Market Snapshot

Detailed Market Summary

Market Internals

Economic Commentary

Movers & Shakers

Today in IBD

NYSE OrderTrac

I-Watch Sector Overview

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Option Dragon

Real-time Intraday Chart/Quote

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, September 11, 2006

Sunday, September 10, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- President Bush said Americans are safer now than before the Sept. 11 terrorist attacks five years ago because of steps taken by his administration.

- The US gasoline pump price fell 21 cents in the past two weeks to $2.66 a gallon as supplies kept ahead of demand, Trilby Lundberg said, citing her survey of about 7,000 filling stations nationwide.

- OPEC President Edmund Daukoru said he’s “very concerned” about the drop in oil prices, down 16% from July highs.

- OPEC is likely to keep production unchanged when it meets next week, OPEC ministers from Saudi Arabia and the UAE said.

- European Central Bank President Jean-Claude Trichet and fellow policy makers signaled interest rates will be raised again in October to temper inflation.

- China’s government will increasingly turn to monetary policy to slow excessive investment, Vice Premier Zeng Peiyan said, signaling that the central bank my raise the cost of borrowing and curb loans in the fourth quarter.

- China’s investment and production grew at a slower pace last month while inflation remained stable, Premier Wen Jiabao said, suggesting government measures are effective in cooling the fastest expansion in more than a decade.

- Former Hewlett-Packard Co.(HPQ) director Tom Perkins, who resigned over an investigation of leaks of company information to the press, today called on Chairwoman Patricia Dunn to step down.

- Coca-Cola(KO) today inaugurated a new $25 million bottling plant in Kabul, marking its re-entry into Afghanistan after a 15-year absence because of violence there.

- The drop in oil, gold and other raw materials since May is signaling an end to the five-year bull market in commodities as global growth slows and demand falls. Frederic Lasserre, director of commodities research at Societe Generale SA in Paris, said a 50% plunge in metals prices is “likely.”

Wall Street Journal:

- Citigroup(C) named Dean Barr as head of its Tribeca Global Management LLC hedge fund unit, replacing Tanya Styblo Beder.

- Asia’s emerging stock markets failed to keep pace with a global rally during the past three months.

- Lenovo Group Ltd., the world’s third-largest pc maker, is prepared to cut prices as competitors such as Dell Inc.(DELL) step up efforts to gain market share in China.

- The Japanese economy grew at a 1.0% annual pace in the three months ended June 30, the Cabinet Office said.

- The Australian dollar may decline a fourth straight day, its longest losing streak in over a month, on concern a slump in the price of metals the nation exports will spur selling.

- President Bush began two days of ceremonies marking the fifth anniversary of the Sept. 11 terrorist attacks, laying wreaths at the site of the World Trade Center in NY.

Barron’s:

- Apple Computer(AAPL) is about to start remodeling some of its stores. The stores’ all-white look will likely be changed and the redesign will focus on new products being added to the company’s lineup.

- Johnson & Johnson(JNJ), General Electric(GE) and Procter & Gamble(PG) were rated the most respected of the world’s 100 largest companies, citing a second annual survey of money managers.

- LaBranche(LAB) is “ripe” for a management-led leveraged buyout as the company may add as much as $400 million in cash during the next few years, citing Louis Capital research head Robert Van Batenburg.

NY Times:

- Medtronic(MDT) and Honeywell Intl.(HON) are betting on remote-monitoring medical technology to lead to more effective use of drugs and fewer and shorter hospital stays for patients.

- The Boston Police Dept. will be testing a system that automatically notifies US immigration officials if state and local police run a federal fingerprint check on a suspect.

Washington Post:

- US intelligence agencies have made “major advance” since the Sept. 11 attacks and are now better prepared to head off terrorist plots, John Negroponte, director of national intelligence, wrote.

LA Times:

- Los Angeles International Airport began a service allowing passengers to check in at locations around the city to avoid the buildup of long lines at the airport.

Financial Times:

- Apple Computer(AAPL) will say it plans to start a service for downloading films.

- General Electric’s(GE) NBC Universal plans a rapid acceleration of its digital activities that could increase online revenue 500% by 2009, citing CEO Wright.

