Weekend Headlines

Bloomberg:- Monti Warns of Spanish Euro Contagion Risk as EU Bolsters Firewall. Italy’s Prime Minister Mario Monti warned that Spain could reignite the European debt crisis as euro-area ministers this week prepare a deal to strengthen the region’s financial firewall. Monti pointed to Spain’s struggle to control its finances ahead of a finance ministers meeting in Copenhagen starting on March 30, where officials will seek agreement to raise a 500 billion-euro ($664 billion) ceiling on bailout funding. “It doesn’t take much to recreate risks of contagion,” Monti said during the weekend at a conference in Cernobbio, Italy. Days after his Cabinet approved a bill to overhaul Italy’s labor laws, Monti praised Spain’s efforts to loosen work regulations while advising it to focus on cutting the national budget. Spain “hasn’t paid enough attention to its public accounts,” he said. The euro crisis has eased after the European Central Bank last month boosted liquidity through three-year loans to banks, while European Union leaders this month sealed a second Greek bailout package. Still, signs of a deepening economic recession in the region and struggles to meet austerity goals have kept decision makers on alert, underscored by rising Spanish and Italian yields. Spain’s 10-year yields climbed for a third week last week after Willem Buiter, Citigroup Inc. chief economist, said the nation faced an increasing risk of debt restructuring. Yields on the security climbed by 19 basis points last week to 5.39 percent, while similar-maturity Italian debt rose 20 basis points to 5.06 percent.

- Rajoy Seeks Free Hand on Cuts in Regional Vote as Crisis Deepens. Spain’s most populous region votes in an election that may give Prime Minister Mariano Rajoy free rein to enact his deficit-cutting policies and tackle a surge in the nation’s borrowing costs. Andalusia, the last region under one-party Socialist control, votes today as surveys show Rajoy’s People’s Party is the favorite to win the southern state for the first time in three decades. Results are due shortly after polls close at 8 p.m. Asturias, the fourth-smallest region, also votes. Victory in Andalusia would leave the PP in control of regions that account for about 70 percent of the Spanish economy, while bolstering Rajoy’s mandate to reorder public finances. Rajoy, who faces his first general strike on March 29, is struggling to convince investors he can reduce the deficit amid a recession, prompting a surge in Spanish borrowing costs last week to the highest in two months.

- Spain PP Misses Majority in Andalusia, Undermining Budget Fight. Spain’s ruling People’s Party failed to dislodge the Socialists in Andalusian elections, undermining Prime Minister Mariano Rajoy as he seeks to cut the deficit and tackle a new surge in borrowing costs. The PP won 50 seats in the 109-strong regional assembly, falling short of a majority, the Seville-based government said on its website yesterday after 99 percent of ballots were counted. The Socialists won 47 seats, and United Left, a traditional ally, won the remaining 12, making a ruling coalition between the two smaller groups possible.

- Merkel Open to Concessions on Rescue Pact, Sueddeutsche Reports. German Chancellor Angela Merkel and the Christian Democratic Union are open to concessions on the euro-area rescue pact in order to win approval from opposition parties, the Sueddeutsche Zeitung said on its website today, without saying where it got the information. Volker Kauder, parliamentary chief of the CDU and its Bavarian Christian Social Union sister party, wants to meet next week with counterparts from the Free Democrats, Social Democrats and Green Party, the newspaper said, citing unidentified political sources. Some sort of financial-market participation in the cost of the euro crisis is among points the CDU is ready to discuss, the newspaper said. The CDU isn’t open to Germany being the only, or one of only a few, European Union countries to implement a financial-transaction tax, according to the report.

- Hungarian Market Collapses After Forex Loans Debacle: Mortgages.

- Oil Price May Spark Global Recession, FT Says. High oil prices are the biggest risk to the global economy and may cause a recession, the Financial Times quoted International Energy Agency chief economist Fatih Birol as saying. Current price levels are on average higher than in 2008 when the oil price hit a record of $147 a barrel, Birol said yesterday in a speech in London, according to the newspaper. The European Union will spend $502 billion on net imports of oil this year, the U.S. $426 billion and China $251 billion, according to the newspaper.

