Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was bearish. The advance/decline line fell, most sectors declined and volume was above average on the week. Measures of investor anxiety were mostly higher. Moreover, the AAII % Bulls fell to 26.23% and is now at depressed levels, which is a big positive. Most other measures of investor sentiment are also at levels associated with meaningful market bottoms.

The average 30-year mortgage rate fell to 6.62% which is 141 basis points above all-time lows set in June 2003. I still believe housing is in the process of slowing to more healthy sustainable levels. I see little evidence of a nationwide “hard landing” for housing at this point.

The benchmark 10-year T-note yield fell 2 basis points on the week on US dollar strength, a flight to safety by global investors and more hawkish comments by the Fed. I still believe inflation concerns have peaked for the year as investors continue to anticipate slower economic growth, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose again even as refinery utilization fell. Unleaded Gasoline futures declined and are now 26.0% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, a significant amount of Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 14% from 36% late last year. I continue to believe the elevated level of gas prices related to shortage speculation and crude oil production disruption speculation should further dampen fuel demand over the coming months, sending gas prices back to reasonable levels.

Natural gas inventories rose less than expectations this week, however supplies are still 41.3% above the 5-year average, near an all-time record high for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have plunged 60.7% since December 2005 highs. Notwithstanding this collapse, industrial demand for natural gas has shown few signs of increasing in any meaningful way. US oil inventories are still approaching 9-year highs. Since December 2003, global oil demand is down .24%, while global supplies have increased 4.94%. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. As the fear premium in oil dissipates back to more reasonable levels and supplies continue to rise, crude oil should head meaningfully lower over the intermediate-term. This will likely begin to happen during the next qauarter.

Gold fell for the week as the US dollar gained and the situations in Iraq and Iran improved. The US dollar rose on hawkish Fed comments, a flight to safety by global investors and dovish comments from the European Central Bank.

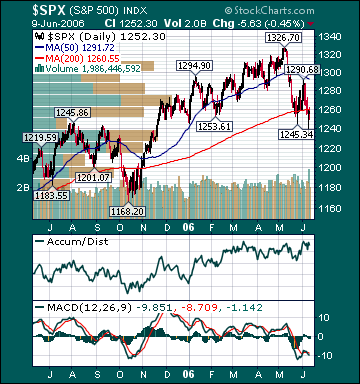

Commodity stocks underperformed substantially for the week on increasing worries over slower global growth, a subsiding of the mania for these securities and a stronger US dollar. The forward p/e on the S&P 500 has contracted relentlessly over the last few years and now stands at a very reasonable 14.6. The average US stock, as measured by the Value Line Geometric Index(VGY), is up 1.14%. Moreover, the Russell 2000 Index is still up 4.63% year-to-date, notwithstanding the recent correction. In my opinion, the current pullback has provided longer-term investors very attractive opportunities in many stocks that have been punished indiscriminately. However, the most overvalued economically sensitive and emerging market stocks should continue to underperform over the intermediate-term as the manias for those shares subside. A chain reaction of events has likely begun that will eventually result in a substantial increase in demand for US stocks.

In my opinion, the market is factoring in way too much bad news at current levels. Problematic inflation, substantially higher long-term rates, a significant US dollar decline, a “hard-landing” in housing, a plunge in consumer spending and ever higher oil prices appear to be mostly factored into stock prices at this point. I view any one of these as unlikely and the occurrence of all as highly unlikely. Over the coming months, a Fed pause, lower commodity prices, decelerating inflation readings, lower long-term rates, increased consumer confidence and the realization that economic growth is only slowing should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I continue to believe the S&P 500 will return a total of around 15% for the year. The ECRI Weekly Leading Index rose this week and is forecasting healthy, but decelerating, US economic activity.

*5-day % Change

No comments:

Post a Comment