S&P 500 1,503.35 +.05%

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Friday, June 29, 2007

Weekly Scoreboard*

Indices

S&P 500 1,503.35 +.05%

DJIA 13,408.62 +.36%

NASDAQ 2,603.23 +.55%

Russell 2000 833.70 -.13%

Wilshire 5000 15,163.08 +.03%

Russell 1000 Growth 595.22 -.03%

Russell 1000 Value 858.51 +.07%

Morgan Stanley Consumer 728.96 +.39%

Morgan Stanley Cyclical 1,076.43 -.59%

Morgan Stanley Technology 622.61 -.14%

Transports 5,098.88 -.18%

Utilities 498.17 +2.64%

MSCI Emerging Markets 131.11 -.45%

Sentiment/Internals

NYSE Cumulative A/D Line 74,318 -2.49%

Bloomberg New Highs-Lows Index +144 +136.1%

Bloomberg Crude Oil % Bulls 48.0 +28.0%

CFTC Oil Large Speculative Longs 197,493 -1.63%

Total Put/Call 1.01 -1.94%

NYSE Arms 1.41 +57.47%

Volatility(VIX) 16.23 +3.05%

ISE Sentiment 166.0 +30.71%

AAII % Bulls 39.02 -9.59%

AAII % Bears 35.77 +6.2%

Futures Spot Prices

Crude Oil 70.47 +2.22%

Reformulated Gasoline 223.75 -.16%

Natural Gas 6.78 -5.23%

Heating Oil 203.79 -.19%

Gold 651.50 -.91%

Base Metals 251.09 -.14%

Copper 343.0 +1.84%

Economy

10-year US Treasury Yield 5.03% -10 basis points

4-Wk MA of Jobless Claims 316,000 +.3%

Average 30-year Mortgage Rate 6.67% -2 basis points

Weekly Mortgage Applications 618.60 -3.90%

Weekly Retail Sales +1.70%

Nationwide Gas $2.97/gallon -.02/gallon

US Cooling Demand Next 7 Days 5.0% below normal

ECRI Weekly Leading Economic Index 142.80 unch.

US Dollar Index 81.93 -.50%

CRB Index 315.74 +.32%

Leading Sectors

Disk Drives +2.96%

Utilities +2.64%

Telecom +2.60%

Wireless +2.2%

Internet +2.2%

Lagging Sectors

I-Banks -1.55%

Gold -1.87%

Coal -1.97%

Homebuilders -2.94%

Oil Service -3.55%

Stocks at Session Lows into Final Hour on Terrorism Fears, Subprime Worries and End-of-Quarter Profit-taking

Today's Headlines

Bloomberg:

- The DJIA is poised to post its best quarterly performance since the fourth quarter of 2003.

- UK police dismantled a car bomb found outside a nightclub packed with hundreds of people near London’s Piccadilly Circus, raising concern about terrorism.

-

- The Canadian dollar fell after the nation’s economy unexpectedly registered zero growth in April.

- Washington Mutual(WM), the biggest

- BP Plc(BP), Europe’s second-largest oil company, and

- General Motors(GM) will invest $945 million over the next five years in

- The price of US steel sheet fell for a third straight month in June because of reduced demand from manufacturers and a drawdown of inventories by distributors, Purchasing magazine said.

- Corn plunged to a 12-week low in

- Crude oil rose to a 10-month high in NY on speculation by investment funds that low supplies of gas will continue to boost prices into the summer.

- Talbots Inc.(TLB) appointed apparel-industry veteran Trudy Sullivan as its new CEO in an effort to stem five years of declining profit at the women’s clothing retailer.

- Chicago Board of Trade’s(BOT) largest shareholder, Sydney-based hedge fund Caledonia Investments, has voted against the proposed sale to the Chicago Mercantile Exchange because the price is too low.

- Bear Stearns(BSC) hired

Wall Street Journal:

- Discover Financial Services, set to be spun off by Morgan Stanley(MS), is far smaller than rivals Visa USA Inc. and MasterCard Inc., yet its shares may be attractive because credit-card demand is growing.

- Delta Air Lines may be the leading contender to gain the first new non-stop flights between the

- Iowa Senator Charles Grassley, the top Republican on the Senate Finance Committee, may determine the outlook for legislative proposals to raise taxes on the hedge-fund and private-equity industries.

