Click here for the Weekly Wrap by Briefing.com.

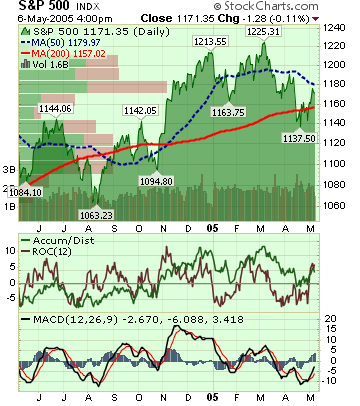

BOTTOM LINE: Overall, last week's market performance was positive considering the rise in energy prices, increase in interest rates and debt worries at GM/Ford. The S&P 500 has now broken out of the trading range it has been in since mid-April. The advance/decline rose, almost every sector gained and volume was average on the week. Small-cap, Cyclical and Tech shares all outperformed as worries over slowing US growth subsided. Measures of investor anxiety were mixed on the week. However, the AAII % Bulls fell again which is a big positive. The decline in the CRB Index was also a positive, considering the gain in energy prices. In my opinion, the longer oil stays above $50, the greater the chances of a substantial decline in its price during the second half of the year. I continue to believe the contango in the crude futures market, slowing demand, excess supply and a stable US dollar, will result in a much larger decline in oil prices than almost anyone expects. I suspect the decline has already begun and will accelerate within the next 6 weeks. The continuing weakness in Gold is likely more evidence that inflation fears have peaked.

*5-Day % Change

No comments:

Post a Comment