- Hedge Funds Capitulating Buy Most Stocks Since 2010 Amid Rally. Hedge funds trailing the S&P 500 Index for the last five months are giving up on bearish bets and buying stocks at the fastest rate in two years. A gauge of hedge-fund bullishness measuring the proportion of bets that shares will rise climbed to 48.6 last week from 42 at the end of November 2011, the biggest increase since April 2010, according to data compiled by the International Strategy & Investment Group. Companies with the most shares borrowed and sold by short sellers have led this quarter's rally as gains forced bearish traders to repurchase them.

- China Soft Landing May Be Hard for Commodity Exporters. “China’s still going to be growing reasonably strongly,” said Nicholas Lardy, senior fellow at the Peterson Institute for International Economics in Washington and author of the 2012 book “Sustaining China’s Economic Growth after the Global Financial Crisis.” Even so, “the super commodity cycle that was driven by China is moderating, and exporters that have ridden the property boom over the last four or five years face a much tougher time.” “The idea that commodities are just a one-way bet as an asset class is over,” said Condon, ING’s Singapore-based head of Asia research, who previously worked at the World Bank.

- Goldman's(GS) Succession Fight Roiled by Infamous Op-Ed.

- Former Goldman(GS) Employee Smith Seeking Book Deal. Greg Smith, the former Goldman Sachs Group Inc. (GS) employee who wrote on opinion piece critical of Goldman in The New York Times, is “shopping” around a book proposal, the Times reported. The book is being pitched as a “coming-of-age” tale, the Times said. Smith, who ran Goldman Sach’s U.S. equities derivaties business in Europe, met with publishers this week. In his op-ed piece, Smith also resigned from the firm.

- Romney Takes Aim at Obama Heatlh-Care Law on Second Anniversary. On the second anniversary of President Barack Obama’s signing of the law overhauling the U.S. health-care system, Mitt Romney aimed to accomplish two goals: renew his vow to repeal it and diminish assertions that the Massachusetts measure he backed was a model for it. Standing amid signs reading “Repeal and replace Obamacare,” the front-runner in the Republican presidential race said yesterday the federal law has increased government spending, raised taxes and violated religious freedom.

- Wells Fargo(WFC) Should Be Forced to Meet Subpoenas, SEC Says. Wells Fargo & Co. (WFC) failed to hand over documents demanded in U.S. subpoenas and should be forced to cooperate with a probe into its sale of almost $60 billion in residential mortgage-backed securities, regulators said.

- Fed Purchases of More Bonds Opposed by Two Regional Presidents. The remarks from Lockhart and Bullard, who have never dissented from a decision by the Federal Open Market Committee, reflect broadening sentiment on the panel against further steps to spur growth. The Fed has held interest rates near zero since 2008 and purchased $2.3 trillion in bonds.

- Citigroup(C) Sets $700 Million on Akbank Stake Sale. Citigroup Inc. (C), the third-largest U.S. bank by assets, expects an impairment charge of $700 million in the first quarter as the lender cuts its investment in Istanbul-based Akbank TAS (AKBNK) by more than half.

- BATS Scrapping IPO is Gift to Critics on Modern Structure. The decision by Bats Global Markets Inc., the third-largest U.S. equity exchange operator, to cancel its initial public offering emboldened brokerage and fund executives who say the way stocks trade in America doesn't work. Bats, founded by a high-frequency trader in 2005 and nurtured by the world's top securities firms, withdrew the IPO yesterday after errors on its own computers kept the stock from trading and forced a halt in Apple Inc. Pulling the IPO capped a day of embarrassments for the Lenexa, Kansas-based company, which rose to prominence with the electronic trading industry. "This tells you the system we've created over the last 15 years has holes in it, and this is one example of a failure," Joseph Saluzzi, partner and co-head of equity trading at Themis Trading LLC in Chatham, New Jersey, said in a phone interview. "When the exchange blows itself up, that's not a good thing."

- MF Global's Corzine May be Liable if Customer Risk Known. Jon S. Corzine, MF Global Holding Ltd.’s former chief executive officer, may face potential legal liability if investigators show he knew customer money might be used when he ordered $200 million transferred to a U.K. account as his brokerage neared collapse, former prosecutors said. The ex-Goldman Sachs Group Inc. (GS) co-chairman gave “direct instructions” to move money from a U.S. account to meet an overdraft with JPMorgan Chase & Co. (JPM) just days before MF Global’s bankruptcy, according to a memo by congressional investigators. Such accounts may have contained assets belonging to both customers and MF Global.

