Week Ahead by Bloomberg.

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

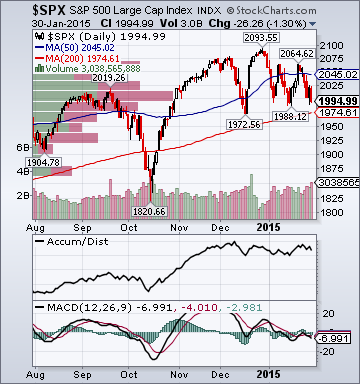

BOTTOM LINE: I expect US stocks to finish the week modestly lower on escalating

Russia/Ukraine tensions, global growth fears, rising European/Emerging

Markets/US High-Yield debt angst, earnings concerns, yen strength and

technical selling. My intermediate-term trading indicators are giving

neutral signals and the Portfolio is 25% net long heading into the week.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Sunday, February 01, 2015

Friday, January 30, 2015

Stocks Reversing Lower into Final Hour on Surging Eurozone/Emerging Markets Debt Angst, Fed Rate Hike Worries, Global Growth Fears, Homebuilding/Transport Sector Weakness

Broad Equity Market Tone:

- Advance/Decline Line: Substantially Lower

- Sector Performance: Most Sectors Declining

- Volume: Slightly Below Average

- Market Leading Stocks: Underperforming

- Volatility(VIX) 19.47 +3.78%

- Euro/Yen Carry Return Index 138.72 -.81%

- Emerging Markets Currency Volatility(VXY) 10.99 +6.29%

- S&P 500 Implied Correlation 65.70 -1.22%

- ISE Sentiment Index 90.0 +25.0%

- Total Put/Call 1.07 -5.31%

- NYSE Arms .92 -28.63%

- North American Investment Grade CDS Index 69.14 +1.98%

- America Energy Sector High-Yield CDS Index 761.0 +.74%

- European Financial Sector CDS Index 68.07 +5.84%

- Western Europe Sovereign Debt CDS Index 25.17 -1.10%

- Asia Pacific Sovereign Debt CDS Index 70.22 +1.78%

- Emerging Market CDS Index 403.62 +1.72%

- iBoxx Offshore RMB China Corporates High Yield Index 113.48 +.41%

- 2-Year Swap Spread 24.0 +1.25 basis points

- TED Spread 24.5 +.75 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -13.75 +.75 basis point

- 3-Month T-Bill Yield .01% unch.

- Yield Curve 120.0 -4.0 basis points

- China Import Iron Ore Spot $62.21/Metric Tonne -1.68%

- Citi US Economic Surprise Index -4.0 -5.1 points

- Citi Eurozone Economic Surprise Index 10.0 +12.3 points

- Citi Emerging Markets Economic Surprise Index -4.80 +1.6 points

- 10-Year TIPS Spread 1.64 +1.0 basis point

- Nikkei Futures: Indicating -45 open in Japan

- DAX Futures: Indicating +5 open in Germany

- Slightly Higher: On gains in my biotech sector longs, index hedges and emerging markets shorts

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges and took some profits in my biotech longs

- Market Exposure: Moved to 25% Net Long

Today's Headlines

Bloomberg:

Fox News:

CNBC:

- Germany Warns Greece Against Isolation as Tsipras Shunned. Greece’s government risks isolation in the European Union by threatening to break ranks on sanctions against Russia and ditch its bailout deal, German Chancellor Angela Merkel’s minister for European affairs said. “Greece is firmly anchored in the mainstream of the European Union,” Michael Roth, who’s also deputy foreign minister, said in an interview. “I can only hope that this is where it wants to stay.” Prime Minister Alexis Tsipras’s government, sworn in Tuesday, is putting Greece’s financial lifeline at risk, the German Finance Ministry said. Greece’s bailout terms mean his government needs to undertake further reforms by the end of February. Extending the deadline would only make sense if Tsipras showed willingness to implement agreed reforms, and “the announcements from Athens go in the opposite direction,” ministry spokesman Martin Jaeger said Friday.

- Greece Sets Up Cash Crunch for March Telling EU It’s Over. Finance Minister Yanis Varoufakis said Greece won’t seek an extension of its bailout agreement, setting the government on course to enter March without a financial backstop for the first time in five years. Greece won’t engage with officials from the troika of official creditors who have been policing the conditions of its rescue since 2010. It’s five-day-old government wants a new deal with the European Union that allows for more spending, Varoufakis said at a joint press conference with Eurogroup Chief Jeroen Dijsselbloem in Athens, Friday.

