Evening Review

Market Summary

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Stock Quote

In Play

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Wednesday, December 26, 2007

Stocks Finish Higher, Led by Technology, Steel and Energy Shares

Stocks Mostly Higher into Final Hour, Led by Small-caps

Today's Headlines

Bloomberg:

- Buy the bond insurers. If you look past the headlines, and the accompanying hysteria, maybe things are about to look up. The stocks of Ambac Financial(ABK) and MBIA Inc.(MBI) are showing up on some securities firms’ lists of buy recommendations.

- The US will avoid a recession next year as a “stable” job market keeps Americans spending, said Bear Stearns(BSC) Chief Investment Strategist Jonathan Golub.

- Michael Klein, the owner of California hedge-fund firm Pacificor LLC, his teenage daughter, Talia, and a pilot died after their private plane crashed near Panama’s tallest mountain, a colleague said.

- Billionaire investor Joseph Lewis raised his stake in Bear Stearns(BSC) for the second time this month as the fifth-largest US securities firm’s stock fell 11% in December.

- Davis Selected Advisers disclosed a 5.1% stake in MBIA Inc.(MBI).

- Crude oil is rising $1.63/bbl. in NY on year-end mark-ups by investment funds and speculation that tomorrow may show a

- Toyota Motor(TM) and Honda Motor(HMC),

- Goldman(GS) Buys Building in NYC for $1.15 Billion.

- The US dollar is poised to end a two-year slide against the euro in 2008 as government-backed funds in Asia and the Middle East purchase US assets, currency strategists say.

Wall Street Journal:

- Videogames Expand A Popular New Phase Of Full-Body Playing. If you gave or got videogames as gifts yesterday, you may have noticed something very different about how some of the hottest ones are played these days.

- Merrill Lynch(MER) may sell additional stock following the sale of stakes to Temasek Holdings Pte. and

NY Times:

- India’s Letter Writers Give Way to Cell Phones.

- NYC’s Amsterdam Avenue Becomes New Shopping Corridor.

CNBC:

- SLM Corp.(SLM), the largest

- Only 7% of US employers plan to trim their full-time permanent staff during the first quarter of 2008, while 29% plan to add employees. 60% plan to maintain current levels of employment, according to an online survey by Harris Interactive.

Newsweek:

- Housing Optimism. Why the year in real estate wasn’t all bad news.

engadget:

- RIM developing angled Blackberry keyboard?

International Herald Tribune:

- “China gives top priority to developing renewable energy,” the cabinet’s press office said today in a 44-page report.

-

Bear Radar

Style Underperformer:

Small-cap Value (-1.08%)

Sector Underperformers:

Retail (-2.75%), Airlines (-2.70%) and REITs (-2.26%)

Stocks Falling on Unusual Volume:

Bull Radar

Style Outperformer:

Large-cap Growth(-.05%)

Sector Outperformers:

Steel (+1.55%) Alternative Energy (+1.34%) and Oil Service (+.88%)

Stocks Rising on Unusual Volume:

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Tuesday, December 25, 2007

Wednesday Watch

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Monday, December 24, 2007

Stocks Finish at Session Highs on Diminishing Credit Market Angst, Less Economic Pessimism

Evening Review

Market Summary

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Stock Quote

In Play

Stocks Higher into Final Hour on Diminishing Credit Market Angst and Economic Pessimism

Bear Radar

Style Underperformer:

Mid-cap Value (+.53%)

Sector Underperformers:

Biotech (-.25%), Utilities (-.04%) and Drugs (+.01%)

Stocks Falling on Unusual Volume:

Bull Radar

Style Outperformer:

Small-cap Value (+.67%)

Sector Outperformers:

REITs (+1.68%) Road & Rail (+1.42%) and Homebuilders (+1.06%)

Stocks Rising on Unusual Volume:

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Sunday, December 23, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- US stocks rose for the third time in four weeks as higher consumer spending and the Federal Reserve’s efforts to provide cash to banks spurred speculation the economy will keep expanding.

- US 10-year Treasury note yields rose to a three-day high on signs that central banks were adding enough funds to the financial system to spur bank lending.

