The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,134.50 +1.85%

- S&P 500 High Beta 31.87 +2.12%

- Wilshire 5000 29,092.60 +1.64%

- Russell 1000 Growth 894.77 +1.84%

- Russell 1000 Value 969.48 +1.35%

- S&P 500 Consumer Staples 461.78 +1.86%

- Morgan Stanley Cyclical 1,552.05 +2.30%

- Morgan Stanley Technology 937.57 +2.26%

- Transports 8,104.57 +2.29%

- Bloomberg European Bank/Financial Services 111.09 +1.81%

- MSCI Emerging Markets 42.58 -1.08%

- HFRX Equity Hedge 1,161.83 +.84%

- HFRX Equity Market Neutral 960.64 -.48%

Sentiment/Internals

- NYSE Cumulative A/D Line 222,986 +1.52%

- Bloomberg New Highs-Lows Index 418 +274

- Bloomberg Crude Oil % Bulls 33.33 -4.17%

- CFTC Oil Net Speculative Position 423,136 +3.15%

- CFTC Oil Total Open Interest 1,635,600 +1.75%

- Total Put/Call .90 +20.0%

- OEX Put/Call 1.86 +20.78%

- ISE Sentiment 100.0 -30.07%

- Volatility(VIX) 11.40 -5.24%

- S&P 500 Implied Correlation 55.24 -3.26%

- G7 Currency Volatility (VXY) 5.93 -4.66%

- Emerging Markets Currency Volatility (EM-VXY) 6.89 -.14%

- Smart Money Flow Index 11,069.16 +.57%

- ICI Money Mkt Mutual Fund Assets $2.587 Trillion +.13%

- ICI US Equity Weekly Net New Cash Flow -$1.802 Billion

- AAII % Bulls 36.46 +19.82%

- AAII % Bears 23.30 -12.12%

Futures Spot Prices

- Reformulated Gasoline 297.19 -.62%

- Heating Oil 288.82 -2.27%

- Bloomberg Base Metals Index 196.63 +.25%

- US No. 1 Heavy Melt Scrap Steel 363.67 USD/Ton unch.

- China Iron Ore Spot 91.80 USD/Ton -5.85%

- UBS-Bloomberg Agriculture 1,489.81 -2.21%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 5.0% unch.

- Philly Fed ADS Real-Time Business Conditions Index -.0307 +37.35%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 123.96 +.22%

- Citi US Economic Surprise Index -4.8 -6.2 points

- Citi Emerging Markets Economic Surprise Index -20.40 -1.3 points

- Fed Fund Futures imply 38.0% chance of no change, 62.0% chance of 25 basis point cut on 6/18

- US Dollar Index 80.37 +.02%

- Euro/Yen Carry Return Index 144.81 -.17%

- Yield Curve 210.0 -9 basis points

- 10-Year US Treasury Yield 2.48% -5 basis points

- Federal Reserve's Balance Sheet $4.280 Trillion -.12%

- U.S. Sovereign Debt Credit Default Swap 16.76 +3.68%

- Illinois Municipal Debt Credit Default Swap 150.0 +7.56%

- Western Europe Sovereign Debt Credit Default Swap Index 34.85 -6.71%

- Asia Pacific Sovereign Debt Credit Default Swap Index 78.80 -4.88%

- Emerging Markets Sovereign Debt CDS Index 208.52 -3.57%

- Israel Sovereign Debt Credit Default Swap 80.0 -2.55%

- Russia Sovereign Debt Credit Default Swap 193.34 -2.55%

- China Blended Corporate Spread Index 328.99 -5.95%

- 10-Year TIPS Spread 2.21% -1.0 basis point

- 2-Year Swap Spread 14.0 +2.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -8.75 -1.25 basis points

- N. America Investment Grade Credit Default Swap Index 62.21 -1.57%

- European Financial Sector Credit Default Swap Index 72.79 -5.91%

- Emerging Markets Credit Default Swap Index 247.0 -5.61%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 86.0 +1.0 basis point

- M1 Money Supply $2.774 Trillion -.40%

- Commercial Paper Outstanding 1,028.0 -.90%

- 4-Week Moving Average of Jobless Claims 311,500 -11,000

- Continuing Claims Unemployment Rate 2.0% unch.

