Bloomberg:

- Oil is falling another $1.37/bbl. on comments from Saudi Arabia that they are happy with oil around $50/bbl.

- Copper prices are plunging 4% as LME inventories have surged 8% in the last week and are near 3 year highs.

- Corn prices in Chicago fell on speculation that commodity- and hedge-fund managers this week will reduce record net-long positions.

- Stainless-steel producers, which use about two-thirds of global nickel supplies, are reducing the amount of the metal in their products after prices soared to a record, an industry organization said.

- The yen declined to the lowest against the US dollar in more than four years after a Japanese government report showed a drop in retail sales last month.

- Microsoft Corp.(MSFT) expects to see a “bump” in sales from the release of its new Windows Vista program, CEO Ballmer said. Symantec Corp.(SYMC) agreed to buy Altiris Inc. for about $830 million in cash to gain programs that help companies manage software for their businesses.

- Merrill Lynch(MER) agreed to buy First Republic Bank for $1.8 billion in cash and stock.

Wall Street Journal:

- Russia’s OAO Gazprom, the world’s No. 2 oil company by reserves after Exxon Mobil(XOM), will double spending on development to $20 billion this year, said Alexander Medvedev, who heads Gazprom’s export effort.

- US utility companies are competing for the best locations for new nuclear power plants and more than $8 billion in federal subsidies.

NY Times:

- Iran plans to expand economic and military ties with Iraq, including opening a national bank in Baghdad and offering military training, citing an interview with Iran’s ambassador to Iraq.

- Nielsen Media Research will for the first time begin using the viewings of college students living away from home.

USA Today:

- House Speaker Nancy Pelosi and two other top Democrats violated a federal ethics law that requires disclosure of leadership roles at non-profit organizations, citing financial disclosure records.

Washington Post:

- President Bush’s new plan to stabilize Baghdad “corrects the problems that plagued previous efforts,” National Security Adviser Stephen Hadley wrote.

Independent:

- Mark Mobius, who manages the Templeton Emerging Markets Investment Trust, faces criticism from City of London Investment Group, the trust’s biggest investor with a 13% stake. In an open letter to the board, City said Mobius runs the trust like an index-tracking vehicle, without much active stock-selection, and thus fails to justify the fees charged by his company, Franklin Templeton Investments.

Boersen:

- AP Moeller-Maersk A/S, the world’s largest container-ship owner, expects oil production in the UK part of the North Sea to rise, citing a director. Production growth will stem from new finds and better exploitation of known fields with new technology.

La Gaceta de los Negocios:

- Actividades de Construccion & Servicios SA, a Spanish construction company, may acquire a company or an “attractive” asset in the US to reinforce its presence in that country.

La Lettre de L’Expansion:

- Sanofi-Aventis SA and Bristol-Myers Squibb(BMY) signed a preliminary agreement to combine last week.

Ma’ariv:

- Nice Systems Ltd. may announce the acquisition of rival Witness Systems(WITS) for $820 million this week.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, January 29, 2007

Sunday, January 28, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- Broadcom Corp.(BRCM), a maker of chips for consumer devices, didn’t infringe two patents owned by Qualcomm Inc.(QCOM), a federal jury in San Diego found.

- Bank of America(BAC), blocked by federal rules from buying another big US bank, has discussed an alliance with Countrywide Financial Corp.(CFC), the nation’s largest mortgage lender.

- Israeli Prime Minister Ehud Olmert’s coalition government approved the appointment of Raleb Majadele today as the nation’s first Arab Muslim Cabinet member.

- Intel Corp.(INTTC) said it made a breakthrough in transistor technology that allows it to make faster, smaller, more efficient processors.

- The US dollar rose for a third straight week against the yen as gains in US durable goods orders and home sales suggested the economy is strengthening.

- President Bush, seeking to garner support for the key proposals in his State of the Union address this week, urged lawmakers to embrace bipartisanship on energy and health-care overhaul.

- Terrorism, a subject that has dominate recent meetings of the World Economic Forums, was largest absent as a topic at this year’s gathering as economic and political leaders turned their focus to global warming.

- Deutsche Telekom AG, Europe’s largest telephone company, unexpectedly cut its forecast for 2007 earnings, citing intensifying domestic competition and the effect of currency fluctuations.

- Institutional Shareholder Services today recommended Equity Office Properties(EOP) holders accept Blackstone Group’s $38.3 billion cash offer, the world’s biggest leveraged buyout.

- European Central Bank President Jean-Claude Trichet said the fastest money supply growth in 17 years validated recent interest rate increases.

- Richard Evans, CEO of Alcan Inc.(AL), the world’s second-largest aluminum producer, expects prices for the metal to be lower in a year.

- Japan’s retail sales fell in December, signaling consumer spending may be slow to recover from its worst slump in almost a decade.

- Energy companies stocks in the US are trading near the lowest prices relative to earnings since November 1982. However, commodity stocks historically look the “cheapest” before significant declines as their earnings are usually near peaks. The average annual price for a barrel of oil peaked in 1980 at $37.42. Moreover, oil topped in August of 1983 at about $33/bbl. and proceeded to plunge 70% to around $10/bbl. by August of 1986.

- US Treasury bond sales may fall to the lowest level in five years as economic growth boosts corporate tax revenue, reducing the government budget deficit.

- The US dollar is rising to the highest in almost four years against the yen on speculation reports this week will show the economy is improving, suggesting the Fed will refrain from lowering interest rates in coming months.

- China’s oil and gas demand and supply will be balanced this year, the nation’s top economic planner said. Tightness in coal and power supplies in China will ease in 2007. “The priority is to push for resource conservation, environmental protection and increase the quality of industrial output,” the National Development and Reform Commission said.

Wall Street Journal:

- Job creation accelerated and average pay rose in California’s Silicon Valley last year, extending technology companies’ recovery from the crash of 2000, citing an annual report by a nonprofit group. The unemployment rate fell to 4% from 5% the previous year and average pay for Silicon Valley employees rose 4% to $74,302.

