Style Outperformer:

Small-cap Value (+4.26%)

Sector Outperformers:

Steel (+6.05%), REITs (+5.21%) and Road & Rail (+5.05%)

Stocks Rising on Unusual Volume:

WTI, CHU, PXP, RTP, PCU, KTC, PTR, STO, LPHI, FOSL, HMIN, FACT, NETL, SVVS, LULU, FUQI, TNDM, CRESY, CSIQ, CENT, SINA, AAUK, GSIC, BEAT, TBSI, MTRX, HOS, OSIR, IAK, TMB, ITB, XOP, CPY, SXE, ROS and XSD

Stocks With Unusual Call Option Activity:

1) CL 2) PCU 3) CSX 4) OSIP 5) X

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, June 01, 2009

Bull Radar

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

Chart Toppers

Real-Time Intraday Quote/Chart

HFR Global Hedge Fund Indices

Sunday, May 31, 2009

Monday Watch

Weekend Headlines

Bloomberg:

- The cost of protecting Asia-Pacific corporate and government bonds from default decreases, according to traders of credit default swaps. The Markit iTraxx Asia index of 50 investment-grade borrowers outside

-

Wall Street Journal:

MarketWatch.com:

CNBC.com:

- If you think crude is marching higher, think again. Option investors are betting that it doesn't!

NY Times:

Business Week:

- Cancer Drugs: News from ASCO.

NY Post:

Politico:

Chicagtribune.com:

Rasmussen Reports:

Crain’s NY Business:

MercuryNews.com:

- 49ers’ Santa Clara stadium plan would cost public $114 million.

AP:

-

Reuters:

Financial Times:

Telegraph:

Xinhua News Agency:

-

Nikkei:

- Nintendo Co. plans to release an updated version of its “Wii Fit” game software this fall. The new version, “Wii Fit Plus,” measures body weight more precisely and has Internet connection so users can compare game data with people at remote locations.

- Semiconductor Manufacturing International Corp.,

Weekend Recommendations

Barron's:

- Made positive comments on (AAPL), (AMZN), (NKE), (BBBY), (CMG), (JCG), (URBN), (SWY), (TGT), (VAR), (RIMM), (BA), (SCHW) and (TM).

- Made negative comments on (GMCR).

Citigroup:

- Reiterated Buy on (DVA), target $62.

Night Trading

Asian indices are +1.25% to +2.50% on avg.

S&P 500 futures +.73%.

NASDAQ 100 futures +.44%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Global Commentary

WSJ Intl Markets Performance

Commodity Futures

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (AZPN)/.22

- (AINV)/.34

Upcoming Splits

- None of note

Economic Releases

8:30 am EST

- Personal Income for April is estimated to fall .2% versus a .3% decline in March.

- Personal Spending for April is estimated to fall .2% versus a .2% decline in March.

- The PCE Core for April is estimated to rise .2% versus a .2% gain in March.

10:00 am EST

- ISM Manufacturing for May is estimated to rise to 42.0 versus 40.1 in April.

- ISM Prices Paid for May is estimated to rise to 35.0 versus 32.0 in April.

- Construction Spending for April is estimated to fall 1.5% versus a .3% gain in March.

Other Potential Market Movers

- Geithner’s Visit to

BOTTOM LINE: Asian indices are higher, boosted by gains in financial and mining stocks in the region. I expect US stocks to open modestly higher and to build on gains into the afternoon, finishing higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are a number of economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Personal Income, Personal Spending, PCE Core, ISM Manufacturing, ISM Prices Paid, Construction Spending

Tues. – Pending Home Sales, Total Vehicle Sales, weekly retail sales reports

Wed. – Weekly EIA energy inventory data, weekly MBA mortgage applications, Challenger Job Cuts, ADP Employment Change, ISM Non-Manufacturing, Factory Orders

Thur. – Non-farm Productivity, Unit Labor Costs, Initial Jobless Claims, ICSC Chain Store Sales

Fri. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Consumer Credit

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – None of note

Tues. – Verifone(PAY), Hovnanian(HOV), Bob Evans(BOBE), United Natural Foods(UNFI)

Wed. – Joy Global(JOYG), Toll Brothers(TOL), William-Sonoma(WSM), Jos. A. Bank(JOSB)

Thur. – Ciena(CIEN), Teekay Shipping(TK), Cooper Cos(COO), Guess(GES), Sina(SINA)

Fri. – None of note

Other events that have market-moving potential this week include:

Mon. – Geithner Visits

Tue. – Geithner Visits China, Fed’s Fisher speaking, KeyBanc Capital Markets Industrial/Automotive/Transportation Conference, Goldman Lodging/Gaming/Restaurant/Leisure Conference, (CAH) investor day, RBC Capital Markets Energy/Power Conference, (THC) investor day, (MDT) analyst meeting, Cowen Display Conference

