Style Underperformer:

Sector Underperformers:

- 1) Alt Energy -3.91% 2) Hospitals -1.57% 3) Biotech -1.31%

Stocks Falling on Unusual Volume:

- LVNTA, EZCH, CSTM, HRB, QCLN, NRP, DECK, VOC, TKMR, BCRX, VNR, OPWR, TSL, MYE, VDSI, GRFS, ALTR, XOOM, KN, BOFI, UIS, SMCI, BWLD, LOGM, PKX, FSS, TTPH, EMES, PBI, LU, LOGM, HRB, MKTO, SMCI and HCLP

Stocks With Unusual Put Option Activity:

- 1) XLV 2) LL 3) XLP 4) CAR 5) EWY

Stocks With Most Negative News Mentions:

- 1) AIG 2) WFC 3) BWLD 4) MBLY 5) F

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Medical Equipment +1.18% 2) Homebuilders +1.08% 3) Steel +.89%

Stocks Rising on Unusual Volume:

- CFN, DRTX, BDX, CMRX, HPQ, LINTA, PBR, ITUB and BBD

Stocks With Unusual Call Option Activity:

- 1) MNK 2) HRB 3) SNSS 4) KR 5) LLY

Stocks With Most Positive News Mentions:

- 1) NOC 2) DIS 3) BDX 4) AAPL 5) ORCL

Charts:

Week Ahead by Bloomberg.

Wall St. Week Ahead by Reuters.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week mixed as Ebola

fears, global growth worries and Fed rate hike concerns offset

bargain-hunting, short-covering and technical buying. My

intermediate-term trading indicators are giving neutral signals and the

Portfolio is 75% net long heading into the week.

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,104.74 -1.30%

- S&P 500 High Beta 33.04 -1.14%

- Wilshire 5000 20,418.60 -.86%

- Russell 1000 Growth 918.57 -.72%

- Russell 1000 Value 983.40 -.90%

- S&P 500 Consumer Staples 468.10 +.63%

- Solactive US Cyclical 133.25 -1.78%

- Morgan Stanley Technology 962.97 -.90%

- Transports 8,481.99 -.03%

- Bloomberg European Bank/Financial Services 108.28 -2.51%

- MSCI Emerging Markets 41.47 -2.52%

- HFRX Equity Hedge 1,171.10 -.88%

- HFRX Equity Market Neutral 978.56 +.33%

Sentiment/Internals

- NYSE Cumulative A/D Line 223,396 -.75%

- Bloomberg New Highs-Lows Index -1060 -287

- Bloomberg Crude Oil % Bulls 32.0 -24.37%

- CFTC Oil Net Speculative Position 295,946 -.04%

- CFTC Oil Total Open Interest 1,485,856 +.35%

- Total Put/Call .91 -18.75%

- ISE Sentiment 79.0 -3.66%

- Volatility(VIX) 14.55 -2.02%

- S&P 500 Implied Correlation 51.55 -.37%

- G7 Currency Volatility (VXY) 7.58 -.92%

- Emerging Markets Currency Volatility (EM-VXY) 7.81 +.64%

- Smart Money Flow Index 11,427.27 +.71%

- ICI Money Mkt Mutual Fund Assets $2.59 Trillion +.88%

- ICI US Equity Weekly Net New Cash Flow -$1.478 Billion

Futures Spot Prices

- Reformulated Gasoline 237.85 -4.25%

- Heating Oil 261.63 -3.13%

- Bloomberg Base Metals Index 190.24 -1.85%

- US No. 1 Heavy Melt Scrap Steel 359.0 USD/Ton unch.

- China Iron Ore Spot 78.60 USD/Ton n/a

- UBS-Bloomberg Agriculture 1,165.89 +.60%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 2.1% unch.

- Philly Fed ADS Real-Time Business Conditions Index .0866 -1.37%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 128.83 +.02%

- Citi US Economic Surprise Index 18.30 -7.9 points

- Citi Eurozone Economic Surprise Index -45.80 -.8 point

- Citi Emerging Markets Economic Surprise Index -18.60 -1.8 points

- Fed Fund Futures imply 36.0% chance of no change, 64.0% chance of 25 basis point cut on 9/17

- US Dollar Index 86.69 +1.25%

- Euro/Yen Carry Return Index 143.47 -.87%

- Yield Curve 188.0 -7.0 basis points

- 10-Year US Treasury Yield 2.43% -10.0 basis points

- Federal Reserve's Balance Sheet $4.409 Trillion -.20%

- U.S. Sovereign Debt Credit Default Swap 17.36 +4.94%

- Illinois Municipal Debt Credit Default Swap 166.0 -2.37%

- Western Europe Sovereign Debt Credit Default Swap Index 26.47 -5.73%

- Asia Pacific Sovereign Debt Credit Default Swap Index 69.90 +1.13%

- Emerging Markets Sovereign Debt CDS Index 234.76 +1.57%

- Israel Sovereign Debt Credit Default Swap 81.69 +2.76%

- Iraq Sovereign Debt Credit Default Swap 357.45 +3.07%

- Russia Sovereign Debt Credit Default Swap 251.33 +4.90%

- China Blended Corporate Spread Index 319.36 +2.74%

- 10-Year TIPS Spread 1.94% -3.0 basis points

- TED Spread 22.50 -.5 basis point

- 2-Year Swap Spread 25.75 +3.0 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -10.0 -1.0 basis point