Ticker Sense:

- Small/Mid-cap growth stocks are “cheaper” than their value counterparts.

NY Times:

- Gap Inc.(GPS), whose CEO Pressler resigned after two years of sales declines, needs to revamp its cradle-to-grave single-line fashion.

- The Freelancers Union, a group of 40,000 Web designers, video editors, writers, dancers and graphic artists in NY, plans to reach out to the 20 million US independent contractors.

Business Week:

- By focusing on the hours between traditional mealtimes, McDonald’s(MCD) is sizzling.

CNN.com:

- 8 technologies to save the world. These futuristic projects promise to make the world greener, while making entrepreneurs some green.

Chicago Tribune:

- Tribune Co.(TRB) rejected two takeover offers as too low and is talking to private-equity companies including Chicago-based Madison Dearborn Partners LLC about a management buyout.

AP:

- Google’s(GOOG) YouTube will begin sharing revenue with its millions of users, citing YouTube’s co-founder Chad Hurley.

Financial Times:

- The London Stock Exchange had more than $5.88 billion of listings by hedge funds last year, surpassing Zurich as the largest market, citing research by ABN Amro Holding NV.

- Global revenue from downloads of television programs and films from Web sites is forecast to grow 1,000% within five years, to $6.3 billion , due to an increase in the use of broadband, citing Informa, a business information group.

- Most French, Italian and Spanish citizens and over half of Germans consider the single European currency to have had a negative impact on their economies, citing a Harris poll. Of those surveyed in France, only 5% said the euro has had a positive effect on the domestic economy.

Sunday Telegraph:

- London Stock Exchange Plc CEO Furse has scheduled meetings with the exchange’s largest shareholders to ask their help in fending off a hostile bid from Nasdaq Stock Market(NDAQ).

- Virgin Group Ltd., the closely held company run by billionaire Richard Branson, plans to list the shares of its US cell phone business on a US stock exchange.

AutomobilWoche:

- Ford Motor Co.(F) CEO Alan Mulally plans to export more cars from the company’s European plants to the US as smaller, more fuel-efficient vehicles become more popular.

El Universal:

- Venezuela may cut the work day to six hours from eight hours to give workers time for “education and instruction,” citing Labor Minister Jose Rivero. President Hugo Chavez said Jan. 25 that the government may force private companies to allow workers at least one hour a day to study “socialist thought.”

Xinhua News Agency:

- China’s crude steel production rose 18.5% last year to 419 million metric tons, citing figures from the nation’s top planning agency.

Commercial Times:

- Taiwan Power Co. plans to spend $106 million on installing solar panels in a four-year period that will start in 2008.

Al-Seyassah:

- Saudi Arabia’s King Abdullah warned Iran against interfering in the kingdom’s affairs, saying the Persian state’s polices must not endanger the region. The Saudi monarch said he told visiting Iranian envoy Ali Larijani last week that the oil-rich kingdom does not want any country to become its enemy or to threaten it or its Gulf Arab neighbors.

Weekend Recommendations

Barron's:

- Made positive comments on (MO), (TXI), (KALU) and (NAV).

- Made negative comments on (BMC).

Citigroup:

- Despite weak demand, 4Q06 inventories for chipmakers and in other areas of the supply chain are coming down, much to our surprise. Lower-than-expected utilization rates at foundries account for this reduction. Meanwhile, signs are pointing to some component demand improvement in January, notably in the PC supply chain and the handset supply chain. We conclude that the inventory problems facing the industry are not as bad as we feared. While we recognize that 1H07 seasonal headwinds create volatility, improved inventories clear the path for much more sustainable share appreciation in 2H07.

Night Trading

Asian indices are -.25% to +.50% on average.

S&P 500 indicated -.05%.

NASDAQ 100 indicated -.03%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (ATHR)/.20

- (CMI)/3.77

- (GNSS)/-.03

- (GNTX)/.18

- (GYI)/.56

- (JDAS)/.21

- (MAT)/.67

- (PD)/4.28

- (PCL)/.34

- (SGP)/.17

- (SYY)/.38

- (TSO)/1.90

- (UNM)/.44

- (TSN)/.06

- (USG)/1.30

- (VZ)/.61

- (ZMH)/.99

Upcoming Splits

- None of note

Economic Releases

- None of note

Bloomberg:

- Broadcom Corp.(BRCM), a maker of chips for consumer devices, didn’t infringe two patents owned by Qualcomm Inc.(QCOM), a federal jury in San Diego found.

- Bank of America(BAC), blocked by federal rules from buying another big US bank, has discussed an alliance with Countrywide Financial Corp.(CFC), the nation’s largest mortgage lender.

- Israeli Prime Minister Ehud Olmert’s coalition government approved the appointment of Raleb Majadele today as the nation’s first Arab Muslim Cabinet member.

- Intel Corp.(INTTC) said it made a breakthrough in transistor technology that allows it to make faster, smaller, more efficient processors.

- The US dollar rose for a third straight week against the yen as gains in US durable goods orders and home sales suggested the economy is strengthening.

- President Bush, seeking to garner support for the key proposals in his State of the Union address this week, urged lawmakers to embrace bipartisanship on energy and health-care overhaul.

- Terrorism, a subject that has dominate recent meetings of the World Economic Forums, was largest absent as a topic at this year’s gathering as economic and political leaders turned their focus to global warming.

- Deutsche Telekom AG, Europe’s largest telephone company, unexpectedly cut its forecast for 2007 earnings, citing intensifying domestic competition and the effect of currency fluctuations.

- Institutional Shareholder Services today recommended Equity Office Properties(EOP) holders accept Blackstone Group’s $38.3 billion cash offer, the world’s biggest leveraged buyout.

- European Central Bank President Jean-Claude Trichet said the fastest money supply growth in 17 years validated recent interest rate increases.

- Richard Evans, CEO of Alcan Inc.(AL), the world’s second-largest aluminum producer, expects prices for the metal to be lower in a year.

- Japan’s retail sales fell in December, signaling consumer spending may be slow to recover from its worst slump in almost a decade.

