Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, June 30, 2008

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, June 29, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- Commodities are heading for their best first half in 35 years. The next six months may not be as rewarding because record prices for oil, copper and a dozen other raw materials may crimp consumption and encourage growth in supply. Investors also may shift away from commodities as an alternative to dollar assets as they expect the U.S. currency to rebound. (video)

- Wheat fell the most in three weeks after the International Grains Council raised its global production forecast. The world's wheat farmers will harvest 658 metric million tons in the year ending June 30, 2009, up from 608 million this year, the council said yesterday. That marked a 1.2 percent increase from the group's forecast on May 30. Stockpiles will rise 20 percent to 143 million tons, the council said.

- The Senate's top banking legislators told the Federal Reserve and Securities and Exchange Commission to hold off on enacting a deal to oversee Wall Street, concerned that regulators are proceeding without consulting Congress.

- A lunch date with billionaire investor Warren Buffett was sold to a Chinese hedge-fund manager yesterday for more than $2.1 million during an online auction, more than tripling last year's record of $650,100.

- Asian currencies, led by South Korea's won, declined this week as overseas investors increased sales of local shares following the biggest loss in U.S. stocks in almost three weeks.

- Hedge fund manager Jim Rogers told investors not to give up on Chinese shares after the country’s stock index plunged almost 50% just this year.

- European government bonds posted the biggest weekly advance in four months as sinking equity markets, surging oil prices and renewed concern over credit-market writedowns drove investors to the safest assets. Futures trading also showed investors reduced bets of further rate increases by the ECB. The implied yield on the December Euribor contract fell to 5.18 percent yesterday from 5.30 percent on June 20.

- OPEC President Chakib Khelil predicted that the price of oil will climb to $170 a barrel before the end of the year, citing the dollar's decline and political conflicts.

- President George W. Bush called on the United Nations to impose an international arms embargo on Zimbabwe and a travel ban on officials from Robert Mugabe’s regime after a presidential run-off denounced by western leaders.

- BG Group Plc, the

- A near-doubling of Russia’s minimum wage starting next year will not spur inflation significantly, Prime Minister Vladimir Putin said. Russia must tackle accelerating inflation to sustain the pace of economic growth, the World Bank and the International Monetary Fund said June 2. Inflation in Russia, the world's biggest oil and gas exporter, reached an annual 15.1 percent in May, the highest level in more than five years, amid record fuel prices.

- South Korean manufacturers' confidence fell to the lowest in three years as energy and commodity costs squeeze profits amid a global economic slowdown.

- Indonesia's central bank may raise its benchmark interest rate for a third straight month to slow inflation that is forecast to reach a 21-month high in June.

- Qatari inflation is likely to stay about 13.75 percent this year as food and oil prices remain high, said central bank Governor Sheikh Abdullah Bin Saud al- Thani.

Wall Street Journal:

- Hedge Fund Ospraie Gets Physical In Bid to Fine-Tune Commodity Bets. Watching sugar prices surge this year has given Dwight Anderson fits. Though the world’s sugar supply is up, speculators have plowed money into the widely traded commodity. This has turned on its head lessons Mr. Anderson learned in two decades of investing – and has eaten into the returns of his hedge-fund firm, Ospraie Management LLC. His predicament illustrates the upside-down world of commodities these days, where the intersection of food and finance is causing clashes. Investors, farmers and regulators are hotly debating whether unprecedented speculation is driving up food prices. And with legislators pointing fingers at commodities traders, Congress is studying new curbs on agricultural investing. Now, Ospraie is looking to get a leg up. In a bid to get an inside look into what is moving commodities markets, the firm closed this week on a $2.8 billion purchase of ConAgra Foods Inc.'s commodities-trading unit. The deal makes Ospraie one of the largest U.S. operators of grain elevators, which buy grain from farmers and sell it up the food chain. "What's going on right now is about crowd psychology, not fundamentals," Arthur Samberg said. "Ospraie is doing the right thing. It will pay off over the long run." Critics contend that by owning all of these assets investors can artificially inflate prices by sitting on inventory.

- Lehman Brothers(LEH) and US credit manager Aladdin Capital are each raising $3 billion funds to back small hedge fund managers in the hope of capitalizing on the worst dislocation in the industry for a decade.

MarketWatch.com:

- California Governor Arnold Schwarzenegger said Sunday he believes his state will shake off its housing troubles by next year.

- Now’s the time to buy and hold. Investors may be seeing the "peak of negativity" in the markets these days, and that's exactly why buy-and-hold types should be on the lookout for opportunities, T. Rowe Price's chief investment officer said on Friday.

- International portfolios lag US in quarter for the first time in three years. The bruising second-quarter and first half of the year has international stock-fund managers increasingly seeking solace in the energy and commodity sectors, which are one of the only games in town right now, despite signs that these parts of the market are frothy. International funds including global-stock funds fell 2.1% in the period versus an 11.9% tumble in the first quarter, according to preliminary data through June 26 from fund-tracker Lipper Inc. That compares to a 0.60% gain and a 9.7% decline, respectively, for diversified U.S. stock funds.