- Average 30-Year Mortgage Rate 4.12% -2 basis points

- Weekly Mortgage Applications 362.20 -1.17%

- Bloomberg Consumer Comfort 33.1 -.8 point

- Weekly Retail Sales +3.80% -30 basis points

- Nationwide Gas $3.66/gallon unch.

- Baltic Dry Index 940.0 -2.69%

- China (Export) Containerized Freight Index 1,103.56 +.58%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 25.0 unch.

- Rail Freight Carloads 269,444 +.89%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (12)

- PTCT, HSH, GTT, PARRE, SHLO, MDBX, BCRX, SN, MGNX, AMSG, TRNO and HPQ

Weekly High-Volume Stock Losers (8)

- DAKT, ARUN, SC, AHC, NTLS, ESI, SCVL and DSW

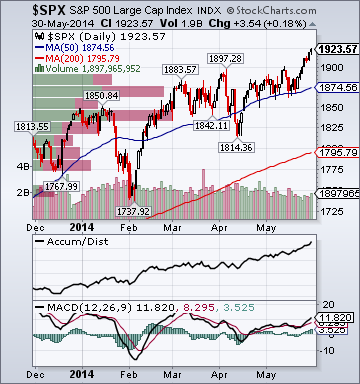

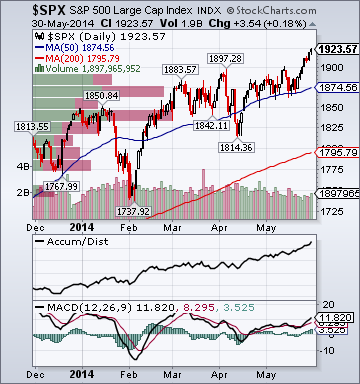

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Equity Market Tone:

- Advance/Decline Line: Lower

- Sector Performance: Most Sectors Declining

- Market Leading Stocks: Underperforming

Equity Investor Angst:

- Volatility(VIX) 11.52 -.43%

- Euro/Yen Carry Return Index 144.87 +.25%

- Emerging Markets Currency Volatility(VXY) 6.89 -.58%

- S&P 500 Implied Correlation 55.06 +1.21%

- ISE Sentiment Index 103.0 +18.39%

- Total Put/Call .88 +27.54%

Credit Investor Angst:

- North American Investment Grade CDS Index 62.32 +.18%

- European Financial Sector CDS Index 72.79 +.37%

- Western Europe Sovereign Debt CDS Index 34.85 -.01%

- Asia Pacific Sovereign Debt CDS Index 79.21 -1.14%

- Emerging Market CDS Index 246.83 +.29%

- China Blended Corporate Spread Index 328.99 -5.65%

- 2-Year Swap Spread 14.0 +1.0 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -8.75 -.5 basis point

Economic Gauges:

- 3-Month T-Bill Yield .03% unch.

- Yield Curve 210.0 +2.0 basis points

- China Import Iron Ore Spot $91.80/Metric Tonne -4.08%

- Citi US Economic Surprise Index-4.80 -1.9 points

- Citi Emerging Markets Economic Surprise Index -20.40 -1.1 points

- 10-Year TIPS Spread 2.21 -2.0 basis points

Overseas Futures:

- Nikkei Futures: Indicating +85 open in Japan

- DAX Futures: Indicating +4 open in Germany

Portfolio:

- Higher: On gains in my medical/retail sector longs and emerging markets shorts

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 25% Net Long

Bloomberg:

- Russian Forces Back Off Ukraine Border as Fighting Rages. Russia has pulled back most of its troops from the border with Ukraine,

according to a U.S. defense official, as government forces continued a

campaign to wipe out separatist rebels in the former Soviet Republic’s

east. A “majority of the Russian forces” have been withdrawn

from the Ukrainian border, Rear Admiral John Kirby, a Pentagon

spokesman, told reporters traveling to Singapore with U.S. Defense

Secretary Chuck Hagel. About seven battalions of Russian troops, or

“several thousands,” remain, he said. Russia’s

withdrawal may be marred by a gas dispute. Talks with Ukraine in Berlin

today won’t advance, Ukrainian First Deputy Energy Minister Yuri Zyukov

said yesterday.