- The yen fell to a six-week low against the dollar and declined versus the euro as concern eased that credit-market losses will deepen, boosting demand for higher-yielding assets funded by loans in Japan.

- Rank Group Ltd., owned by New Zealand billionaire Graeme Hart, agreed to buy Alcoa’s(AA) packaging and consumer businesses for $2.7 billion to expand in the US and gain control of units including Reynolds Wrap foil.

- China, which produces a third of the world’s steel, will raise export tariffs on some steel products from Jan.1 to help rein in a record trade surplus and reduce energy consumption and pollution.

- China will support international investment by companies next year as part of its effort to expand channels for such outbound ventures, said Wei Benhua, deputy director of the State Administration of Foreign Exchange. China will also relax controls on individual overseas investment, Wei said.

- China should take measures to cool economic growth and reduce energy consumption, an official with the National Development and Reform Commission said.

- News Corp.(NWS/A) agreed to sell eight of its Fox network-affiliated television stations in the US to Oak Hill Capital Partners LP for about $1.1 billion in cash.

Wall Street Journal:

- JPMorgan Chase(JPM) and Deutsche Bank AG are among companies planning to start an exchange to compete with CME Group Inc.(CME), operator of the Chicago Mercantile Exchange. The exchange is expected to open next year and will be backed by a dozen firms, including Merrill Lynch(MER), Credit Suisse Group and Citigroup(C).

- Banks Abandon Effort to Set Up Big Rescue Fund. The banks had been trying since September to set up a fund that would buy securities tied to mortgages and other assets that were controlled by banks in off-balance-sheet funds. By the time it began to try to gather assets, banks were already handling the problems themselves.

- Nardelli Says Chrysler Hitting Targets.

Barron’s:

- Getting the red carpet treatment. Preferred shares of Fannie Mae, WaMu and others now look enticing.

- Contrarians Beware: Putin May Mark the Top of Emerging Markets. Is Vladimir Putin the new Jeff Bezos?

NY Times:

- The IRS issued a new rule yesterday that bans selling stock at a loss to get a tax deduction, then immediately buying replacement shares through a retirement account.

- With customers leery of buying toys made in China, makers of wooden toys say in the US they can barely keep up with demand and are hiring extra employees.

TheStreet.com:

- Growth Fund Smokes With Potash and RIM.

CNBC.com:

- SEC Launches Web Tool to Compare Executive Pay.

- Top Manager: Invest in The Next Info Revolution.

- The national average price for gasoline dropped about 3 cents over the last two weeks, according to a survey released Sunday.

MarketWatch.com:

- NetSuite(N): Deja Google(GOOG) all over again. Commentary: NetSuite evolves into key player in online business software.

- Retailers Hope for Big Final Push. The final weekend of the holiday shopping season will likely bring a sigh of relief from many retailers who feared that sales would be weak. This holiday season, “we had projected a 3.6% increase and we expect that number will be hit and, potentially, could go a little bit higher,” said Bill Martin, co-founder of ShopperTrak RCT Corp., which monitors retail sales.

Forbes.com:

- Shoot To Kill. Nvidia(NVDA)

Business Week:

- What the Pros Are Saying. Most of the experts we surveyed the market going up a bit – but the climb will be tough.

- For Nokia(NOK), Excess is a Vertu. Its luxury division is booming as a high-end cell phone becomes the latest status symbol for the world’s richest people.

- A Wily Road Warrior’s Airport Tips.

- Tech Sector Outlook 2008: Part 1.

- Research In Motion(RIMM): What Slowdown?

- Deconstructing the Energy Bill.

- Microsoft’s(MSFT) Games Get Serious. ESP is a new software product based on the popular PC game Flight Simulator. It’s also Microsoft’s first foray into non-entertainment games.

- MySpace cranks up heat in Facebook turf war.

- Internet renovates how homes get sold.

CNNMoney.com:

- X-mas electronics: Apple Inc.(AAPL) rules on Amazon.com(AMZN).

- The odds on an Apple(AAPL) flash memory laptop.

