Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Saturday, March 31, 2007

Friday, March 30, 2007

Weekly Scoreboard*

Indices

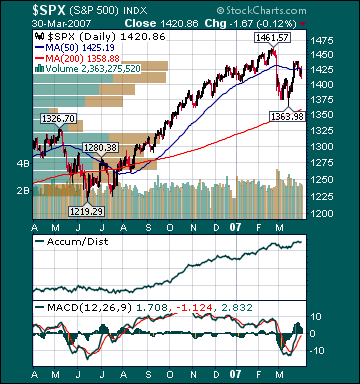

S&P 500 1,420.86 -1.06%

DJIA 12,354.35 -1.01%

NASDAQ 2,421.64 -1.11%

Russell 2000 800.71 -1.08%

Wilshire 5000 14,354.03 -1.01%

Russell 1000 Growth 558.59 -1.22%

Russell 1000 Value 823.02 -.86%

Morgan Stanley Consumer 702.15 -.81%

Morgan Stanley Cyclical 955.53 -1.0%

Morgan Stanley Technology 556.42 -.77%

Transports 4,810.70 -3.2%

Utilities 500.18 +.12%

MSCI Emerging Markets 118.32 +1.64%

Sentiment/Internals

NYSE Cumulative A/D Line 68,908 -1.9%

Bloomberg New Highs-Lows Index +94 -72.2%

Bloomberg Crude Oil % Bulls 39.0% -50.0%

CFTC Oil Large Speculative Longs 179,645 +5.1%

Total Put/Call 1.19 +32.2%

NYSE Arms 1.45 +61.1%

Volatility(VIX) 14.64 +13.05%

ISE Sentiment 94.0 -16.8%

AAII % Bulls 42.68 -2.73%

AAII % Bears 25.61 -22.6%

Futures Spot Prices

Crude Oil 65.72 +5.87%

Reformulated Gasoline 205.25 +5.65%

Natural Gas 7.71 +4.37%

Heating Oil 186.75 +8.57%

Gold 669.40 +.81%

Base Metals 249.55 +.75%

Copper 314.85 +2.27%

Economy

10-year US Treasury Yield 4.64% +3 basis points

4-Wk MA of Jobless Claims 316,800 -2.2%

Average 30-year Mortgage Rate 6.16% unch.

Weekly Mortgage Applications 671.0 -.16%

Weekly Retail Sales +3.9%

Nationwide Gas $2.63/gallon +.06/gallon

US Heating Demand Next 7 Days 13.3% below normal

ECRI Weekly Leading Economic Index 140.60 +.36%

US Dollar Index 82.93 -.42%

CRB Index 316.88 +1.91%

Leading Sectors

Nanotechnology +2.73%

Steel +2.0%

Tobacco +1.6%

Telecom +.83%

Internet +.51%

Lagging Sectors

I-Banks -2.93%

Oil Tankers -3.4%

Coal -3.6%

Airlines -3.6%

Homebuilders -4.8%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day Change

