Click here for a weekly economic preview by MarketWatch.

Click here for Monday’s US Equity Preview by Bloomberg.

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – ISM Manufacturing, ISM Prices Paid, Construction Spending, Total Vehicle Sales

Tues. – Weekly retail sales reports

Wed. – Weekly EIA energy inventory data, weekly MBA Mortgage Applications report, Challenger Job Cuts, ADP Employment Change, 4Q Non-farm Productivity, 4Q Unit Labor Costs, Factory Orders, ISM Non-Manufacturing, Fed’s Beige Book

Thur. – Initial Jobless Claims, Pending Home Sales, Mortgage Delinquencies, ICSC Chain Store Sales

Fri. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Consumer Credit

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – None of note

Tues. – Tech Data(TECD), Kenneth Cole(KCP), Chico’s FAS(CHS), Take-Two(TTWO), WellCare Health(WCG), Copart(CPRT), Staples(SPLS), AES Corp.(AES)

Wed. – Brown Shoe(BWS), BJ’s Wholesale(BJ), Saks Inc.(SKS), Martek Biosciences(MATK), ADC Telecom(ADCT), PetSmart(PETM), H&R Block(HRB), Coldwater Creek(CWTR), Big Lots(BIG), Costco Wholesale(COST), Longs Drug Stores(LDG)

Thur. – Joy Global(JOYG), Urban Outfitters(URBN), Blockbuster Inc.(BBI), Orbitz Worldwide(OWW), National Semi(NSM), Cooper Cos(COO), Quiksilver Inc.(ZQK), Marvel Tech(MRVL), Dillard’s(DDS), Korn/Ferry(KFI), VeriFone(PAY), Blackstone Group(BX)

Fri. – None of note

Other events that have market-moving potential this week include:

Mon. – Fed’s Plosser speaking, (KEG) analyst meeting, Morgan Stanley Tech Conference, Merriman Curhan Ford IP Video Conference, Citi Global Property Conference, Raymond James Institutional Conference, CSFB Under Followed Opportunities Conference

Tue. – Fed’s Bernanke speaking, (EAC) analyst meeting, (JAH) analyst meeting, (ARRS) analyst meeting, (RTIX) analyst dinner, (OMTR) analyst meeting, CSFB Under Followed Opportunities Conference, Bear Stearns Retail/Restaurants/Consumer Conference, Citi Global Property Conference, Morgan Stanley Tech Conference, Merrill Global Automotive Conference, Raymond James Institutional Investor Conference, Citi Industrial Manufacturing Conference

Wed. – OPEC Meeting, (PFE) analyst meeting, (XOM) analyst meeting, (KWK) analyst meeting, (TAP) analyst meeting, CSFB Under Followed Opportunities Conference, Morgan Stanley Tech Conference, CSFB Global Biotech Conference, Citi Global Real Estate Conference, Bear Stearns Retail/Restaurant/Consumer Conference, Citi Industrial Manufacturing Conference, CSFB Global Biotech Conference, CIBC Retail Conference, Raymond James Institutional Investor Conference, Citi Global Industrial Manufacturing Conference

Thur. – (SD) analyst meeting, (BNI) analyst meeting, (IBM) investor briefing, (IT) investor day, (JNPR) analyst meeting, (LMNX) investor day, (HRS) analyst meeting, Bear Stearns Retail/Restaurants/Consumer Conference, UBS Energy Conference, UBS Engineering/Construction Conference

Fri. – UBS Energy Conference

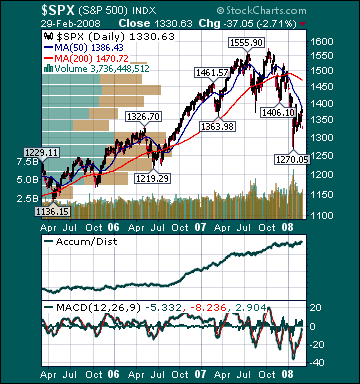

BOTTOM LINE: I expect US stocks to finish the week mixed as mostly positive earnings reports, increasing odds for a 75 basis pint rate cut, bargain hunting and diminishing bond insurer uncertainty offsets more shorting and economic pessimism. My trading indicators are giving mixed signals and the Portfolio is 75% net long heading into the week.