Weekend Headlines

Bloomberg:

- Crude oil may extend this week’s decline after falling below its 34-day average, according to technical analysis from PVM Oil Associates Ltd. “So long as we do not move and close back above here, the market is in bear mode,” Robin Bieber, a London-based director for PVM, said in a note to clients.

Wall Street Journal:

- Tilting at Windmill Jobs. The 'stimulus' promised a jobless peak of 8%; it's now 9.5%.

- US Retailers Find New Ways To Fine-Tune Discounts.

NY Times:

CNNMoney.com:

- Survey: The iPhone is No. 1 in Japan.

Business Week:

- The iPhone was just the start. To offset slowing growth, AT&T(T) is seeking devices that will expand the way people use its wireless network.

The

Politico:

LA Times:

World Health Organization:

Reuters:

Financial Times:

Die Welt:

- More than two-thirds of Germans prefer the government cut subsidies and benefits rater than raise taxes to cope with the financial cost of the economic crisis, citing an Infratest Dimap survey. The poll found that 68% of those questioned said the government should reduce subsidy and benefit spending, while 18% said taxes should be increased. The preference for spending cuts over higher taxes stretched across supporters of all political parties.

NRC Handelsblad:

-

Nikkei English News:

- Toyota Motor Corp. will start commercial production of plug-in hybrid cars in 2012, the first time such vehicles will be mass-produced.

Economic Daily News:

- Flat-panel display prices rose this month from late June as customers stocked up for the peak season in the third quarter, citing research by DisplaySearch LLC. Monitor prices climbed between $3 and $7 this month from late June, television-panel prices gained $5 to $15, and notebook-computer panel prices advanced $3 to $5.

Straits Times:

Emirates Business 24/7:

Weekend Recommendations

Barron's:

- Made positive comments on (DNEX), (SCHW), (FL), (DBA), (PETM) and (MSFT).

- Made negative comments on (IMAX), (MIDD) and (CMP).

Citigroup:

- Reiterated Buy on (GLW), target $20.50.

Night Trading

Asian indices are -1.25% to +.25% on avg.

S&P 500 futures -.76%.

NASDAQ 100 futures -.85%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Global Commentary

WSJ Intl Markets Performance

Commodity Futures

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- None of note

Economic Releases

- The ISM Non-Manufacturing Index for June is estimated to rise to 46.0 versus 44.0 in May.

Other Potential Market Movers

- President Obama Visiting Russia could also impact trading today.

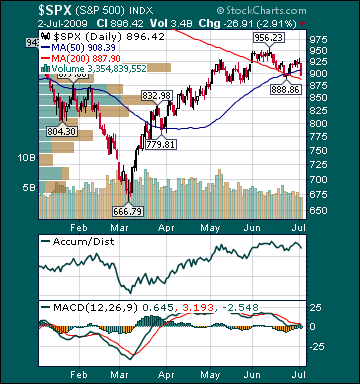

BOTTOM LINE: Asian indices are mostly lower, weighed down by commodity and shipping stocks in the region. I expect US stocks to open modestly lower and to maintain losses into the afternoon. The Portfolio is 75% net long heading into the week.