Sunday Times:

- Richard Branson, the UK billionaire who controls Virgin Group, invested $60 million in a stake in Cilion, a company that makes fuel from corn.

AP:

- Former US Vice President Al Gore said he hasn’t ruled out the possibility of making another run for president, but considers it unlikely.

- Iran’s chief nuclear negotiator said the country is willing to consider halting uranium enrichment for as long as two months.

Le Monde:

- French Interior Minister Nicolas Sarkozy, a probable candidate for the nation’s presidency next year, said he feels “close” with the US and expressed admiration for its “energy and fluidity” in an interview.

Daily Mail:

- Scientists may find a cure for hay fever within three years, and asthma “shortly” after that, citing Dr. Ronald van Ree, a researcher at the University of Amsterdam.

al-Ayam:

- Trade between Bahrain and the US increased 58% in the first half after the two countries signed a free-trade agreement.

Weekend Recommendations

Barron's:

- Had positive comments on (SYMC) and (IR).

Night Trading

Asian indices are -.50% to +.50% on average.

S&P 500 indicated -.05%

NASDAQ 100 indicated +.03%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CPB)/.22

- (PRX)/.15

Upcoming Splits

- None of note

Economic Releases

- None of note

Bloomberg:

- President Bush said Americans are safer now than before the Sept. 11 terrorist attacks five years ago because of steps taken by his administration.

- The US gasoline pump price fell 21 cents in the past two weeks to $2.66 a gallon as supplies kept ahead of demand, Trilby Lundberg said, citing her survey of about 7,000 filling stations nationwide.

- OPEC President Edmund Daukoru said he’s “very concerned” about the drop in oil prices, down 16% from July highs.

- OPEC is likely to keep production unchanged when it meets next week, OPEC ministers from Saudi Arabia and the UAE said.

- European Central Bank President Jean-Claude Trichet and fellow policy makers signaled interest rates will be raised again in October to temper inflation.

- China’s government will increasingly turn to monetary policy to slow excessive investment, Vice Premier Zeng Peiyan said, signaling that the central bank my raise the cost of borrowing and curb loans in the fourth quarter.

- China’s investment and production grew at a slower pace last month while inflation remained stable, Premier Wen Jiabao said, suggesting government measures are effective in cooling the fastest expansion in more than a decade.

- Former Hewlett-Packard Co.(HPQ) director Tom Perkins, who resigned over an investigation of leaks of company information to the press, today called on Chairwoman Patricia Dunn to step down.

- Coca-Cola(KO) today inaugurated a new $25 million bottling plant in Kabul, marking its re-entry into Afghanistan after a 15-year absence because of violence there.

- The drop in oil, gold and other raw materials since May is signaling an end to the five-year bull market in commodities as global growth slows and demand falls. Frederic Lasserre, director of commodities research at Societe Generale SA in Paris, said a 50% plunge in metals prices is “likely.”

Wall Street Journal:

- Citigroup(C) named Dean Barr as head of its Tribeca Global Management LLC hedge fund unit, replacing Tanya Styblo Beder.

- Asia’s emerging stock markets failed to keep pace with a global rally during the past three months.

- Lenovo Group Ltd., the world’s third-largest pc maker, is prepared to cut prices as competitors such as Dell Inc.(DELL) step up efforts to gain market share in China.

- The Japanese economy grew at a 1.0% annual pace in the three months ended June 30, the Cabinet Office said.

- The Australian dollar may decline a fourth straight day, its longest losing streak in over a month, on concern a slump in the price of metals the nation exports will spur selling.

- President Bush began two days of ceremonies marking the fifth anniversary of the Sept. 11 terrorist attacks, laying wreaths at the site of the World Trade Center in NY.

Barron’s:

- Apple Computer(AAPL) is about to start remodeling some of its stores. The stores’ all-white look will likely be changed and the redesign will focus on new products being added to the company’s lineup.

- Johnson & Johnson(JNJ), General Electric(GE) and Procter & Gamble(PG) were rated the most respected of the world’s 100 largest companies, citing a second annual survey of money managers.

