Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, November 03, 2008

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, November 02, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- The cost of protecting investors in Australian corporate bonds against default declined, according to traders of credit-default swaps. The Markit iTraxx

- ECB May Follow as Fed, BOJ, India ‘Shocked’ Into Cuts.

- Steel Authority of India Ltd., the country’s second-biggest steelmaker, and rival Essar Steel Ltd. cut November prices to cope with falling demand. Prices of flat and long products have been cut by as much as $121 a ton, said RK Singhal, a spokesman for Steel Authority. The reductions mean that the price of Steel Authority’s benchmark hot-rolled products will fall by more than 10%, according to Niraj Shah, an analyst at Centrum Broking Pvt.

- Gold, the metal that rallied during every

Wall Street Journal:

Barron’s:

- Steve Leuthold, who manages $4 billion at Leuthold Weeden Capital Management in

NY Times:

- Prostitute-Friendly Ballot Measure Finding Support.

San Francisco Chronicle:

Reuters:

Financial Times:

Telegraph:

Estado de Sao Paulo:

- More than half of Brazilian companies plan to curb investments next year as the credit freeze worsens, citing a survey by a national industry group. About 57% of 658 companies in the country’s main industrial state will slow spending in 2009, citing a survey by the Sao Paulo State Federation of Industries. Only 16% will boost budgets, and the rest plan to maintain current levels. Brazilian credit is the scarcest its been in 20 years, citing Paulo Skaf, president of the group known as Fiesp.

The Australian:

Weekend Recommendations

Barron's:

- Made positive comments on (MI), (TAP), (KEY), (FITB), (ORCL), (CVS), (GENZ) and (MET).

- Made negative comments on (CHD).

Citigroup:

- Reiterated Buy on (PCLN), target $83.

- Added (AOC) and (MMC) to Top Picks Live List and deleted (AIZ) and (ACV).

Night Trading

Asian indices are +1.25% to +5.0% on avg.

S&P 500 futures +.81%.

NASDAQ 100 futures +.77%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (ASF)/.45

- (SPG)/1.57

- (GT)/.30

- (AMT)/.13

- (VIA/B)/.55

- (N)/-.01

- (PPS)/.43

- (MA)/2.23

- (FST)/1.40

- (ADP)/.50

- (PBI)/.69

- (MHK)/1.11

- (SYY)/.47

- (APC)/1.48

Upcoming Splits

- None of note

Economic Releases

10:00 am EST

- ISM Manufacturing for October is estimated to fall to 41.5 versus 43.5 in September.

- ISM Prices Paid for October is estimated to fall to 48.0 versus 53.5 in September.

- Construction Spending for September is estimated to fall .8% versus a 0.0% gain in August.

Afternoon:

- Total Vehicle Sales for October are estimated to fall to 12.0M versus 12.5M in September.

Other Potential Market Movers

- The Fed’s Lacker speaking, (NITE) analyst meeting and Oppenheimer Healthcare Conference could also impact trading today.

BOTTOM LINE: Asian indices are sharply higher, boosted by technology and financial shares in the region. I expect US stocks to open modestly higher and to maintain gains into the afternoon. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for Wall Street Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are a number of economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Total Vehicle Sales, ISM Manufacturing, ISM Prices Paid, Construction Spending

Tues. – Factory Orders, weekly retail sales

Wed. – Weekly MBA mortgage applications report, weekly EIA energy inventory report, Challenger Job Cuts, ADP Employment Change, ISM Non-Manufacturing

Thur. – Preliminary 3Q Non-farm Productivity, Preliminary 3Q Unit Labor Costs, Initial Jobless Claims, ICSC Chain Store Sales

Fri. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Wholesale Inventories, Pending Home Sales, Consumer Credit

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Goodyear Tire(GT), American Tower(AMT), Viacom(VIA/B), Forest Oil(FST), Mastercard(MA), Post Properties(PPS), Automatic Data Processing(ADP), NetSuite(N), Anadarko Petroleum(APC), Pitney Bowes(PBI), SYSCO(SYY), Mohawk Industries(MHK)

Tues. – Dean Foods(DF), St Joe(JOE), Archer-Daniels(ADM), Emerson Electric(EMR), Pappa John’s(PZZA), Rowan Cos(RDC), Louisiana-Pacific(LPX), Kenneth Cole(KCP), Vornado Realty(VNO)

Wed. – Foster Wheeler(FWLT), Corinthian Colleges(COCO), Checkpoint Systems(CKP), Quanta Services(PWR), Time Warner(TWX), IAC/InterActiveCorp(IACI), Marsh & McLennan(MMC), Medco Health(MHS), Duke Energy(DUK), Transocean(RIG), Polo Ralph Lauren(RL), News Corp.(NWS/A), Cisco Systems(CSCO), Vulcan Materials(VMC), Conseco(CNO), THQ Inc.(THQI), Devon Energy(DVN), Las Vegas Sands(LVS), McDermott Intl.(MDR), Whole Foods(WFMI)

