic activity.

*5-day % Change

Friday, June 23, 2006

Weekly Scoreboard*

Indices

S&P 500 1,244.50 -.56%

DJIA 10,989.09 -.23%

NASDAQ 2,121.47 -.40%

Russell 2000 690.14 -.42%

Wilshire 5000 12,513.34 -.41%

S&P Equity Long/Short Index 1,128.44 -.38%

S&P Barra Growth 576.81 -.67%

S&P Barra Value 665.86 -.45%

Morgan Stanley Consumer 601.11 -.47%

Morgan Stanley Cyclical 806.60 +.43%

Morgan Stanley Technology 486.38 -.61%

Transports 4,772.96 +2.95%

Utilities 406.17 -1.12%

S&P 500 Cum A/D Line 6,378.0 -8.0%

Bloomberg Oil % Bulls 40.0 unch.

CFTC Oil Large Speculative Longs 161,715 -6.6%

Put/Call .99 -20.8%

NYSE Arms .75 -40.0%

Volatility(VIX) 15.89 -7.88%

ISE Sentiment 134.0 +74.0%

AAII % Bulls 34.40 +30.25%

AAII % Bears 41.60 -24.34%

US Dollar 86.88 +1.09%

CRB 335.04 -1.23%

ECRI Weekly Leading Index 136.80 -.44%

Futures Spot Prices

Crude Oil 70.84 +1.79%

Unleaded Gasoline 212.85 +6.67%

Natural Gas 6.21 -9.47%

Heating Oil 196.50 +3.53%

Gold 586.00 +2.36%

Base Metals 200.86 -3.48%

Copper 312.65 +1.84%

10-year US Treasury Yield 5.22% +1.95%

Average 30-year Mortgage Rate 6.71% +1.21%

Leading Sectors

Airlines +7.77%

Gold & Silver +4.17%

Steel +3.07%

I-Banks +2.21%

Software +1.27%

Lagging Sectors

Defense -1.66%

Semis -1.79%

Networking -2.08%

Broadcasting -2.85%

Wireless -3.21%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

S&P 500 1,244.50 -.56%

DJIA 10,989.09 -.23%

NASDAQ 2,121.47 -.40%

Russell 2000 690.14 -.42%

Wilshire 5000 12,513.34 -.41%

S&P Equity Long/Short Index 1,128.44 -.38%

S&P Barra Growth 576.81 -.67%

S&P Barra Value 665.86 -.45%

Morgan Stanley Consumer 601.11 -.47%

Morgan Stanley Cyclical 806.60 +.43%

Morgan Stanley Technology 486.38 -.61%

Transports 4,772.96 +2.95%

Utilities 406.17 -1.12%

S&P 500 Cum A/D Line 6,378.0 -8.0%

Bloomberg Oil % Bulls 40.0 unch.

CFTC Oil Large Speculative Longs 161,715 -6.6%

Put/Call .99 -20.8%

NYSE Arms .75 -40.0%

Volatility(VIX) 15.89 -7.88%

ISE Sentiment 134.0 +74.0%

AAII % Bulls 34.40 +30.25%

AAII % Bears 41.60 -24.34%

US Dollar 86.88 +1.09%

CRB 335.04 -1.23%

ECRI Weekly Leading Index 136.80 -.44%

Futures Spot Prices

Crude Oil 70.84 +1.79%

Unleaded Gasoline 212.85 +6.67%

Natural Gas 6.21 -9.47%

Heating Oil 196.50 +3.53%

Gold 586.00 +2.36%

Base Metals 200.86 -3.48%

Copper 312.65 +1.84%

10-year US Treasury Yield 5.22% +1.95%

Average 30-year Mortgage Rate 6.71% +1.21%

Leading Sectors

Airlines +7.77%

Gold & Silver +4.17%

Steel +3.07%

I-Banks +2.21%

Software +1.27%

Lagging Sectors

Defense -1.66%

Semis -1.79%

Networking -2.08%

Broadcasting -2.85%

Wireless -3.21%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

Subscribe to:

Posts (Atom)