Reuters:

- Microsoft’s(MSFT) piracy fight gains momentum in China.

- Merrill Lynch(MER) may get up to $5 billion in a capital infusion from Singapore state investor Temasek Holdings.

- Consumer spending strong in November.

- Research In Motion(RIMM) stock shoots higher after results.

Financial Times:

- Saudi Arabia plans to establish a sovereign wealth fund that is expected to dwarf Abu Dhabi’s $900 billion and become the largest in the world. The new fund will be a formidable rival for other government-owned investment funds in the Middle East and Asia, which are playing an increasingly active role in channeling capital to western companies, particularly financial companies hard hit by the

- Central banks resolve eases year-end fears. Interbank lending rates have fallen throughout this week, with the three-month euro Libor rate fixing on Friday at 4.78%, down 17 basis points since action by central banks was announced on December 12.

- iPhone users raise network hopes. Buyers of Apple’s(AAPL) iPhone have turned out to be voracious users of electronic mail and other data services, giving network operators hope that the much-hyped device will finally unlock billions of dollars in mobile advertising revenue.

- Cisco to network whole cities. Cisco Systems(CSCO) plans to launch a business group, based in Bangalore, India, that will wire new buildings and even entire new cities with state-of-the-art networking technology.

- iPhone key to O2 growth. Mathew Key was in California last week, briefing Steve Jobs on the iPhone’s impact in the UK.

AFP:

-

Weekend Recommendations

Barron's:

- Made positive comments on (TWP) and (RHI).

- Made negative comments on (CWCO).

Night Trading

Asian indices are +1.0% to +2.0% on avg.

S&P 500 futures unch..

NASDAQ 100 futures -.08%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- (

Economic Data

- None of note

Other Potential Market Movers

- None of note - US stock exchanges close at 1pm EST

Weekly Outlook

Click here for the Wall St. Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are a few economic reports of note and significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note,

Tues. –

Wed. – S&P/CaseShiller Home Price Index,

Thur. – Weekly MBA Mortgage Applications Report, weekly EIA energy inventory report, Durable Goods Orders, Initial Jobless Claims, Consumer Confidence

Fri. – Chicago Purchasing Manager, New Home Sales, weekly EIA natural gas inventory report

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – None of note

Tues. –

Wed. – None of note

Thur. – Christopher & Banks(CBK), Verifone(PAY)

Fri. –

Other events that have market-moving potential this week include:

Mon. – None of note

Tue. –

Wed. – None of note

Thur. – None of note

Fri. – None of note

Friday, December 21, 2007

Weekly Scoreboard*

Indices

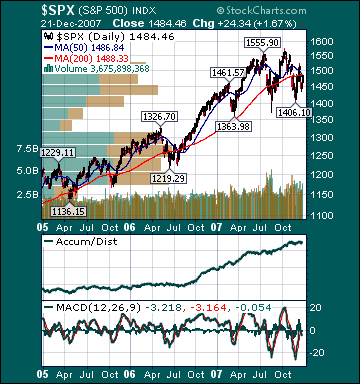

S&P 500 1,484.47 +1.13%

DJIA 13,450.65 +.83%

NASDAQ 2,691.99 +2.1%

Russell 2000 785.60 +4.2%

Wilshire 5000 14,917.77 +1.28%

Russell 1000 Growth 619.43 +1.18%

Russell 1000 Value 803.47 +1.09%

Morgan Stanley Consumer 748.94 +.3%

Morgan Stanley Cyclical 1,005.44 +1.72%

Morgan Stanley Technology 632.29 +1.47%

Transports 4,644.05 -.72%

Utilities 540.32 +.18%

MSCI Emerging Markets 151.90 +.35%

Sentiment/Internals

NYSE Cumulative A/D Line 59,087 -5.3%

Bloomberg New Highs-Lows Index -794

Bloomberg Crude Oil % Bulls 16.0 -60.0%

CFTC Oil Large Speculative Longs 213,103 -.51%

Total Put/Call .56 -46.2%

NYSE Arms .50 -62.87%

Volatility(VIX) 18.47 -19.81%

ISE Sentiment 114.0 -3.25%

AAII % Bulls 35.85 -24.7%

AAII % Bears 47.2 +32.1%

Futures Spot Prices

Crude Oil 93.28 +1.65%

Reformulated Gasoline 237.85 +1.32%

Natural Gas 7.21 +3.11%

Heating Oil 260.70 -.19%

Gold 813.80 +2.19%

Base Metals 214.14 +2.39%

Copper 310.0 +4.59%

Economy

10-year US Treasury Yield 4.17% -7 basis points

4-Wk MA of Jobless Claims 343,000 +1.2%

Average 30-year Mortgage Rate 6.14% +3 basis points

Weekly Mortgage Applications 653.80 -19.5%

Weekly Retail Sales +1.4%

Nationwide Gas $2.98/gallon -.01/gallon

US Heating Demand Next 7 Days 10.0% below normal

ECRI Weekly Leading Economic Index 136.20 -1.23%

US Dollar Index 77.73 +.37%

CRB Index 354.23 +1.6%

Best Performing Style

Small-cap Value +4.50%

Worst Performing Style

Large-cap Value +1.09%

Leading Sectors

Alternative Energy +4.59%

Computer Service +4.27%

Oil Service +3.29%

Wireless +3.15%

Biotech +2.52%

Lagging Sectors

Gaming -.56%

Road & Rail -1.27%

Restaurants -2.25%

Oil Tankers -3.35%

Airlines -4.28%

Stocks Soaring into Final Hour on Less Economic Pessimism, Short-Covering, Bargain-Hunting

Today's Headlines

Bloomberg:

- US stocks gained the most in two weeks, led by energy and technology shares, after the biggest increase in consumer spending in two years helped reduce concern the economy will slow.

- Merrill Lynch(MER) rose in NY trading after the Wall Street Journal reported that the world’s biggest brokerage firm may receive a cash infusion of as much as $5 billion from Singapore’s state-owned Temasek Holdings Pte.

- Dennis Gartman, economist and editor of the Gartman Letter says oil won’t likely reach $100/bbl. in 2008.

- Crude oil rose more than $2/bbl. in NY after a

- First Marblehead Corp.(FMD), the third-largest US arranger of securities backed by student loans, rose the most ever on the NYSE after Goldman Sachs(GS) agreed to a $260.5 million investment, equivalent to about 20% of current shares.

- The Federal Reserve will conduct biweekly emergency auctions of loans as “long as necessary” as part of a global attempt by central bankers to restore faith in the money markets.

- ResMed Inc.(RMD), the No. 2 maker of equipment for treating breathing-related sleep disorders, rose the most in five years on the NYSE after analyst speculation that the company may be a takeover target.

- Itron Inc.(ITRI), the maker of utility meters for electric, gas and water usage, rose the most in a year after RBC Capital Markets recommended investors buy the shares.

- Walgreen Co.(WAG), the largest US drugstore chain, posted quarterly profit that beat analysts’ estimates on higher sales of prescription drugs and reduced expenses, sending the shares up the most in more than seven years.

- NetSuite Inc.(N), the software maker majority-owned by Oracle’s Larry Ellison, rose for a second day after its IPO, advancing as much as 30% as investors seek to tap demand for business programs.

- Apple Inc.(AAPL) CEO Steve Jobs’ annual Macworld surprise may be a slimmed-down laptop and a higher-capacity model of the iPhone.

- Hedge Connection looks to set up investors with fund managers.

CNBC:

- Bear Stearns(BSC) has been talking to Fortress Investment Group(FIG) about a “capital infusion.”

- Third Avenue Management LLC holds common stock in Radian Group(RDN) and MBIA Inc.(MBI), citing an interview with the money manager’s founder, Martin Whitman. “We hope to be part of the capital infusions that go into these troubled financial institutions,” Whitman said. He said Third Avenue holds 19% of Radian and a little more than 10% of MBIA. He also said the company’s bets involve MGIC Investment Corp.(MTG) and Ambac Financial Group(ABK) and were made over the past 30 to 45 days. (video)

- Senator Barack Obama has pulled even with Senator Hillary Clinton among Democrats in

Bearish Sentiment Now Exceeds Levels Seen at Depths of 2000-2003 Bear Market

* Meanwhile, corporate insiders are buying hand over fist.