- Energy companies stocks in the US are trading near the lowest prices relative to earnings since November 1982. However, commodity stocks historically look the “cheapest” before significant declines as their earnings are usually near peaks. The average annual price for a barrel of oil peaked in 1980 at $37.42. Moreover, oil topped in August of 1983 at about $33/bbl. and proceeded to plunge 70% to around $10/bbl. by August of 1986.

- US Treasury bond sales may fall to the lowest level in five years as economic growth boosts corporate tax revenue, reducing the government budget deficit.

- The US dollar is rising to the highest in almost four years against the yen on speculation reports this week will show the economy is improving, suggesting the Fed will refrain from lowering interest rates in coming months.

- China’s oil and gas demand and supply will be balanced this year, the nation’s top economic planner said. Tightness in coal and power supplies in China will ease in 2007. “The priority is to push for resource conservation, environmental protection and increase the quality of industrial output,” the National Development and Reform Commission said.

Wall Street Journal:

- Job creation accelerated and average pay rose in California’s Silicon Valley last year, extending technology companies’ recovery from the crash of 2000, citing an annual report by a nonprofit group. The unemployment rate fell to 4% from 5% the previous year and average pay for Silicon Valley employees rose 4% to $74,302.

Ticker Sense:

- Small/Mid-cap growth stocks are “cheaper” than their value counterparts.

NY Times:

- Gap Inc.(GPS), whose CEO Pressler resigned after two years of sales declines, needs to revamp its cradle-to-grave single-line fashion.

- The Freelancers Union, a group of 40,000 Web designers, video editors, writers, dancers and graphic artists in NY, plans to reach out to the 20 million US independent contractors.

Business Week:

- By focusing on the hours between traditional mealtimes, McDonald’s(MCD) is sizzling.

CNN.com:

- 8 technologies to save the world. These futuristic projects promise to make the world greener, while making entrepreneurs some green.

Chicago Tribune:

- Tribune Co.(TRB) rejected two takeover offers as too low and is talking to private-equity companies including Chicago-based Madison Dearborn Partners LLC about a management buyout.

AP:

- Google’s(GOOG) YouTube will begin sharing revenue with its millions of users, citing YouTube’s co-founder Chad Hurley.

Financial Times:

- The London Stock Exchange had more than $5.88 billion of listings by hedge funds last year, surpassing Zurich as the largest market, citing research by ABN Amro Holding NV.

- Global revenue from downloads of television programs and films from Web sites is forecast to grow 1,000% within five years, to $6.3 billion , due to an increase in the use of broadband, citing Informa, a business information group.

- Most French, Italian and Spanish citizens and over half of Germans consider the single European currency to have had a negative impact on their economies, citing a Harris poll. Of those surveyed in France, only 5% said the euro has had a positive effect on the domestic economy.

Sunday Telegraph:

- London Stock Exchange Plc CEO Furse has scheduled meetings with the exchange’s largest shareholders to ask their help in fending off a hostile bid from Nasdaq Stock Market(NDAQ).

- Virgin Group Ltd., the closely held company run by billionaire Richard Branson, plans to list the shares of its US cell phone business on a US stock exchange.

AutomobilWoche:

- Ford Motor Co.(F) CEO Alan Mulally plans to export more cars from the company’s European plants to the US as smaller, more fuel-efficient vehicles become more popular.

El Universal:

- Venezuela may cut the work day to six hours from eight hours to give workers time for “education and instruction,” citing Labor Minister Jose Rivero. President Hugo Chavez said Jan. 25 that the government may force private companies to allow workers at least one hour a day to study “socialist thought.”

Xinhua News Agency:

- China’s crude steel production rose 18.5% last year to 419 million metric tons, citing figures from the nation’s top planning agency.

Commercial Times:

- Taiwan Power Co. plans to spend $106 million on installing solar panels in a four-year period that will start in 2008.

Al-Seyassah:

- Saudi Arabia’s King Abdullah warned Iran against interfering in the kingdom’s affairs, saying the Persian state’s polices must not endanger the region. The Saudi monarch said he told visiting Iranian envoy Ali Larijani last week that the oil-rich kingdom does not want any country to become its enemy or to threaten it or its Gulf Arab neighbors.

Weekend Recommendations

Barron's:

- Made positive comments on (MO), (TXI), (KALU) and (NAV).

- Made negative comments on (BMC).

Citigroup:

- Despite weak demand, 4Q06 inventories for chipmakers and in other areas of the supply chain are coming down, much to our surprise. Lower-than-expected utilization rates at foundries account for this reduction. Meanwhile, signs are pointing to some component demand improvement in January, notably in the PC supply chain and the handset supply chain. We conclude that the inventory problems facing the industry are not as bad as we feared. While we recognize that 1H07 seasonal headwinds create volatility, improved inventories clear the path for much more sustainable share appreciation in 2H07.

Night Trading

Asian indices are -.25% to +.50% on average.

S&P 500 indicated -.05%.

NASDAQ 100 indicated -.03%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (ATHR)/.20

- (CMI)/3.77

- (GNSS)/-.03

- (GNTX)/.18

- (GYI)/.56

- (JDAS)/.21

- (MAT)/.67

- (PD)/4.28

- (PCL)/.34

- (SGP)/.17

- (SYY)/.38

- (TSO)/1.90

- (UNM)/.44

- (TSN)/.06

- (USG)/1.30

- (VZ)/.61

- (ZMH)/.99

Upcoming Splits

- None of note

Economic Releases

- None of note

BOTTOM LINE: Asian Indices are mostly higher, boosted by commodity shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are a number of economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - None of note

Tues. - Consumer Confidence

Wed. - MBA Mortgage Applications, ADP Employment Change, Advance 4Q GDP, Advance 4Q Personal Consumption, Advance 4Q GDP Price Index, Employment Cost Index, Construction Spending, Chicago Purchasing Manager, FOMC Rate Decision

Thur. - Challenger Job Cuts, Personal Income, Personal Spending, PCE Deflator, Initial Jobless Claims, Pending Home Sales, ISM Manufacturing, ISM Prices Paid, Total Vehicle Sales