- Ukraine Rebels Urge Cease-Fire Talks After Territorial Gains. Rebels fighting government forces in Ukraine said they’re ready to discuss peace terms with the administration in Kiev after taking more territory and surrounding a key railway town. Artillery shells rained down on the eastern city of Debaltseve, where rebels said they had surrounded government positions in an assault that Ukraine and its allies in the U.S. and the European Union say is backed by Russia. Negotiators for the self-proclaimed rebel entities in the Donetsk and Luhansk regions called for a demarcation line agreed in a Sept. 5 truce in Minsk, Belarus to be moved to reflect their advance.

- Ruble Slides to Lowest Since December Panic on Surprise Rate Cut. The ruble slumped to the weakest level since panic swept across Russian financial markets last month after a surprise interest-rate cut signaled the central bank no longer considered tackling inflation its primary task. The currency tumbled as much as 4.3 percent to 71.8465 after borrowing costs were reduced by 200 basis points to 15 percent, in contrast to the expectations of all but one of 32 economists surveyed by Bloomberg. It hasn’t breached 70 since Dec. 17, a day after the currency tumbled past 80 in a rout that wreaked havoc across emerging markets.

- Ruble Bulls Facing $10 Billion Reason to Adjust Positions. Think the ruble’s close to finding its bottom? Investors might want to wait a month before deciding yes. Along with the central bank’s surprise rate cut on Friday, the threat of expanded sanctions over Ukraine and the prospect of a second, or third, downgrade to junk, Russian companies need $10.2 billion of foreign currency to repay maturing debt in February, according to data compiled by Bloomberg. Next month is the biggest for corporate redemptions this year, accounting for almost a quarter of the total.

- Spain Compares Greek Debt Request to Catalan Independence. Spain’s deputy minister for the European Union, Inigo Mendez de Vigo, compared Greece’s request for a debt writedown to Catalonia’s push for independence and said EU officials won’t accept either. Mendez de Vigo insisted EU members are bound by common rules and must honor their commitments to each other in a speech at the University of Navarre, Spain, on Friday.

- Honda Cuts Profit Forecast After Recall Costs Mount. Honda Motor Co., Japan’s third-largest carmaker, cut its profit forecast for the second time in as many quarters recall costs mount. Net income will probably be 545 billion yen ($4.6 billion) in the fiscal year ending March, the Tokyo-based carmaker said in a statement today. That compares with the 565 billion yen the company previously forecast and the 591.2 billion yen average of 24 analysts’ estimates compiled by Bloomberg. Honda in October cut an earlier forecast.

- Canadian Bank Stocks on Pace for Worst Start in 25 Years. Canadian bank stocks are on track for their worst start to the year in a quarter century as a plunge in crude oil and overstretched consumers dim their profit outlook. The eight-company Standard & Poor’s/TSX Commercial Banks index has dropped 9.5 percent this month, the weakest start to the year since a 12 percent decline in January 1990, according to data compiled by Bloomberg.

- Europe Stocks Head for Best January Since 1989. European stocks declined, paring the best start to a year since 1989, as banks and telecommunications companies dropped. The Stoxx Europe 600 Index dropped 0.5 percent to 367.05 at the close of trading. The gauge rose as much as 0.4 percent earlier, before falling as much as 0.7 percent as Russia’s central bank unexpectedly cut its key rate.

- Oil Rebounds on Speculation Low Prices Slowing Output. Crude oil rose for a second day on speculation the almost 60 percent slump in prices over the past seven months will slow production. The oil rig count fell to a three-year low of 1,223 this week, Baker Hughes Inc. reported.

- Coal Keeps Dropping as OPEC-Like Tactic Stymied by Dollar. Coal prices, already down 52 percent since 2011, are forecast to keep falling. The rout shows that exporters’ OPEC-like tactics of trying to squeeze out high-cost producers have been frustrated by the rising dollar.

- VIX Calls Most Hated Since 2012 as Traders Shrug Off Volatility. Even with stock swings nearly doubling since 2014 and U.S. equities poised for their worst month in a year, traders aren't signaling too much concern. Investors own about 2.4 million options betting on a rise in the Chicago Board Options Exchange Volatility Index, compared to about 1.6 million contracts wagering on a drop. That's around the lowest ratio of calls to puts in more than two years, Bloomberg data show, indicating traders don't anticipate an increase in market turbulence anytime soon. "Those that typically use VIX call options to hedge long portfolios could be giving up on those hedges," Max Breir, a senior equity-derivatives trader at BMO in NY, said by phone.

- Bullard Says Markets Wrong Not to Expect Mid-Year Rate Rise. Federal Reserve Bank of St. Louis President James Bullard said investors are wrong to expect the Fed to postpone an interest-rate increase beyond midyear, with the U.S. economy leading global growth and unemployment dropping. “The market has a more dovish view of what the Fed is going to do than the Fed itself,” Bullard said in an interview Friday in New York. “Markets should take it at face value” from the Fed’s rate projections, and it’s “reasonable” to expect an increase in June or July.

