Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, December 24, 2007

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Sunday, December 23, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- US stocks rose for the third time in four weeks as higher consumer spending and the Federal Reserve’s efforts to provide cash to banks spurred speculation the economy will keep expanding.

- US 10-year Treasury note yields rose to a three-day high on signs that central banks were adding enough funds to the financial system to spur bank lending.

- The yen fell to a six-week low against the dollar and declined versus the euro as concern eased that credit-market losses will deepen, boosting demand for higher-yielding assets funded by loans in Japan.

- Rank Group Ltd., owned by New Zealand billionaire Graeme Hart, agreed to buy Alcoa’s(AA) packaging and consumer businesses for $2.7 billion to expand in the US and gain control of units including Reynolds Wrap foil.

- China, which produces a third of the world’s steel, will raise export tariffs on some steel products from Jan.1 to help rein in a record trade surplus and reduce energy consumption and pollution.

- China will support international investment by companies next year as part of its effort to expand channels for such outbound ventures, said Wei Benhua, deputy director of the State Administration of Foreign Exchange. China will also relax controls on individual overseas investment, Wei said.

- China should take measures to cool economic growth and reduce energy consumption, an official with the National Development and Reform Commission said.

- News Corp.(NWS/A) agreed to sell eight of its Fox network-affiliated television stations in the US to Oak Hill Capital Partners LP for about $1.1 billion in cash.

Wall Street Journal:

- JPMorgan Chase(JPM) and Deutsche Bank AG are among companies planning to start an exchange to compete with CME Group Inc.(CME), operator of the Chicago Mercantile Exchange. The exchange is expected to open next year and will be backed by a dozen firms, including Merrill Lynch(MER), Credit Suisse Group and Citigroup(C).

- Banks Abandon Effort to Set Up Big Rescue Fund. The banks had been trying since September to set up a fund that would buy securities tied to mortgages and other assets that were controlled by banks in off-balance-sheet funds. By the time it began to try to gather assets, banks were already handling the problems themselves.

- Nardelli Says Chrysler Hitting Targets.

Barron’s:

- Getting the red carpet treatment. Preferred shares of Fannie Mae, WaMu and others now look enticing.

- Contrarians Beware: Putin May Mark the Top of Emerging Markets. Is Vladimir Putin the new Jeff Bezos?

NY Times:

- The IRS issued a new rule yesterday that bans selling stock at a loss to get a tax deduction, then immediately buying replacement shares through a retirement account.

- With customers leery of buying toys made in China, makers of wooden toys say in the US they can barely keep up with demand and are hiring extra employees.

TheStreet.com:

- Growth Fund Smokes With Potash and RIM.

CNBC.com:

- SEC Launches Web Tool to Compare Executive Pay.

- Top Manager: Invest in The Next Info Revolution.

- The national average price for gasoline dropped about 3 cents over the last two weeks, according to a survey released Sunday.

MarketWatch.com:

- NetSuite(N): Deja Google(GOOG) all over again. Commentary: NetSuite evolves into key player in online business software.

- Retailers Hope for Big Final Push. The final weekend of the holiday shopping season will likely bring a sigh of relief from many retailers who feared that sales would be weak. This holiday season, “we had projected a 3.6% increase and we expect that number will be hit and, potentially, could go a little bit higher,” said Bill Martin, co-founder of ShopperTrak RCT Corp., which monitors retail sales.

Forbes.com:

- Shoot To Kill. Nvidia(NVDA)

Business Week:

- What the Pros Are Saying. Most of the experts we surveyed the market going up a bit – but the climb will be tough.

- For Nokia(NOK), Excess is a Vertu. Its luxury division is booming as a high-end cell phone becomes the latest status symbol for the world’s richest people.

- A Wily Road Warrior’s Airport Tips.

- Tech Sector Outlook 2008: Part 1.

- Research In Motion(RIMM): What Slowdown?

- Deconstructing the Energy Bill.

- Microsoft’s(MSFT) Games Get Serious. ESP is a new software product based on the popular PC game Flight Simulator. It’s also Microsoft’s first foray into non-entertainment games.

- MySpace cranks up heat in Facebook turf war.

- Internet renovates how homes get sold.

CNNMoney.com:

- X-mas electronics: Apple Inc.(AAPL) rules on Amazon.com(AMZN).

- The odds on an Apple(AAPL) flash memory laptop.

Reuters:

- Microsoft’s(MSFT) piracy fight gains momentum in China.

- Merrill Lynch(MER) may get up to $5 billion in a capital infusion from Singapore state investor Temasek Holdings.

- Consumer spending strong in November.

- Research In Motion(RIMM) stock shoots higher after results.

Financial Times:

- Saudi Arabia plans to establish a sovereign wealth fund that is expected to dwarf Abu Dhabi’s $900 billion and become the largest in the world. The new fund will be a formidable rival for other government-owned investment funds in the Middle East and Asia, which are playing an increasingly active role in channeling capital to western companies, particularly financial companies hard hit by the

- Central banks resolve eases year-end fears. Interbank lending rates have fallen throughout this week, with the three-month euro Libor rate fixing on Friday at 4.78%, down 17 basis points since action by central banks was announced on December 12.

