Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, March 10, 2008

Links of Interest

Sunday, March 09, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- Treasury Secretary Henry Paulson said the Bush administration is nearing agreement with Congress on a bill that would make more Federal Housing Administration loans available to borrowers facing foreclosure.

- Countrywide Financial(CFC) is Probed by FBI for Possible Fraud.

- Ambac Financial(ABK) and Thornburg Mortgage(TMA) surged on the NYSE after investors traded blocks totaling at least 10 million shares in the week’s final moments.

- General Motors Corp.(GM) is losing almost a third of its daily US and Canadian vehicle production as parts shortages caused by an 11-day supplier strike shut down more of the automaker’s manufacturing network.

- Orders for Japanese machinery rose at the fastest pace in more than seven years in January, a sign demand from emerging markets may help the economy ride out the US slump.

- Malaysia’s stock index slumped the most in almost 10 years and the ringgit fell after the ruling coalition lost its two-thirds majority in parliament, sparking concerns the opposition will delay state projects.

Wall Street Journal:

- Obama Wins in Wyoming, Gets Boost for Mississippi.

- China says it stopped Islamic terror group plan to target Olympics.

NY Times:

- Wal-Mart Stores(WMT) hired designer Norma Kamali, who ended an agreement making fashionable sweat pants for Macy’s Inc.’s(M) Bloomingdale’s as US retailers compete for top designers.

- US public universities such as California State University, East Bay, and the University of Wisconsin have lowered the tuition they charge out-of-state students to help raise their profiles.

- Text Generation Gap: U R 2 Old (JK). Children increasingly rely on personal technological devices to create social circles apart from their families, changing the way they communicate with their parents.

- Hewlett-Packard(HPQ) is trying to galvanize thousands of its retirees into an auxiliary army of senior marketers, good-will ambassadors and volunteer sales people.

MarketWatch.com:

- Lending standards have gotten tougher, but inventory and opportunities are lining up to give first-time buyers better chances to own a home.

- Visa picks up kudos ahead of IPO.

- Your best auto bets for beating the cost of gas.

NY Times:

- US presidential candidate Barack Obama’s cachet as a celebrity outweighs his legislative accomplishments since he arrived in Washington as an Illinois senator in 2005.

- Can You Beat the Market? It’s a $100 Billion Question. Investors collectively spend around $100 billion a year trying to beat the stock market. The huge price tag helps explain why beating a buy-and-hold strategy is so difficult.

TheStreet.com:

- Google(GOOG) is a short-term buy. (video)

IBD:

- Intel’s(INTC) New Centrino Will Mark True Start Of WiMax Chip Era.

Crain’s

- New York Mercantile Exchange(NMX) members have asked for a special meeting in a dispute over the value of their franchise as futures market CME Group Inc.(CME) enters the last week of acquisition negotiations.

- A public opinion poll of 1,000 Iranians shows that 86% want to directly elect the country’s supreme leader in a free vote and be able to replace him.

- A mass grave containing the remains of about 100 people was found in an area north of

Business Week:

- SXSW: Where Tech Mingles with Music. At this year’s Interactive Conference, exhibitors from Facebook to Animoto will vie for the kind of buss Twitter earned last year.

- Al Gore’s Convenient IPO. Current TV’s parent is launching a public offering whose terms, though sweet for the company’s high-profile founder, may be inconvenient for investors.

San Francisco Chronicle:

- Oil demand is drying up – slightly.

Forbes:

- US bond giant Pimco has purchased “hundreds of millions” of Thornburg Mortgage Inc.(TMA) paper in the last few days, Pimco’s founder and chief investment officer said Friday.

- Some strange schemes are appearing in our efforts to deal with auto emissions, energy prices and our dependence on petroleum from countries that are unfriendly to the US and our allies. Perhaps the most ambitious project of all is to electrify Israel and create an oasis of electric cars in the Middle East.

- If you believe the popular economic myths of the day, you think there’s a credit squeeze – less total credit available. This is nonsense.

SmartMoney.com:

- Fund Manager Fingers 3 Oversold Small Caps.

