Bloomberg:

- US authorities arrested more than 400 people and seized 18 tons of illegal drugs over the course of a 20-month investigation into a Mexican smuggling cartel.

- Motorola Inc.(MOT) said billionaire investor Carl Icahn plans to buy as much as $2 billion in shares of the company’s stock.

- Pakistan’s President Pervez Musharraf said his government will force terrorists to leave the tribal region bordering Afghanistan and appealed to the Pakistani people to help the operations of security forces.

- Inpex Holdings Inc., Japan’s largest oil explorer, said it will spend more than $1.7 billion annually to search and develop oil and gas fields over the next three to four years.

- Former Fed Reserve Chairman Alan Greenspan said a recession in the US is possible, though not probable this year as inventory problems in the economy are being addressed quickly.

- Global semiconductor sales will rise 6.7% this year, according to Gartner Inc. Gartner had earlier forecast that 2007 semiconductor sales would rise 9.2%.

- Talks between the US and North Korea next week will start a process aimed at normalizing relations between the countries, US Secretary of State Christopher Hill said.

Wall Street Journal:

- MasterCard Inc.(MA), a credit- and debit-card company, in June will change the fees it charges merchants that accept its cards.

Financial Times:

- The UK will support a 20% mandatory target for renewable power by 2020 at a European Union summit next week. France yesterday indicated it may also drop its opposition to the mandatory targets.

- Sony Corp.(SNE) will increase supplies of PlayStation 3 consoles in the US to catch up with demand, citing Jack Tretton, chief executive of Sony Computer Entertainment’s US division.

- India, where elections can be won or lost on the price of onions, is trying to ensure that measures to control runaway inflation don’t derail economic growth. Higher incomes have increased consumer demand for wheat, sugar, cooking oil and other food staples, pushing India’s key inflation rate to 6.73% last month. A separate measure of consumer prices among farmers is at an eight-year high of 8.94%, and urban price gains are at the highest levels in six years.

Late Buy/Sell Recommendations

Citigroup:

- Reiterated Sell on (FRO), target $26.

- Reiterated Buy on (MRK), target $50.

Night Trading

Asian Indices are -1.50% to -.50% on average.

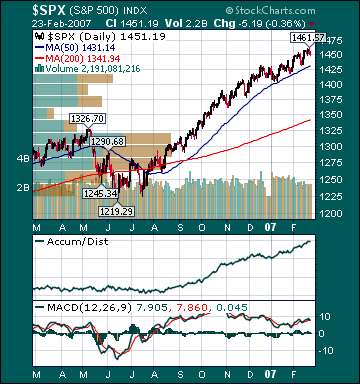

S&P 500 indicated -.36%.

NASDAQ 100 indicated -.21%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

- (AIG)/1.49

- (ILA)/-.05

- (CIEN)/.22

- (DLM)/.22

- (DELL)/.30

- (DISH)/.31

- (FAF)/.85

- (FLS)/.74

- (FLR)/.59

- (GPS)/.24

- (GM)/1.22

- (KSS)/1.42

- (MTZ)/.14

- (MDR)/.68

- (NOVL)/.00

- (OVTI)/.20

- (REV)/.10

- (SGMS)/.23

- (SFD)/.49

- (BID)/.97

- (SPLS)/.45

- (VIA/B)/.57

- (OATS)/.05

Upcoming Splits

- (ALB) 2-for-1

Economic Releases

8:30 am EST

- Personal Income for January is estimated to rise .3% versus a .5% gain in December.

- Personal Spending for January is estimated to rise .4% versus a .7% gain in December.

- PCE Core for January is estimated to rise .2% versus a .1% gain in December.

- Initial Jobless Claims for last week are estimated to fall to 325K versus 332K prior.

- Continuing Claims are estimated to rise to 2513K versus 2509K prior.

10:00 am EST

- ISM Manufacturing for February is estimated to rise to 50.0 versus a reading of 49.3 in January.

- ISM Prices Paid for February is estimated to rise to 54.0 versus a reading of 53.0 in January.

- Construction Spending for January is estimated to fall by -.5% versus a -.4% decline in December.

Afternoon:

- Total Vehicle Sales for February are estimated to fall to 16.2 million versus 16.7 million in January.

- Domestic Vehicle Sales for February are estimated to fall to 12.4 million versus 12.7 million in January.

BOTTOM LINE: Asian indices are lower, weighed down by commodity and automaker shares in the region. I expect US equities to open mixed and to weaken into the afternoon, finishing modestly lower. The Portfolio is 50% net long heading into the day.