- Lawmakers moved to salvage parts of a grand compromise on immigration reform following the collapse of the broad package.

-

- Russian authorities have shut down a US-funded non-profit training organization for journalists and filed criminal charges that critics say are politically motivated.

LA Times:

- Doug Frantz, managing editor of the LA Times, will become the

AP:

- The California State Assembly approved another 17,000 slot machines at casinos run by four

CNBC:

- The SEC is increasing its scrutiny of Bear Stearns’(BSC) hedge fund business.

Financial Times:

- Goldman Sachs Group(GS) was the top investment banking adviser in the world in the first half of 2007, citing Dealogic data.

- BP Plc(BP), Europe’s second-largest oil company, aims to double the import and sale of liquefied petroleum gas in

Incomes/Spending Rise Less Than Estimates, Inflation Decelerates Further, Chicago Manufacturing Strong, Construction Jumps, Confidence Revised Higher

- Personal Income for May rose .4% versus estimates of a .6% gain and a -.2% decline in April.

- Personal Spending for May rose .5% versus estimates of a .7% increase and a .5% gain in April.

- The PCE Core (MoM) for May rose .1% versus estimates of a .1% gain and a .1% increase in April.

- The Chicago Purchasing Manager Index for June came in at 60.2 versus estimates of 58.0 and a reading of 61.7 in May.

- Construction Spending for May rose .9% versus estimates of a .1% gain and a .2% increase in April.

- The

BOTTOM LINE: Americans spent less than forecast in May and the Fed’s preferred inflation gauge cooled, Bloomberg reported. The Core PCE, the Fed’s favorite inflation gauge, rose 1.9% from a year earlier, the smallest gain since March 2004. This is also well below the 20-year average of 2.5% and within the Fed’s comfort zone. Consumer spending will come in below average rates this quarter, however spending should substantially exceed estimates of 2.5% in the second half of the year as interest rates come back down, energy prices fall substantially, sentiment improves, inflation decelerates further, stocks rise further, incomes continue to outpace inflation and housing sales stabilize at relatively high levels.

A measure of

Spending on US construction projects rose more than forecast last month as work on non-residential and government projects helped overcome cutbacks in homebuilding, Bloomberg said. The .9% increase was the biggest gain since February 2006. Every category besides residential construction showed an increase, spurred by the building of factories and utilities. I still expect construction spending to trend below average rates as homebuilders further pare down inventories and commercial construction slows modestly.

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Thursday, June 28, 2007

Friday Watch

Late-Night Headlines

Bloomberg:

- Research In Motion Ltd.(RIMM), maker of the BlackBerry e-mail phone, said first quarter profit rose 73% on demand for new devices with cameras and music players. The company also announced a 3-for-1 stock spit. Shares soared 17% in after-hours trading.

- Some seafood imported to the US from China will be detained by regulators because of possible contamination with unsafe drugs, the latest health warning about products from that country.

- FedEx Corp.(FDX) truck drivers would be able to join unions more easily under US legislation approved by a House panel today, in a victory for organized labor.

- The yen headed for the biggest quarterly loss against the US dollar since 2001 before reports that are forecast to show falling prices and slowing consumption in Japan.

- North Korea’s pledge to close its Yongbyon reactor and dismantle its nuclear program may help establish a security agreement for northeast Asia, South Korean Foreign Minister Song Min Soon said.

- Japan’s consumer prices fell .1% in May, a pace of decline that’s unlikely to deter the central bank from raising its benchmark interest rate, the lowest among major economies.

- The

- Consideration of an energy package in the House of Representatives that had been scheduled for July may be delayed until September partly because of pending work on other legislation, Speak Nancy Pelosi said.

- The highest-rated collateralized debt obligations holding subprime mortgages may be worth buying if an abundance of selling causes prices to drop, according to Morgan Stanley.

- Members of the International Swaps and Derivatives Assoc. said they will not change trading contract language to address concerns raised by a group of hedge funds that banks who invest in derivatives tied to subprime mortgage bonds may try to suppress defaults by buying bad loans out of the deals.

- Apollo Group(APOL), the for-profit education company, reported profit excluding some items of 81 cents a share in the third quarter and said it plans to buy back as much as $500 million of its own stock. The stock rose 6.7% in after-hours trading.

- Komag(KOMG), the maker of computer disk-drive components, agreed to be bought by Western Digital(WDC) for $32.25 a share, or $1 billion, in cash. Komag rose 7.7% in after-hours trading.

-

Wall Street Journal:

- Apple Inc.(AAPL) may not be able to meet demand for its iPhone, Chief Executive Officer Steve Jobs said. The iPhone hasn’t had an effect on iPod sales, Jobs said.

- Ford Motor(F) plans to resume paying a dividend sometime in the future, citing a video of CEO Mulally talking to dealers.

LA Times:

- Doug Frantz, managing editor of the LA Times, will leave the paper, citing Editor James O’Shea.

Late Buy/Sell Recommendations

Citigroup:

- Reiterated Buy on (MON), target raised to $77.

- Rated (CMG) Buy, target $100.

- Reiterated Buy on (SNDK), target $52.

Needham & Co.:

- Rated (SNDK) Buy, target $55.

Business Week:

- Shares of USG Corp., the No. 1 maker of gypsum wallboard in the

- Shares of Kaydon Corp.(KDN) may rise as increased interest in wind energy will strengthen demand for the anti-friction bearings the company makes for turbines.

- United Retail Group(URGI), whose clothing caters to women wearing size 14 or larger, will benefit from summer sales.

Night Trading

Asian Indices are -.25% to +.75% on average.

S&P 500 indicated +.05%.

NASDAQ 100 indicated +.12%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

- (NDN)/.01

- (AZZ)/.42

Upcoming Splits

- (CXW) 2-for-1

Economic Releases

8:30 am EST

- Personal Income for May is estimated to rise .6% versus a -.1% decline in April.

- Personal Spending for May is estimated to rise .7% versus a .5% gain in April.

- PCE Core (MoM) for May is estimated to rise .1% versus a .1% gain in April.

9:45 am EST

- The Chicago Purchasing Manager Index for June is expected to fall to 58.0 versus a reading of 61.7 in May.

10:00 am EST

- Construction Spending for May is estimated to rise .1% versus a .1% gain in April.

-

Other Potential Market Movers

- The JPMorgan Global Tobacco Conference could also impact trading today.

Stocks Finish Mixed on Quarter-end Profit-taking

Stocks Higher into Final Hour as Fed Says Core Inflation is Moderating, Leaves Benchmark Rate at 5.25%

BOTTOM LINE: The Portfolio is higher into the final hour on gains in my Medical longs, Software longs and Networking longs. I have not traded today, thus leaving the Portfolio 100% net long. The tone of the market is positive as the advance/decline line is mildly higher, almost every sector is rising and volume is above average. The Fed left the benchmark rate unchanged at 5.25%. They made both hawkish and dovish comments in the ensuing policy statement. They said core inflation has improved modestly, but that it may not be sustained. The other statements were about the same as prior ones. They did not stress a focus on headline inflation rather than core, as some investors had feared. Natural gas has broken down again technically, which seems to be weighing on oil service stocks despite today’s rise in oil. As well, corn has plunged 19% in nine days, even as oil has risen and talk of alternative energy has grown louder. Nasdaq reported that short interest on the exchange surged another 9.2% to 9,170,000,000 shares, from mid May through mid June, hitting another all-time high. Moreover, as on the NYSE, the last four months have seen Nasdaq short interest soar an astounding 30.2%, the largest four-month percentage increase since at least 1991, according to Bloomberg data.

Here are the 25 Nasdaq stocks with the largest percentage increase in their short interest relative to their float from mid May through mid June:

1) USNA +20.6%

2) SMTC +18.0%

3) BBND +13.7%

4) PODD +11.6%

5) GMTN +10.9%

6) OATS +9.4%

7) TRMP +8.6%

8) KLIC +8.4%

9) TRGL +7.6%

10) MCHX +7.5%

11) LPHI +7.2%

12) GMET +7.0%

13) SNTA +7.0%

14) AGEN +6.9%

15) GLBC +6.6%

16) MNKD +6.6%

17) PALM +6.4%

18) ENTG +6.3%

19) SIRO +6.2%

20) MALL +6.1%

21) UHAL +6.1%

22) CHIP +5.9%

23) COMV +5.7%

24) SHFL +5.6%

25) TSCM +5.6%

The S&P 500 also reported short interest data. Here are the five industries in the S&P 500 with the largest percentage increase in their short interest from mid May through mid June:

1) Utilities +16.3%

2) Information Technology +12.8%

3) Health Care +8.3%

4) Financials +7.9%

5) Telecom Services +3.5%

Here are the 20 S&P 500 stocks with the largest percentage increase in their short interest relative to their float from mid-May through mid-June:

1) NSM +13.8%

2) PNW +5.6%

3) KLAC +5.2%

4) RSH +4.8%

5) HAS +4.7%

6) CIEN +4.0%

7) MBI +3.3%

8) TRB +3.0%

9) WFMI +3.0%

10) EQR +2.8%

11) NVDA +2.6%

12) GNW +2.4%

13) IBM +2.1%

14) LIZ +2.1%

15) SSP +1.9%

16) MU +1.9%

17) HBAN +1.9%

18) DTE +1.9%

19) MYL +1.8%

20) DCT +1.8%

Today's Headlines

Bloomberg:

- Venezuelan President Hugo Chavez attacked

- A US District Court froze the assets of Lake Shore Asset Management, a hedge funds run by a former chairman of the Chicago Mercantile Exchange, after misrepresentations in the fund’s financial statements were uncovered by the Commodity Futures Exchange Commission. Chicago-based

- Jeremy Siegel, a professor at the

- Corn in

- Natural gas is plunging 5% to a five-month low after a weekly government report showed inventories are 18% above the five-year average for this time of the year as industrial demand falters.

- The Fed kept the benchmark

- Petro-Canada, the third-largest oil company in

- A bald eagle swept above a crowd at the Jefferson Memorial in

- GM(GM) agreed to sell its Allison Transmission unit to buyout firms Carlyle Group and Onex for $5.6 billion.

- Robert Steel, the US Treasury’s top finance official, said concerns that the near failure of two money-losing hedge funds run by Bear Stearns(BSC) might spark a financial crisis or hurt the economy are unfounded.

- Shares of Build-A-Bear Workshop(BBW) rose the most in almost three years after the maker of stuffed animals hired Lehman Brothers(LEH) to explore a sale, following a forecast of declining profit.

- The

- Ford Motor(F) said it’s offering three-year, no-interest loans on all 2007 Ford,

- Intel Corp.(INTC) was upgraded to “overweight” from “equal weight” at Lehman Brothers, which said a new series of semiconductors designed for laptop computers may boost revenue and earnings growth.

Wall Street Journal:

- Visa International Inc. will pay $170 million to sponsor soccer’s World Cup for eight years, citing FIFA President Sepp Blatter.

- Enterprise Rent-A-Car is opening a branch in

- Chipotle Mexican Grill(CMG), the Chicago Tribune(TRB) and Visa will sponsor the first Windy City Cornhole Classic on July 28 at Soldier Field in

- Some US House Republicans have aligned with Wall Street in an attempt to halt a congressional proposal that would raises taxes substantially on financial firms.

AP:

- The Democrat-controlled House of Representatives endorsed a $4,000 pay raise that would increase their salaries to almost $170,000.

Expansion:

- Acciona SA has acquired the rights to develop wind parks in the

Final GDP and GDP Price Index Revised Slightly Higher, Job Market Still Healthy

- Final 1Q GDP rose .7% versus estimates of a .8% gain and a prior estimate of a .6% gain.

- Final 1Q Personal Consumption rose 4.2% versus estimates of a 4.4% gain and a prior estimate of a 4.4% increase.

- Final 1Q GDP Price Index rose 4.2% versus estimates of a 4.2% gain and a prior estimate of a 4.0% increase.

- Final 1Q Core PCE QoQ rose 2.4% versus estimates of a 2.2% gain and a prior estimate of a 2.2% increase.

- Initial Jobless Claims for last week fell to 313K versus estimates of 315K and 326K the prior week.

- Continuing Claims fell to 2490K versus estimates of 2500K and 2517K prior.

BOTTOM LINE: The

Links of Interest

Market Snapshot Commentary

Market Performance Summary

WSJ Data Center

Top 20 Biz Stories

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Wednesday, June 27, 2007

Thursday Watch

Late-Night Headlines

Bloomberg:

- Apple Inc.'s campaign to build excitement about its iPhone may be the most successful marketing effort ever, surpassing the drive to promote Ford Motor Co.'s 1964 Mustang and Microsoft Corp.'s Windows 95.

- CryoCor Inc.(CRYO) won the backing of US advisers for its experimental device to treat a type of irregular heartbeat, moving the product a step closer to approval more than a year after regulators rejected it.

- UBS AG, Europe’s largest bank by assets, was accused by Massachusetts regulators of “dishonest and unethical” practices in dealings with hedge-fund advisers.

- The yen fell from a two-week high against the US dollar and euro on speculation investors resumed sales of the currency in search of higher returns elsewhere.

-

- The fate of US immigration legislation was cast into doubt when at least six senators who helped revive the proposed overhaul said they either oppose or are leaning against a move to permit a vote on final passage.

Financial Times:

- Motorola(MOT) is worried about the effect of Apple’s(AAPL) iPhone but believes the device has weaknesses, citing an interview with Padmasree Warrior, Motorola’s chief technology officer.

- Signs emerged on Wednesday that efforts by federal officials to tackle the competitiveness of the US capital markets are speeding up.

- Ten international banks, including HSBC and Standard Charter, have been punished by China’s foreign exchange regulator for breaching strict capital controls by helping to funnel huge amounts of foreign exchange into the country’s soaring stock and property markets.

- Iran’s parliament on Wednesday night agreed to press ahead with plans to introduce fuel rationing in the face of panic and rioting across the country over the proposals.

Late Buy/Sell Recommendations

Citigroup:

- We strongly recommend investors take advantage of current weakness to add to their (ABK, target $103) and (MBI, target $74) positions. Valuations are neat the trough, yet market conditions for new business are the most attractive they have been since 2003 as spreads are finally widening.

- Reiterated Buy on (JCI), target raised to $131.

Night Trading

Asian Indices are +.25% to +1.0% on average.

S&P 500 indicated +.05%.

NASDAQ 100 indicated +.12%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

- (COMS)/.02

- (ACN)/.55

- (APOL)/.71

- (ARRO)/.37

- (BMET)/.48

- (BBOX)/.61

- (CBK)/.30

- (STZ)/.15

- (FDO)/.41

- (FINL)/-.10

- (GIS)/.63

- (KBH)/.26

- (MU)/-.24

- (MON)/1.00

- (TONS)/.98

- (PALM)/.14

- (RAD)/.00

- (RBN)/.59

- (SLR)/.05

- (TIBX)/.02

- (WOR)/.36

Upcoming Splits

- (FLO) 3-for-2

Economic Releases

8:30 am EST

- Final 1Q GDP is estimated to rise .8% versus prior estimates of .6% increase.

- Final 1Q Personal Consumption is estimated to rise 4.4% versus prior estimates of a 4.4% increase.

- Final 1Q GDP Price Index is estimated to rise 4.0% versus prior estimates of a 4.0% gain.

- Final 1Q Core PCE QoQ is estimated to rise 2.2% versus prior estimates of a 2.2% gain.

- Initial Jobless Claims for last week are estimated to fall to 315K versus 324K the prior week.

- Continuing Claims are estimated to fall to 2500K versus 2523K prior.

2:15 pm EST

- The FOMC is expected to leave the benchmark Fed Funds rate at 5.25%.

Other Potential Market Movers

- The Wachovia CEO

Stocks Finish Sharply Higher on Diminishing Sub-Prime Worries and Short-Covering

Indices

S&P 500 1,506.34 +.90%

DJIA 13,427.73 +.68%

NASDAQ 2,605.35 +1.21%

Russell 2000 838.46 +1.49%

Wilshire 5000 15,187.08 +.96%

Russell 1000 Growth 596.72 +1.0%

Russell 1000 Value 858.88 +.85%

Morgan Stanley Consumer 730.23 +.51%

Morgan Stanley Cyclical 1,072.66 +.82%

Morgan Stanley Technology 625.94 +1.30%

Transports 5,129.77 +1.05%

Utilities 496.11 +1.70%

MSCI Emerging Markets 130.21 +.16%

Sentiment/Internals

Total Put/Call 1.05 -2.78%

NYSE Arms .72 -41.42%

Volatility(VIX) 15.53 -17.79%

ISE Sentiment 116.0 -15.94%

Futures Spot Prices

Crude Oil 69.01 +1.83%

Reformulated Gasoline 225.46 +.34%

Natural Gas 6.93 +.76%

Heating Oil 202.51 +1.60%

Gold 645.80 +.08%

Base Metals 246.31 -2.53%

Copper 335.25 +1.09%

Economy

10-year US Treasury Yield 5.08% unch.

US Dollar 82.32 +.03%

CRB Index 312.30 +.51%

Leading Sectors

Biotech +2.20%

REITs +2.08%

Alternative Energy +2.12%

Lagging Sectors

Insurance +.20%

Gaming +.08%

Hospitals +.05%

Evening Review

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Movers

After-hours Stock Quote

In Play

Afternoon Recommendations

Bank of

- Rated (SPR) Buy, target $42.

Oppenheimer:

- Rated (CRWN) Buy, target $9.25.

Afternoon/Evening Headlines

Bloomberg:

- Treasury Secretary Henry Paulson said Congress shouldn’t punish Blackstone Group LP with higher taxes because it became a publicly traded partnership, and he warned against “unintended consequences” of broader efforts to tax hedge funds and buyout firms.

- Merrill Lynch(MER) CEO O’Neal and Goldman Sachs Group(GS) CEO Lloyd Blankfein offered reassurance to investors today, saying they see few risks of widespread turmoil in the credit markets.

- James Glassman, senior US economist at JPMorgan(JPM), sees the Fed “on the sidelines” and the price of oil dropping.

- Corn fell to a six-week low in

- Sugar fell in NY on renewed speculation that rising Brazilian and Indian production will widen a global glut.

- A Senate panel probing the National Security Agency’s domestic terrorism surveillance program issued subpoenas to the White House, VP Dick Cheney and the Justice Dept. for documents showing the Bush administration’s legal justification for the program.

- Shares of Nike Inc.(NKE), the world’s largest sneaker maker, posted their biggest gain in 4 ½ years after the company said orders for clothing and shoes rose 12%, the most since 1997.

- Shares of ComScore Inc.(SCOR), Data Domain(DDUP) and Spreadtrum Communications(SPRD) soared in their first day of trading as demand for speedier wireless connections and Web content renewed investor appetite for technology stocks.

- Bed Bath & Beyond(BBBY) said first quarter profit rose 4.2% after customers bought less bedding and curtains as

- NYC is experiencing scattered power outages, affecting parts of the South Bronx, East Harlem and the

BOTTOM LINE: The Portfolio finished higher today on gains in my I-Banking longs, Medical longs, Semi longs, Biotech longs and Base Metal shorts. I did not trade in the final hour, thus leaving the Portfolio 100% net long. The tone of the market was positive today as the advance/decline line finished higher, every sector rose and volume was above average. Measures of investor anxiety were above-average into the close. Today's overall market action was very bullish. Growth stocks were especially strong, however, every sector I follow finished higher. Technology stocks outperformed again today, and the MS Tech Index is now 10.6% higher year-to-date vs. a 7.2% gain for the S&P 500. Corn fell another 3.6% and has completely broken down technically. I continue to believe a major top in the commodity is already in place. This spurred another 1% decline in the Goldman Ag Commodity Sub-Index. Retail options traders exhibited bearish sentiment throughout the day. The Nikkei futures are indicating an up 100 open in

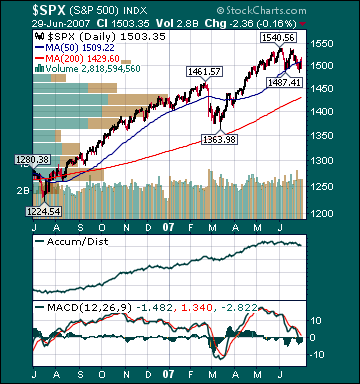

Here is a five-year chart of NYSE short-interest:

As you can see, short interest was basically flat from mid-2002 through first quarter 2005, which is what I would expect considering the massive number of new hedge funds created during that period and a large stock rally off the bottom in October 2002. However, the recent parabolic rise in short interest, the largest four-month percentage increase on record (+30%), is stunning considering recent stock gains and is symptomatic of the current

Stocks Reverse Sharply Higher into Final Hour on Diminishing Subprime Angst, Short-Covering

Today's Headlines

Bloomberg:

- Goldman Meets Match in Googleplex When Recruiting Graduates.

- Merrill Lynch(MER) CEO O’Neal says subprime mortgage losses are contained.

- White House spokesman Tony Snow said the Bush administration is critical of Democratic legislation that would more than double taxes paid by managers of hedge funds, buyout firms, real estate partnerships and venture capital firms.

- The wealth of the world’s millionaires swelled at the fastest pace in seven years in 2006, led by growth in emerging markets such as China, according to an annual survey by Capgemini SA and Merrill Lynch.

- Lloyd Blankfein, CEO of Goldman Sachs(GS), said “the private equity boom isn’t over” and that “market conditions are quite benign.”

- Corn is falling another 4.1% in

- Oil is rising over $1/bbl. on a fall in gasoline supplies as refinery utilization remains very low for this time of year due to ongoing maintenance “problems” and the cancellation of plans by refiners to increase production capacity by 500,000 barrels per day earlier in the year.

- Apple Inc.(AAPL) is offering easy activation of its new iPhone by using iTunes, which will be critical to a successful introduction of the mobile device, according to American Technology Research analysts.

- Iranians rioted in the streets of

- Fidelity National Information Services(FIS) agreed to buy rival EFunds(EFD) for about $1.8 billion in cash to bolster its debit-card business.

- CommScope Inc.(CTV), a maker of cable for high-speed services, agreed to buy mobile-phone equipment maker Andrew Corp.(ANDW) for about $2.6 billion.

-

Wall Street Journal:

-

- Wal-Mart Stores(WMT), Home Depot(HD), Best Buy(BBY) and other big-box retailers are putting up clearer signs, adding brighter lights and speeding up checkouts to make shopping less tedious.

- Apple Inc., Nokia Corp., Samsung and other makers of cell phones are increasingly offering wireless Internet access.

- About 17% of the fund managers questioned said

- United Auto Group(UAG) will change its name to Penske Automotive Group next week to tap the name recognition of its CEO and controlling shareholder.

- Amazon.com(AMZN) is increasing services to business Internet usurers, selling digital storage and computing power that could lift sales in 2008 and 2009, citing Deutsche Bank analyst Jeetil Patel.

NY Times:

- Kurdistan’s relative stability compared with the rest of

Dow Jones:

- Carlyle Group may go public after rival buyout firm Blackstone Group’s successful IPO, citing a managing director.

- Donald Trump’s plan to sell Trump Entertainment Resorts(TRMP), the casino company he controls, to a private-equity partnership has hit snags over the price.

Market News Intl.:

- The European Central Bank hasn’t decided whether to raise interest rates again in September, citing “well-placed monetary sources.”

Frankfurter Allgemeine Zeitung:

-

People’s Daily:

-

Durable Goods Orders Fall in May after Large April Upward Revision

- Durable Goods Orders for May fell 2.8% versus estimates of a 1% decline and an upwardly revised 1.1% gain in April.

- Durables Ex Transports for May fell 1% versus estimates of a .2% gain and an upwardly revised 2.5% increase in April.

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

WSJ Data Center

Top 20 Biz Stories

Movers & Shakers

Upgrades/Downgrades

In Play

Today in IBD

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Wednesday Watch

Late-Night Headlines

Bloomberg:

- General Motors’(GM) Cadillac luxury-vehicle division is considering hybrid versions of all its models.

- A unit of General Electric(GE), the world’s biggest maker of power generators, will invest in three windparks in

- Shares of Cameco Corp.(CCJ), the world’s largest uranium producer, fell the most in eight months on concern that the price of uranium has peaked.

- Countrywide Financial Corp.(CFC) called “unfounded” market speculation that the company was the subject of raids by federal authorities.

- North Korea is “committed” to scrapping its nuclear program and is “positive” about its relations with the US and the international community, a group of European Union lawmakers told reporters in

-

Wall Street Journal:

- Apple’s iPhone is a breakthrough smart phone with some flaws, according to a review by Walter S. Mossberg. The “simply beautiful” handheld computer, set to go on sale June 29, offers the “best Web browser,” the biggest and highest-resolution screen and better battery life than key competitors, according to the review, also written by Katherine Boehret.

Late Buy/Sell Recommendations

Citigroup:

- (TSO) and (VLO) are downgraded to Sell and (SUN) is lowered to Hold. We are lowering ratings across the board for the

- Reiterated Buy on (NKE), target $65.

Morgan Stanley:

- Reiterated Outperform on (ORCL), target $24.

Night Trading

Asian Indices are -1.0% to -.25% on average.

S&P 500 indicated -.09%.