- Abe Offers Japan’s Support to Southeast Asia on Sea Disputes. Prime

Minister Shinzo Abe said Japan

would spare no effort in helping Southeast Asian nations secure the seas

and pledged strong support for the Philippines and Vietnam in their

maritime disputes with China. “Japan will offer its utmost support

for the efforts of the countries of Asean as they work to ensure the

security of the seas and the skies, and thoroughly maintain freedom of

navigation and freedom of overflight,” Abe said in Singapore today,

referring to the 10-member Association of Southeast Asian Nations. Abe’s

speech to defense officials at the Shangri-La security forum comes at a

time of rising tensions over China’s assertiveness in the East and

South China Sea.

- Vietnam Prepares Legal Action Against China, Prime Minister Says. Vietnam has prepared evidence for a legal suit challenging China’s claim to waters off the Vietnamese coast and is considering the best time to file it, Prime Minister Nguyen Tan Dung said yesterday in an interview. “We are prepared and ready for legal action,” Dung

said, sitting in the prime minister’s compound in Hanoi in front of a

bronze bust of Ho Chi Minh, the founder of communist Vietnam. “We are

considering the most appropriate timing to take this measure.”

- Brazil Growth Slowed in First Quarter as Investment Fell. Brazil’s economic growth slowed in

the first quarter as President Dilma Rousseff, who is up for re-election in October, struggles to rebuild confidence that led to

the biggest decline in investment in two years. Gross domestic product increased 0.2 percent in the first

quarter, the equivalent to 0.8 percent on an annual basis, down

from a revised 0.4 percent in the last three months of 2013. The

result was in line with the median estimate of 41 analysts

surveyed by Bloomberg. Investment fell 2.1 percent in the quarter.

- Vale Set for Worst Losing Streak Since 2008.

Vale SA (VALE5), the world’s largest iron-ore producer, is posting its

worst streak of monthly losses in five years as prices for the

steel-making ingredient sink. The shares fell 3.2 percent to 25.79 reais

at 11:42 a.m. in Sao Paulo today, bringing losses this month to 2.4

percent. The stock is now set for its seventh monthly drop, the longest

losing rout since 2008. Brazil’s benchmark Ibovespa gauge is up 0.2

percent this month, its third straight gain. Iron ore sank 4.1

percent today to $91.80 a dry ton and has lost 13 percent in May, a

sixth monthly retreat. That’s the longest losing run since the data

series began in November 2008. The commodity is down 32 percent this

year, entering a bear market in March as the biggest miners raised

output, spurring forecasts for a rising global surplus while slowing

growth in China capped demand. “The best way to begin to understand

Vale’s weakness is to look to China,” Lawrence Creatura, a Rochester, New York-based fund manager at Federated Investors Inc., which oversees about

$366 billion, said in a telephone interview. “If China were to

decelerate further, it’s reasonable to expect pressure on

commodities to continue.”

- European Stocks Little Changed for Seventh Weekly Gain.

European stocks were little changed,

with the Stoxx Europe 600 Index advancing for a seventh week, as a

better-than-expected report on U.S. business activity offset

consumer-confidence data that missed forecasts. Societe Generale SA

slipped 2.2 percent after Les Echos reported that the French bank’s

Russian unit posted a decline in first-quarter profit. BNP Paribas SA

fell 2.4 percent as a

person familiar with the matter said U.S. authorities are

seeking more than $10 billion from the bank to settle

investigations into dealings with sanctioned countries. Rio

Tinto Group and BHP Billiton Ltd. slid as a gauge of commodity

producers declined the most on the Stoxx 600.

The Stoxx 600 fell 0.1 percent to 344.24 at the close of

trading.

Wall Street Journal:

- Moody's Warns on EU New Banking Rules. Rating Agency Says Directive Could Leave Stakeholders Vulnerable to Banking Crises.

