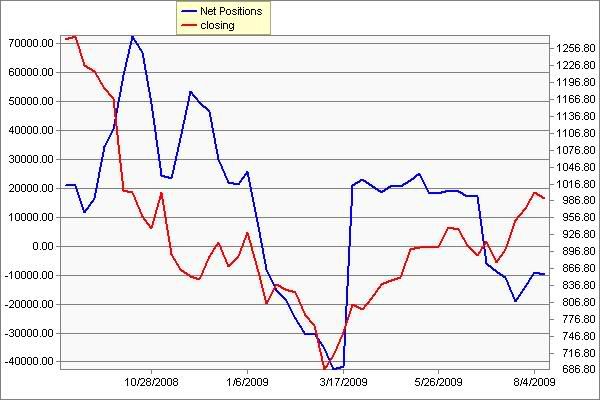

BOTTOM LINE: Given the recent sharp rise in US stocks, many believe investor sentiment has become way too bullish and thus an imminent correction is a certainty. However, the chart above from Schaeffer's Investment Research indicates one group of investors that is positioned net short again. As you can see, large speculators in the S&P 500 have had EXCEPTIONALLY poor market timing over the last year as they were positioned very net long right before the accelerated down move began and were positioned very net short right at the stock market bottom in March. Moreover, the AAII % Bulls plunged to 34.1 this week from 51.0 the prior week, while the % Bears jumped to 40.0 from 33.0 the prior week. The S&P 500 is taking out its recent high today. There are an unusual number of stocks rising meaningfully on volume today for a sleepy summer Friday. Considering these investor sentiment readings and the overwhelming belief that a correction is imminent during the seasonally weak month of September, another push higher is likely over the coming weeks on short-covering, performance chasing and technical buying.

No comments:

Post a Comment