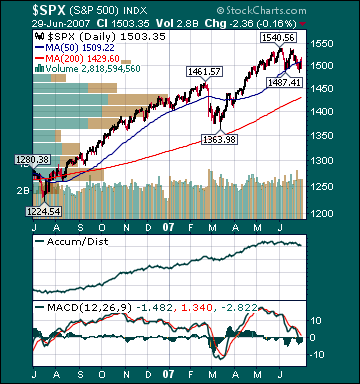

S&P 500 1,503.35 +.05%

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Friday, June 29, 2007

Weekly Scoreboard*

Indices

S&P 500 1,503.35 +.05%

DJIA 13,408.62 +.36%

NASDAQ 2,603.23 +.55%

Russell 2000 833.70 -.13%

Wilshire 5000 15,163.08 +.03%

Russell 1000 Growth 595.22 -.03%

Russell 1000 Value 858.51 +.07%

Morgan Stanley Consumer 728.96 +.39%

Morgan Stanley Cyclical 1,076.43 -.59%

Morgan Stanley Technology 622.61 -.14%

Transports 5,098.88 -.18%

Utilities 498.17 +2.64%

MSCI Emerging Markets 131.11 -.45%

Sentiment/Internals

NYSE Cumulative A/D Line 74,318 -2.49%

Bloomberg New Highs-Lows Index +144 +136.1%

Bloomberg Crude Oil % Bulls 48.0 +28.0%

CFTC Oil Large Speculative Longs 197,493 -1.63%

Total Put/Call 1.01 -1.94%

NYSE Arms 1.41 +57.47%

Volatility(VIX) 16.23 +3.05%

ISE Sentiment 166.0 +30.71%

AAII % Bulls 39.02 -9.59%

AAII % Bears 35.77 +6.2%

Futures Spot Prices

Crude Oil 70.47 +2.22%

Reformulated Gasoline 223.75 -.16%

Natural Gas 6.78 -5.23%

Heating Oil 203.79 -.19%

Gold 651.50 -.91%

Base Metals 251.09 -.14%

Copper 343.0 +1.84%

Economy

10-year US Treasury Yield 5.03% -10 basis points

4-Wk MA of Jobless Claims 316,000 +.3%

Average 30-year Mortgage Rate 6.67% -2 basis points

Weekly Mortgage Applications 618.60 -3.90%

Weekly Retail Sales +1.70%

Nationwide Gas $2.97/gallon -.02/gallon

US Cooling Demand Next 7 Days 5.0% below normal

ECRI Weekly Leading Economic Index 142.80 unch.

US Dollar Index 81.93 -.50%

CRB Index 315.74 +.32%

Leading Sectors

Disk Drives +2.96%

Utilities +2.64%

Telecom +2.60%

Wireless +2.2%

Internet +2.2%

Lagging Sectors

I-Banks -1.55%

Gold -1.87%

Coal -1.97%

Homebuilders -2.94%

Oil Service -3.55%

Stocks at Session Lows into Final Hour on Terrorism Fears, Subprime Worries and End-of-Quarter Profit-taking

Today's Headlines

Bloomberg:

- The DJIA is poised to post its best quarterly performance since the fourth quarter of 2003.

- UK police dismantled a car bomb found outside a nightclub packed with hundreds of people near London’s Piccadilly Circus, raising concern about terrorism.

-

- The Canadian dollar fell after the nation’s economy unexpectedly registered zero growth in April.

- Washington Mutual(WM), the biggest

- BP Plc(BP), Europe’s second-largest oil company, and

- General Motors(GM) will invest $945 million over the next five years in

- The price of US steel sheet fell for a third straight month in June because of reduced demand from manufacturers and a drawdown of inventories by distributors, Purchasing magazine said.

- Corn plunged to a 12-week low in

- Crude oil rose to a 10-month high in NY on speculation by investment funds that low supplies of gas will continue to boost prices into the summer.

- Talbots Inc.(TLB) appointed apparel-industry veteran Trudy Sullivan as its new CEO in an effort to stem five years of declining profit at the women’s clothing retailer.

- Chicago Board of Trade’s(BOT) largest shareholder, Sydney-based hedge fund Caledonia Investments, has voted against the proposed sale to the Chicago Mercantile Exchange because the price is too low.

- Bear Stearns(BSC) hired

Wall Street Journal:

- Discover Financial Services, set to be spun off by Morgan Stanley(MS), is far smaller than rivals Visa USA Inc. and MasterCard Inc., yet its shares may be attractive because credit-card demand is growing.

- Delta Air Lines may be the leading contender to gain the first new non-stop flights between the

- Iowa Senator Charles Grassley, the top Republican on the Senate Finance Committee, may determine the outlook for legislative proposals to raise taxes on the hedge-fund and private-equity industries.

- Lawmakers moved to salvage parts of a grand compromise on immigration reform following the collapse of the broad package.

-

- Russian authorities have shut down a US-funded non-profit training organization for journalists and filed criminal charges that critics say are politically motivated.

LA Times:

- Doug Frantz, managing editor of the LA Times, will become the

AP:

- The California State Assembly approved another 17,000 slot machines at casinos run by four

CNBC:

- The SEC is increasing its scrutiny of Bear Stearns’(BSC) hedge fund business.

Financial Times:

- Goldman Sachs Group(GS) was the top investment banking adviser in the world in the first half of 2007, citing Dealogic data.

- BP Plc(BP), Europe’s second-largest oil company, aims to double the import and sale of liquefied petroleum gas in

Incomes/Spending Rise Less Than Estimates, Inflation Decelerates Further, Chicago Manufacturing Strong, Construction Jumps, Confidence Revised Higher

- Personal Income for May rose .4% versus estimates of a .6% gain and a -.2% decline in April.

- Personal Spending for May rose .5% versus estimates of a .7% increase and a .5% gain in April.

- The PCE Core (MoM) for May rose .1% versus estimates of a .1% gain and a .1% increase in April.

- The Chicago Purchasing Manager Index for June came in at 60.2 versus estimates of 58.0 and a reading of 61.7 in May.

- Construction Spending for May rose .9% versus estimates of a .1% gain and a .2% increase in April.

- The

BOTTOM LINE: Americans spent less than forecast in May and the Fed’s preferred inflation gauge cooled, Bloomberg reported. The Core PCE, the Fed’s favorite inflation gauge, rose 1.9% from a year earlier, the smallest gain since March 2004. This is also well below the 20-year average of 2.5% and within the Fed’s comfort zone. Consumer spending will come in below average rates this quarter, however spending should substantially exceed estimates of 2.5% in the second half of the year as interest rates come back down, energy prices fall substantially, sentiment improves, inflation decelerates further, stocks rise further, incomes continue to outpace inflation and housing sales stabilize at relatively high levels.

A measure of

Spending on US construction projects rose more than forecast last month as work on non-residential and government projects helped overcome cutbacks in homebuilding, Bloomberg said. The .9% increase was the biggest gain since February 2006. Every category besides residential construction showed an increase, spurred by the building of factories and utilities. I still expect construction spending to trend below average rates as homebuilders further pare down inventories and commercial construction slows modestly.

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes