Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, January 05, 2009

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, January 04, 2009

Monday Watch

Weekend Headlines

Bloomberg:

- Wall Street’s biggest bond firms say Treasuries will fall for the first time in a decade as efforts to spur the economy gain traction and the flight to safety that drove the best returns in government debt since 1995 wanes. Benchmark 10-year notes may lose 3.1% this year, the first loss since declining 8.3% in 1999, based on the median forecast of the 17 primary government security dealers that trade with the Federal Reserve. “We could start to see stability sooner than the market would otherwise expect,” said William O’Donnell, a

- The cost of protecting investors from defaults on Asia-Pacific corporate and government bonds declined, according to traders of credit-default swaps. The Markit iTraxx

Wall Street Journal:

Barron’s:

MarketWatch.com:

NY Times:

TheStreet.com:

- Top 2009 Biotech Stocks. (video)

Econbrowser:

Business Week:

- Mortgage rates are at historic lows and may be poised to go even lower next year. It's a great time to buy a home—if you can.

- Expert predictions: Stock market could be good in 2009.

CNNMoney.com:

- Top 10 Macworld rumors for 2009.

International Herald Tribune:

Reuters:

Financial Times:

AFP:

- The first passenger flight from Europe in 18 years landed at

-

Business Standard:

-

Sankei:

- Toyota Motor Corp. will freeze construction plans for new factories in

Weekend Recommendations

Barron's:

- Made positive comments on (TBT), (HYG), (F), (GE), (AMZN), (BIIB), (DO) and (C).

Night Trading

Asian indices are +1.0% to +2.50% on avg.

S&P 500 futures -.43%.

NASDAQ 100 futures -.42%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (MOS)/1.52

Upcoming Splits

- None of note

Economic Releases

10:00 am EST

- Construction Spending for November is estimated to fall 1.4% versus a 1.2% decline in October.

- Total Vehicle Sales for December are estimated to fall to 10.0M versus 10.2M in November.

Other Potential Market Movers

- The Fed’s Yellen Speaking could also impact trading today.

BOTTOM LINE: Asian indices are higher, boosted by technology and commodity shares in the region. I expect

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are a number of economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Construction Spending, Total Vehicle Sales

Tues. – Weekly retail sales reports, ISM Non-Manufacturing, Factory Orders, Pending Home Sales, Dec. 16 FOMC Meeting Minutes

Wed. – Weekly MBA mortgage applications report, weekly EIA energy inventory data, Challenger Job Cuts, ADP Employment Change

Thur. – ICSC Chain Store Sales, Initial Jobless Claims, Consumer Credit

Fri. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Wholesale Inventories

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Mosaic Co.(MOS)

Tues. – Global Payments(GPN), Acuity Brands(AYI), Supervalu(SVU)

Wed. – Constellation Brands(STZ), Monsanto(MON), Ruby Tuesday(RI), Bed Bath & Beyond(BBBY), Family Dollar(FDO)

Thur. – Chevron Corp.(CVX), Allscripts(MDRX), Apollo Group(APOL)

Fri. – KB Home(KBH)

Other events that have market-moving potential this week include:

Mon. – The Fed’s Yellen Speaking

Tue. – The

Wed. – The Fed’s Hoenig speaking, Goldman Healthcare Conference, Needham Growth Conference, Citi Entertainment/Media/Telecom Conference, Consumer Electronics Show

Thur. – 10-year Treasury Auction, the Fed’s Hoenig speaking, (MON) R&D Pipeline update, Needham Growth Conference, Goldman Healthcare Conference, JPMorgan Tech Forum, Citi Entertainment/Media/Telecom Conference

Fri. – (GIS) analyst meeting, the Fed’s Lacker speaking, (MON) R&D Pipeline update

Saturday, January 03, 2009

Friday, January 02, 2009

Weekly Scoreboard*

Indices

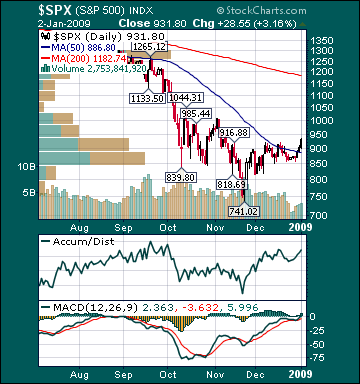

S&P 500 931.80 +7.33%

DJIA 9,034.69 +6.69%

NASDAQ 1,632.21 +7.04%

Russell 2000 505.82 +7.51%

Wilshire 5000 9,331.77 +7.51%

Russell 1000 Growth 384.31 +7.54%

Russell 1000 Value 500.54 +7.45%

Morgan Stanley Consumer 565.06 +5.76%

Morgan Stanley Cyclical 498.94 +10.93%

Morgan Stanley Technology 356.52 +7.78%

Transports 3,651.02 +9.34%

Utilities 378.82 +5.80%

MSCI Emerging Markets 25.59 +6.93%

Sentiment/Internals

NYSE Cumulative A/D Line 21,471 +32.24%

Bloomberg New Highs-Lows Index -319 +39.47%

Bloomberg Crude Oil % Bulls 36.0 unch.

CFTC Oil Large Speculative Longs 215,665 +4.77%

Total Put/Call .94 +17.50%

OEX Put/Call 1.20 -60.66%

ISE Sentiment 118.0 -15.11%

NYSE Arms .69 -23.59%

Volatility(VIX) 39.19 -12.52%

G7 Currency Volatility (VXY) 20.33 +5.17%

Smart Money Flow Index 7,344.83 +3.52%

AAII % Bulls 24.0 -17.1%

AAII % Bears 54.67 +24.65%

Futures Spot Prices

Crude Oil 46.25 +29.90%

Reformulated Gasoline 111.0 +32.0%

Natural Gas 6.03 +2.95%

Heating Oil 147.70 +18.49%

Gold 876.80 +3.42%

Base Metals 110.93 +9.79%

Copper 146.05 +14.81%

Agriculture 308.73 +4.81%

Economy

10-year US Treasury Yield 2.39% +26 basis points

10-year TIPS Spread .12% +2 basis points

TED Spread 1.33 -15 basis points

N. Amer. Investment Grade Credit Default Swap Index 200.0 -2.19%

Emerging Markets Credit Default Swap Index 721.70 -1.69%

Citi US Economic Surprise Index -117.3 +.93%

Fed Fund Futures imply 74.0% chance of no change, 26.0% chance of 25 basis point cut on 1/28

Iraqi 2028 Govt Bonds 42.12 -1.25%

4-Wk MA of Jobless Claims 552,300 -1.0%

Average 30-year Mortgage Rate 5.10% -4 basis points

Weekly Mortgage Applications 1,245,700 +.02%

Weekly Retail Sales -.90%

Nationwide Gas $1.63/gallon -.01/gallon

US Heating Demand Next 7 Days 8.0% below normal

ECRI Weekly Leading Economic Index 108.0 +1.12%

US Dollar Index 81.84 +.77%

Baltic Dry Index 774.0 unch.

CRB Index 233.92 +11.05%

Best Performing Style

Mid-cap Growth +9.56%

Worst Performing Style

Small-cap Value +7.10%

Leading Sectors

Oil Service +18.24%

Steel +14.11%

I-Banks +11.97%

Gaming +10.92%

Semis +9.43%

Lagging Sectors

Restaurants +4.87%

Foods +4.74%

Drugs +4.40%

Tobacco +2.61%

REITs +1.09%

Stocks Finish Sharply Higher, Boosted by Gaming, Technology, Commodity, Alternative Energy, Construction and Airline Shares

Market Summary

Top 20 Biz Stories

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Real-Time Stock Bid/Ask

After-hours Stock Quote

After-hours Stock Chart

In Play