Wed. – Bernanke testimony before House Budget Committee, Fed’s Hoenig speaking, BofA-Merrill Tech Conference, Goldman Basic Materials Conference, Keefe/Bruyette/Woods Financial Services Conference, (FE) analyst meeting, Stephens Investment Conference, KeyBanc Industrial/Auto/Transport Conference, (ERTS) analyst meeting, Lazard Alt Energy/Infrastructure Conference

Thur. – Fed’s Pianalto speaking, Fed’s Dudley speaking, Bernanke gives speaks at Fed Conference, Keefe Bruyette Financial Services Conference, CSFB Engineering/Construction Service Conference, (MCO) Investor Day, Goldman Basic Materials Conference, Lazard Alt Energy/Infrastructure Conference, Sandler O’Neil Electronic Trading Conference, Citi Power/Utility Conference, BofA-Merrill Tech Conference, Raymond James Investors Conference

Fri. – Fed’s Rosengren, Yellen and Kohn in Panel Discussion, (WMT) analyst meeting, Sandler O’Neil Electronic Trading Conference

Friday, May 29, 2009

Weekly Scoreboard*

Indices

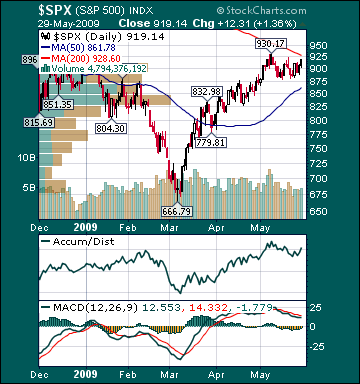

S&P 500 919.14 +3.47%

DJIA 8,500.33 +2.51%

NASDAQ 1,774.33 +4.67%

Russell 2000 501.58 +4.23%

Wilshire 5000 9,323.47 +3.54%

Russell 1000 Growth 406.15 +3.94%

Russell 1000 Value 469.61 +3.03%

Morgan Stanley Consumer 562.75 +2.76%

Morgan Stanley Cyclical 549.45 +4.37%

Morgan Stanley Technology 439.06 +5.38%

Transports 3,202.45 +6.12%

Utilities 340.99 +4.22%

MSCI Emerging Markets 33.02 +4.44%

Sentiment/Internals

NYSE Cumulative A/D Line 33,532 +10.50%

Bloomberg New Highs-Lows Index +23 +142.59%

Bloomberg Crude Oil % Bulls 32.0 -17.95%

CFTC Oil Large Speculative Longs 185,237 +5.82%

Total Put/Call .77 -20.62%

OEX Put/Call 1.07 -43.39%

ISE Sentiment 175.0 +23.38%

NYSE Arms .95 -25.78%

Volatility(VIX) 28.92 -7.75%

G7 Currency Volatility (VXY) 15.23 +.4%

Smart Money Flow Index 8,153.17 +.80%

AAII % Bulls 40.37 +19.72%

AAII % Bears 48.62 +7.21%

Futures Spot Prices

Crude Oil 66.31 +8.56%

Reformulated Gasoline 189.53 +2.96%

Natural Gas 3.83 +2.82%

Heating Oil 167.76 +8.06%

Gold 980.30 +2.50%

Base Metals 138.62 +3.29%

Copper 219.75 +6.67%

Agriculture 345.88 +3.28%

Economy

10-year US Treasury Yield 3.46% +1 basis point

U.S. Sovereign Debt Credit Default Swap 46.0 +4.54%

10-year TIPS Spread 1.84% +6 basis points

TED Spread 53.0 +4 basis points

N. Amer. Investment Grade Credit Default Swap Index 139.19 -5.31%

Emerging Markets Credit Default Swap Index 385.56 -2.83%

Citi US Economic Surprise Index +59.90 +34.91%

Fed Fund Futures imply 78.0% chance of no change, 22.0% chance of 25 basis point cut on 6/24

Iraqi 2028 Govt Bonds 63.67 +4.09%

4-Wk MA of Jobless Claims 626,800 -.5%

Average 30-year Mortgage Rate 4.91% +9 basis points

Weekly Mortgage Applications 786,000 -14.18%

Weekly Retail Sales -.20%

Nationwide Gas $2.47/gallon +.08/gallon

US Cooling Demand Next 7 Days 13.0% below normal

ECRI Weekly Leading Economic Index 111.90 +.81%

US Dollar Index 80.43 -.16%

Baltic Dry Index 3,494 +25.41%

CRB Index 249.83 +3.08%

Best Performing Style

Small-cap Growth +5.13%

Worst Performing Style

Large-cap Value +3.03%

Leading Sectors

Steel +13.11%

Oil Service +10.72%

Alt Energy +8.97%

Road & Rail +8.49%

Construction +7.18%

Lagging Sectors

Drugs +1.89%

Retail +1.04%

HMOs +.04%

Airlines -3.56%

Education -5.19%