Fri. - Change in Non-farm Payrolls, Unemployment Rate, Change in Manufacturing Payrolls, Average Hourly Earnings, Factory Orders, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Cummins Inc.(CMI), JDA Software(JDAS), Mattel Inc.(MAT), Phelps Dodge(PD), Schering-Plough(SGP), Tyson Foods(TSN), Verizon Communications(VZ), Zimmer Holdings(ZMH)

Tues. - 3M Co(MMM), Aflac Inc.(AFL), Allstate Corp.(ALL), Apollo Group(APOL), Black & Decker(BDK), Burger King Holdings(BKC), Chicago Merc(CME), Chubb Corp.(CB), Colgate-Palmolive(CL), Corinthian Colleges(COCO), Countrywide Financial(CFC), Diebold Inc.(DBD), Flextronics(FLEX), General Motors(GM), Illinois Tool Works(ITW), Kellogg Co(K), Lexmark Intl(LXK), MBIA Inc.(MBI), Merck & Co.(MRK), Pepsi Bottling(PBG), Pilgrim’s Pride(PPC), Procter & Gamble(PG), Safeco Corp.(SFC), SanDisk Corp.(SNDK), United Parcel Service(UPS), US Air(LCC), Wyeth(WYE)

Wed. - Allergan Inc.(AGN), Altria Group(MO), Armor Holdings(AH), Boeing Co.(BA), Constellation Energy(CEG), Dominion Resources(D), Eastman Kodak(EK), Eli Lilly(LLY), Estee Lauder(EL), Gilead Sciences(GILD), Google Inc.(GOOG), Hilton Hotels(HLT), Ingersoll-Rand(IR), JB Hunt(JBHT), JDS Uniphase(JDSU), Kraft Foods(KFT), L-3 Communications(LLL), Microchip Tech(MCHP), MicroStrategy(MSTR), Murphy Oil(MUR), Nymex Holdings(NMX), Pulte Homes(PHM), Starbucks(SBUX), Time Warner Inc.(TWX), Tractor Supply(TSCO), VeriSign(VRSN), Xcel Energy(XEL)

Thur. - Amazon.com(AMZN), American Standard(ASD), Anheuser-Busch(BUD), Apache Corp.(APA), Archer-Daniels(ADM), Avid Tech(AVID), Boston Scientific(BSX), CA Inc.(CA), Celgene Corp.(CELG), Cerner Corp.(CERN), Clorox Co.(CLX), Comcast Corp.(CMCSA), CVS Corp.(CVS), Dolby Labs(DLB), Electronic Arts(ERTS), Exxon Mobil(XOM), Goodrich Corp.(GR), Intuitive Surgical(ISRG), JetBlue(JBLU), Marathon Oil(MRO), Monster Worldwide(MNST), Raytheon Cos(RTN), Royal Gold(RGLD), Sabre Holdings(TSG), St Paul(STA), Starwood Hotels(HOT), Under Armour(UA), Valero Energy(VLO), YRC Worldwide(YRCW)

Fri. - American Axle(AXL), Arch Coal(ACI), Equity Office Properties(EOP), Gannett Co.(GCI), ITT Corp.(ITT), Medimmune(MEDI), Moody’s Corp.(MCO), NYSE Group(NYX), Royal Caribbean(RCL), Ryder System(R), Sara Lee(SLE), THQ Inc.(THQI), Wendy’s Intl(WEN), Whirlpool Corp.(WHR)

Other events that have market-moving potential this week include:

Mon. - Wachovia Healthcare Conference

Tue. - Wachovia Healthcare Conference, Citigroup Financial Services Conference

Wed. - Citigroup Financial Services Conference, Wachovia Healthcare Conference

Thur. - Raymond James Growth Airline Conference, Retail Same-Store-Sales

Fri. - None of note

There are a number of economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - None of note

Tues. - Consumer Confidence

Wed. - MBA Mortgage Applications, ADP Employment Change, Advance 4Q GDP, Advance 4Q Personal Consumption, Advance 4Q GDP Price Index, Employment Cost Index, Construction Spending, Chicago Purchasing Manager, FOMC Rate Decision

Thur. - Challenger Job Cuts, Personal Income, Personal Spending, PCE Deflator, Initial Jobless Claims, Pending Home Sales, ISM Manufacturing, ISM Prices Paid, Total Vehicle Sales

Fri. - Change in Non-farm Payrolls, Unemployment Rate, Change in Manufacturing Payrolls, Average Hourly Earnings, Factory Orders, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Cummins Inc.(CMI), JDA Software(JDAS), Mattel Inc.(MAT), Phelps Dodge(PD), Schering-Plough(SGP), Tyson Foods(TSN), Verizon Communications(VZ), Zimmer Holdings(ZMH)

Tues. - 3M Co(MMM), Aflac Inc.(AFL), Allstate Corp.(ALL), Apollo Group(APOL), Black & Decker(BDK), Burger King Holdings(BKC), Chicago Merc(CME), Chubb Corp.(CB), Colgate-Palmolive(CL), Corinthian Colleges(COCO), Countrywide Financial(CFC), Diebold Inc.(DBD), Flextronics(FLEX), General Motors(GM), Illinois Tool Works(ITW), Kellogg Co(K), Lexmark Intl(LXK), MBIA Inc.(MBI), Merck & Co.(MRK), Pepsi Bottling(PBG), Pilgrim’s Pride(PPC), Procter & Gamble(PG), Safeco Corp.(SFC), SanDisk Corp.(SNDK), United Parcel Service(UPS), US Air(LCC), Wyeth(WYE)