- LaBranche(LAB) is “ripe” for a management-led leveraged buyout as the company may add as much as $400 million in cash during the next few years, citing Louis Capital research head Robert Van Batenburg.

NY Times:

- Medtronic(MDT) and Honeywell Intl.(HON) are betting on remote-monitoring medical technology to lead to more effective use of drugs and fewer and shorter hospital stays for patients.

- The Boston Police Dept. will be testing a system that automatically notifies US immigration officials if state and local police run a federal fingerprint check on a suspect.

Washington Post:

- US intelligence agencies have made “major advance” since the Sept. 11 attacks and are now better prepared to head off terrorist plots, John Negroponte, director of national intelligence, wrote.

LA Times:

- Los Angeles International Airport began a service allowing passengers to check in at locations around the city to avoid the buildup of long lines at the airport.

Financial Times:

- Apple Computer(AAPL) will say it plans to start a service for downloading films.

- General Electric’s(GE) NBC Universal plans a rapid acceleration of its digital activities that could increase online revenue 500% by 2009, citing CEO Wright.

Sunday Times:

- Richard Branson, the UK billionaire who controls Virgin Group, invested $60 million in a stake in Cilion, a company that makes fuel from corn.

AP:

- Former US Vice President Al Gore said he hasn’t ruled out the possibility of making another run for president, but considers it unlikely.

- Iran’s chief nuclear negotiator said the country is willing to consider halting uranium enrichment for as long as two months.

Le Monde:

- French Interior Minister Nicolas Sarkozy, a probable candidate for the nation’s presidency next year, said he feels “close” with the US and expressed admiration for its “energy and fluidity” in an interview.

Daily Mail:

- Scientists may find a cure for hay fever within three years, and asthma “shortly” after that, citing Dr. Ronald van Ree, a researcher at the University of Amsterdam.

al-Ayam:

- Trade between Bahrain and the US increased 58% in the first half after the two countries signed a free-trade agreement.

Weekend Recommendations

Barron's:

- Had positive comments on (SYMC) and (IR).

Night Trading

Asian indices are -.50% to +.50% on average.

S&P 500 indicated -.05%

NASDAQ 100 indicated +.03%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CPB)/.22

- (PRX)/.15

Upcoming Splits

- None of note

Economic Releases

- None of note

BOTTOM LINE: Asian Indices are mostly lower, weighed down by commodity shares in the region. I expect US stocks to open modestly lower and to rally into the afternoon, finishing mixed. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - None of note

Tues. - Trade Balance

Wed. - Monthly Budget Statement

Thur. - Import Price Index, Advance Retail Sales, Initial Jobless Claims, Business Inventories

Fri. - Consumer Price Index, Empire Manufacturing, Industrial Production, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Campbell Soup(CPB)

Tues. - Best Buy(BBY), CBRL Group(CBRL), Energy Conversion(ENER), Goldman Sachs(GS), John Wiley & Sons(JW/A), Kroger(KR), Pall Corp.(PLL)

Wed. - Lehman Brothers(LEH)

Thur. - Adobe Systems(ADBE), Bear Stearns(BSC), Pier 1(PIR), Tektronix(TEK)

Fri. - Corinthian Colleges(COCO), Sands Regent(SNDS), Verint Systems(VRNT)

Other events that have market-moving potential this week include:

Mon. - Bear Stearns Healthcare Conference, CSFB Homebuilding Symposium, TXN Mid-quarter Update, Fed’s Kohn speaks, Fed’s Minehan speaks, Fed’s Poole speaks

Tue. - Bear Stearns Healthcare Conference, Merrill Lynch Media & Entertainment Conference, CSFB Homebuilding Symposium, Lehman Brothers Conference, DELL analyst meeting, Fed’s Yellen speaks

Wed. - Morgan Stanley Industrials Conference, Merrill Lynch Media & Entertainment Conference, Lehman Brothers Conference, AKAM analyst summit

Thur. - Bear Stearns Liquid Products Conference, Morgan Stanley Industrials Conference, Merrill Lynch Media & Entertainment Conference, Lehman Brothers Conference

