U.S. Week Ahead by MarketWatch (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week mixed as profit-taking, global growth fears and rising energy prices offset positive US economic data, technical buying and investor performance angst. My intermediate-term trading indicators are giving mostly bullish signals and the Portfolio is 75% net long heading into the week.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Sunday, March 18, 2012

Friday, March 16, 2012

Weekly Scoreboard*

Indices

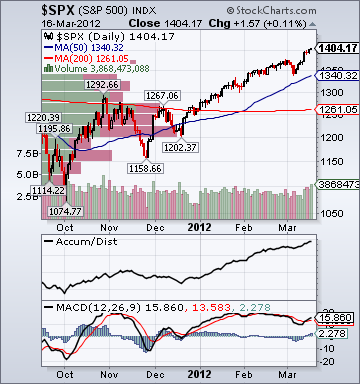

- S&P 500 1,404.17 +2.43%

- DJIA 13,232.60 +2.40%

- NASDAQ 3,055.26 +2.24%

- Russell 2000 830.18 +1.61%

- Wilshire 5000 14,598.30 +2.27%

- Russell 1000 Growth 659.86 +2.20%

- Russell 1000 Value 692.28 +2.47%

- Morgan Stanley Consumer 794.94 +1.57%

- Morgan Stanley Cyclical 1,040.69 +3.19%

- Morgan Stanley Technology 704.24 +2.44%

- Transports 5,351.32 +3.67%

- Utilities 453.60 -.30%

- MSCI Emerging Markets 43.92 +.50%

- Lyxor L/S Equity Long Bias Index 1,031.77 +2.30%

- Lyxor L/S Equity Variable Bias Index 831.61 +1.21%

- Lyxor L/S Equity Short Bias Index 538.94 unch.

- NYSE Cumulative A/D Line 145,772 +.21%

- Bloomberg New Highs-Lows Index 233 +98

- Bloomberg Crude Oil % Bulls 34.0 -5.6%

- CFTC Oil Net Speculative Position 243,174 +2.63%

- CFTC Oil Total Open Interest 1,579,060 -.37%

- Total Put/Call .76 -15.56%

- OEX Put/Call .69 -56.33%

- ISE Sentiment 151.0 +62.37%

- NYSE Arms .67 -41.74%

- Volatility(VIX) 14.47 -15.43%

- S&P 500 Implied Correlation 68.34 -.94%

- G7 Currency Volatility (VXY) 10.12 -2.22%

- Smart Money Flow Index 11,095.25 +2.35%

- Money Mkt Mutual Fund Assets $2.637 Trillion -.30%

- AAII % Bulls 45.61 +7.62%

- AAII % Bears 27.20 -6.21%

- CRB Index 317.93 +.10%

- Crude Oil 107.06 -.33%

- Reformulated Gasoline 335.69 +.54%

- Natural Gas 2.33 +.56%

- Heating Oil 328.19 +.41%

- Gold 1,655.80 -3.38%

- Bloomberg Base Metals Index 227.59 +2.65%

- Copper 387.80 +.61%

- US No. 1 Heavy Melt Scrap Steel 403.33 USD/Ton unch.

- China Iron Ore Spot 144.70 USD/Ton +1.47%

- Lumber 272.20 -.26%

- UBS-Bloomberg Agriculture 1,563.05 +2.65%

- ECRI Weekly Leading Economic Index Growth Rate -1.40% +120 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.0132 +.01

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 107.95 +.10%

- Citi US Economic Surprise Index 33.10 -5.9 points

- Fed Fund Futures imply 52.0% chance of no change, 48.0% chance of 25 basis point cut on 4/25

- US Dollar Index 79.79 -.22%

- Yield Curve 193.0 +22 basis points

- 10-Year US Treasury Yield 2.29% +26 basis points

- Federal Reserve's Balance Sheet $2.876 Trillion +.31%

- U.S. Sovereign Debt Credit Default Swap 32.66 -4.10%

- Illinois Municipal Debt Credit Default Swap 216.0 -5.26%

- Western Europe Sovereign Debt Credit Default Swap Index 224.84 -36.17%(Greece taken out)