Reuters:

- Any takeover bid for peripherals maker Logitech Intl.(LOGI) by Microsoft(MSFT) would be “an operation without sense,” Logitech’s chairman was quoted as saying.

- Private equity groups target Virgin Media.

- China, like other rapidly industrializing economies, is learning it cannot compete forever by churning out cheap, simple goods while gobbling up increasingly costly resources such as oil and iron ore. Policymakers are keen to promote more efficient industries and higher-value products as a route to more predictable and sustainable economic growth.

- US bank Merrill Lynch(MER) will not need to return to the market again following the turbulence in credit markets that forced it to raise nearly $13 billion, its CEO said.

Financial Times:

- Credit Suisse to set up hedge fund clones.

- India may have solved cheap energy question.

- Turmoil in the credit derivatives markets is having an increasingly brutal impact on the wider financial system.

Le Monde:

- The euro’s appreciation to a record against the dollar is a “problem” that heads of state should discuss urgently, Laurence Parisot, said chief of

Le Journal du Dimanche:

- European Commission President Jose Manuel Barroso said he is concerned the euro’s appreciation may threaten growth in the region.

Folha de S. Paulo:

- Telefonica SA, Europe’s second-largest phone company, is in talks with Apple(AAPL) to offer iPhones in

Business Times:

- Haruhiko Kuroda, president of the Asian Development Bank, said the

Yediotd Aharonot:

- Republican presidential candidate John McCain will visit

Weekend Recommendations

Barron's:

- Made positive comments on (CX).

- Made negative comments on (FNM).

Citigroup:

- Downgraded (ARO) to Sell, target $24.

Night Trading

Asian indices are -2.50% to -.75% on avg.

S&P 500 futures -.36%.

NASDAQ 100 futures -.40%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (HOV)/-2.10

- (FL)/.45

- (BX)/.20

- (MTN)/1.35

Upcoming Splits

- None of note

Economic Data

10:00 am EST

- Wholesale Inventories for January are estimated to rise .5% versus a 1.1% gain in December.

Other Potential Market Movers

- The (TXN) Mid-Quarter Update, Stifel Nicolaus Consumer Conference, Bear Stearns Media Conference, CSFB Ag Science Conference and CSFB Communications Conference could also impact trading today.

Weekly Outlook

Click here for a weekly economic preview by MarketWatch.

Click here for stocks in focus for Monday by MarketWatch.

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Wholesale Inventories

Tues. – Trade Balance, IDP/TIPP Economic Optimism, weekly retail sales reports

Wed. – Weekly EIA energy inventory data, weekly MBA Mortgage Applications report, Monthly Budget Statement

Thur. – Import Price Index, Advance Retail Sales, Initial Jobless Claims, Business Inventories

Fri. – Consumer Price Index,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Hovnanian Enterprises(HOV), Foot Locker(FL), Blackstone Group(BX)

Tues. – Dick’s Sporting Goods(DKS), Take-Two(TTWO), J Crew Group(JCG), Kroger(KR), GlobalSantaFe(GSF), John Wiley(JW/A)

Wed. – JA Solar(JASO), Men’s Warehouse(MW), Sigma Designs(SIGM), American Eagle Outfitters(AEO), Gymboree Corp.(GYMB), Pacific Sunwear(PSUN), Hibbett Sports(HIBB)

Thur. – Aeropostale(ARO), Genesco(GCO), Dillard’s(DDS)

Fri. – Liz Claiborne(LIZ), AnnTaylor(ANN), WellCare Health(WCG)

Other events that have market-moving potential this week include:

Mon. – (TXN) Mid-Quarter Update, Stifel Nicolaus Consumer Conference, Bear Stearns Media Conference, CSFB Ag Science Conference, CSFB Communications Conference

Tue. – (NTAP) Analyst Day, (CVX) Analyst Day, (BMC) Analyst Day, (CAT) Analyst Day, Bear Stearns Media Conference, Banc of America Consumer Conference, CSFB Communications Conference, Piper Jaffray ChinaVenture Conference

Wed. – (COP) Analyst Meeting, (FRE) Analyst Meeting, (ABI) Analyst Meeting, Bear Stearns Media Conference, Banc of America Consumer Conference, Deutsche Bank Hospitality & Gaming Conference, Lehman High-Yield Bond Conference