S&P 500 1,420.86 -1.06%

DJIA 12,354.35 -1.01%

NASDAQ 2,421.64 -1.11%

Russell 2000 800.71 -1.08%

Wilshire 5000 14,354.03 -1.01%

Russell 1000 Growth 558.59 -1.22%

Russell 1000 Value 823.02 -.86%

Morgan Stanley Consumer 702.15 -.81%

Morgan Stanley Cyclical 955.53 -1.0%

Morgan Stanley Technology 556.42 -.77%

Transports 4,810.70 -3.2%

Utilities 500.18 +.12%

MSCI Emerging Markets 118.32 +1.64%

Sentiment/Internals

NYSE Cumulative A/D Line 68,908 -1.9%

Bloomberg New Highs-Lows Index +94 -72.2%

Bloomberg Crude Oil % Bulls 39.0% -50.0%

CFTC Oil Large Speculative Longs 179,645 +5.1%

Total Put/Call 1.19 +32.2%

NYSE Arms 1.45 +61.1%

Volatility(VIX) 14.64 +13.05%

ISE Sentiment 94.0 -16.8%

AAII % Bulls 42.68 -2.73%

AAII % Bears 25.61 -22.6%

Futures Spot Prices

Crude Oil 65.72 +5.87%

Reformulated Gasoline 205.25 +5.65%

Natural Gas 7.71 +4.37%

Heating Oil 186.75 +8.57%

Gold 669.40 +.81%

Base Metals 249.55 +.75%

Copper 314.85 +2.27%

Economy

10-year US Treasury Yield 4.64% +3 basis points

4-Wk MA of Jobless Claims 316,800 -2.2%

Average 30-year Mortgage Rate 6.16% unch.

Weekly Mortgage Applications 671.0 -.16%

Weekly Retail Sales +3.9%

Nationwide Gas $2.63/gallon +.06/gallon

US Heating Demand Next 7 Days 13.3% below normal

ECRI Weekly Leading Economic Index 140.60 +.36%

US Dollar Index 82.93 -.42%

CRB Index 316.88 +1.91%

Leading Sectors

Nanotechnology +2.73%

Steel +2.0%

Tobacco +1.6%

Telecom +.83%

Internet +.51%

Lagging Sectors

I-Banks -2.93%

Oil Tankers -3.4%

Coal -3.6%

Airlines -3.6%

Homebuilders -4.8%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day Change

Today's Headlines

Bloomberg:

- Crude oil is falling .13/bbl., notwithstanding rumors surrounding the situation with Iran and the UK sailors.

- Corn prices are falling the maximum daily limit of 5% after a government survey showed US farmers plan to sow more of the grain than analysts expected this spring and the most since 1944. Soybeans and wheat are also falling on the report.

- Brazilian President Luiz Inacio Lula da Silva, seeking to bolster his nation’s influence in Latin America, heads to Camp David tomorrow for the first state visit to the US presidential retreat in 16 years by a leader from the region.

- The US dollar fell against the euro and declined versus the yen as the US added tariffs on imports from China.

- European Union foreign ministers pressed Iran to release 15 captive British sailors and marines, calling the arrest a “big mistake” that could do further damage to Iran’s international standing.

Wall Street Journal:

- Germany’s economic recovery is benefiting the west of the country far more than the east, where jobs remain scarce and unemployment levels much higher.

NY Times:

- An increasing number of US middle-aged and elderly people are playing non-violent, intellectually challenging video games to keep their minds sharp.

Financial Times:

- Global mergers and acquisitions reached $1.13 trillion in the first three months of 2007, a 14% increase from the same period last year, citing data provider Dealogic.

Marine Link:

- Azerbaijan plans to double its oil output by 2010, pushing it to 65 million tons a year, citing the country’s energy minister.

Xinhua News Agency:

- Volkswagen AG plans to make its China-made cars at least 20% more fuel efficient by 2010.

- Crude oil is falling .13/bbl., notwithstanding rumors surrounding the situation with Iran and the UK sailors.

- Corn prices are falling the maximum daily limit of 5% after a government survey showed US farmers plan to sow more of the grain than analysts expected this spring and the most since 1944. Soybeans and wheat are also falling on the report.

- Brazilian President Luiz Inacio Lula da Silva, seeking to bolster his nation’s influence in Latin America, heads to Camp David tomorrow for the first state visit to the US presidential retreat in 16 years by a leader from the region.

- The US dollar fell against the euro and declined versus the yen as the US added tariffs on imports from China.

- European Union foreign ministers pressed Iran to release 15 captive British sailors and marines, calling the arrest a “big mistake” that could do further damage to Iran’s international standing.

Wall Street Journal:

- Germany’s economic recovery is benefiting the west of the country far more than the east, where jobs remain scarce and unemployment levels much higher.

