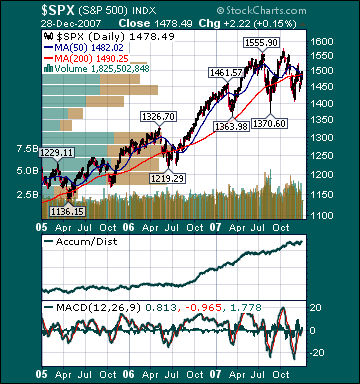

S&P 500 1,478.48 +1.26%*

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Friday, December 28, 2007

Weekly Scoreboard*

Indices

S&P 500 1,478.48 +1.26%

DJIA 13,365.87 +.91%

NASDAQ 2,674.46 +1.27%

Russell 2000 771.76 +.55%

Wilshire 5000 14,847.34 +1.19%

Russell 1000 Growth 616.54 +1.13%

Russell 1000 Value 800.28 +1.28%

Morgan Stanley Consumer 744.24 +.75%

Morgan Stanley Cyclical 999.99 +1.53%

Morgan Stanley Technology 629.30 +.52%

Transports 4,625.57 +.91%

Utilities 537.17 +.09%

MSCI Emerging Markets 152.17 +2.28%

Sentiment/Internals

NYSE Cumulative A/D Line 60,357 +2.68%

Bloomberg New Highs-Lows Index -436

Bloomberg Crude Oil % Bulls 41.0 +156.2%

CFTC Oil Large Speculative Longs 219,382 +2.95%

Total Put/Call .92 +42.86%

NYSE Arms 1.10 +13.26%

Volatility(VIX) 20.71 +.68%

ISE Sentiment 169.0 +53.64%

AAII % Bulls 30.0 -16.3%

AAII % Bears 50.0 +6.0%

Futures Spot Prices

Crude Oil 96.08 +5.59%

Reformulated Gasoline 246.65 +5.54%

Natural Gas 7.36 +1.69%

Heating Oil 264.45 +1.94%

Gold 841.90 +5.07%

Base Metals 214.73 +.28%

Copper 307.70 +3.55%

Economy

10-year US Treasury Yield 4.08% -9 basis points

4-Wk MA of Jobless Claims 342,500 -.3%

Average 30-year Mortgage Rate 6.17% +3 basis points

Weekly Mortgage Applications 603.80 -7.6%

Weekly Retail Sales +1.3%

Nationwide Gas $3.00/gallon +.02/gallon

US Heating Demand Next 7 Days 2.0% below normal

ECRI Weekly Leading Economic Index 135.20 -.73%

US Dollar Index 76.20 -2.02%

CRB Index 358.51 +2.54%

Best Performing Style

Large-cap Value +1.28%

Worst Performing Style

Small-cap Value -.04%

Leading Sectors

Alternative Energy +5.7%

Steel +5.7%

Oil Service +5.6%

Telecom +3.3%

Wireless +2.4%

Lagging Sectors

REITs -.94%

Computer Services -1.23%

Hospitals -1.25%

Retail -1.77%

Airlines -5.0%

Stocks Mostly Lower into Final Hour on More Economic Pessimism, Profit-taking

Today's Headlines

Bloomberg:

- A Taliban commander linked to al-Qaeda is suspected of plotting the suicide attack that killed former Prime Minister Benazir Bhutto, Pakistan’s government said.

- Macy’s Inc.(M), Best Buy(BBY) and Abercrombie & Fitch(ANF) may get a boost in store traffic and revenue in the next few weeks from the redemption of gift cards, which are growing faster than total retail sales.

- The cost of borrowing in dollars, euros and pounds fell, capping a second week of declines, as coordinated central bank action to revive money markets showed signs of success.

- Checkpoint Systems(CKP), the maker of anti-theft tags for retailers, rose the most in nine months after it named a new CEO and forecast 2008 earnings exceeding analysts’ estimates.

- Farmers in

- Crude oil is rising to a one-month high on year-end investment fund mark-ups and a weaker dollar.

- Treasuries rose the most in more than two weeks and headed for the best annual returns since 2002 after a government report showed sales of new homes in the

- Democratic presidential candidate John Edwards said neither of his two major opponents would bring substantial change to the way Washington works – Hillary Clinton doesn’t want to and Barack Obama doesn’t know how.

NY Post:

- NY’s population stays almost unchanged.

Information Times:

-

Bear Radar

Style Underperformer:

Small-cap Value (-.50%)

Sector Underperformers:

Airlines (-2.13%), REITs (-1.28%) and Hospitals (-.80%)

Stocks Falling on Unusual Volume:

Bull Radar

Style Outperformer:

Small-cap Growth(+.69%)

Sector Outperformers:

Foods (+1.51%), Oil Service (+1.21%) and Telecom (+1.09%)

Stocks Rising on Unusual Volume: