Weekend Headlines

Bloomberg:

- Cyprus Said to Reach Tentative Deal to Avert Default. (video) Cyprus agreed to the outlines of an international bailout, paving the way for 10 billion euros ($13 billion) of emergency loans and eliminating the threat of default. The accord between Cyprus and the “troika” representing international lenders was reached in overnight talks in Brussels and ratified by finance ministers from the 17-nation euro area. “It’s in best interest of the Cyprus people and the European Union,” Cyprus President Nicos Anastasiades told reporters.

- Bank of Italy Says Recovery Threatened by Political Uncertainty. Moderate recovery in country expected for end of year threatened by unpredictability in domestic politics, Bank of Italy Deputy Director General Fabio Panetta said today.

- Spain’s Swelling Debt Seen Impeding Rajoy Deficit Battle. Prime Minister Mariano Rajoy’s progress in curbing a deficit worsened by the cost of servicing Spain’s swelling debt load will be revealed this week with the release of data on the country’s finances. The Budget Ministry will tomorrow publish figures for February showing the central government’s budget shortfall, which accounted for more than half of the nation’s deficit in 2012. Data in the following days on mortgage loans, inflation and retail sales will also highlight the plight of the taxpayers financing those outlays. “The increase in government debt is causing the interest rate burden to take a bigger toll on tax revenues,” said Ricardo Santos, an economist at BNP Paribas in London. “Spain needs to do more in terms of structural tightening, not only this year, but also in 2014 and this will imply a significant drag on growth.”

- Most Chinese Stocks Fall as ZTE Slumps. Most Chinese stocks fell as declines by phone stocks overshadowed higher-than-estimated profit from China Construction Bank Corp. (601939) ZTE Corp. (000063) led telecommunications stocks lower for a second day on concern a rally in the stock was overdone.

- South Korea Escalates Concern With Japan Policies on Yen. South Korea’s newly appointed finance minister, Hyun Oh Seok, revived his nation’s concerns over weakness in the yen and said that the Group of 20 nations should revisit the issue. “Japan’s expansionary policies are having various ripple effects on many countries,” Hyun, 62, told reporters on March 23 in Bundang, on his second day as finance chief. “The yen is depreciating while the won is gaining and this is flashing a red light for Korea’s exports.”

- Risk Unrewarded as Emerging Stocks Lose in Worst Start Since ’08. The link between risk and reward in stocks is breaking down as emerging markets post the worst first quarter since 2008 and lag behind shares of developed economies by the most in 15 years. The MSCI Emerging Markets Index (MXEF)’s 3.8 percent drop this year trimmed its rebound from an October 2011 low to 22 percent. That compares with a 33 percent advance for the MSCI World (MXWO) Index and marks the first time since 1998 that developing-country shares have underperformed during a global rally. When adjusted for price swings, emerging market returns are 37 percent smaller than in advanced nations, data compiled by Bloomberg show.

- Hedge Funds Most Bearish Ever on Copper, Favor Gold: Commodities. Hedge funds are making the biggest bet against copper on record as global inventories expand to a nine-year high, while concern that Europe’s debt crisis will spread spurred the biggest gain in gold bets since 2008. Speculators raised net-short positions in U.S. copper futures and options by 53 percent to 25,719 contracts in the week ended March 19, according to Commodity Futures Trading Commission data that begins in 2006. A jump in bullish bets on corn, gold and natural gas boosted overall holdings across 18 raw materials for a second consecutive week.

- Corn, Soybeans Decline as Feed Use Slows, Farmers Boost Sowing. Corn and soybeans dropped for a second session on speculation that domestic feed use may slow just as U.S. farmers prepare to boost plantings. Corn for delivery in May lost as much as 0.5 percent to $7.23 a bushel on the Chicago Board of Trade, after decreasing 0.9 percent on March 22. Futures were at $7.2525 by 9:56 a.m. Singapore time. Soybeans for delivery in the same month fell 0.2 percent to $14.38 a bushel on a volume that was 46 percent below the 100-day average for that time of day.