- iPhone users raise network hopes. Buyers of Apple’s(AAPL) iPhone have turned out to be voracious users of electronic mail and other data services, giving network operators hope that the much-hyped device will finally unlock billions of dollars in mobile advertising revenue.

- Cisco to network whole cities. Cisco Systems(CSCO) plans to launch a business group, based in Bangalore, India, that will wire new buildings and even entire new cities with state-of-the-art networking technology.

- iPhone key to O2 growth. Mathew Key was in California last week, briefing Steve Jobs on the iPhone’s impact in the UK.

AFP:

-

Weekend Recommendations

Barron's:

- Made positive comments on (TWP) and (RHI).

- Made negative comments on (CWCO).

Night Trading

Asian indices are +1.0% to +2.0% on avg.

S&P 500 futures unch..

NASDAQ 100 futures -.08%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- (

Economic Data

- None of note

Other Potential Market Movers

- None of note - US stock exchanges close at 1pm EST

Weekly Outlook

Click here for the Wall St. Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are a few economic reports of note and significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note,

Tues. –

Wed. – S&P/CaseShiller Home Price Index,

Thur. – Weekly MBA Mortgage Applications Report, weekly EIA energy inventory report, Durable Goods Orders, Initial Jobless Claims, Consumer Confidence

Fri. – Chicago Purchasing Manager, New Home Sales, weekly EIA natural gas inventory report

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – None of note

Tues. –

Wed. – None of note

Thur. – Christopher & Banks(CBK), Verifone(PAY)

Fri. –

Other events that have market-moving potential this week include:

Mon. – None of note

Tue. –

Wed. – None of note

Thur. – None of note

Fri. – None of note

Friday, December 21, 2007

Weekly Scoreboard*

Indices

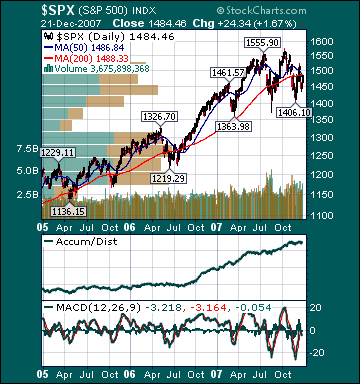

S&P 500 1,484.47 +1.13%

DJIA 13,450.65 +.83%

NASDAQ 2,691.99 +2.1%

Russell 2000 785.60 +4.2%

Wilshire 5000 14,917.77 +1.28%

Russell 1000 Growth 619.43 +1.18%

Russell 1000 Value 803.47 +1.09%

Morgan Stanley Consumer 748.94 +.3%

Morgan Stanley Cyclical 1,005.44 +1.72%

Morgan Stanley Technology 632.29 +1.47%

Transports 4,644.05 -.72%

Utilities 540.32 +.18%

MSCI Emerging Markets 151.90 +.35%

Sentiment/Internals

NYSE Cumulative A/D Line 59,087 -5.3%

Bloomberg New Highs-Lows Index -794

Bloomberg Crude Oil % Bulls 16.0 -60.0%

CFTC Oil Large Speculative Longs 213,103 -.51%

Total Put/Call .56 -46.2%

NYSE Arms .50 -62.87%

Volatility(VIX) 18.47 -19.81%

ISE Sentiment 114.0 -3.25%

AAII % Bulls 35.85 -24.7%

AAII % Bears 47.2 +32.1%

Futures Spot Prices

Crude Oil 93.28 +1.65%

Reformulated Gasoline 237.85 +1.32%

Natural Gas 7.21 +3.11%

Heating Oil 260.70 -.19%

Gold 813.80 +2.19%

Base Metals 214.14 +2.39%

Copper 310.0 +4.59%

Economy

10-year US Treasury Yield 4.17% -7 basis points

4-Wk MA of Jobless Claims 343,000 +1.2%

Average 30-year Mortgage Rate 6.14% +3 basis points

Weekly Mortgage Applications 653.80 -19.5%

Weekly Retail Sales +1.4%

Nationwide Gas $2.98/gallon -.01/gallon

US Heating Demand Next 7 Days 10.0% below normal

ECRI Weekly Leading Economic Index 136.20 -1.23%

US Dollar Index 77.73 +.37%

CRB Index 354.23 +1.6%

Best Performing Style

Small-cap Value +4.50%

Worst Performing Style

Large-cap Value +1.09%

Leading Sectors

Alternative Energy +4.59%

Computer Service +4.27%

Oil Service +3.29%

Wireless +3.15%

Biotech +2.52%

Lagging Sectors

Gaming -.56%

Road & Rail -1.27%

Restaurants -2.25%

Oil Tankers -3.35%

Airlines -4.28%