Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are several economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – S&P/CaseShiller Home Price Index, Consumer Confidence, Richmond Fed Manufacturing Index, House Price Index, weekly retail sales

Wed. – Durable Goods Orders, New Home Sales, FOMC rate decision, weekly MBA Mortgage Applications report, weekly EIA energy inventory data report

Thur. – Final 1Q GDP, Final 1Q, Personal Consumption, Final 1Q GDP Price Index, Final 1Q Core PCE, Initial Jobless Claims, Existing Home Sales, weekly EIA natural gas inventory report

Fri. – Personal Income, Personal Spending, PCE Core, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Walgreen Co.(WAG)

Tues. – Jabil Circuit(JBL), Darden Restaurant(DRI), Sonic Corp.(SONC), Kroger Co.(KR)

Wed. – Monsanto(MON), General Mills(GIS), Nike Inc.(NKE), Oracle Corp.(ORCL), CKE Restaurants(CKE), Herman Miller(MLHR), Red Hat Inc.(RHT), Bed Bath & Beyond(BBBY), American Greeting(AM)

Thur. – Discover Financial(DFS), Lennar Corp.(LEN), ConAgra Foods(CAG), Palm Inc.(PALM), Christopher & Banks(CBK), Paychex(PAYX), Accenture(ACN), Rite Aid(RAD), McCormick & Co.(MKC), Micron Tech(MU)

Fri. – KB Home(KBH), Steelcase Inc.(SCS), Finish Line(FINL)

Other events that have market-moving potential this week include:

Mon. – (ECA) analyst meeting, (FEIC) investor meeting, Wachovia Nantucket Equity Conference

Tue. – (ALD) investor day, (POR) analyst day, (RDC) conference call, Wachovia Nantucket Equity Conference, Jeffries Healthcare Conference, Bank of America Utilities Conference, Deutsche Bank Alternative Energy Conference, UBS Global Financial Markets & Technology Conference

Wed. – (PRXL) investor meeting, (WMB) analyst day, (MORN) investment conference, Jeffries Healthcare Conference, Wachovia Nantucket Conference, UBS Global Financial Markets & Technology Conference

Thur. – (MORN) investment conference, (GT) investor meeting, (XLNX) analyst meeting, (AUXL) conference call, (BRCD) technology day, Wachovia Nantucket Conference, Jeffries Healthcare Conference, UBS Insurance Conference

Fri. – (MORN) investment conference, JPMorgan Tobacco Conference, UBS Insurance Conference

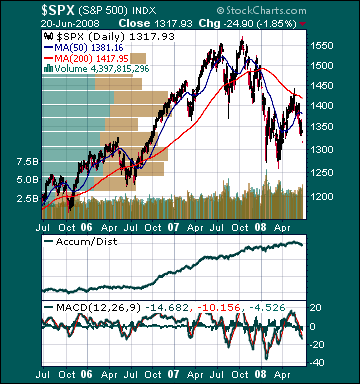

BOTTOM LINE: I expect US stocks to finish the week modestly higher on a firmer US dollar, lower energy prices, less economic pessimism, a bounce in emerging market shares, a bounce in financial stocks, bargain-hunting and short-covering. My trading indicators are giving mostly bearish signals and the Portfolio is 75% net long heading into the week.