- N. America Investment Grade Credit Default Swap Index 59.99 -8.82%

- European Financial Sector Credit Default Swap Index 58.53 -7.26%

- Emerging Markets Credit Default Swap Index 278.78 +5.79%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 83.50 +1.0 basis point

- M1 Money Supply $2.861 Trillion -1.11%

- Commercial Paper Outstanding 1,052.90 -.50%

- 4-Week Moving Average of Jobless Claims 294,750 -3,750

- Continuing Claims Unemployment Rate 1.8% unch.

- Average 30-Year Mortgage Rate 4.19% -1 basis point

- Weekly Mortgage Applications 337.80 -.18%

- Bloomberg Consumer Comfort 34.8 -.7 point

- Weekly Retail Sales +4.10% unch.

- Nationwide Gas $3.32/gallon -.02/gallon

- Baltic Dry Index 1,037 -1.14%

- China (Export) Containerized Freight Index 1,187.67 -1.55%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 20.0 +14.29%

- Rail Freight Carloads 275,071 -1.68%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (25)

- AMBI, BAGL, ESPR, MOVE, ARDX, AMAG, IMDZ, JNS, KITE, ATHL, RLD, CMCT, TIBX, AGIO, FNHC, CEMP, LMOS, SAGE, NYT, BREW, DWA, AYI, ADPT, SNX and HAWK

Weekly High-Volume Stock Losers (18)

- HMST, NWSA, AMPH, IRM, TERP, WLK, CLH, CAR, F, ZINC, KPTI, ELGX, TSE, FINL, POWL, GTLS, PDFS and CVEO

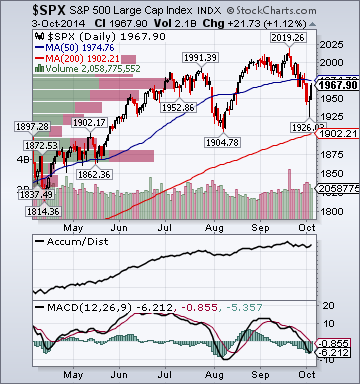

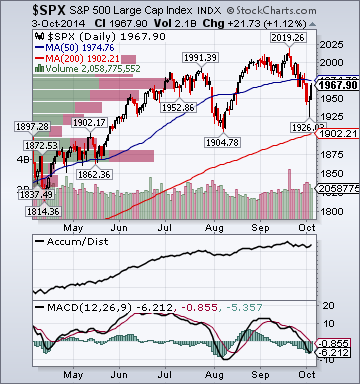

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Equity Market Tone:

- Advance/Decline Line: Substantially Higher

- Sector Performance: Most Sectors Rising

- Market Leading Stocks: Outperforming

Equity Investor Angst:

- Volatility(VIX) 14.49 -10.33%

- Euro/Yen Carry Return Index 143.46 +.03%

- Emerging Markets Currency Volatility(VXY) 7.81 +.13%

- S&P 500 Implied Correlation 51.18 -9.86%

- ISE Sentiment Index 74.0 -10.84%

- Total Put/Call .92 -8.91%

Credit Investor Angst:

- North American Investment Grade CDS Index 58.87 -6.60%

- European Financial Sector CDS Index 58.72 -7.47%

- Western Europe Sovereign Debt CDS Index 26.47 -2.54%

- Asia Pacific Sovereign Debt CDS Index 70.02 -2.42%

- Emerging Market CDS Index 279.36 -.30%

- China Blended Corporate Spread Index 319.36 -.1%

- 2-Year Swap Spread 25.75 -.5 basis point

- TED Spread 22.75 +.25 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -10.0 -.25 basis point

Economic Gauges:

- 3-Month T-Bill Yield .01% unch.

- Yield Curve 188.0 -2.0 basis points

- China Import Iron Ore Spot $77.50/Metric Tonne n/a

- Citi US Economic Surprise Index 18.30 +6.9 basis points

- Citi Emerging Markets Economic Surprise Index -18.60 +.8 point

- 10-Year TIPS Spread 1.94 -2.0 basis points

Overseas Futures:

- Nikkei Futures: Indicating +282 open in Japan

- DAX Futures: Indicating +19 open in Germany

Portfolio:

- Higher: On gains in my tech/biotech/medical/retail sector longs

- Disclosed Trades: Covered some of my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 75% Net Long