- Chemical Weapons Probably Used in Syria, Rogers Says. U.S. Representative Mike Rogers said it is “probable” that the regime of Syria’s Bashar al- Assad has used chemical weapons in that country’s civil war. “When you look at the whole body of information” that “over the last two years there is mounting evidence that it is probable that the Assad regime has used at least a small quantity of chemical weapons,” Rogers, a Michigan Republican and chairman of the House Intelligence Committee, said today on CBS’s “Face the Nation” program.

- Debt Flagged by Fed Bought by Funds Copying 2007: Credit Markets. Money managers from Ares Management LLC to Onex Corp. are borrowing at the fastest pace in six years to buy the type of speculative-grade loans that federal bank regulators warned last week is becoming riskier. Ares, which oversees $59 billion, and Onex's credit unit are among firms that have raised $22.9 billion of collaterialized-loan obligations this quarter, approaching the all-time high of $26.4 billion in the three months ended June 30, 2007, according to Royal Bank of Scotland Group Plc. Leveraged-loan mutual funds have received their two biggest weekly inflows since January. At the same time the Federal Reserve' zero interest-rate policy is encouraging investors to seek ever-riskier debt assets to generate returns, some members of the central bank are also saying the market my be overheating.

- Cyprus's Bank Crisis Feeds Recession Risk. Cyprus's race to avert a collapse of its banking system has put another issue on the back burner for now: The country faces a recession so deep that it may soon need even more money to survive inside the euro.

- Spain Brings the Pain to Bank Investors. Government to Impose Heavy Losses on Shareholders and Bondholders, Hire Advisers to Help Manage Lenders' Assets. The Spanish government will impose heavy losses on investors at nationalized banks and hire external advisers to help it manage these banks' assets, its latest efforts to overhaul a financial sector battered by the collapse of a decadelong housing boom.

- Mortgage Securitizers Didn’t Know Housing Was Going Bust. A popular explanation for why the housing bubble happened says that unbalanced incentives within the financial system were to blame. Financial-sector workers reaped huge bonuses for gambling on home prices continuing to climb, but knew that they bore little personal risk if things went awry.

- Government Payrolls Are Facing New Pressures. Governments bled hundreds of thousands of jobs after the U.S. economic recovery started. Now they're preparing to pass the knife around again as the federal budget comes under pressure. The cuts in the public-sector workforce—at the federal, state and local levels—marked the deepest retrenchment in government employment of civilians since just after World War II. About 21.8 million civilians were directly employed by a government in the U.S. in February, accounting for roughly one out of every six nonfarm payroll jobs, according to the Labor Department.

- Trading Clamps Spur Lobby Effort. High-speed trading firms and exchanges are being forced into the lobbying game by taxes on trades in Europe, proposals for similar levies in the U.S. and beefed-up regulatory scrutiny. While still far less conspicuous than big banks and their legions of arm-twisters, executives and lobbyists for trading firms and exchanges have stepped up their behind-the-scenes efforts to avert specific rules and legislation, say staff members in Congress and agencies.

- A Better Strategy for Faster Growth. At last count, 38 million working-age households received benefits from at least one federal welfare program.

Marketwatch.com:

- The last chance of survival in China: Andy Xie. China facing array of problems, including a looming banking crisis. The 20% capital gains tax is the latest half-measure in the government’s attempt to stabilize, rather than burst, the property bubble. If the measure deflates the bubble, new measures may appear to revive speculation, as occurred in 2008 and 2012. Managing rather than rooting out speculation is a dangerous game. The prolonged bubble will eventually bring a bill large enough to sink the banking system.

Fox News:

- Israeli military in Golan Heights responds to fire from Syria. Israel's army said it fired a guided missile into Syria on Sunday, destroying a military post after gunfire flew across the border and struck an Israeli vehicle. The shooting along the frontier in the Israeli-occupied Golan Heights was one of the most serious incidents between the countries since Syria's civil war erupted two years ago.