Moody's Investors Service Inc. has become the latest of the three big

debt rating firms to warn that new European Union rules could make

stakeholders more vulnerable to losses in any future banking crisis. In

response to the EU's so-called Bank Recovery and Resolution Directive,

under which shareholders, bondholders and some depositors may have to

stomach big losses or commit to so-called bail ins to help rescue ailing

banks, Moody's has cut its long-term rating outlook on 82 European

banks to negative. That means the...

Fox News:

- Shinseki resigns over growing VA scandal. President Obama announced Friday that embattled Veterans Affairs

Secretary Eric Shinseki would take the fall for the rapidly growing

scandal over veterans' health care, accepting his resignation under

pressure from members of both parties. The president announced that Shinseki would resign after they met at the

White House and he received an update on an internal review of the

problems at the VA. The review showed the problems were not limited to

just a few facilities, Obama said, adding: "It's totally unacceptable.

Our veterans deserve the best."

CNBC:

- Fast food CEO: Minimum wage hikes closing locations. CKE Restaurants' roots began in

California roughly seven decades ago, but you won't see the parent

company of Carl's Jr. and Hardee's expanding there much anymore. What's causing what company CEO Andy Puzder describes as "very little growth" in the state? In part it's because "the minimum wage is so high

so it's harder to come up with profitable business models," Puzder said

in an interview. The state's minimum wage is set to rise to $9 in July,

making it among the nation's highest, and $10 by January 2016.

ZeroHedge:

Business Insider:

meps:

- Steel Price Hike in U.S. Heightens Import Threat from China. US

flat product producers have successfully implemented at least a

proportion of their latest round of proposed increases. However, the

upward movements now appear to have stalled. Local supply is slowly

returning to normal and the recent hikes, together with expanding

domestic delivery lead times, have spurred an interest in imported

material.

Business Recorder:

- Real Slides on Swaps; Bovespa Suffers with GDP. Brazil's real fell the most among Latin American currencies on Friday as

investors tried to curb losses related to the expiration of currency

swaps next week, while Brazilian stocks suffered with weak economic data

and a fall in iron-ore prices.

Valor:

- Brazil Vehicle Sales Fall 11% Y/Y in May.

Xinhua:

- China's Instant Messaging Cos. to Crack Down on Rumors. Tencent's

WeChat, NetEase's Yixin and other 5 instant messaging applications

vowed to clean up illegal contents after the nation's public security

ministry started to crack down on spreading rumors or information of

violence, terrorism, pornography and fraud from May 27, citing the

companies.

Sina:

- CBRC Official Says China Property Loan Risk Controllable. China

will not relax or offer discounts for property development loans or

mortgages, citing an official at China Banking Regulatory Commission.

China must "strictly" control risks from property loans, CBRC says in

its 2013 annual report issued today.

Style Underperformer:

Sector Underperformers:

- 1) Steel -2.67% 2) Disk Drives -2.21% 3) Alt Energy -2.01%

Stocks Falling on Unusual Volume:

- BLOX, BNNY, CSTE, NMBL, EXPR, SPLK, RCAP, LGF, VEEV, GES, QSII, MTZ, AFSI, RNET, DISCK, RIO, AERI, NRP, REX, AFOP, ENS, TWTR, AVA, HQL, USLV, NRP and QSII

Stocks With Unusual Put Option Activity:

- 1) JNPR 2) XLU 3) FFIV 4) XLY 5) COG

Stocks With Most Negative News Mentions:

- 1) NFLX 2) LGF 3) CLI 4) JD 5) VALE

Charts:

Style Outperformer:

Sector Outperformers:

- 1) REITs +.36% 2) Retail +.35% 3) Utilities +.29%

Stocks Rising on Unusual Volume:

- OVTI, RTRX, NPSP, BIG, NLNK, DKS, ANN, PANW and PCYC

Stocks With Unusual Call Option Activity:

- 1) CL 2) OVTI 3) NPSP 4) SPLK 5) PEP

Stocks With Most Positive News Mentions:

- 1) BIG 2) OVTI 3) AAPL 4) MNKD 5) NOC

Charts: