Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was very bullish. The advance/decline line rose, most sectors gained and volume was above average on the week. Measures of investor anxiety were mixed. The AAII percentage of Bulls rose to 47.95% this week from 42.99% the prior week. This reading is now slightly above average levels. The AAII percentage of Bears rose to 38.36% this week from 29.91% the prior week. This reading is now again above average levels. The 10-week moving average of the percent Bears is currently 40.04%. The 10-week moving-average of percent Bears was 43.0% at the major bear market lows during 2002. The only other times it was higher than these levels, since record keeping began in 1987, were the significant market bottom during the 1990 recession/Gulf War and in October 1992. In my opinion, the fact that bullish sentiment is moving up from excessively depressed levels is a positive. The steadfastly high bearish percentage, given recent gains, is still providing a wall of worry for stocks to climb higher. I continue to believe the “irrational pessimism” aimed towards most US stocks has never been this great in history given the positive macro backdrop.

The average 30-year mortgage rate fell another 4 basis points to 6.43%, which is 37 basis points below July highs. I still believe housing is in the process of slowing to more healthy sustainable levels. Mortgage rates have likely begun an intermediate-term move lower, which should help stabilize housing over the next few months. The Case-Shiller housing futures are still projecting a 5% decline in the average home price over the next 9 months. Considering the average house has appreciated over 50% during the last few years, this would be considered a “soft landing.” The overall negative effects of housing on the US economy are currently being exaggerated, in my opinion. Housing has been slowing substantially for 13 months and has been mostly offset by other very positive aspects of the economy.

The benchmark 10-year T-note yield rose 2 basis points on the week on profit-taking and more economic optimism. The CRB Commodities Index, the main source of inflation fears, has now declined 4% over the last 12 months and is down 16.0% from May highs, approaching bear market territory. I believe inflation concerns have peaked for the year as economic growth moderates to around average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose less than expectations as refinery utilization fell. Unleaded Gasoline futures dropped substantially again and are now 45.9% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. Gasoline demand is estimated to rise .8% this year versus a 20-year average of 1.7% demand growth. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 10% from 36% late last year. The elevated level of gas prices related to crude oil production disruption speculation is further dampening fuel demand, which is sending gas prices back to more reasonable levels.

US oil inventories have only been higher during one other period over the last 7 years. Since December 2003, global oil demand is only up .1%, while global supplies have increased 5.3%, according to the Energy Intelligence Group. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. Oil closed the week at $63.33/bbl., breaking clearly below its major uptrend line at $66.33 despite the fact that we are in a seasonally strong period for the commodity. A major top in oil is likely already in place. However, a Gulf hurricane will likely lead to a bounce higher in price over the next month further accelerating demand destruction, resulting in a complete technical breakdown in crude. As the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should head meaningfully lower from current levels over the intermediate-term.

Natural gas inventories rose more than expectations this week, sending prices for the commodity plunging further. Supplies are now 12.4% above the 5-year average, a record high level for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have collapsed 68.2% since December 2005 highs. It is very likely US natural gas storage will become full during October, creating the distinct possibility of a “no-bid” situation for the physical commodity. Colorado State recently reduced its forecast from three to two major hurricanes for this season versus seven last year. The peak of hurricane season was September 10. Natural gas made new cycle lows again this week despite the fact that the commodity is in its seasonally strong period.

Gold fell on the week as the US dollar strengthened and inflation fears continued to diminish. The US dollar rose on more US economic optimism, lower commodity prices and weaker international economic reports. I continue to believe there is almost zero chance of a Fed rate hike at the September 20 meeting and very little chance of another hike this year.

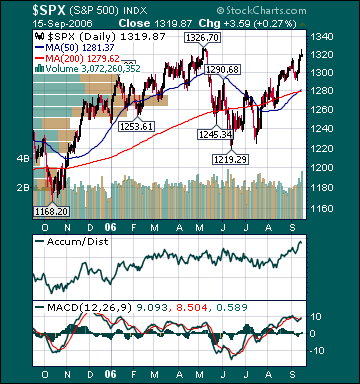

Investment Banking stocks outperformed for the week on more US stock market optimism and strong earnings reports. Commodity stocks underperformed substantially again as the mania for these shares continues to subside in the face of falling prices and declining inflation worries. S&P 500 profit growth for the second quarter came in a strong 16.3% versus a long-term historical average of 7%, according to Thomson Financial. This is the 16th straight quarter of double-digit profit growth, the best streak since recording keeping began in 1936. Moreover, another double-digit gain is likely in the third quarter. Despite a 77.1% total return for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 15.1. The 20-year average p/e for the S&P 500 is 24.4. The S&P 500 is now up 7.2% and the Russell 2000 Index is up 9.2% year-to-date. The DJIA is only 190 points away from its all-time high reached on January 14, 2000. I expect the Dow to breach this level convincingly during the fourth quarter.

Current stock prices are still providing longer-term investors very attractive opportunities in many equities that have been punished indiscriminately. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A recent CSFB report confirmed this view. The report concluded that on a price-to-cash flow basis growth stocks are now cheaper than value stocks for the first time since at least 1977. Almost the entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is a function of growth stock multiple contraction. The p/e on value stocks is back near high levels. I still expect the most overvalued economically sensitive and emerging market stocks to continue underperforming over the intermediate-term as the manias for those shares subside and global growth slows to more average rates. I believe a chain reaction of events has begun that will result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels. One of the characteristics of the current “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated and promptly priced in to stock prices. This “irrational pessimism” by investors is resulting in a dramatic decrease in the supply of stock as companies buy back shares, IPOs are pulled and secondary stock offerings are canceled.

Over the coming months, an end to the Fed rate hikes, lower commodity prices, seasonal strength, the November election, decelerating inflation readings, lower long-term rates, increased consumer/investor confidence, rising demand for US stocks and the realization that economic growth is only slowing to around average levels should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I expect the S&P 500 to return a total of at least 15% for the year. The ECRI Weekly Leading Index rose again this week and is forecasting healthy US economic activity.

*5-day % Change

No comments:

Post a Comment