NY Times:

- An increasing number of US middle-aged and elderly people are playing non-violent, intellectually challenging video games to keep their minds sharp.

Financial Times:

- Global mergers and acquisitions reached $1.13 trillion in the first three months of 2007, a 14% increase from the same period last year, citing data provider Dealogic.

Marine Link:

- Azerbaijan plans to double its oil output by 2010, pushing it to 65 million tons a year, citing the country’s energy minister.

Xinhua News Agency:

- Volkswagen AG plans to make its China-made cars at least 20% more fuel efficient by 2010.

Personal Income/Spending Surges, Core PCE Above Estimates, Chicago PMI Jumps Most on Record, Confidence Slightly Below Estimates

- Personal Income for February rose .6% versus estimates of a .3% gain and a 1.0% rise in January.

- Personal Spending for February rose .6% versus estimates of a .3% gain and a .5% rise in January.

- The PCE Core for February rose .3% versus estimates of a .2% gain and a .2% rise in January.

- The Chicago Purchasing Manager Index for March rose to 61.7 versus estimates of 49.3 and a reading of 47.9 in February.

- The Final Univ. of Mich. Consumer Confidence reading for March fell to 88.4 versus estimates of 88.5 and a prior estimate of 88.8.

- Personal Spending for February rose .6% versus estimates of a .3% gain and a .5% rise in January.

- The PCE Core for February rose .3% versus estimates of a .2% gain and a .2% rise in January.

- The Chicago Purchasing Manager Index for March rose to 61.7 versus estimates of 49.3 and a reading of 47.9 in February.

- The Final Univ. of Mich. Consumer Confidence reading for March fell to 88.4 versus estimates of 88.5 and a prior estimate of 88.8.

BOTTOM LINE: Consumer spending and incomes rose more than expected last month, Bloomberg reported. The report suggests the US economy will continue to weather the slump in housing. The PCE Core for February, the Fed’s favorite inflation gauge, rose 2.4% year-over-year versus a 2.2% rise in January. I continue to believe consumer spending is accelerating into the spring as income growth substantially outpaces inflation and Americans’ median net worth is at all-time high levels.

A gauge of US business activity unexpectedly expanded this month at the fastest pace in almost two years, signaling the economy may be gaining momentum heading into the second quarter, Bloomberg said. The increase was the largest since at least 1968 when record-keeping began. Readings greater than 50 indicate expansion. A surge in orders and production gains point to the US economy overcoming the drag of housing on manufacturing. The New Orders component of the index also gained the most in history, soaring from 48.7 to 72.2. The Inventories component of the index fell to 48.8 from 54.5, which shows inventories are falling. The Employment component of the index fell to 45 from 50.6 the prior month. The Prices Paid component fell to 59.1 from 63.2 the prior month. I continue to believe the worst of the manufacturing slowdown is over and that inventory rebuilding in the second quarter will help boost overall economic growth.

US construction spending unexpectedly rose last month by the most in almost a year, as work increased on factories, commercial buildings and highways, Bloomberg said. Commercial and government-funded construction spending more than offset the drag from declining residential construction. Non-residential construction, including public projects rose 13.6% year-over-year in February. Private non-residential construction is being supported by corporate hiring that has resulted in increased demand for office space and decreased vacancy rates. I expect residential construction spending to remain a drag on overall construction throughout the year, notwithstanding February’s increase.

Consumer confidence fell slightly more than expected in March as gas prices rose, Bloomberg reported. The current conditions component of the index fell from 103.5 from 106.7 in February. Gasoline prices rose to $2.59/gallon on March 26 from $2.40 at the end of February. While recent confidence readings have declined modestly, consumer spending appears to be accelerating as unemployment remains low and wages outpace inflation. I still expect confidence to make new cycle highs later this year as gas prices fall, interest rates remain low, inflation decelerates further, the job market remains healthy, housing sales stabilize at relatively high levels and stock prices rise further.

Subscribe to:

Posts (Atom)