- JPMorgan(JPM) 'Whale' Traders Probe Advances. (video) The U.S. Department of Justice is in the advanced stages of an investigation into whether former traders in JPMorgan Chase's chief investment office in London engaged in criminal misconduct in the marking of credit positions last year, according to someone familiar with the matter. The Justice Department probe centers on whether a handful of individual traders deliberately mis marked certain complex credit positions in an effort to mask the growing losses in a key CIO portfolio during the spring of 2012, according to this person.

- No Matter Outcome, Cyprus Crisis Is Blow to Business. It is not just about rich Russians and Cypriot retirees. Also vitally at stake in this island country's banking crisis is Cyprus's credibility as a place for international companies to continue doing business.

Zero Hedge:

Business Insider: - Four Feckless Features Of A Post-Cyprus Europe. Four of the features of the reported deal are setting unfortunate precedents for the future.

IBD:

Reuters:

- Delaying savings will only make problem worse - ECB's Praet. Savings required to bring euro zone budgets under control cannot be put off for long, European Central Bank Executive Board member Peter Praet said in an interview in two Belgian newspapers. "You can have a little delay. But you will not solve the problem that way. Quite the contrary, a delay will only make your debt mountain bigger. And it needs to stay manageable," Praet said. "I hear far too much policymakers saying: wait a little, give me more time. That can affect the credibility of a country. The debts will not miraculously disappear," he said. Praet said he expected the euro zone to have contracted in the first quarter of 2013. The recession overall was not deep, although the difference between countries was sharp. Praet also said he was pre-occupied with two chief concerns. Consumers were concerned that their income over the long term would fall and were cutting spending, which was making the problem worse. His second concern was that banks were receiving cheap money, such as from the European Central Bank, but were not passing this on as credit to companies.

- Top China college in focus with ties to army's cyber-spying unit. Faculty members at a top Chinese university have collaborated for years on technical research papers with a People's Liberation Army (PLA) unit accused of being at the heart of China's alleged cyber-war against Western commercial targets.

- Dell's(DELL) board evaluates rival bids: source. A special committee of Dell Inc's board is evaluating separate takeover proposals from Blackstone Group and billionaire investor Carl Icahn to decide whether either or both are likely to trump an existing $24.4 billion take-private deal, a source familiar with the discussions said on Sunday. Icahn and Blackstone put in preliminary bids late last week, potentially upsetting the plans of the No. 3 PC maker's founder, Michael Dell, and private equity firm Silver Lake to take Dell private.

- Last-minute Cyprus deal to close bank, force losses. Cyprus clinched a last-ditch deal with international lenders to shut down its second largest bank and inflict heavy losses on uninsured depositors, including wealthy Russians, in return for a 10 billion euro ($13 billion) bailout. The agreement came hours before a deadline to avert a collapse of the banking system in fraught negotiations between President Nicos Anastasiades and heads of the European Union, the European Central Bank and the International Monetary Fund.

- Europe may not solve debt woes in 10 years-China FinMin.

China's new finance minister said on Sunday it was unclear whether the

Euro zone would solve its debt problems over the next decade and

suggested further turmoil would complicate efforts to reduce Beijing's

fiscal deficits. Lou Jiwei said external difficulties might oblige

China to run deficits for longer than anticipated as government

expenditure was rising quickly and revenue growing only at a

single-digit pace. "I am really very worried about Europe. I am worried about

whether it can get out of trouble in the next 10 years," Lou

said in an address to an economic forum. "Our fiscal expenditure is growing very quickly while I

estimate fiscal revenue will only post single-digit growth rates

in future ... we are facing substantive domestic pressures."

- IMF draft cuts 2013 U.S. growth forecast - report. The International Monetary Fund (IMF) is planning to cut its U.S. growth forecast for this year due to higher taxes and spending cuts, Italian news agency ANSA said, citing a draft of the IMF's next World Economic Outlook report. The U.S. economy, the world's biggest, will expand 1.7 percent this year, down from the 2.0 percent predicted in January, ANSA reported late on Saturday. The next round of IMF forecasts is scheduled to be published in mid-April.

