BOTTOM LINE: Overall, last week's market performance was mildly bearish. The advance/decline line fell, almost every sector fell and volume was about average on the week. Measures of investor anxiety were mostly higher. The AAII % Bulls fell to 45.36% and is still only around average levels, which is a positive considering this year’s gains. The average 30-year mortgage rate rose to 6.49% which is 128 basis points above all-time lows set in June 2003.

I continue to believe housing is slowing to more healthy sustainable levels. This will also likely result in the slowing of consumer spending back to around average levels. The benchmark 10-year T-note yield rose 7 basis points on the week even as the Import Price Index fell. I expect inflation concerns to begin declining again later this quarter as economic growth slows to average levels, unit labor costs remain subdued and commodity prices weaken from current levels.

Unleaded Gasoline futures rose again this week, but are still 27.6% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, 22.7% of Gulf of Mexico oil production remains shut-in and fears over Iranian/Nigerian production disruptions persist. Natural gas inventories rose less than expected this week. However, supplies are now 63.4% above the 5-year average, near an all-time record high for this time of year, even as 13.6% of daily Gulf of Mexico production remains shut-in. Natural gas prices have plunged 54.5% since December 2005 highs.

OPEC said recently that global oil demand will average 84.5 million barrels/day for the remainder of the year. The most recent data from Energy Intelligence shows global oil supplies at 85.6 millions barrels/day. Since Dec. 2003, global oil supplies have risen 13.1% while demand has risen 5.0%. U.S. oil inventories are now close to 8-year highs. I continue to believe oil is priced above $60/bbl. on fear and record speculation, not fundamentals. Demand for oil can and will fall, even with healthy economic growth, as we saw in the U.S. last year. As the fear premium in oil dissipates back to more reasonable levels and supplies continue to rise, crude should head meaningfully lower over the intermediate-term.

Gold rose modestly for the week as higher energy prices and mostly positive economic data more than offset the unexpected decline in the Import Price Index. The US dollar rose as speculation increased that the Fed will continuing hiking rates as a result of rising commodity prices and a strong US economy.

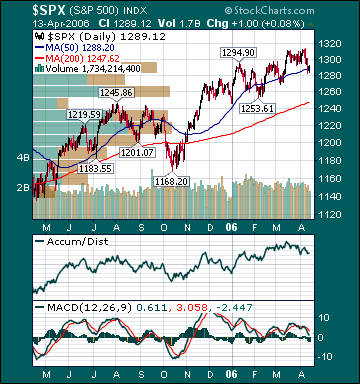

Interest rate sensitive stocks such as Homebuilders, REITs and Utilities underperformed for the week as long-term interest rates rose. The average US stock, as measured by the Value Line Geometric Index(VGY), is still up a strong 7.2% so far this year. Moreover, the Russell 2000 Index is up 11.9% year-to-date. I still believe US economic growth peaked for the year during the first quarter and will decelerate back to around average levels through year-end.

I expect stocks to continue trading mixed-to-lower over the next few weeks. Subsequently, a reversal lower in long-term rates and/or energy prices should provide the catalyst for another push higher by the major averages. The ECRI Weekly Leading Index fell slightly this week and is still forecasting healthy, but decelerating, US economic activity.

*5-day % Change