Wed. - Allergan Inc.(AGN), Altria Group(MO), Armor Holdings(AH), Boeing Co.(BA), Constellation Energy(CEG), Dominion Resources(D), Eastman Kodak(EK), Eli Lilly(LLY), Estee Lauder(EL), Gilead Sciences(GILD), Google Inc.(GOOG), Hilton Hotels(HLT), Ingersoll-Rand(IR), JB Hunt(JBHT), JDS Uniphase(JDSU), Kraft Foods(KFT), L-3 Communications(LLL), Microchip Tech(MCHP), MicroStrategy(MSTR), Murphy Oil(MUR), Nymex Holdings(NMX), Pulte Homes(PHM), Starbucks(SBUX), Time Warner Inc.(TWX), Tractor Supply(TSCO), VeriSign(VRSN), Xcel Energy(XEL)

Thur. - Amazon.com(AMZN), American Standard(ASD), Anheuser-Busch(BUD), Apache Corp.(APA), Archer-Daniels(ADM), Avid Tech(AVID), Boston Scientific(BSX), CA Inc.(CA), Celgene Corp.(CELG), Cerner Corp.(CERN), Clorox Co.(CLX), Comcast Corp.(CMCSA), CVS Corp.(CVS), Dolby Labs(DLB), Electronic Arts(ERTS), Exxon Mobil(XOM), Goodrich Corp.(GR), Intuitive Surgical(ISRG), JetBlue(JBLU), Marathon Oil(MRO), Monster Worldwide(MNST), Raytheon Cos(RTN), Royal Gold(RGLD), Sabre Holdings(TSG), St Paul(STA), Starwood Hotels(HOT), Under Armour(UA), Valero Energy(VLO), YRC Worldwide(YRCW)

Fri. - American Axle(AXL), Arch Coal(ACI), Equity Office Properties(EOP), Gannett Co.(GCI), ITT Corp.(ITT), Medimmune(MEDI), Moody’s Corp.(MCO), NYSE Group(NYX), Royal Caribbean(RCL), Ryder System(R), Sara Lee(SLE), THQ Inc.(THQI), Wendy’s Intl(WEN), Whirlpool Corp.(WHR)

Other events that have market-moving potential this week include:

Mon. - Wachovia Healthcare Conference

Tue. - Wachovia Healthcare Conference, Citigroup Financial Services Conference

Wed. - Citigroup Financial Services Conference, Wachovia Healthcare Conference

Thur. - Raymond James Growth Airline Conference, Retail Same-Store-Sales

Fri. - None of note

BOTTOM LINE: I expect US stocks to finish the week mixed as mostly positive economic data, mostly positive earnings reports, buyout speculation, a stronger US dollar and constructive Fed comments offsets profit-taking, higher long-term rates and shorting. My trading indicators are giving mostly bullish signals and the Portfolio is 100% net long heading into the week.

Market Week in Review

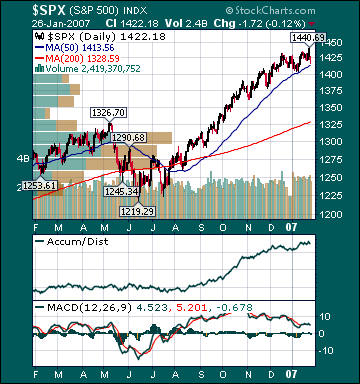

S&P 500 1,422.18 -.58%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was slightly bearish. The advance/decline line rose, most sectors declined and volume was above-average on the week. Measures of investor anxiety were mostly higher. The AAII percentage of Bulls plunged to 39.51% this week from 57.58% the prior week. This reading is now below average levels. The AAII percentage of Bears rose to 33.33% this week from 27.27% the prior week. This reading is now above average levels. The 10-week moving average of the percentage of Bears is currently 37.2%, an above-average level. The 10-week moving average of the percentage of Bears peaked at 43.0% at the major bear market low during 2002. Moreover, the 50-week moving average of the percentage of Bears is 36.9%, a very high level seen during only two other periods since tracking began in the 80s.

I continue to believe that steadfastly high bearish sentiment in many quarters is mind-boggling, considering the S&P 500's 17.5% rise in just over seven months, one of the best August/September/October runs in U.S. history, economic growth is accelerating back to around average levels, the fact that the Dow made another all-time high recently and that we are in the early stages of what is historically a very strong period for U.S. stocks after a midterm election. As well, despite recent gains, the forward P/E on the S&P 500 is a very reasonable 15.6, falling from 16.2 just a few weeks ago, due to the historic run of double-digit profit growth increases. The S&P P/E multiple has contracted for three consecutive years. It has only contracted four consecutive years two times since 1905. Each point of multiple expansion is equivalent to a 6.6% gain in the S&P 500. Bears still remain stunningly complacent, in my opinion. As I have said many times over the last few months, every pullback is seen as a major top and every move higher is just another shorting/selling opportunity. Even most bulls have raised cash of late, anticipating a correction after the recent surge.

As well, there are many other indicators registering high levels of investor skepticism regarding recent stock market gains. The 50-day moving average of the ISE Sentiment Index just recently crossed above the 200-day moving average for the first time since November 2005 and is already rolling over. The ISE Sentiment Index plunged to a depressed 95.0 on Wednesday. Nasdaq and NYSE short interests are very close again to record highs. Moreover, public short interest continues to soar to record levels, and U.S. stock mutual funds have seen outflows for most of the last year, according to AMG Data Services. The percentage of U.S. mutual fund assets in domestic stocks is the lowest since at least 1984, when record-keeping began. There has been a historic explosion of hedge funds created with absolute return, low correlation or negative correlation U.S. stock strategies that directly benefit from the perception of a stagnant or declining US stock market. The UltraShort QQQQ ProShares (QID) continues to see surging volume. Many of the most widely read stories on financial sites are written with a pessimistic slant. Wall Street analysts have made the fewest "buy" calls on stocks this month since Bloomberg began tracking in 1997. "Buy" calls have been trending lower for six months through most of last year's rally. Finally, investment blogger bullish sentiment is hovering near record lows at 21.62% Bulls, 45.95% Bears. There is still a high wall of worry for stocks to climb substantially from current levels as the public remains very skeptical of this bull market.