Wall Street Journal:- BATS Founder Wants Bonuses Suspended. Dave Cummings, founder and a current director of BATS Global Markets Inc., said the computerized stock exchange should suspend its bonus plans in light of its "botched" initial public offering Friday.

- Fresh Warnings on Money Policies. Three global central-bank leaders warned that decision makers needed to be on alert for an array of risks associated with their easy-money policies. Most notably, the three—Bank of Japan governor Masaaki Shirakawa, former European Central Bank president Jean-Claude Trichet and Jaime Caruana, who runs the Bank for International Settlements—all cautioned in different ways against banks and governments taking advantage of low interest rates to avoid taking hard steps to repair their own finances after years of aggressive borrowing.

- Businesses See Risks to Growth in China. U.S. businesses see slowing sales growth in China this year, according to an annual survey by the American Chamber of Commerce in China, while nearly half rate the nation's economic slowdown as a top risk factor. Worries of moderating growth in China are rippling across the global economy. Economists generally say Beijing would ramp up spending or take other measures if growth slowed alarmingly, significantly limiting the chances of what they call a hard landing.

Business Insider:

Zero Hedge:

CNBC:

Wall Street All-Stars:

NY Times:- Principal Write-Downs Equate to Bailout, Morgenson Says. The acting director of the Federal Housing Finance Agency and overseer of Fannie Mae and Freddie Mac, Mr. DeMarco is a soft-spoken, career public servant — and under fire. In the thankless job of conservator for the loss-ridden mortgage finance giants, he has a duty to ensure that the companies operate in the best interests of the taxpayers who own them. That means working to keep a lid on the companies’ losses, which now total $183 billion. But in recent weeks, Mr. DeMarco has come under increasing pressure to chuck his obligation to taxpayers and make Fannie and Freddie write down principal on mortgages held by troubled borrowers. He says, with reason, that such a program would run counter to his legal obligation to pursue only those activities that pose the least cost to taxpayers.

Forbes:

Chicago Tribune:

- Australia's Ruling Labor Party Crushed In State Polls. Australia's ruling Labor Party has suffered a crushing defeat in an election in the state of Queensland, handing the conservative Liberal National coalition the biggest majority in the state's history. While having no direct impact on federal politics, the result is likely to be a worry for Prime Minister Julia Gillard and her Labor Party who hold a knife-edge, one-seat majority in the federal parliament with the backing of the Greens and two independents.

CBS News:

- Islamists Are Majority On Egypt Constitution Panel. Egypt's Islamists will make up a sizable majority of a 100-member panel tasked with drafting a new constitution. The names of the 100 were published Sunday by Egypt's official news agency. Islamists form the majority of the 50 lawmakers selected by parliament's two chambers to sit on the panel. The other 50, also selected by lawmakers, are public figures who include enough Islamists to give them a comfortable overall majority in the panel.

reason:

Rasmussen Reports:

- Daily Presidential Tracking Poll. The Rasmussen Reports daily Presidential Tracking Poll for Sunday shows that 25% of the nation's voters Strongly Approve of the way that Barack Obama is performing his role as president. Forty-one percent (41%) Strongly Disapprove, giving Obama a Presidential Approval Index rating of -16 (see trends).

Reuters:

- Italy Union Says May Step Up Job Reform Strikes. Italy's biggest labour union threatened on Saturday to step up strikes to protest against plans to open up the job market that the government says will encourage investment but critics say will fail to boost employment and the economy. The bill, the first radical overhaul of Italian labour rules since the 1970s, faces lengthy political debate after the government of Prime Minister Mario Monti opted to send it through parliament, a process that could take several months, rather than pass it by decree.

- Banks Set to Cut $1 Trillion from Balance Sheets. Investment banks are to shrink their balance sheets by another $1tn or up to 7 per cent globally within the next two years, says a report that foresees a shake-up of market share in the industry. Higher funding costs and increased regulatory pressure to bolster capital will force wholesale banks also to cut 15 per cent, or up to $0.9tn, of assets that are weighted by risk, a joint report by Morgan Stanley and consultants Oliver Wyman predicts. In addition, banks are expected take out $10bn to $12bn in costs by reducing pay, firing employees and paring back investments in areas that are no longer considered core.

