- French Attacks Prompt East Europe Calls for Curbs on Immigration. Hungary’s prime minister and the Czech president demanded a tougher stance on immigrants to the European Union as fallout from the terrorist attacks in France last week spread to former communist countries. Hungarian Prime Minister Viktor Orban said the EU must limit immigration to people seeking political asylum. Czech President Milos Zeman said the foreign incomers and their descendants who can’t adapt and follow local norms should “return home,” according to an interview published in Denik newspaper Jan 10. “Immigration is a bad thing,” Orban said yesterday on Hungarian public television after attending a march in Paris to mark the killings in France. “We shouldn’t view it as if it had any use because it only brings problems and peril to Europeans and so it must be stopped.”

- Top Russian Ruble Forecaster Sees Fresh Run at Record Low. The world’s top ruble forecaster is unimpressed by the currency’s 30 percent rebound from a record low. The analyst -- Danske Bank A/S’s Vladimir Miklashevsky -- says the ruble could be testing new lows again this quarter as the plunge in oil, Russia’s top export, threatens to cost the country its investment-grade credit ratings and turns Russians away from their currency. The ruble traded at 62.32 per dollar at 2:35 p.m. in Moscow, after reaching 80.1 on Dec. 16, the weakest on record.

- Ukraine Eurobonds Drop as Goldman Sees More Than 70% Haircut. Ukraine’s foreign-currency borrowing costs rose for a second day as Goldman Sachs Group Inc. (GS) said a debt writedown may erase 70 percent of the bonds’ value and Russia said it may demand the early repayment of a $3 billion bond. Ukraine’s dollar-denominated debt maturing July 2017 fell 2.7 cents to 59.87 cents on the dollar by 6:52 p.m. in Kiev after rising 2.2 cents last week as the European Union pledged further financial aid. The yield on the notes rose 229 basis points to 34.20 percent, nearing the record 36.10 percent reached last week.

- Greek Contagion Concerns Attract Bears to Spain, Italy. Traders are buying up protection should Greece’s potential exit from the euro trigger a domino drop in Spanish and Italian stocks. Investors are pulling out of exchange-traded funds tracking the equities, while driving up costs to hedge against declines. The price of bearish options versus bullish ones on the iShares MSCI Spain Capped ETF hit a 20-month high last week, while the cost of the contracts on the iShares MSCI Italy Capped ETF jumped 27 percent since early December, according to data compiled by Bloomberg.

- Emerging Energy Stocks Drop on Goldman Oil Outlook; Real Weakens. Emerging-market stocks fell, ending a three-day advance, as oil’s plunge below $48 a barrel dragged down energy companies from Russia to India. The real fell from a one-month high as economists cut their growth forecasts for Brazil. OAO Rosneft slid 1.3 percent in Moscow. Reliance Industries Ltd., India’s largest oil refinery, decreased 1.2 percent. Coal India Ltd. dropped 4.6 percent after reports the government will sell shares in the company. Stocks in net oil importers Turkey and Egypt climbed. The ruble weakened 2.3 percent after Fitch Ratings Ltd. cut Russia’s credit rating. The MSCI Emerging Markets Index decreased 0.6 percent to 955.48 at 10:51 a.m. in New York.

- Europe Stocks Rise as Health-Care Gains Offset Energy. European stocks advanced for the third time in four days, pushed higher by drugmakers and Greek equities. The Stoxx Europe 600 Index added 0.6 percent to 339.87 at the close of trading in London, after earlier climbing as much as 1.1 percent and falling 0.4 percent. Roche Holding AG helped send health-care companies up 0.9 percent, and Greece’s ASE Index climbed 3.8 percent, completing its biggest two-day rally since November. The broad European benchmark gauge fell 1 percent last week for a second decline, posting its worst start to a year since 2008.

- Copper Falling to 5-Year Low Defies Forecasts for Better Economy. Economists say the world economy will do better this year. The copper market is saying that won’t be enough to eliminate a supply glut that’s lasted at least two years. Prices of the metal slumped to the lowest since October 2009 today, fueled by concerns that output is outpacing demand. China’s copper consumption will grow at the slowest pace since at least 2010, Deutsche Bank AG predicts. At the same time, global economic growth will be the best in four years, economist estimates compiled by Bloomberg show.