- Emerging Markets Sovereign Debt CDS Index 204.17 -6.77%

- Saudi Sovereign Debt Credit Default Swap 119.95 -8.02%

- Iraqi 2028 Government Bonds 82.16 +.65%

- China Blended Corporate Spread Index 586.0 -13 basis points

- 10-Year TIPS Spread 2.41% +12 basis points

- TED Spread 39.25 +.25 basis point

- 3-Month Euribor/OIS Spread 49.50 -5.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -60.0 +5.75 basis points

- N. America Investment Grade Credit Default Swap Index 89.07 -6.11%

- Euro Financial Sector Credit Default Swap Index 144.39 -12.89%

- Emerging Markets Credit Default Swap Index 221.79 -7.21%

- CMBS Super Senior AAA 10-Year Treasury Spread 159.0 -3 basis points

- M1 Money Supply $2.218 Trillion unch.

- Commercial Paper Outstanding 936.80 +1.20%

- 4-Week Moving Average of Jobless Claims 355,800 +.10%

- Continuing Claims Unemployment Rate 2.6% -10 basis points

- Average 30-Year Mortgage Rate 3.92% +4 basis points

- Weekly Mortgage Applications 736.50 -2.37%

- Bloomberg Consumer Comfort -33.7 +3.0 points

- Weekly Retail Sales +3.10% +10 basis points

- Nationwide Gas $3.83/gallon +.07/gallon

- U.S. Heating Demand Next 7 Days 63.0% below normal

- Baltic Dry Index 866.0 +6.65%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 37.50 +7.14%

- Rail Freight Carloads 226,039 -.54%

- Large-Cap Value +2.47%

- Small-Cap Growth +1.21%

- Banks +8.79%

- I-Banks +5.42%

- Steel +5.30%

- Road & Rail +5.0%

- Alt Energy +4.50%

- Telecom -.05%

- Utilities -.30%

- Disk Drives -.33%

- Computer Hardware -.40%

- Gold & Silver -5.09%

- PCBC, FXCM, ZOLL, QSFT, FRAN, ARGN, SCHL, SLCA, BTH, ITMN, MCP, ADES, MIDD, SUP, EVR, ASCA, XPO and SLXP

- GES, MTGE and MAPP

ETFs

Stocks

*5-Day Change

Today's Headlines

Bloomberg

- Spain Debt Reaches Record as Rajoy Becomes Crisis Focus: Economy. Spain’s public-debt burden surged to the most in at least two decades, underlining concerns about its ability to reorder state finances as contagion from the debt crisis focuses on the euro area’s fourth-biggest economy. The nation’s overall debt last year amounted to 68.5 percent of gross domestic product, exceeding the government’s forecast of 67.3 percent, data on the Bank of Spain’s website showed today. That compares with 66 percent in the third quarter and 61.2 percent at the end of 2010. “Spain seems to be the main risk in the near future for Europe,” Stephane Deo, chief European economist at UBS AG, wrote in a note today. “There are enormous challenges ahead, including the debt-recession spiral in Portugal and Spain.” The increase in Spanish debt was driven by the nation’s 17 semi-autonomous regional governments, whose borrowings swelled 17 percent from a year earlier as they overshot their budget- deficit goals.

- Chinese Companies Forced to Falsify Data, Government Says. China’s statistics bureau said local officials forced some hotels, coal miners and aluminum makers to report false numbers, highlighting flaws in data tracking the world’s second-largest economy. Statistics officials in Hejin city in northern Shanxi province gave companies “seriously untrue” numbers to submit for 2011, the Beijing-based National Bureau of Statistics said in a statement on its website dated March 12. Discrepancies between national and local numbers for gross domestic product indicate the task that remains for officials seeking to bolster confidence in the statistics system. So far, steps have included crackdowns on leaks of market-moving numbers and direct online reporting of data by companies to limit opportunities for provincial officials to massage the numbers. “The national bureau is demonstrating its resolve in improving the nation’s data accuracy but it has a long way to go,” said Lu Ting, a Hong Kong-based economist at Bank of America Corp. In general, national-level data from the bureau is “more trustworthy” while local numbers “need a closer look.” The bureau urged regions, departments and individuals to learn a lesson from the Hejin case, without commenting on the frequency of such incidents. It also urged statistics officials to not violate laws and regulations.