- Airlines Struggle to Secure Jet Financing. Almost one in four airlines fear they will not secure financing to buy aircraft this year, and many are having to look beyond their established lenders for funding, according to a new survey.

- Hedge Funds Face Higher Trading Costs. Leading prime brokerages are preparing to hit clients with across-the-board increases in the cost of trading, which could dry up liquidity and cause niche global markets to shut down.

- Greek Yields Up As CDS Trading Put On Hold. Banks have stopped offering prices on Greek sovereign credit default swaps because a payout on new instruments could be forced immediately due to technical problems with the documentation used to settle contracts. Yields, which have an inverse relationship with prices, have leapt more than 3 percentage points to 16.93 per cent on the new 2042 Greek bond – which is issued under a debt exchange with private sector bondholders and used to set the final payout on CDS contracts – since March 12, its first day of trading.

- Auditors On Alert Over Chinese Results. A new wave of scandals involving Chinese companies listed overseas could hit New York and Hong Kong in the coming weeks as the annual results season get under way with auditors on high alert for fraud.

Der Spiegel:

- GM(GM) to Shift More Production to Low-Cost Countries. General Motors(GM) is planning to shift more of its production to low-cost countries including Poland, Russia, China, India, Mexico and Brazil, citing a company strategy paper. As the automaker's output is increasing, GM Plans to build 80% of the additional units in low-cost countries, the paper said.

Bild:

- Germany's opposition Social Democrats demand measures to promote growth, ensure taxation of financial markets and reduce youth unemployment as conditions for supporting new euro-area budget rules, the party's leader Frank-Walter Steinmeier said. The party will only support the fiscal pact "if it is economically reasonable and fair," Germany's biggest tabloid quoted Steinmeier as saying. "We won't sign a blank check," he said.

Real News:

- French presidential candidate Francois Hollande said he is opposed to transferring Greek sovereignty to the European Union or anyone else, according to an interview. The Greek government should be accountable to its people for the options it chooses to overcome the economic crisis, Hollande said. He said the second bailout package for Greece, although a positive step forward, was not enough and without economic development it only buys time.

Australian Financial Review:

- China's Huawei Banned From Australia's NBN. The federal government has banned Chinese technology giant Huawei from participating in multibillion- dollar tenders to supply equipment to the national broadband network because of concerns over cyber attacks originating in China.

Xinhua:

- China will curb "unreasonable" home demand and make efforts to increase supply of residential properties, citing Housing and Urban-Rural Development Vice Minister Qi Ji.

- China's general consumer price level will rise because of higher resources and energy prices, rising labor cost and industrial and consumer products prices, Wu Ritu, a standing committee member of the National People's Congress, wrote in a commentary today. China should stick to property price controls, Wu said.

Weekend Recommendations

Barron's:- Made positive comments on (IGT) and (DE).

- Made negative comments on (ALXN).

Night Trading- Asian indices are -1.0% to +.25% on average.

- Asia Ex-Japan Investment Grade CDS Index 151.50 -3.0 basis points.

- Asia Pacific Sovereign CDS Index 117.75 -.75 basis point.

- FTSE-100 futures +.02%.

- S&P 500 futures +.11%.

- NASDAQ 100 futures +.27%.

Morning Preview LinksEarnings of NoteCompany/EstimateEconomic Releases10:00 am EST- Pending Home Sales for February are estimated to rise +1.0% versus a +2.0% gain in January.

10:30 am EST

- Dallas Fed Manufacturing Activity for March is estimated to fall to 16.0 versus a reading of 17.8 in February.

Upcoming Splits

Other Potential Market Movers- The Fed's Bernanke speaking, ECB's Draghi speaking, Chicago Fed National Activity Index for February and the Maxim Growth Conference could also impact trading today.

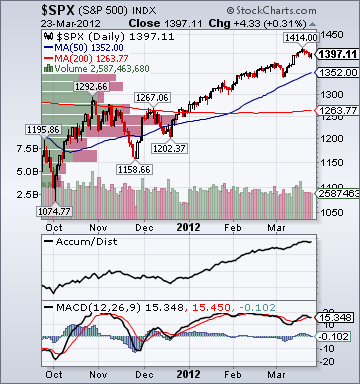

BOTTOM LINE: Asian indices are mostly lower, weighed down by industrial and technology shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing mixed. The Portfolio is 75% net long heading into the week.