- Oil Falls to 5 1/2-Year Low; Goldman, SocGen Cut Price Outlook. West Texas Intermediate decreased as much as 5.1 percent to $45.90 a barrel, and Brent 5.9 percent to $47.18. Crude has to “stay lower for longer” if investment in shale is to be curtailed to re-balance the global market, according to Goldman analysts. Prices need to return to $100 a barrel for economic equilibrium, Venezuelan President Nicolas Maduro said in Iran during a tour of Middle Eastern OPEC members.

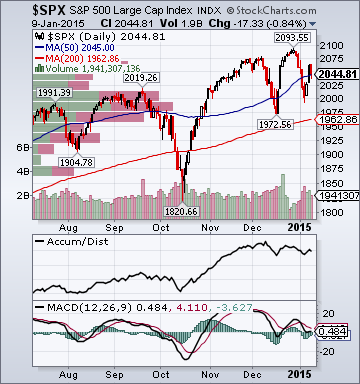

- Oil Whacks S&P 500 Earnings Growth. Forecasts for first-quarter profits in the Standard & Poor’s 500 Index have fallen by 6.4 percentage points from three months ago, the biggest decrease since 2009, according to more than 6,000 analyst estimates compiled by Bloomberg. Reductions spread across nine of 10 industry groups and energy companies saw the biggest cut. Earnings pessimism is growing just as the best three-year rally since the technology boom pushed equity valuations to the highest level since 2010.

- Shale Drillers Can Brag About Their Holdings. Investors Ask: How's Your Debt? U.S. shale drillers may tout how much oil they have in the ground or how cheaply they can get it out. For stock investors, what matters most is debt. The worst performers among U.S. oil producers in a Bloomberg index owe about 5.7 times more than they earn, before certain deductions, compared with 1.7 times for companies that have taken less of a hit. Operations, such as where the companies drill or how much oil versus gas they pump, matter less.

- Utah Mall’s Travails Expose Property Weak Link: Mortgages. “There’s a level of complacency among investors,” he said. “Competitive pressures that haven’t been seen in decades are making some retailers and some properties obsolete.” Even as U.S. real estate prices surpass their November 2007 peak, neighborhood shopping centers, malls and other retail properties remain 15 percent below their record, according to indexes compiled by Moody’s and Real Capital Analytics Inc. Retail is the only major type of commercial real estate, which also includes office buildings and warehouses, that failed to achieve price growth of at least 10 percent in the 12 months through November.

- Tiffany(TIF) Shares Tumble After Jeweler Cuts Annual Forecast. Tiffany & Co. (TIF) shares fell the most in more than three years after a sluggish holiday season spurred the luxury jewelry chain to cut its annual forecast. Sales in November and December declined 1 percent to $1.02 billion worldwide, the New York-based company said today in a statement. Currency fluctuations and a continued slump in Japan took a toll on the results, along with a surprise slowdown in its home market.

- Islamic State Adds to Terror In Afghanistan. Raises Prospect of Battling Jihadists, Rising Terrorism. Adherents of Islamic State this weekend declared their intention to step up operations in Afghan territory where the Taliban have long held sway, raising the prospect of battling jihadist groups and rising terrorism in the region.

- Big Market Moves to Dent Results at U.S. Banks. Many Executives Have Already Flagged Difficult Trading Environment.

- SanDisk(SNDK) Drops 11%: Cuts Q4 Rev View; FBN Sees Samsung the Main Culprit.

SanDisk said the reduced outlook was “primarily due to weaker than expected sales of retail and iNAND products.” SanDisk’s iNAND products are flash memory modules that are built into mobile devices such as smartphones and tablets.

- White House admits should have sent 'higher-profile' official to Paris rally. (video) The White House acknowledged Monday that it erred in not sending a higher-level official to the massive rally in Paris against Islamic terrorism. "We should have sent someone with a higher profile to be there," Press Secretary Josh Earnest said.

- The Confessions Begin: Goldman, BofA Warn Crude Crash Will Have Negative Impact On GDP, Earnings. (graph)

Reuters:

- Lululemon(LULU) forecast signals turnaround moves bearing fruit. Lululemon Athletica Inc issued a robust forecast for the current quarter on Monday that topped market expectations and lifted its shares as strong holiday sales signaled the Canadian yogawear maker's comeback efforts may be paying off.

Telegraph:

- Deflation is coming to the UK - and it will have a huge impact on business. Inflation has been hard-wired into the economic system for so long that it will be very hard to adjust to falling prices.