The AAII percentage of bulls dropped to 35.85% this week from 47.6% the prior week. This reading is approaching depressed levels. The AAII percentage of bears jumped to 47.2% this week from 35.7% the prior week. This reading is now approaching elevated levels. Moreover, the 10-week moving average of the percentage of bears is currently at 45.3%, an elevated level. It has only been higher two other times in its history, which were July-August 2006 and September 1990-December 1990. Moreover, the 10-week moving average of the percentage of bears peaked at 43.0% right near the major bear market low during 2002. It is astonishing that the 10-week moving average of the % bears is currently greater than at any time during the bubble bursting meltdown of 2000-2003, which was arguably the worst stock market decline since the Great Depression.

Furthermore, the 50-week moving average of the percentage of bears is currently 38.3%, an elevated level seen during only one other period since tracking began in the 80s. That period was October 1990-July 1991, right near another major stock market bottom. The extreme reading of the 50-week moving average of the percentage of bears during that period peaked at 41.6% on Jan. 31, 1991. The current reading of 38.3% is slightly above the peak during the 2000-2003 bear market, which was 38.1% on April 10, 2003. I find this even more astonishing, notwithstanding the recent pullback, given that the S&P 500 is currently 102% higher from the October 2002 major bear market lows and just 5.2% off a record high.

Individual investor pessimism towards US stocks is currently deep-seated and historical in nature. This is just more evidence of the current “Personal Incomes Rise, Spending Strongest in Over 2 Years, Spread Between Consumer Present Situation/Expectations Largest Since After Hurricanes in 05

- Personal Income for November rose .4% versus estimates of a .5% increase and a .2% gain in October.

- Personal Spending for November rose 1.1% versus estimates of a .7% gain and an upwardly revised .4% increase in October.

- The PCE Core for November rose .2% versus estimates of a .2% gain and a .2% increase in October.

-

BOTTOM LINE: Consumer spending in the

Bull Radar

Style Outperformer:

Small-cap Value (+1.53%)

Sector Outperformers:

Wireless (+3.2%) Steel (+2.84%) and Oil Service (+2.64%)

Stocks Rising on Unusual Volume:

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Thursday, December 20, 2007

Friday Watch

Late-Night Headlines

Bloomberg:

- MBIA Inc.(MBI) has announced that in response to media and other inquiries received as a result of information the Company posted on December 19, 2007 on its Web site relating to its collateralized debt obligation exposure, the Company is issuing the following statement: The inflation posted on December 19,2007 discloses no additional Multi-Sector CDO exposure. MBIA discussed its exposure to CDO transactions with inner CDOs during a conference call for investors on August 2, 2007. The stock surged 11% in after-hours trading.

- Toshihiko Fukui’s final act as governor of the Bank of Japan may be to cut borrowing costs for the first time in more than six years.

- Sharp Corp.,

MarketWatch.com:

- Research In Motion(RIMM) on Thursday saw earnings more than double for its fiscal quarter amid continued strong demand for the company’s BlackBerry line of smart-phone devices.

- NetSuite CEO: Ellison played critical role. Buy Nelson says software on-demand marks changing of the guard in industry.

BusinessWeek.com:

- If you’re a contrarian, you’ll probably like Eastman Kodak(EK), which is currently a pariah on the Street.

- The FCC’s auction of wireless spectrum is swarming with participants, some of which you might not expect – including Chevron(CVX) and Vulcan’s Paul Allen.

- Record Online Sales in Britain. Christmas came early to online retailers as Internet sales have skyrocketed more than 65% higher than during last year’s holiday period.

CNNMoney.com:

- Toy makers close in on safety plan. Group representing companies hopes to get regulators’ OK on tougher testing measures.

SmartMoney.com:

- CEO Interview: John Riccitiello, Electronic Arts(ERTS).

- Starbucks-Dunkin’ faceoff may stir market share in hot industry.

-

Late Buy/Sell Recommendations

Citigroup:

- In general, we garnered little new from Micron’s(MU) earnings report. We maintain our generally positive view, therefore, predicated on capital spending declines, 200mm decommissioning and NT price stabilization. We note that Micron did point to above seasonal demand conditions for CY1Q08, echoing commentary from other parts of the supply chain. This bodes well for Intel(INTC), our top idea, where strong demand will support upside to consensus margin for 1Q08 and 2Q08(as inventories prove difficult to build).

Morgan Stanley:

- Reiterated Overweight on (CELG), target $79.

CSFB:

- Reiterated Outperform on (CELG), target lowered to $65.

Night Trading

Asian Indices are +.75% to +1.25% on average.

S&P 500 futures +.14%.

NASDAQ 100 futures +.29%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

- (CC)/-.31

- (WAG)/.44

Upcoming Splits

- None of note

Economic Releases

8:30 am EST

- Personal Income for November is estimated to rise .5% versus a .2% decline in October.

- Personal Spending for November is estimated to rise .7% versus a .2% gain in October.

- The PCE Core for November is estimated to rise .2% versus a .2% gain in October.

10:00 am EST

-

Other Potential Market Movers

- None of note

Stocks Finish at Session Highs, Boosted by Gains in the Technology Sector

Indices

S&P 500 1,460.12 +.49%

DJIA 13,245.64 +.29%

NASDAQ 2,640.86 +1.53%

Russell 2000 767.54 +1.51%

Wilshire 5000 14,673.05 +.62%

Russell 1000 Growth 609.65 +.79%

Russell 1000 Value 790.14 +.29%

Morgan Stanley Consumer 738.66 +.05%

Morgan Stanley Cyclical 984.85 +1.18%

Morgan Stanley Technology 626.02 +1.70%

Transports 4,583.86 -.01%

Utilities 536.72 -.02%

MSCI Emerging Markets 148.72 +.23%

Sentiment/Internals

Total Put/Call .63 -44.7%

NYSE Arms 1.05 +7.63%

Volatility(VIX) 20.58 -5.07%

ISE Sentiment 110.0 -1.79%

Futures Spot Prices

Crude Oil $91.20 -.04%

Reformulated Gasoline 233.73 +.23%

Natural Gas 7.11 -.89%

Heating Oil 259.43 -.14%

Gold 799.80 -.70%

Base Metals 212.28 +1.92%

Copper 297.0 +.41%

Economy

10-year US Treasury Yield 4.04% +1 basis point

US Dollar 77.78 +.26%

CRB Index 349.63 -.16%

Leading Sectors

Software +2.22%

Wireless +2.11%

Computer Hardware +2.08%

Lagging Sectors

Insurance -.55%

Oil Tankers -1.04%

Airlines -1.17%

Evening Review

Market Summary

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Stock Quote

In Play

Afternoon Recommendations

- Rated (SINA) Buy.

Afternoon/Evening Headlines

Bloomberg:

- The

- Research In Motion Ltd.(RIMM) said third-quarter profit doubled and gave a forecast that topped analysts’ estimates on consumer demand for the BlackBerry e-mail phone, spurring an 11% surge in the stock in after-hours trading.

- GE Commercials Finance and Allied Capital Corp. raised $3.6 billion to fund smaller private-equity transactions after lenders tightened financing requirements. Unitranche Fund LLC will provide loans of as much as $500 million.

- Red Hat Inc.(RHT) named former Delta Air Lines(DAL) COO James Whitehurst as CEO and said third-quarter profit rose 39%. Red Hat jumped 7.4% in extended trading.

- Campbell Soup(CPB) agreed to sell its Godiva chocolate unit to Yildiz Holding AS for $850 million.

- NetSuite Inc.(N), the software maker majority-owned by Oracle’s(ORCL) Larry Ellison, surged 37% in its first day of trading, underscoring investors’ confidence in business software spending.

NY Times:

- GM’s Fuel-Cell Test: 100 Cars, No Charge.