NASDAQ 100 indicated -.10%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

- (ATML)/.03

- (BBBY)/.37

- (CKR)/.27

- (CAG)/.31

- (GY)/-.04

- (MLHR)/.49

- (MKC)/.33

- (PKE)/.41

- (PAYX)/.36

- (RHT)/.15

- (SMOD)/.22

- (SMSC)/.25

- (TBL)/.15

- (XRTX)/.14

Upcoming Splits

- (SPAR) 3-for-2

- (VSEC) 2-for-1

- (FLO) 3-for-2

Economic Releases

8:30 am EST

- Durable Goods Orders for May are estimated to fall -1.0% versus a .8% gain in April.

- Durables Ex Transports for May are estimated to rise .2% versus a 1.9% increase in April.

10:30 am EST

- Bloomberg consensus estimates call for a weekly crude oil build of 1,500,000 barrels versus a 6,902,000 barrel build the prior week. Gasoline supplies are estimated to rise by 1,000,000 barrels versus a 1,791,000 barrel increase the prior week. Distillate inventories are expected to rise by 500,000 barrels versus a 157,000 barrel build the prior week. Finally, Refinery Utilization is expected to rise by .83% versus a -1.63% decline the prior week.

Other Potential Market Movers

- The weekly MBA Mortgage Applications report, (LUV) analyst meeting, Wachovia CEO Summit and Jeffries Healthcare Conference could also impact trading today.

Tuesday, June 26, 2007

Stocks Finish Slightly Lower on Weakness in Commodity Stocks and Lingering Housing Worries

Indices

S&P 500 1,492.89 -.32%

DJIA 13,337.66 -.11%

NASDAQ 2,574.16 -.11%

Russell 2000 826.13 -.16%

Wilshire 5000 15,043.04 -.34%

Russell 1000 Growth 590.79 -.32%

Russell 1000 Value 851.68 -.40%

Morgan Stanley Consumer 726.53 +.09%

Morgan Stanley Cyclical 1,063.97 -1.05%

Morgan Stanley Technology 617.93 -.24%

Transports 5,076.57 -.94%

Utilities 487.84 -.13%

MSCI Emerging Markets 129.99 -.35%

Sentiment/Internals

Total Put/Call 1.08 -2.70%

NYSE Arms 1.24 -7.51%

Volatility(VIX) 18.89 +13.45%

ISE Sentiment 143.0 +8.33%

Futures Spot Prices

Crude Oil 67.94 -1.79%

Reformulated Gasoline 224.89 -2.33%

Natural Gas 6.85 -1.27%

Heating Oil 199.71 -2.22%

Gold 644.30 -1.59%

Base Metals 252.70 +1.82%

Copper 332.85 -2.05%

Economy

10-year US Treasury Yield 5.08% unch.

US Dollar 82.32 unch.

CRB Index 310.73 -.80%

Leading Sectors

Internet +1.53%

Drugs +.86%

Restaurants +.64%

Lagging Sectors

Oil Service -1.85%

Steel -1.93%

Gold -2.64%

Evening Review

Market Performance Summary

Market Gauges

ETF Performance

Style Performance

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Economic Calendar

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Movers

After-hours Stock Quote

In Play

Afternoon Recommendations

Deutsche Bank:

- Rated (RYL) Buy, target $52.

Citigroup:

- Reiterated Buy on (MO).

Afternoon/Evening Headlines

Bloomberg:

- Bear Stearns(BSC) probably won’t bail out the second of its money-losing hedge funds, Merrill Lynch(MER) analyst Guy Moszkowski said, a day after sounding the alarm that investors couldn’t “rule out” such a rescue.

- Bear Stearns(BSC) said it will put up $1.6 billion to rescue one of its money-losing hedge funds, half as much as it offered last week, after raising additional money through asset sales.

- NY harbor conventional gasoline’s discount to futures widened for a second day and reformulated gasoline’s premium declined as traders may be anticipating lower prices next month.

- The Intl. Monetary Fund said it will consider whether to sell gold and invest the proceeds in interest-bearing accounts during a board meeting next month.

- The SEC has undertaken about a dozen probes involving collateralized loans, Chairman Christopher Cox said.

-

-

- Oracle Corp.(ORCL) said fourth-quarter profit rose 23%, beating analysts’ estimates, buoyed by database sales and recent acquisitions. The stocks is rising .23 to $19.39 in after-hours trading.

- Nike Inc.(NKE) said fourth quarter profit climbed 32% on a weaker dollar and increased

- Apple’s(AAPL) iPhone already has people lining up at two Apple stores in