Thur. – Wendy’s(WEN), Dynegy(DYN), Warnaco(WRC), Williams Cos(WMB), Grub & Ellis(GBE), Qualcomm(QCOM), Walt Disney(DIS), Flour Corp.(FLR), Dolby Labs(DLB), Avis Budget(CAR), CB Richard Ellis(CBG), Onyx Pharmaceuticals(ONXX), Nvidia Corp.(NVDA), BearingPoint(BE), priceline.com(PCLN), El Paso(EP), Beazer Homes(BZH), AutoNation(AN), OfficeMax(OMX)

Fri. – Anheuser-Busch(BUD), Sprint Nextel(S), Ford Motor(F),

Other events that have market-moving potential this week include:

Mon. – Fed’s Lacker speaking, (NITE) analyst meeting, Oppenheimer Healthcare Conference

Tue. – (FFIV) analyst meeting, Fed’s Fisher speaking, Oppenheimer Healthcare Conference, Goldman Sachs Software Conference

Wed. – (L) investor meeting, (SLE) analyst meeting, (CEPH) analyst day, Goldman Sachs Industrials Conference, Keefe Bruyette Woods Brokerage Conference, Goldman Sachs Software Conference

Thur. – Fed’s Warsh speaking, (CTV) financial analyst conference, (ILMN) analyst day, (SRP) analyst meeting

Fri. – Fed’s Lockhart speaking

Saturday, November 01, 2008

Friday, October 31, 2008

Weekly Scoreboard*

Indices

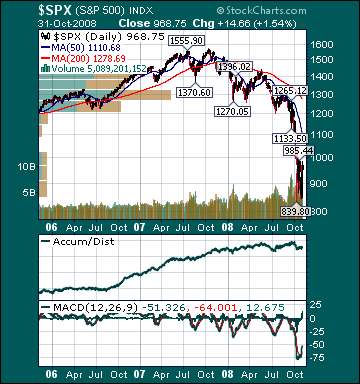

S&P 500 968.75 +10.49%

DJIA 9,325.01 +11.29%

NASDAQ 1,720.95 +10.88%

Russell 2000 537.52 +14.09%

Wilshire 5000 9,732.07 +10.86%

Russell 1000 Growth 397.85 +11.37%

Russell 1000 Value 521.37 +10.24%

Morgan Stanley Consumer 565.72 +6.48%

Morgan Stanley Cyclical 534.96 +8.84%

Morgan Stanley Technology 376.53 +10.75%

Transports 3,885.83 +12.68%

Utilities 378.42 +6.99%

MSCI Emerging Markets 25.09 +24.11%

Sentiment/Internals

NYSE Cumulative A/D Line 22,974 +22.26%

Bloomberg New Highs-Lows Index -442 +86.93%

Bloomberg Crude Oil % Bulls 57.0 +90%

CFTC Oil Large Speculative Longs 185,108 +5.91%

Total Put/Call .93 -23.77%

OEX Put/Call 1.15 +7.48%

ISE Sentiment 121.0 +6.14%

NYSE Arms .93 -30.07%

Volatility(VIX) 59.89 -24.31%

G7 Currency Volatility (VXY) 23.03 +1.23%

Smart Money Flow Index 6,701.71 +6.82%

AAII % Bulls 37.14 -4.13%

AAII % Bears 40.57 +4.72%

Futures Spot Prices

Crude Oil 67.81 +4.97%

Reformulated Gasoline 149.59 +2.11%

Natural Gas 6.78 +5.78%

Heating Oil 208.42 +5.26%

Gold 718.20 -2.42%

Base Metals 135.74 +9.75%

Copper 182.90 +7.74%

Agriculture 289.60 +5.90%

Economy

10-year US Treasury Yield 3.96% +27 basis points

10-year TIPS Spread .91% +21 basis points

TED Spread 2.65% -2 basis points

N. Amer. Investment Grade Credit Default Swap Index 200.94 -8.66%

Emerging Markets Credit Default Swap Index 681.18 -18.31%

Citi US Economic Surprise Index -71.40 -64.14%

Fed Fund Futures imply 55.3% chance of 50 basis point cut, 44.7% chance of 25 basis point cut on 12/16

Iraqi 2028 Govt Bonds n/a

4-Wk MA of Jobless Claims 475,500 -1.0%

Average 30-year Mortgage Rate 6.46% +42 basis points

Weekly Mortgage Applications 476,700 +16.81%

Weekly Retail Sales +.7%

Nationwide Gas $2.50/gallon -.28/gallon

US Heating Demand Next 7 Days 30.0% below normal

ECRI Weekly Leading Economic Index 112.95 -.95%

US Dollar Index 85.63 -.93%

Baltic Dry Index 851 -22.78%

CRB Index 268.39 +4.84%

Best Performing Style

Small-cap Value +14.69%

Worst Performing Style

Large-cap Value +10.24%

Leading Sectors

Gaming +32.4%

Homebuilders +26.41%

Airlines +19.47%

Retail +19.01%

Networking +17.04%

Lagging Sectors

Utilities +6.99%

Tobacco +6.89%

Software +6.74%

Insurance +4.64%

HMOs -1.23%