Broad Market Tone: - Advance/Decline Line: Higher

- Sector Performance: Mixed

- Volume: Light

- Market Leading Stocks: Underperforming

Equity Investor Angst: - VIX 27.07 -1.24%

- ISE Sentiment Index 70.0 +40.0%

- Total Put/Call .92 -3.16%

- NYSE Arms .90 -3.52%

Credit Investor Angst:- North American Investment Grade CDS Index 124.23 -2.64%

- European Financial Sector CDS Index 275.72 -4.92%

- Western Europe Sovereign Debt CDS Index 337.78 -1.43%

- Emerging Market CDS Index 303.98 -1.93%

- 2-Year Swap Spread 45.0 +3 bps

- TED Spread 53.0 unch.

- 3-Month EUR/USD Cross-Currency Basis Swap -126.0 -5 bps

Economic Gauges:- 3-Month T-Bill Yield .00% unch.

- Yield Curve 179.0 -6 bps

- China Import Iron Ore Spot $138.80/Metric Tonne +3.89%

- Citi US Economic Surprise Index 85.70 +23.8 points

- 10-Year TIPS Spread 2.05 -2 bps

Overseas Futures: - Nikkei Futures: Indicating +19 open in Japan

- DAX Futures: Indicating -18 open in Germany

Portfolio:

- Slightly Lower: On losses in my tech and medical sector longs

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges and to my (EEM) short, then covered some of them

- Market Exposure: 75% Net Long

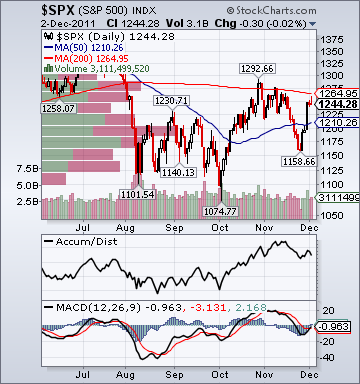

BOTTOM LINE: Today's overall market action is mildly bearish, as the S&P 500 reverses sharp morning gains near its 200-day moving average and moves to session lows on Eurozone debt angst, rising global growth fears, technical selling, profit-taking, more shorting and rising energy prices. On the positive side, Paper, Disk Drive, Networking, Bank, I-Banking and Education shares are especially strong, rising more than +1.0%. Small-caps and cyclicals are outperforming. (XLF) has traded very well throughout the day. Copper is rising +1.95%, lumber is gaining +3.37% and the UBS-Bloomberg Ag Spot Index is falling -.13%. The Brazil sovereign cds is falling -4.69%, the Russia sovereign cds is falling -5.4% to 226.50 bps and the US sovereign cds is falling -5.56% to 49.17 bps. On the negative side, Gaming, HMO, Hospital, Drug, Medical Equipment, Wireless, Ag and Utility shares are

under pressure, falling more than -1.0%. (XLK) has been relatively weak throughout the day. Oil is rising +.93% and gold is gaining +.17%. The Saudi sovereign cds is surging +4.96% to 127.0 bps, the France sovereign cds is gaining +.28% to 192.66 bps and the Ireland sovereign cds is gaining +.4% to 705.0 bps. The Italian/German 10Y Yld Spread is rising +7.4 bps to 454.71 bps. The US 10-year yield is falling -5 bps to 2.04%, despite today's jobs report. The TED spread continues to trend higher and is at the highest since May 2009. The 2Y Euro Swap Spread is near the highest since Nov. 2008. The 3M Euribor-OIS spread is very near the highest since March 2009. The 3M EUR/USD Cross-Currency Basis Swap is falling -4.15% to -126.33 bps. The Libor-OIS spread is the widest since June 2009, which is also noteworthy considering the equity surge off the recent lows. China Iron Ore Spot has plunged -27.7% since February 16th and -23.3% since Sept. 7th. The Shanghai Composite fell -1.1% overnight, as it nears its October lows, and is down -16.0% ytd. Considering the recent global equity rally and RRR cut, Chinese shares still trade poorly. As well, Brazilian shares fell -.44% today and are down -16.5% ytd. Volume is surprisingly low today given the jobs report and leadership is of fairly low-quality. Breadth is decent. The market is likely coming under pressure this afternoon mainly on a number of negative headlines out of Europe. With technical resistance at hand, I suspect investors will need to see some concrete evidence that the "kick-the-can" Euro crisis solution that is currently being priced into equities has more support from key Eurozone officials before any further stock surge into year-end. I still believe that while US economic data remain mostly firm, a "real" solution to the Eurozone crisis is needed to prevent a global double dip next year. I expect US stocks to trade mixed-to-lower into the close from current levels on tech sector pessimism, Eurozone debt angst, global growth fears, profit-taking, technical selling and more shorting.