Fri. - Morgan Stanley Industrials Conference, Fed’s Hoenig speaks

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - None of note

Tues. - Trade Balance

Wed. - Monthly Budget Statement

Thur. - Import Price Index, Advance Retail Sales, Initial Jobless Claims, Business Inventories

Fri. - Consumer Price Index, Empire Manufacturing, Industrial Production, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Campbell Soup(CPB)

Tues. - Best Buy(BBY), CBRL Group(CBRL), Energy Conversion(ENER), Goldman Sachs(GS), John Wiley & Sons(JW/A), Kroger(KR), Pall Corp.(PLL)

Wed. - Lehman Brothers(LEH)

Thur. - Adobe Systems(ADBE), Bear Stearns(BSC), Pier 1(PIR), Tektronix(TEK)

Fri. - Corinthian Colleges(COCO), Sands Regent(SNDS), Verint Systems(VRNT)

Other events that have market-moving potential this week include:

Mon. - Bear Stearns Healthcare Conference, CSFB Homebuilding Symposium, TXN Mid-quarter Update, Fed’s Kohn speaks, Fed’s Minehan speaks, Fed’s Poole speaks

Tue. - Bear Stearns Healthcare Conference, Merrill Lynch Media & Entertainment Conference, CSFB Homebuilding Symposium, Lehman Brothers Conference, DELL analyst meeting, Fed’s Yellen speaks

Wed. - Morgan Stanley Industrials Conference, Merrill Lynch Media & Entertainment Conference, Lehman Brothers Conference, AKAM analyst summit

Thur. - Bear Stearns Liquid Products Conference, Morgan Stanley Industrials Conference, Merrill Lynch Media & Entertainment Conference, Lehman Brothers Conference

Fri. - Morgan Stanley Industrials Conference, Fed’s Hoenig speaks

BOTTOM LINE: I expect US stocks to finish the week modestly higher on short-covering, bargain hunting, decelerating inflation readings and less pessimism. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.

Saturday, September 09, 2006

Market Week in Review

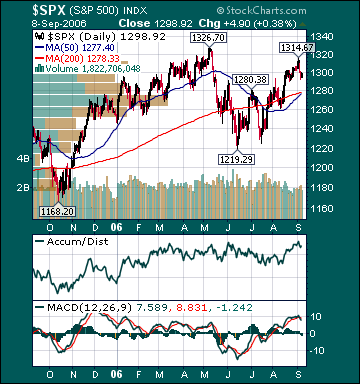

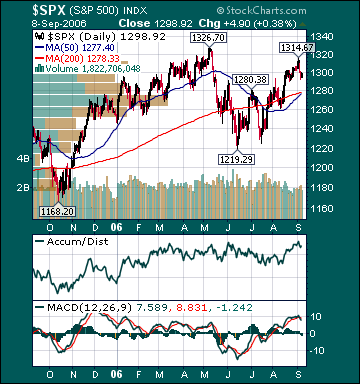

S&P 500 1,298.92 -.37%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was mildly bearish. The advance/decline line fell slightly, most sectors declined and volume was below average on the week. Measures of investor anxiety were mostly higher. The AAII percentage of Bulls rose to 42.99% this week from 41.57% the prior week. This reading is still slightly below-average levels. The AAII percentage of Bears rose to 29.91% this week from 25.84% the prior week. This reading is now slightly above average levels. The 10-week moving average of the percent Bears is currently 41.03%. The 10-week moving-average of percent Bears was 43.0% at the major bear market lows during 2002. The only other time it was higher than these levels, since record keeping began in 1987, was the significant market bottom during the 1990 recession and Gulf War. I continue to believe the “irrational pessimism” aimed towards most US stocks has never been this great in history given the positive macro backdrop.

The average 30-year mortgage rate rose 3 basis points to 6.47%, which is 33 basis points below July highs. I still believe housing is in the process of slowing to more healthy sustainable levels. Mortgage rates have likely begun an intermediate-term move lower, which should help stabilize housing over the next few months. The Case-Shiller housing futures are projecting a 5% decline in the average home price over the next 9 months. Considering the average house has appreciated over 50% during the last few years, this would be considered a “soft landing.” The overall negative effects of housing on the US economy are currently being exaggerated, in my opinion. Housing has been slowing substantially for 13 months and has been mostly offset by other very positive aspects of the economy.