I continue to believe this is a direct result of the strong belief by the herd that the U.S. is in a long-term trading range or secular bear environment. There is still overwhelming evidence that investment sentiment by the general public regarding U.S. stocks has never been this poor in history, with the Dow registering all-time highs almost weekly. I still expect the herd to finally embrace the current bull market this year, which should result in another substantial move higher in the major averages as the S&P 500 breaks out to an all-time high to join the Dow and Russell 2000. Only in a "negativity bubble" could Wall Street strategists' consensus predictions of a 7% gain for the S&P 500 this year be characterized as "very bullish" by the many bearish pundits. A recent UBS investor sentiment survey hit a three-year high and was characterized as “very bullish,” yet only 37% of respondents expected a gain in the DJIA this year. Moreover, of those 37% that expected a gain, only 11% thought the DJIA would rise over 10%. As well, many of the so-called “bullish” U.S. investors are only "really bullish" on commodity stocks and U.S. companies with substantial emerging markets exposure, not the broad U.S. stock market. Finally, how many investors are bullish on "growth" stocks? There are very few true "growth" investors even left after six years of underperformance.

Based on the action during the first few weeks of this year, I suspect even more cash has piled up on the sidelines. The recent trading range has just allowed time for the shorts to reload and bulls to take profits without doing technical damage to the major averages. I continue to believe significant portion of this cash will be deployed into “true growth” companies as their outperformance versus “value” stocks gains steam throughout the year. Finally, I continue to believe the coming bullish shift in long-term sentiment with respect to U.S. stocks will result in the "mother of all short-covering rallies."

The average 30-year mortgage rate rose 2 basis points this week to 6.25%, which is still 55 basis points below July 2006 highs. There is mounting evidence that the worst of the housing downturn is over and that activity is stabilizing at relatively high levels. The Fed’s Hoenig, Lacker and Bies all made positive comments recently regarding the prospects for the US housing market. Mortgage applications fell -8.4% this week, but continue to trend higher with the decline in mortgage rates and healthy job market. The Mortgage Bankers Association said last month that the US housing market will “fully regain its footing” by the middle of this year. Moreover, the California Building Industry Association recently gave an upbeat forecast for housing, saying production would be near last year’s brisk levels.

Housing inventories have been trending meaningfully lower and homebuilding stocks have been moving higher. The Housing Index(HGX) has risen 26.0% from July lows. The Case-Schiller housing futures have improved substantially and are now projecting a 1.5% decline in the average home price by May, up from projections of a 5.2% decline a few months ago. Considering the median house has appreciated over 50% during the last few years with record high US home ownership, this would be considered a “soft landing.” The overall negative effects of housing on the US economy and the potential for significant price drops are still being exaggerated by the many stock market bears in hopes of dissuading buyers from stepping up, in my opinion. Housing and home equity extractions had been slowing substantially for almost 2 years and the negative effects were mostly offset by many other very positive aspects of the US economy.

Home values are more important than stock prices to the average American, but the median home has barely declined in value after a historic run-up, while the S&P 500 has risen 17.5% in about seven months and 92.0% since the Oct. 4, 2002 bear market low. Americans’ median net worth is still very close to or at record high levels as a result, a fact that is generally unrecognized or minimized by the record number of stock market participants that feel it is in their financial and/or political interests to paint a bleak picture of America.

Moreover, energy prices are down significantly, consumer spending remains healthy, unemployment is low by historic standards, interest rates are low, inflation is below average rates, stocks are surging and wages are rising at above-average rates. The economy has created 840,000 jobs in the last five months. Challenger, Gray & Christmas reported recently that December job cuts plunged 49.3% from year-ago levels. As well, the Monster Employment Index is just off record highs. The 50-week moving average of initial jobless claims has been lower during only two other periods since the 70s. Finally, the unemployment rate is a historically low 4.5%, down from 5.1% in September 2005, notwithstanding fewer real estate-related jobs and significant auto production cutbacks. The unemployment rate’s current 12-month moving-average is 4.6%. It has only been lower during two other periods since the mid-50s.

The Consumer Price Index for December rose 2.5% year-over-year, down from a 4.7% increase in September of 2005. This is meaningfully below the 20-year average of 3.1%. Moreover, the CPI has only been lower during four other periods since the mid-1960s. Many other measures of inflation have recently shown substantial deceleration. The Producer Price Index for December rose a historically low 1.1% year-over-year. The recent plunge in many commodities should eventually result in the complete debunking of the problematic inflation myth that so many have perpetuated endlessly over the last couple of years. Furthermore, most measures of Americans’ income growth are now almost twice the rate of inflation. Americans’ Average Hourly Earnings rose 4.2% in December, substantially above the 3.2% 20-year average. Throughout the entire decade of the 90s Americans’ Average Hourly Earnings exceeded current rates of 4.2% during only four months.

The benchmark 10-year T-note yield rose 10 basis points for the week on more positive economic data and a bounce in commodity prices. In my opinion, many investors’ lingering fears over an economic “hard landing” seem more misplaced than ever. The housing slowdown and auto-production cutbacks impacted manufacturing greatly over the last six months, however those drags on growth are subsiding. Durable Goods Orders Ex Transports for December rose by the most since March. The ISM Manufacturing Index improved in December and is now registering expansion. Moreover, the ISM’s semi-annual forecast was released recently and gave an upbeat assessment of expected manufacturing activity this year. Furthermore, the ISM Non-Manufacturing Index, which is a gauge of the vast majority of U.S. economic activity, came in at a healthy 57.1 for December. Manufacturing accounts for roughly 12% of US economic growth, while consumer spending accounts for about 70% of growth.

U.S. GDP growth came in at a sluggish 1.1% and 0.7% during the first two quarters of 1995. During May 1995, the ISM Manufacturing Index fell below 50, which signals a contraction in activity. It stayed below 50, reaching a low of 45.5, until August 1996. During that period, the S&P 500 soared 31% as its P/E multiple expanded from 16.0 to 17.2. This was well before the stock market bubble began to inflate. As well, manufacturing was more important to overall US economic growth at that time. Stocks can and will rise as P/E multiples expand, even with more average economic and earnings growth.