- Cyprus Ex-Central Bankers Sees 'European Project' Failing. "The European project is crashing to earth," Athanasios Orphanides, head of Cyprus central bank 2007-2012, said in an interview. "We have seen a cavalier attitude towards the expropriation of property and the bullying of a people," Orphanides said. "This is a fundamental change in the dynamics of Europe towards disintegration, and I don't see how this can be reversed," he said. "Shattering of trust" caused by Cyrpus hasn't been fully seen, will increase funding costs in "perisphery" nations, Orphanides said.

- The dangerous drift towards world war in Asia. At ground zero in Hiroshima the inscription for victims of the world's first Atomic bomb is a pledge. We will never again repeat the evil of war.

- Cyprus crisis is at the heart of fundamental problems in the eurozone. According to the well-known quotation from Virgil, you should beware Greeks bearing gifts. But what about Greeks asking for them?

- Depart store chain Karstadt sales for February at EU133m were 12% below target and 15% below level from a year earlier, citing internal documents.

- Four in 10 Greeks say Europe's problems best solved by a break-up of EU, up from 26% in January, according to a Metron Analysis poll. 38% says Europe needs further integration, down from 46% in a January poll. 45% say they are now against the euro. 72% say Greece's economic situation is worse than a year ago. 96% say Germany more motivated by national interest than European solidarity. If Greek elections were held now, main opposition Syriza party would get 25.8%, PM Antonis Samaras's New Democracy party 25.2%. The nationalist Golden Dawn party would be third with 11.7%.

- Economic Minister Luis de Guindos discusses proposal with EU to increase 2013 budget deficit to as much as 5.8% of GDP instead of agreed 4.5%. Spain seeks to extend deadline for deficit target of 3% by 2 yrs to 2016, citing people familiar with the situation. Proposed deficit target of 5.8% this yr would mean EU12b fewer spending cuts.

- China's GDP growth will moderate to a rate of 6% to 7%, after growing at above 10% for mush of the past 30 years, citing Liu Shijin, deputy director of the Development Research Center of the State Council.

- China Banking Regulatory Commission asked big banks recently to pay special attention to risks in the real estate, steel, construction machinery, wind power equipment and solar equipment industries, citing a person familiar with the situation. Loans to property sector, industries with overcapacity and company clusters may be a high as 40 trillion yuan, the person said.

- A property tax on the ownership of three or more homes is a policy tool "most worthy of consideration," citing Hu Cunzhi, vice minister at the Ministry of Land and Resources.

Weekend Recommendations

Barron's:- Bullish commentary on (DRI), (KSS), (CKH), (GOOG), (INTC), (EMC), (GILD), (FRX) and (SRPT).

- Bearish commentary on (BHP), (RIO), (VALE) and (CLF).

- Asian indices are unch. to +1.25% on average.

- Asia Ex-Japan Investment Grade CDS Index 118.0 -2.0 basis points.

- Asia Pacific Sovereign CDS Index 92.5 +1.75 basis points.

- FTSE-100 futures +.55%.

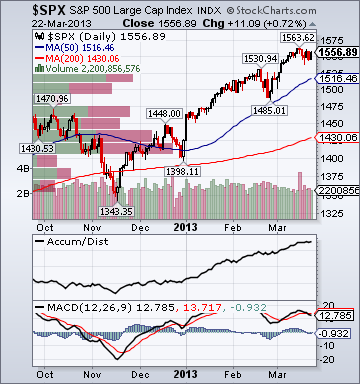

- S&P 500 futures +.41%.

- NASDAQ 100 futures +.52%.

Earnings of Note

Company/Estimate

- (DG)/.90

- (APOL)/.19

- (KYAK)/.20

10:30 am EST

- Dallas Fed Manufacturing Activity for March is estimated to rise to 3.7 versus 2.2 in February.

- None of note

- The Fed's Dudley speaking, German Consumer Confidence/Retail Sales/Import&Export data, Chicago Fed Nat activity Index and the Morgan Stanley Tech/Media/Telecom Conference could also impact trading today.