The benchmark 10-year T-note yield rose 4 basis points on the week on profit-taking. The CRB Commodities Index, the main source of inflation fears, has now declined 1% over the last 12 months. I still believe inflation concerns have peaked for the year as economic growth moderates to around average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose more than expectations as refinery utilization increased. Unleaded Gasoline futures dropped substantially again this week and are now 44.5% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. Gasoline demand is estimated to rise .8% this year versus a 20-year average of 1.7% demand growth. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 8.6% from 36% late last year. The elevated level of gas prices related to crude oil production disruption speculation is further dampening fuel demand, which is sending gas prices back to more reasonable levels.

US oil inventories are near 7-year highs. Since December 2003, global oil demand is only up .1%, while global supplies have increased 5.3%, according to the Energy Intelligence Group. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. Oil closed the week at $66.25/bbl., breaking slightly below its major uptrend line at $66.33. A major top in oil is likely already in place. However, a Gulf hurricane will likely lead to a bounce higher in price over the next month further accelerating demand destruction, resulting in a complete technical breakdown in crude. As the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should head meaningfully lower over the intermediate-term.

Natural gas inventories rose more than expectations this week, sending prices for the commodity even lower. Supplies are now 12.1% above the 5-year average, a record high level for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have collapsed 64.1% since December 2005 highs. It is very likely US natural gas storage will become full during October, creating the distinct possibility of a “no-bid” situation for the physical commodity. Colorado State recently reduced its forecast from three to two major hurricanes for this season versus seven last year. Natural gas made new cycle lows again this week despite the fact that the commodity is in its seasonally strong period.

Gold fell on the week as the US dollar strengthened and inflation fears continued to diminish. The US dollar rose on mostly hawkish Fed commentary and weaker international economic reports. I continue to believe there is almost zero chance of a Fed rate hike at the September meeting and very little chance of another hike this year.

Consumer discretionary stocks outperformed on the week as energy prices continued to fall and weekly retail sales accelerated to a strong 3.7%. Commodity stocks underperformed again as the mania for these shares continues to subside in the face of falling prices and declining inflation worries. S&P 500 profit growth for the second quarter is coming in a strong 13.2% versus a long-term historical average of 7%, according to Reuters. This would mark the 16th straight quarter of double-digit profit growth, the best streak since recording keeping began in 1936. Moreover, another double-digit gain is likely in the third quarter. Despite a 74.2% total return for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 14.9. The 20-year average p/e for the S&P 500 is 24.4. The S&P 500 is up 5.4% and the Russell 2000 Index is up 6.1% year-to-date, notwithstanding the recent pullback.

Current stock prices are still providing longer-term investors very attractive opportunities in many stocks that have been punished indiscriminately. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A recent CSFB report confirmed this view. The report concluded that on a price-to-cash flow basis growth stocks are now cheaper than value stocks for the first time since at least 1977. Almost the entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is a function of growth stock multiple contraction. The p/e on value stocks is back near high levels. I still expect the most overvalued economically sensitive and emerging market stocks to continue underperforming over the intermediate-term as the manias for those shares subside and global growth slows to more average rates. I still believe a chain reaction of events has begun that will eventually result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels. One of the characteristics of the current “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated and promptly priced in to stock prices. Problematic inflation, substantially higher long-term rates, a significant US dollar decline, a “hard-landing” in housing, a plunge in consumer spending and ever higher oil prices appear to be mostly factored into stock prices at this point. I view any one of these as unlikely and the occurrence of all as highly unlikely. This “irrational pessimism” by investors is resulting in a dramatic decrease in the supply of stock as companies buy back shares, IPOs are pulled and secondary stock offerings are canceled.

Over the coming months, an end to the Fed rate hikes, lower commodity prices, seasonal strength, the November election, decelerating inflation readings, lower long-term rates, increased consumer/investor confidence, rising demand for US stocks and the realization that economic growth is only slowing to around average levels should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I expect the S&P 500 to return a total of at least 15% for the year. The ECRI Weekly Leading Index rose this week and is forecasting healthy US economic activity.

