Bloomberg:

- Senator John McCain said a “substantial” and “sustained” increase in US troop levels in Iraq is necessary to help the local government establish its own security authority throughout the country.

- The US dollar posted its biggest weekly rally against the euro since June as the US economy added more jobs than traders anticipated and a gauge of manufacturing accelerated.

- Microsoft(MSFT) will team with Ford Motor(F) to provide drivers with voce-activated software that helps them make mobile phone calls and play songs stored on digital music players.

- Eastman Kodak(EK) plans to sell picture frames that display digital phone slideshows to attract customers looking for new ways to present their shots.

- Palestinian Authority President Abbas yesterday declared a militia belonging to the Hams-controlled Interior Ministry illegal after its gunmen killed a security official and four others.

- Israel denied a newspaper report that it’s preparing a nuclear attack against Iranian uranium-enrichment plants and said it remain committed to ending a dispute over Iran’s nuclear program through diplomacy.

- The nation’s retailers enjoyed the strongest back-to-back sales gains in almost a year at the end of 2006, brightening the outlook for the US economy, according to a survey of economists before a government report this week.

- The largest US teachers union is among a group endorsing a plan in Congress that would expand the federal No Child Left Behind law by offering states a single national standard for teaching math and science.

- Toyota Motor(TM), the world’s biggest seller of gasoline-electric hybrid vehicles, expects US hybrid sales to rise as much as 57% this year.

- Gold may fall for a second week on speculation US economic growth will boost the US dollar and erode the appeal of the precious metal as an alternative investment.

- Investors are withdrawing money from Treasury bond mutual funds that protect against inflation for the first time, a sign of confidence that the Federal Reserve will keep price increases from accelerating.

- United Arab Emirates economic growth will slow this year on lower oil prices which will trim export earnings in the second-largest Arab economy, the National Bank of Abu Dhabi said.

- US sales of consumer electronics will increase 7% to more than $155 billion this year, led by game consoles and music players, an industry group predicted.

- The US dollar may strengthen for a fourth day against the euro on speculation Federal Reserve Vice Chairman Kohn will signal interest rates won’t be cut this quarter.

- Stock markets are shrinking as mergers and acquisitions take shares out of public hands faster than companies add them through equity sales. The value of US shares dropped last year by the most since 1984. The contraction may continue in 2007 as dealmaking accelerates.

- The homebuilding industry is about to stop hurting the US economy and later this year may start to help it.

- Bruce Phillips, founder and managing director of Australian Worldwide Exploration, an oil and gas explorer, sees oil at $50/bbl. this year.

- Copper futures in Shanghai are falling for a fourth day, extending last week’s decline to a nine-month low, as rising stockpiles and slowing demand cut investment fund speculation on the metal.

- Microsoft Corp.(MSFT) exceeded a target for sales of its Xbox 360 and will enable the video-game console to function as a television set-top box in time for year-end holiday shopping.

- Under a new law, Iraq’s massive oil reserves will open for Western oil companies. The law would give oil companies like British Petroleum, Shell and ExxonMobil 30-year contracts to have access to Iraqi crude. It would be the first large-scale operation of foreign interests in Iraq since the oil industry was nationalized in 1972.

Christian Science Monitor:

- New prospect for US: glut of ethanol plants

ComputerWorld:

- Apple Computer(AAPL) MacWorld predictions for next week.

NY Times:

- Verizon Communications may announce an agreement tomorrow to offer full-length shows form television networks to mobile phone users.

- Blue Nile(NILE), an online purveyor of jewelry, ranks just behind Tiffany & Co.(TIF) and Zale Corp.(ZLC) in diamond ring sales after a decade in business, citing industry analysts.

Washington Post:

- Nuclear power plants are making a comeback from Asia to South America as governments rush to secure energy resources. Globally 29 nuclear power plants are being built and more than 100 have been written into the development plans of governments for the next 30 years.