Thur. – (MSFT) Financial Analyst Briefing, Bear Stearns Healthcare Conference, Lehman High-Yield Bond Conference

Fri. – (DNA) Investment Meeting, Lehman High-Yield Bond Conference

Saturday, March 08, 2008

Friday, March 07, 2008

Weekly Scoreboard*

Indices

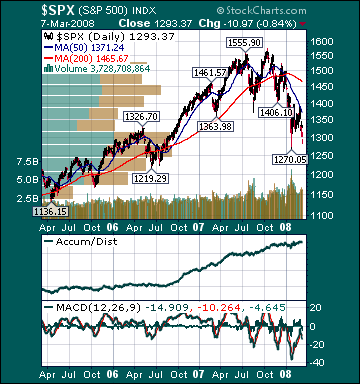

S&P 500 1,293.37 -2.8%

DJIA 11,893.69 -3.0%

NASDAQ 2,212.49 -2.6%

Russell 2000 660.11 -3.8%

Wilshire 5000 12,999.60 -2.97%

Russell 1000 Growth 538.72 -2.4%

Russell 1000 Value 703.42 -3.4%

Morgan Stanley Consumer 664.59 -2.42%

Morgan Stanley Cyclical 900.56 -3.1%

Morgan Stanley Technology 518.77 -2.1%

Transports 4,490.24 -1.33%

Utilities 478.86 +.28%

MSCI Emerging Markets 135.14 -4.6%

Sentiment/Internals

NYSE Cumulative A/D Line 54,356 -9.1%

Bloomberg New Highs-Lows Index -684

Bloomberg Crude Oil % Bulls 37.0 +110.2%

CFTC Oil Large Speculative Longs 258,929 +.4%

Total Put/Call 1.24 +.8%

OEX Put/Call .93 -49.5%

ISE Sentiment 65.0 -13.3%

NYSE Arms 1.14 -58.5%

Volatility(VIX) 27.49 +3.6%

G7 Currency Volatility (VXY) 11.50 +5.0%

AAII % Bulls 21.9 -35.9%

AAII % Bears 51.6 +14.1%

Futures Spot Prices

Crude Oil 105.51 +3.6%

Reformulated Gasoline 269.75 +1.1%

Natural Gas 9.80 +4.2%

Heating Oil 295.88 +5.5%

Gold 975.20 unch.

Base Metals 273.82 +1.3%

Copper 389.75 +2.0%

Agriculture 465.9 -2.4%

Economy

10-year US Treasury Yield 3.53% +2 basis points

10-year TIPS Spread 2.56% +12 basis points

TED Spread 1.50 +28 basis points

Investment Grade Credit Default Swap Index 178.2 +11.3%

Fed Fund Futures 98.0% chance of 75 cut, 2.0% chance of 50 cut on 3/18

Iraqi 2028 Govt Bonds 74.25 +1.2%

4-Wk MA of Jobless Claims 359,500 -.4%

Average 30-year Mortgage Rate 6.03% -21 basis points

Weekly Mortgage Applications 684,900 +3.0%

Weekly Retail Sales +.5%

Nationwide Gas $3.19/gallon +.03/gallon.

US Heating Demand Next 7 Days 2.0% above normal

ECRI Weekly Leading Economic Index 132.60 +.9%

US Dollar Index 72.99 -.9%

Baltic Dry Index 8,403 +14.6%

CRB Index 411.65 -.3%

Best Performing Style

Large-cap Growth -2.4%

Worst Performing Style

Small-cap Growth -4.2%

Leading Sectors

Steel +1.1%

Software +.4%

Utilities +.3%

Semis -.05%

Foods -.5%

Lagging Sectors

Alt Energy -4.9%

Gaming -5.4%

Banks -6.1%

Airlines -6.7%

I-Banks -7.1%

*5-Day Change

Evening Review

Market Summary

Top 20 Biz Stories

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Real-Time Stock Bid/Ask

After-hours Stock Quote

After-hours Stock Chart

In Play