- Italy Said to Pay Morgan Stanley(MS) $3.4 Billion. When Morgan Stanley (MS) said in January it had cut its “net exposure” to Italy by $3.4 billion, it didn’t tell investors that the nation paid that entire amount to the bank to exit a bet on interest rates. Italy, the second-most indebted nation in the European Union, paid the money to unwind derivative contracts from the 1990s that had backfired, said a person with direct knowledge of the Treasury’s payment. It was cheaper for Italy to cancel the transactions rather than to renew, said the person, who declined to be identified because the terms were private.

- Crude Futures Advance. Crude for April delivery rose $1.13, or 1.1 percent, to $106.24 a barrel at 12:49 p.m. on the New York Mercantile Exchange. Prices are up 7.5 percent this year and down 1.1 percent this week. Brent oil for May settlement increased $2.34, or 1.9 percent, to $124.94 a barrel on the London-based ICE Futures Europe exchange.

- Consumer Sentiment in U.S. Drops on Gasoline Prices: Economy. Confidence among U.S. consumers unexpectedly dropped in March as this year’s 17 percent jump in gasoline prices threatens to squeeze household budgets. The Thomson Reuters/University of Michigan preliminary index of consumer sentiment fell to 74.3, the lowest this year, from 75.3 the prior month. The gauge was projected to rise to 76, according to the median forecast of 70 economists surveyed by Bloomberg News. A government report today showed that consumer prices rose in February by the most in 10 months, with gasoline accounting for 80 percent of the increase.

- Consumer Prices in U.S. Rose in February as Gasoline Jumped. The cost of living in the U.S. rose in February by the most in 10 months, reflecting a jump in gasoline that failed to spread to other goods and services. The consumer-price index climbed 0.4 percent, matching the median forecast of economists surveyed by Bloomberg News, after increasing 0.2 percent the prior month, the Labor Department reported today in Washington. The so-called core measure, which excludes more volatile food and energy costs, climbed 0.1 percent, less than projected.

- U.S. Industrial Production Was Little Changed in February. Industrial production in the U.S. was little changed in February, restrained by a slowdown in manufacturing and a decline in natural gas extraction. The output last month at factories, mines and utilities compared with a median projection for a 0.4 percent gain in a Bloomberg News survey of economists. Production in January was revised to a 0.4 percent increase, initially reported as no change, data from the Federal Reserve showed today in Washington. Manufacturing (IPMGCHNG), which makes up about 75 percent of total output, rose at the slowest pace in three months.

- Goldman(GS) Reviewing Conflicts Policies for M&A Bankers. Goldman Sachs Group Inc. is considering strengthening internal rules on disclosure to clients of bankers' financial holdings, after being criticized in a recent court opinion because of a deal maker's potential conflict of interest in a large transaction. Goldman's review—and similar initiatives by some of its rivals—could provide companies with greater transparency on the financial interests of the bankers they hire to advise on deals. In a statement to The Wall Street Journal, Goldman said it was reviewing its "policies and procedures with the goal of strengthening them."

- Europe Can't Swap Its Banking Problem. It's the pattern investors have grown used to since the rolling financial crisis began in 2008. The market zeroes in on a point of weakness, policy makers finally apply a band aid, financial apocalypse is averted and the bears retreat before moving on to the next target.

- Apple's(AAPL) New iPad Goes on Sale Today. Shoppers began purchasing Apple Inc.'s third-generation iPad on Friday, as the technology giant tries to widen its lead in the fast-growing tablet market. Crowds showed up at Apple retail stores around the world. The tablet computer, priced starting at $499 in the U.S., has a higher-resolution screen and faster networking capabilities than its predecessor, which has dominated the market to date.