- A Texas center is producing ready-made human embryos that can be ordered by single women and couples, alarming ethicists. The Abraham Center of Life LLC in San Antonio calls itself “the world’s first human embryo bank” that allows people to choose from an extensive database of donors, according to their website.

- Democratic Senator Barbara Boxer of California rescinded a “certificate of achievement” her office awarded to an Islamic activist following criticism the group he represents has extremist views and ties to international terrorist organizations.

Crain’s Chicago Business:

- The Chicago Board of Trade(BOT) vowed to block the Chicago Board Options Exchange’s planned 2008 initial public offering unless the parties can settle their differences, citing a CBOT lawyer.

AP:

- The United Nations investigated more than 300 members of its 16 peacekeeping missions for alleged sexual abuse during the past three years, citing a senior official. More than half of those investigated were fired or sent home. The UN is currently probing a report in the British newspaper The Daily Telegraph that alleged UN personnel in southern Sudan sexually abused more than 20 children.

- Iraqi forces will lead a new attempt to take control of Baghdad’s violent neighborhoods from sectarian militias, citing Prime Minister Nuri al-Maliki.

- Google(GOOG) partnered with scientists building a telescope and may provide public access to pictures of objects in space.

Financial Times:

- Citigroup(C) will tomorrow say it has raised $3.3 billion for private equity investments.

Oriental Morning Post:

- Best Buy Co.(BBY), which last month opened its first branded store in China, plans to open between two and four new outlets in the country this year.

China Oil News:

- PetroChina’s Karamay oilfield in the northwestern province of Xinjiang will become the oil producer’s second-biggest oilfield this year, overtaking Liaohe in the northesast.

Nikkei:

- Sony Corp.(SNE) will use organic electroluminescence technology for a new line of flat-panel televisions. Organic electroluminescence is attracting consumer electronics makers as it can provide higher image quality than existing plasma and liquid crystal displays.

Business Standard:

- India plans to announce a policy on developing hydro-power plants in the country in the next month.

Middle East Economic Digest:

- Iran is seeking bids from international companies to explore for and develop oil reserves in 17 areas as it seeks to boost output.

Weekend Recommendations

Barron's:

- Made positive comments on (TYC), (NUE) and (BBBY).

- Made negative comments on (MED).

Morgan Stanley:

- Remains cautious on offshore Chinese equities and is turning cautious on onshore Chinese A-shares. If a bubble does not burst at the tip of negative macro events, it deflates under the weight of valuations it can no longer sustain. Market fundamentals cannot explain today’s valuations and is rallying beyond rationale levels. Typical symptoms of a late-stage peak-market cycle are emerging: 1) a flood of corporate financing 2) loose corporate investment discipline 3) rotational sector rallies without fundamental support 4) target price rises without earnings forecast revisions 5) undaunted confidence in a coming liquidity flow that no one can quantify. Financial shares are in the largest bubble among offshore Chinese equities.

Night Trading

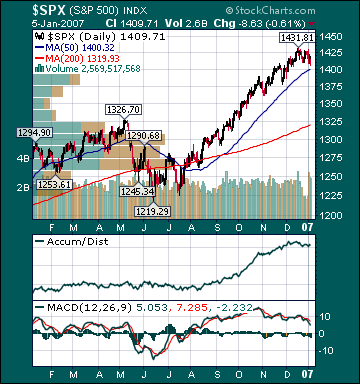

Asian indices are -1.0% to -.50% on average.

S&P 500 indicated +.08%.

NASDAQ 100 indicated +.06%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (SCHN)/.99

Upcoming Splits

- None of note

Economic Releases

3:00 pm EST

- Consumer Credit for November is estimated to rise to $5.4 billion versus -$1.2 billion in October.

BOTTOM LINE: Asian Indices are lower, weighed down by commodity and technology shares in the region. I expect US stocks to open modestly lower and to rally into the afternoon, finishing modestly higher. The Portfolio is 75% net long heading into the week.