Weekend Headlines

Bloomberg:

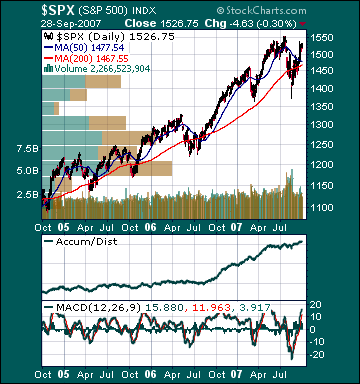

- US stocks rose this week to complete the steepest September advance since 1998 as the Fed’s interest-rate cut helped energy and raw-material companies lead the market’s recovery from a summer rout.

- China Investment Corp., the nation’s $200 billion sovereign wealth fund, starts operations today as the government seeks to boost returns on the world’s biggest foreign-exchange reserves.

- US high-yield bonds posted the best returns in four years this month after the Fed’s interest rate cut enticed investors back to the riskiest debt.

- US Treasuries capped their biggest quarterly rally in five years as the inflation gauge preferred by Fed policy makers showed consumer prices rose at the slowest pace in more than three years during August.

- The euro’s record-setting rally may not extend through the end of October, according to analysts who rely on market patterns for their predictions.

- Garry Kasparov, the ex-world chess champion turned politician, will run in

- Sentiment among Japan’s largest manufacturers unexpectedly held near a two-year high last quarter as exports expanded even as US economic growth cools.

NY Times:

- China Toys a Boon to Lead-Testing Companies.

- At first blush, the iPhone from Apple(AAPL), the new microprocessor family from Intel(INTC) and the ubiquitous Google(GOOG) search engine have nothing in common. Yet all of these products depend on obscure process innovations that, while highly complex and lacking glamour, are an essential part of establishing a winning edge in commercial electronics.

MarketWatch.com:

- EMC: more than just the VMware parent. Diversification has been a boon to storage-technology giant.

- Boeing Co.(BA) took the lead over Airbus in commercial airplane orders in the third quarter, according to an early tally, as both aircraft makers kept drumming up business from fast-growing Asian markets and got some late-period purchase from venerable European carriers.

Barron’s:

- London’s $2.27 billion RAB Special Situations was the top-performing hedge fund during the past three years, with a 47.7% cumulative return.

- The Dow Jones has climbed in the fourth quarter for nine consecutive years, and in 24 of the past 27 years. The S&P 500 has produced fourth-quarter rallies in 13 of the past 15 years and racked up an average 6.3% haul, according to researchers at Bespoke Investment Group.

BusinessWeek.com:

- A group of Midwest utilities is building a plant that will store excess wind power underground.

TheStreet.com:

- Coming Week: Bond Binge.

CNNMoney.com:

- 5 Ways to Slash Your Energy Bill.

- 4 Must Have Gadgets.

- 5 Blinged-out Tech Toys.

Newsweek:

- The search for renewable-energy sources is making clean-tech jobs hot.

Crain’s

- Exelon Corp.(EXE) CEO John Rowe said the utility operator is interested in mergers and acquisitions.

- McDonald’s Corp.(MCD) forecasts its expanded offering of drinks will boost sales by more than $1 billion annually.

Crain’s NY Business:

- Morgan Stanley(MS) Co-President Zoe Cruz and Avon Products(AVP) Chairman and CEO Andrea Jung are among the 25 most powerful women in NY businesses.

- Returns from large-capitalization growth funds far outpaced those of other diversified equity funds in the July-September period as investors sought the safety and growth potential of big companies following the return of volatility and the stock market’s pullback from its mid-July highs.

- Advertisers who wanted to know more about radio listeners are finally getting an electronic audience measurement system that’s not only delivering more accurate results but also shaking up the broadcasting business.

AP:

- Former Republican House Speaker Newt Gringrich won’t run for president in 2008 because exploring a bid would clash with his role as the head of a tax-exempt group.

-

Financial Times:

- FT.com, the internet arm of the Financial Times, will on Monday announce an innovative charging system and a major expansion of the site, fueling debate about newspapers’ online business models.

- The UAW union could become General Motors’ biggest shareholder under a deal to transfer the carmaker’s healthcare obligations to a huge union-managed trust.

Times:

- Goldman makes $370 million after saving its black box hedge fund.

Sunday Telegraph:

- The UK Treasury has given the go-ahead to JC Flowers & Co. and Cerberus Capital to proceed with their bids for Northern Rock Plc.

Commercial Times:

- Taiwan Semiconductor Manufacturing’s chip shipments in the fourth quarter will rise between 7% and 10% from the third quarter. Taiwan Semi received orders to make more chips fro clients such as Qualcomm Inc.(QCOM), Nvidia Corp.(NVDA), and Broadcom(BRCM).

-

Weekend Recommendations

Barron's:

- Made positive comments on (BWA), (AMR) and (NDSN).

Citigroup:

- West Texas Intermediate crude rebounded from a mid-week breach below $80 to finish the week at $81.77. However, support from financial speculators and refining margins has declined, leaving our model delta about $6. Against a backdrop of deteriorating storm concerns, downside risk to oil prices looks like a reality. Open interest fell 1%, almost entirely on higher non-commercial short positions. This follows the 6% decline that accompanied the 9/20 contract expiration and contrasts with the post expiration rebound seen typically in recent months. Our technical team remains cautious, targeting support around $74/bbl.

Night Trading

Asian indices are +.25% to +.75% on average.

S&P 500 futures +.06%.

NASDAQ 100 futures -.07%

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (WAG)/.47

- (PALM)/.08

Upcoming Splits

- (BCSI) 2-for-1

- (JCI) 3-for-1

- (TAP) 2-for-1

Economic Releases

10:00 am EST

- ISM Manufacturing for September is estimated to fall to 52.5 versus 52.9 in August.

- ISM Prices Paid for September is estimated to fall to 62.3 versus 63.0 in August.

Other Potential Market Movers

- The Jeffries Technology Conference could also impact trading today.