Weekly retail sales rose a slightly below average 2.7% for the week. However, retail sales are poised to accelerate. The Department of Energy is projecting nationwide average gas prices to fall to $1.95 per gallon over the coming weeks, with oil around current levels. Moreover, jobless claims have taken another dip lower of late, housing has improved, wage growth has accelerated, stocks are higher and inflation has decelerated to below average rates. Both main consumer confidence readings are now very near cycle highs and many consumers are chomping at the bit to buy new spring clothing after such a warm fall muted holiday clothing sales. I expect new cycle highs for both measures of consumer sentiment over the next few months.

Just take a look at commodity charts, gauges of commodity sentiment and inflows into commodity-related funds over the last couple of years. There has been a historic mania for commodities. That mania is now in the stages of unwinding. The CRB Commodities Index, the main source of inflation fears has declined -14.7% over the last 12 months and -19.0% from May highs despite a historic flood of capital into commodity-related funds and numerous potential upside catalysts. Oil has declined $23/bbl from July highs. Last year, oil rose $2.05/bbl. on the first trading day of the year and $7.40/bbl. through the first three weeks of trading as commodity funds, flush with new capital, drove futures prices higher. I suspect, given the average commodity hedge fund fell around double-digits last year as the CRB Index dropped 7.4%, that many energy-related funds saw outflows at year-end. Oil has declined 11.1% or $6/bbl. already this year. The commodity mania has pumped air into the current US “negativity bubble.” In my opinion, that is why it is so easy for most to believe that housing was in a bubble, but then act shocked when commodities plunge. I continue to believe inflation fears have peaked for this cycle as global economic growth slows to average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose substantially more than expectations again even as refinery utilization fell. U.S. gasoline supplies are at high levels for this time of the year, notwithstanding declining refinery utilization. Gasoline futures rose slightly for the week and have plunged 50.0% from September 2005 highs even as some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. The still very elevated level of gas prices, related to crude oil production disruption speculation by investment funds, will further dampen global fuel demand, sending gas prices still lower over the intermediate-term.

The 10-week moving-average of US oil inventories is still approaching 8-year highs. Global demand destruction is pervasive. Oil consumption in the 30 OECD countries fell last year for the first time in over two decades. Since December 2003, global oil demand is only up 2.6%, despite the strongest global growth in almost three decades, while global supplies have increased 5.7%, according to the Energy Intelligence Group. The EIA recently forecast that bio-fuels should rise to the equivalent of more than five million barrels of crude oil production a day within four years. Just this week, Energy Secretary Bodman said the US will likely remove tariffs to boost bio-fuel imports, which should reduce fears over a potential corn shortage. As well, OPEC said recently that global crude oil supply would exceed demand by 100 million barrels by the second quarter of this year. Worldwide oil inventories are poised to begin increasing at an accelerated rate over the next year. There is a very fine line in the crude oil market between perceptions of "significantly supply constrained" and "massive oversupply." One of the main reasons I believe OPEC has been slow to actually meet their pledged cuts has been the fear of losing market share to non-OPEC countries. Moreover, OPEC actually needs lower prices to prevent any further long-term demand destruction. I continue to believe oil is priced at elevated levels on record speculation by investment funds, not fundamentals.

The Amaranth Advisors hedge fund blow-up is a prime example of the extent to which many investment funds have been speculating on ever higher energy prices through futures contracts, thus driving the price of the underlying commodity to absurd levels for consumers and businesses. Amaranth, a multi-strategy hedge fund, lost about $6.5 billion of its $9.5 billion under management in less than two months speculating mostly on higher natural gas prices even as they plunged. I continue to believe a number of other funds will experience similar fates over the coming months after managers “pressed their bets” in hopes of making up for recent poor performance, which will further pressure energy prices as these funds unwind their leveraged long positions to meet rising investor redemptions. Moreover, the same rampant speculation that has driven the commodity mania will work against energy as downside speculation increases and drives down prices even further than the fundamentals would otherwise dictate.

Recently, Cambridge Energy Research, one of the most respected energy research firms in the world, put out a report that drills gaping holes in the belief by most investors of imminent "peak oil" production. Cambridge said that its analysis indicates that the remaining global oil base is actually 3.74 trillion barrels, three times greater than "peak oil" theory proponents say and that the "peak oil" theory is based on faulty analysis. I suspect the substantial contango that still exists in energy futures, which encourages hoarding, will begin to reverse over the coming months as more investors come to the realization that the "peak oil" theory is hugely flawed, global storage tanks fill and Chinese/US demand slows further.

Global crude oil storage capacity utilization is running around 98%. Recent OPEC production cuts have resulted in a complete technical breakdown in crude futures. Spare production capacity, which had been one of the main sources of angst among the many oil bulls, rises with each OPEC cut. As well, demand destruction which is already pervasive globally will only intensify over the coming years as many more alternative energy projects come to the fore. Moreover, many Americans feel as though they are helping fund terrorism or hurting the environment every time they fill up their gas tanks. I do not believe we will ever again see the demand for gas-guzzling vehicles that we saw in recent years, even if gas prices plunge further from current levels, as I expect. If OPEC actually implements all their announced production cuts, with oil still at very high levels and weakening global growth, it will only further deepen resentment towards the cartel and result in even greater long-term demand destruction.

I continue to believe oil made a major top last year during the period of historic euphoria surrounding the commodity with prices above $70/bbl. Falling demand growth for oil in emerging market economies, an explosion in alternatives, rising spare production capacity, increasing global refining capacity, the complete debunking of the hugely flawed "peak oil" theory, a firmer U.S. dollar, less demand for gas guzzling vehicles, accelerating non-OPEC production, a reversal of the "contango" in the futures market, a smaller risk premium and essentially full global storage should provide the catalysts for oil to fall to $35 per barrel to $40 per barrel this year. I fully expect oil to test $20 per barrel to $25 per barrel within the next three years.