- Fund manager favors Priceline(PCLN), Trimble Navigation(TRMB), Nintendo(NTDOY).

- Oil pain will be greater in Asia. The damage from $140-a-barrel oil will be much greater in developing economies like China’s and India’s than in the West. Analysts have begun to flag a worrying deterioration in government balance sheets as fuel subsidies and high oil prices lead to swelling fuel tax surcharges.

NY Times:

- Intel’s(INTC) Dominance Is Challenged by a Low-Power Upstart. Intel, might do well to be alarmed by the computer chips being designed by Qualcomm(QCOM), a maker of chips for cellphones.

- Google(GOOG) is experimenting with a new method of distributing original material on the Web, and some Hollywood film financiers are betting millions that the company will succeed.

- Talks between Apple Inc.(AAPL) and China's largest mobile provider are back on track according to reports Friday, putting the American company closer to selling the iPhone in the world's biggest market.

- Wal-Mart(WMT) to revamp its logo.

- As CEO pay in Europe rises, so does talk of curbing it.

Forbes:

- Top 25 Best Countries for Business.

- America’s Highest-Paying Blue-Collar Jobs.

Reuters:

- Steel tycoon Lakshmi Mittal has joined the board of directors of Goldman Sachs Group(GS).

Economist.com:

- The US may drop a tariff on Brazilian ethanol. But the industry is still the victim of much misplaced criticism.

Financial Times:

- Several Asian countries are looking at spending billions of dollars on shares to support plunging stock markets in a move likely to be welcomed by global investors who fear emerging markets may be about to suffer further dramatic falls. The development follows a 13 per cent fall this year in the MSCI Asia Pacific index, which looks as though it will end the month on Monday with its worst first-half performance since 1992, when it sank by 23 per cent as the Japanese economic bubble deflated.

- Citigroup(C) is planning to overhaul its bonus system for hundreds of top managers in an effort to increase co-operation and minimize in-fighting among the disparate parts of the sprawling financial services conglomerate.

Guardian:

- As we suffer, City speculators are moving in for the kill. As the credit crunch deepens and prices spiral upwards the antics of the hedge fund managers are making our lives even worse.

- Foreign sovereign wealth investors are targeting London’s hedge fund industry as they seek to boost returns on their vast savings, much of it generated from trade with the west in oil and other commodities.

Auto Motor und Sport:

- Volkswagen AG’s management board will decide where to build a

El Pais:

- Spanish Prime Minister Jose Luis Rodriguez Zapatero said the European Central Bank should take a “flexible” view of price increases because they aren’t a sign the euro-region economy is growing too quickly. He repeated criticism of ECB President Jean-Claude Trichet’s announcement that the central bank may raise rates next week. Signaling that the bank may raise interest rates ahead of time “produces disquiet,” Zapatero said. “The effect is almost as if it had been two rate increases. The US Fed has pursued a different policy, and over the medium term we will see which was correct.”

WirtschaftsWoche:

- Chancellor Angela Merkel and US Treasury Secretary Henry Paulson will discuss how to curb speculation in energy markets at a meeting in

Business Timesonline:

- The worst of the financial crisis is over and markets should start settling from the second half of this year, the head of France’s biggest listed bank, BNP Paribas, told Italy’s La Repubblica newspaper.

International Herald Tribune:

- Pricey oil makes geothermal projects more attractive for Indonesia and the Philippines.

Weekend Recommendations

Barron's:

- Made positive comments on (PBR), (LGCY), (NLY) and (NOK).

- Made negative comments on (MVL) and (C).

Citigroup:

- Reiterated Buy on (GOOG), target $630. Our #1 Internet Long Recommendation – Based on the results of proprietary research into GOOG’s near-/medium-/long-term outlooks and on what presents itself as a highly favorable Risk-Reward outlook we are making GOOG our #1 choice for Top Picks Live – Citi’s dynamic list of stocks to buy or sell today. Based on extensive channel checks, we believe that GOOG’s Q2 results are well on track to meet our estimates. Key channel themes include: continued marketing budget shifts to Search, continued pricing growth, and continued market share gains by Google. We believe that the 12 month outlook for the “PC Search” industry remains robust. Among the key themes: over 50% of marketers view Search as the highest ROI advertising channel. We continue to believe GOOG has significant long-term option value with mobile search and display advertising.

- Reiterated Buy on (CELG), raised estimates, target $79.

Night Trading

Asian indices are -.25% to +.50% on avg.

S&P 500 futures +.27%.

NASDAQ 100 futures +.21%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (RBN)/.58

- (HRB)/2.04

Upcoming Splits

- (PDO) 5-for-4

Economic Releases

9:45 am EST

- The Chicago Purchasing Manager report for June is estimated to fall to 48.0 versus a reading of 49.1 in May.