*5-day % Change

Friday, September 08, 2006

Weekly Scoreboard*

Indices

S&P 500 1,298.92 -.37%

DJIA 11,392.11 +.09%

NASDAQ 2,165.79 -.82%

Russell 2000 708.54 -1.66%

Wilshire 5000 12,977.52 -.57%

S&P Barra Growth 602.96 -.42%

S&P Barra Value 693.93 -.33%

Morgan Stanley Consumer 643.74 +.22%

Morgan Stanley Cyclical 807.11 +.55%

Morgan Stanley Technology 502.69 -1.19%

Transports 4,195.07 -2.05%

Utilities 434.10 -1.91%

MSCI Emerging Markets 96.08 -1.58%

S&P 500 Cum A/D Line 7,018.0 -1.0%

Bloomberg Oil % Bulls 25.0 -33.3%

CFTC Oil Large Speculative Longs 179,017 unch.

Put/Call 1.01 +14.77%

NYSE Arms 1.13 -4.24%

Volatility(VIX) 13.16 +6.9%

ISE Sentiment 125.0 -38.42%

AAII % Bulls 42.99 +3.42%

AAII % Bears 29.91 +15.75%

US Dollar 85.95 +1.06%

CRB 320.39 -2.62%

ECRI Weekly Leading Index 135.50 +.3%

Futures Spot Prices

Crude Oil 66.25 -5.79%

Unleaded Gasoline 160.91 -9.85%

Natural Gas 5.67 -3.49%

Heating Oil 184.32 -8.34%

Gold 617.90 -2.38%

Base Metals 237.34 +3.03%

Copper 357.75 +3.37%

10-year US Treasury Yield 4.76% +.63%

Average 30-year Mortgage Rate 6.47% +.47%

Leading Sectors

Restaurants +2.40%

Retail +1.66%

Defense +.49%

Computer Services +.37%

Software +.32%

Lagging Sectors

Gold & Silver -4.03%

Airlines -4.32%

Disk Drives -5.59%

Oil Tankers -6.0%

Coal -6.59%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

S&P 500 1,298.92 -.37%

DJIA 11,392.11 +.09%

NASDAQ 2,165.79 -.82%

Russell 2000 708.54 -1.66%

Wilshire 5000 12,977.52 -.57%

S&P Barra Growth 602.96 -.42%

S&P Barra Value 693.93 -.33%

Morgan Stanley Consumer 643.74 +.22%

Morgan Stanley Cyclical 807.11 +.55%

Morgan Stanley Technology 502.69 -1.19%

Transports 4,195.07 -2.05%

Utilities 434.10 -1.91%

MSCI Emerging Markets 96.08 -1.58%

S&P 500 Cum A/D Line 7,018.0 -1.0%

Bloomberg Oil % Bulls 25.0 -33.3%

CFTC Oil Large Speculative Longs 179,017 unch.

Put/Call 1.01 +14.77%

NYSE Arms 1.13 -4.24%

Volatility(VIX) 13.16 +6.9%

ISE Sentiment 125.0 -38.42%

AAII % Bulls 42.99 +3.42%

AAII % Bears 29.91 +15.75%

US Dollar 85.95 +1.06%

CRB 320.39 -2.62%

ECRI Weekly Leading Index 135.50 +.3%

Futures Spot Prices

Crude Oil 66.25 -5.79%

Unleaded Gasoline 160.91 -9.85%

Natural Gas 5.67 -3.49%

Heating Oil 184.32 -8.34%

Gold 617.90 -2.38%

Base Metals 237.34 +3.03%

Copper 357.75 +3.37%

10-year US Treasury Yield 4.76% +.63%

Average 30-year Mortgage Rate 6.47% +.47%

Leading Sectors

Restaurants +2.40%

Retail +1.66%

Defense +.49%

Computer Services +.37%

Software +.32%

Lagging Sectors

Gold & Silver -4.03%

Airlines -4.32%

Disk Drives -5.59%

Oil Tankers -6.0%

Coal -6.59%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

Subscribe to:

Comments (Atom)