Natural gas inventories fell slightly more than expectations this week. Prices for the commodity rose again as historic investment fund speculation continues despite the fact that supplies are now 20.7% above the 5-year average and at all-time high levels for this time of year, even as some daily Gulf of Mexico production remains shut-in. Moreover, inventories are still around 85% of their pre-season capacity. Usually natural gas supplies are down to 60% at this point in the year. Furthermore, the EIA recently projected global liquefied natural gas production to soar this year, with the US poised to see a 34.5% surge in imports and another 38.5% increase in 2008. Natural gas prices have collapsed 54.3% since December 2005 highs. Notwithstanding this decline, natural gas anywhere near current prices is ridiculous with absolute inventories poised to hit new records this year. The long-term average price of natural gas is $4.63 with inventories much lower than current levels.

Gold rose on the week on rising speculation even as demand from India, the world’s largest buyer of the metal, continues to moderate, the US dollar gained and inflation is poised to decelerate further on the decline in other commodities. Gold, natural gas, oil and copper still look both fundamentally and technically weak. The US dollar rose again on more positive economic reports. The monthly budget statement for December was significantly better-than-expected once again. The US budget deficit is now 1.5% of GDP, well below the 40-year average of 2.3% of GDP. I continue to believe there is very little chance of another Fed rate hike anytime soon despite the current modest acceleration in economic activity. An eventual rate cut is more likely this year as inflation continues to decelerate substantially. An eventual Fed rate cut should actually boost the dollar as currency speculators anticipate faster US economic activity relative to other developed economies. Moreover, last month’s net long-term TIC flows report showed foreign investors’ demand for US securities remains strong despite last year’s dollar weakness.

Steel stocks outperformed significantly for the week on better-than-expected earnings reports and speculation that steel price declines are coming to an end. Airline shares underperformed substantially on worries over fundamentals and less consolidation speculation. Current stock prices are still providing longer-term investors very attractive opportunities, in my opinion. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A CSFB report late last year confirmed this view. The report concluded that on a price-to-cash flow basis growth stocks are cheaper than value stocks for the first time since at least 1977. The entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is attributable to growth stock multiple contraction. I still expect the most overvalued economically sensitive and emerging market stocks to continue underperforming over the intermediate-term as the manias for those shares subside as global growth slows to more average rates.

The emerging markets’ mania, which has mainly been the by-product of the commodity mania, is likely nearing an end, as well. I am keeping a close eye on the Vietnam Stock Index(VNINDEX), which has recently dwarfed the Nasdaq’s meteoric rise in the late 90s, rocketing 211.1% higher over the last 12 months. Moreover, it is already 29.7% higher this year. The bursting of this bubble in Vietnam, which I suspect will begin very soon, may well signal the end of the mania for emerging market stocks. I continue to believe a chain reaction of events has already begun that will result in a substantial increase in demand for US equities.

S&P 500 profit growth for the third quarter came in around 20% versus a long-term historical average of 7%, according to Thomson Financial. This marks the 17th straight quarter of double-digit profit growth, the best streak since recording keeping began in 1936. Another double-digit gain is likely for the fourth quarter despite a number of pundits already proclaiming the end of the historic streak with only about 30% of companies reporting. Despite a 92.0% total return(which is equivalent to a 16.2% average annual return) for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 15.6. The 20-year average p/e for the S&P 500 is 23.0.

In my opinion, the US stock market is still factoring in way too much bad news at current levels, notwithstanding recent gains. One of the characteristics of the current US “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated, trumpeted and promptly priced in to stock prices. I am beginning to see some signs the “shoot first” mentality that has dominated trading for many years is developing cracks as several high-profile stocks were punished severely in after-hours trading on supposed “weak” earnings reports only to surge substantially higher by the close of trading the following day. Furthermore, this “irrational pessimism” by investors is resulting in a dramatic decrease in the supply of stock as companies buy back shares, IPOs are pulled and secondary stock offerings are canceled. Booming merger and acquisition activity is also greatly constricting the supply of stock. Many commodity funds, which have received a historic flood of capital inflows over the last few years are likely now seeing redemptions as the CRB Index continues to languish near bear market territory. Some of this capital will likely find its way back to US stocks. As well, money market funds are brimming with cash. There is massive bull firepower available on the sidelines for US equities at a time when the supply of stock has contracted.

Considering the overwhelming majority of investment funds failed to meet the S&P 500's 15.8% return last year, I suspect most portfolio managers have a very low threshold of pain this year for falling substantially behind their benchmark once again. The fact that last year the US economy withstood one of the sharpest downturns in the housing market in history and economic growth never dipped below 2% illustrates the underlying strength of the economy as a whole. A stronger US dollar, lower commodity prices, seasonal strength, decelerating inflation readings, a pick-up in consumer spending, lower long-term rates, increased consumer/investor confidence, short-covering, investment manager performance anxiety, rising demand for US stocks and the realization that economic growth is poised to accelerate back to around average levels should provide the catalysts for another substantial push higher in the major averages this year as p/e multiples expand significantly. A recent Citigroup report said that the total value of U.S. shares dropped last year, despite rising stock prices, by the most in 22 years. Last year, supply contracted, but demand for U.S. equities was muted. While overall US public sentiment is still depressed given the macro backdrop, I am seeing some signs that irrational pessimism is lifting a bit. This should make the many bears very nervous as keeping the public excessively pessimistic on U.S. stocks has been one of their main weapons.

In my opinion, this is why the bearish attacks on Apple Inc.(AAPL) have been so vigorous of late despite its stunning business execution and notwithstanding the fact that most of the bears aren’t even short the stock. Apple Inc. was recently named the second most recognized brand in the world, behind Google Inc.(GOOG) by brandchannel.com. Apple is a great American “growth” story that has the potential to help turn the bearish general public bullish on US stocks. The hordes of newly minted short-sellers, since the bubble burst in 2000, can’t allow that. Their business models depend on the herd maintaining the belief that US stocks are in a secular decline. I suspect accelerating demand for U.S. stocks, combined with shrinking supply, will make for a lethally bullish combination this year. Finally, the ECRI Weekly Leading Index fell slightly this week, but is still forecasting a modest acceleration in US economic activity.

*5-day % Change

Subscribe to:

Posts (Atom)