CNBC.com:

- Fed's Lacker: Rate Hike Likely Needed in 2013. A top U.S. Federal Reserve official said on Friday that he dissented against the central bank's decision this week to hold interest rates near zero until at least late 2014 because he thought rates would need to rise some time next year.

- Why Fed's Easy Money Policy Is 'Straining Credulity'. The Federal Reserve's promises to keep its monetary policy loose may be upended by higher oil prices, which threaten to push U.S. inflation to unsustainable levels, analysts said.

- The Navy is Sending Everything It Needs For a War With Iran to the Strait of Hormuz.

- You Have to Read This Explosive Letter About a Coverup at the Congressional Budget Office.

- There's a Brewing Battle Over A Mysterious Government Bank That Does Nothing But Subsidize Huge Corporations.

- Everyone is Passing Around This 'Whistleblower' Letter Claiming to Know About Market Manipulation at JPMorgan(JPM).

- iPad Lines Around The World.

- India Doubles Customs Duty on Gold Bullion, Central Banks Buy On Dip.

- The Fool's Game: Unraveling Europe's Epic Ponzi Pyramid of Lies.

- Remember Fukushima: Presenting The Radioactive Seawater Impact Map. (pic)

- Obama's Oil Flimflam. Yes, of course, presidents have no direct control over gas prices. But the American people know something about this president and his disdain for oil. The “fuel of the past,” he contemptuously calls it. To the American worker who doesn’t commute by government motorcade and is getting fleeced every week at the pump, oil seems very much a fuel of the present — and of the foreseeable future. President Obama incessantly claims energy open-mindedness, insisting that his policy is “all of the above.” Except, of course, for drilling:

Gallup:

Rasmussen Reports:

Reuters:

- Brazil Job Creation Plummets on Abrupt Slowdown. Payroll job growth in Brazil's economy plummeted in February from a year earlier, as a broad economic slowdown forced employers to slow hiring. Manufacturers, farmers and retailers added a net 150,600 payroll jobs in February, down 57 percent from a year earlier, the Labor Ministry said on Friday.

USA Today:

- Senators to Obama: Disclose Patriot Act Powers. Two senators -- two Democratic senators -- are asking the Obama administration to disclose surveillance powers under the Patriot Act, saying citizens would be "stunned" to learn what the government says it can do. "As we see it, there is now a significant gap between what most Americans think the law allows and what the government secretly claims the law allows," said a letter to the Justice Department by Sens. Ron Wyden, D-Ore., and Mark Udall, D-Colo. Addressing Attorney General Eric Holder, Wyden and Udall wrote, "This is a problem, because it is impossible to have an informed public debate about what the law should say when the public doesn't know what its government thinks the law says."

Telegraph:

- Do Eurozone Voters Really Want a 'United States of Europe'? A new, interesting YouGov-Cambridge poll out this week, looking at European attitudes amongst citizens in the UK, Germany, France, Italy and Scandinavia is a case in point. As expected, a full 40% of Brits want a “looser” relationship with Europe. Another 13% want no more integration while 20% want to withdraw altogether. These attitudes span the political divide.

Bear Radar

Style Underperformer:

- Mid-Cap Value -.22%

- 1) Airlines -1.99% 2) Homebuilders -1.45% 3) Retail -.98%

- APU, RP, SKYW, OGXI, NTCT, ADTN, GTY, LMNX, TEI and RKT

- 1) AMRN 2) HYG 3) RSX 4) ELN 5) ARIA

- 1) BWLD 2) ADTN 3) FSLR 4) FLIR 5) WAG

Bull Radar

Style Outperformer:

- Mid-Cap Value -.20%

- 1) Oil Tankers +4.60% 2) Coal +2.5% 3) Oil Service +1.90%

- ATLS, KOS, PACD, UPL, PWRD, IMOS, JVA, HSTM, ADSK, RIMM, NXTM, EBAY, ARP, ATE, NAT, DOLE, OSG, CHMT, MOS, NOV, UIS, ANR and BTU

- 1) FRO 2) GNW 3) BBY 4) ELX 5) AFL

- 1) RIG 2) STT 3) APKT 4) UTX 5) MS

Subscribe to:

Comments (Atom)