- Islamic State Militants Launch Offensive Outside Kurdish-Controlled Kirkuk. Senior Kurdish Commander Among the Dead in Surprise Offensive in Northern Iraqi Region.

Fox News:

CNBC:

- Secret hedge fund shorts revealed. Six hedge fund managers gave their best investment ideas at an exclusive—and private—conference, including new bets against companies.

- Thanks Obamacare: This Is What Americans Spent The Most Money On In Q4. (graph)

- Chevron(CVX) Slashes 23% Of PA Workforce As US Rig Count Collapses To June 2010 Lows. (graph)

- Brazil's Economy Is On The Verge Of Total Collapse.

- Treasury Yields Are Crashing (Again). (graph)

- It Begins: Energy Giant Chevron Suspends Stock Buyback, Blames "Cash Flow Squeeze". (table)

- Shake Shak Opens For Trading Valued At 108x EBITDA. (graph)

- Greek Bond Yields Surge Above 19% After EU Talks. (graph)

- "Everything Is Awesome" American Consumers Are The Happiest In 11 Years. (graph)

- Chicago PMI Beats But Remains Lower Year-Over-Year. (graph)

- The Mexican Peso & Brazilian Real Are Collapsing. (graph)

- Greece Slams EU Bailout-ers: "We Don't Want The $7 Billion, We Want To Rethink The Whole Program".

- Q4 Annualized GDP Misses, Tumbles To 2.6% From 5.0%; Surging Personal Consumption Pulled Forward From 2015. (graph)

- Eurozone Deflation Ties Post-Lehman Record, Worse Than Expected. (graph)

- Bill Ackman just made his biggest ever investment in another hedge fund manager.

- The index that timed the 2008 crash perfectly just slumped to a 3-decade low. (graph)

- TRADER: 'At this point, the Fed could be screwed'.

- China is banning university textbooks that promote Western values.

- The relationship between the White House and Israel is getting even more strained.

- New Greek government has deep, long-standing ties with Russian 'fascist' Dugin.

- Russian bank boss: sanctions are economic war against Russia.

- Greece 'Doesn't Want' EU7b Bailout Tranche, Varoufakis Says. "Out task is not to get the next loan tranche," which would be merely "kicking the can down the road," Greek Finance Minister Yanis Varoufakis is cited as saying. Greece asks "an opportunity to put together a proposal that will minimize the costs of Greece's loan agreement and give this country a chance to breathe again after policies that created massive social depravity," he said. EC President Jean-Claude Juncker's EU300b investment plan is "a public relations gimmick that has unfortunately occupied the minds of good people for too long - it will be a failure," he said. "We want to ensure that this country becomes an attractive destination for foreign direct investment, but not interest in a fire sale or selling the family silver," he said.

- Eurozone heads towards 'protracted' deflation as bloc hit by record price drop. Prices fall by 0.6pc across the 19-nation single currency area in January as energy costs continue to tumble.

- Eurozone breakup threat reaches all-time high. As Greek leaders enter negotiations with the troika, analysts have described the coming confrontation as an “unstoppable force meeting an immovable object”.

- Russia to Send New Aid Convoy to Eastern Ukraine Jan. 31, Citing Russian Emergencies Ministry.

- Worsening Asset Quality Hits Banks; Sensex Sinks 600 Points. The BSE Sensex declined as much as 611 points in intraday trade on Friday as banking stocks came under sharp selling pressure. The Nifty snapped its 10-day rally that had powered the blue chip index to several record highs in the last few days. State-run lenders bore the brunt of the carnage with the sub-index of PSU banks on the National Stock Exchange ending 6 per cent lower.

Bear Radar

Style Underperformer:

- Small-Cap Value -1.23%

- 1) Airlines -4.03% 2) Construction -2.75% 3) Hospitals -2.46%

- ADES, DECK, TUES, HA, ALGN, CPSI, GDOT, CBI, N, PAYC, FICO, JDSU, IIIN, BZH, UIS, RESN, SAIA, BMO, HBI, RY, BCR, CSII, IBN, BA, OSTK, HOG, CB, ABBV, XRX, INGR, COH, SFG, AHT, SAIA, PHM, PCAR, INVN, DMND, EXAM, DKS and HA

- 1) DECK 2) CNX 3) EWT 4) DISH 5) LOCO

- 1) PBR 2) DAL 3) COP 4) WYNN 5) CVX

Bull Radar

Style Outperformer:

- Large-Cap Growth -.62%

- 1) Gold & Silver +1.72% 2) Oil Service +.53% 3) Steel -.23%

- AMZN, ICPT, SYNA, MAN, CPHD, QLGC, BIIB and V

- 1) DECK 2) GDP 3) SYNA 4) KRFT 5) RPTP

- 1) COST 2) BIIB 3) AMZN 4) CELG 5) MA

Subscribe to:

Comments (Atom)