There are a few of economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - 2Q Current Account Balance, Net Foreign Security Purchases, NAHB Housing Market Index

Tues. - Producer Price Index, Housing Starts, Building Permits

Wed. - FOMC Rate Decision

Thur. - Initial Jobless Claims, Leading Indicators, Philly Fed

Fri. - None of note

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - None of note

Tues. - Autozone(AZO), CBRL Group(CBRL), Chaparral Steel(CHAP), Darden Restaurants(DRI), Factset Research(FDS), Oracle Corp.(ORCL)

Wed. - Carmax(KMX), Cintas Corp.(CTAS), Circuit City(CC), Herman Miller(MLHR), Morgan Stanley(MS), Stage Stores(SSI), Steelcase(SCS)

Thur. - AG Edwards(AGE), Bed Bath & Beyond(BBBY), Biomet(BMET), Carnival Corp.(CCL), ConAgra Corp.(CAG), FedEx Corp.(FDX), Finish Line(FINL), General Mills(GIS), Nike Inc.(NKE), Palm Inc.(PALM), Scholastic Corp.(SCHL)

Fri. - KB Home(KBH)

Other events that have market-moving potential this week include:

Mon. - Bank of America Investment Conference, TGT Mid-month Sales Update

Tue. - CSFB Chemical Conference, UBS Global Paper and Forest Products Conference, Bank of America Investment Conference

Wed. - CSFB Chemical Conference, UBS Global Paper and Forest Products Conference, Bank of America Investment Conference, Goldman Sachs Communacopia Conference

Thur. - Oppenheimer Diabetes Conference, Bank of America Investment Conference

Fri. - None of note

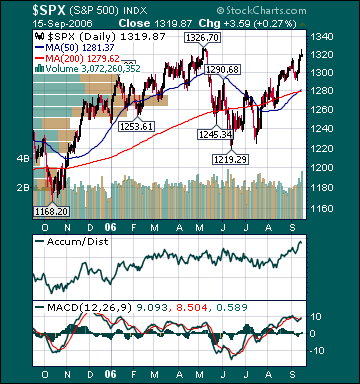

BOTTOM LINE: I expect US stocks to finish the week modestly higher on short-covering, bargain hunting, decelerating inflation readings, no Fed rate hike, less hawkish Fed policy comments, mostly positive earnings reports and less pessimism. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.