Other Potential Market Movers

- The NAPM-Milwaukee report could also impact trading today.

Weekly Outlook

Click here for the Weekly Economic Preview by MarketWatch.

There are several economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. –

Tues. – Total Vehicle Sales, ISM Manufacturing, ISM Prices Paid, Construction Spending, weekly retail sales

Wed. – Challenger Job Cuts, ADP Employment Change, Factory Orders, weekly EIA energy inventory data report, weekly MBA Mortgage Applications report

Thur. – Change in Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings, Initial Jobless Claims, ISM Non-Manufacturing Composite

Fri. –

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – H&R Block(HRB)

Tues. – Oshkosh Corp.(OSK), Constellation Brands(STZ), Schnitzer Steel(SCHN), Apollo Group(APOL)

Wed. – Family Dollar(FDO), Acuity Brands(AYI)

Thur. – None of note

Fri. –

Other events that have market-moving potential this week include:

Mon. – None of note

Tue. – (TDG) analyst day, (CPB) analyst presentation

Wed. – None of note

Thur. – None of note

Fri. –

Friday, June 27, 2008

Weekly Scoreboard*

Indices

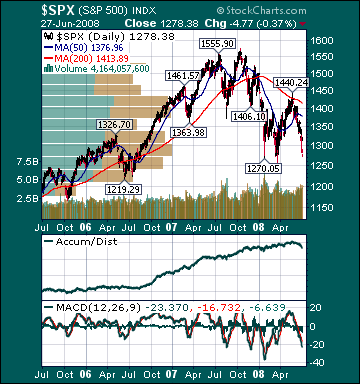

S&P 500 1,278.38 -3.0%

DJIA 11,346.51 -4.19%

NASDAQ 2,315.63 -3.76%

Russell 2000 698.14 -3.80%

Wilshire 5000 13,019.88 -3.13%

Russell 1000 Growth 553.92 -3.01%

Russell 1000 Value 676.23 -3.21%

Morgan Stanley Consumer 648.60 -2.93%

Morgan Stanley Cyclical 859.97 -5.42%

Morgan Stanley Technology 559.64 -3.97%

Transports 4,909.12 -5.49%

Utilities 506.99 -2.29%

MSCI Emerging Markets 135.20 -2.69 %

Sentiment/Internals

NYSE Cumulative A/D Line 47,110 -8.26%

Bloomberg New Highs-Lows Index -1099 -67.8%

Bloomberg Crude Oil % Bulls 38.0 +31.03%

CFTC Oil Large Speculative Longs 211,137 +3.6%

Total Put/Call 1.11 -13.95%

OEX Put/Call 1.0 -30.07%

ISE Sentiment 112.0 +47.37%

NYSE Arms .90 -33.82%

Volatility(VIX) 23.44 +2.49%

G7 Currency Volatility (VXY) 10.11 +2.02%

Smart Money Flow Index 8,081.35 -3.55%

AAII % Bulls 31.25 -5.25%

AAII % Bears 52.27 +14.28%

Futures Spot Prices

Crude Oil 140.21 +4.08%

Reformulated Gasoline 350.12 +2.19%

Natural Gas 13.20 +.63%

Heating Oil 390.66 +3.69%

Gold 931.30 +3.16%

Base Metals 246.92 -.38%

Copper 387.80 +1.28%

Agriculture 483.47 +3.0%

Economy

10-year US Treasury Yield 3.97% -20 basis points

10-year TIPS Spread 2.53% +3 basis points

TED Spread 1.13 +18 basis points

N. Amer. Investment Grade Credit Default Swap Index 141.57 +17.97%

Emerging Markets Credit Default Swap Index 255.43 +7.05%

Citi US Economic Surprise Index +7.50 -39.0%

Fed Fund Futures 24.7% chance of 25 hike, 75.3% chance of no move on 8/5

Iraqi 2028 Govt Bonds 72.54 -1.18%

4-Wk MA of Jobless Claims 378,300 +.6%

Average 30-year Mortgage Rate 6.45% +3 basis points

Weekly Mortgage Applications 461,300 -9.26%

Weekly Retail Sales +2.4%

Nationwide Gas $4.07/gallon -.01/gallon.

US Cooling Demand Next 7 Days 5.0% above normal

ECRI Weekly Leading Economic Index 131.70 -.68%

US Dollar Index 72.36 -.92%

Baltic Dry Index 9,599 +1.81%

CRB Index 464.40 +1.98%

Best Performing Style

Large-cap Growth -3.02%

Worst Performing Style

Small-cap Value -4.47%

Leading Sectors

Oil Service +3.21%

Energy 1.31%

Drugs +.83%

Hospitals -.65%

Medical Equipment -.80%

Lagging Sectors

I-Banks -5.60%

Wireless -6.48%

Alternative Energy -7.58%

Airlines -10.52%

Gaming -11.40%