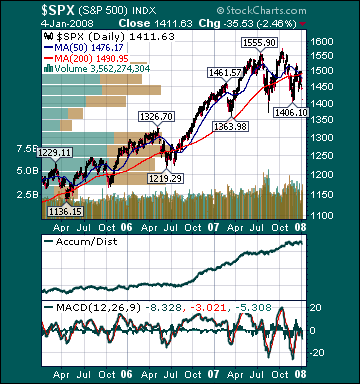

S&P 500 1,411.63 -4.39%*

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Saturday, January 05, 2008

Friday, January 04, 2008

Weekly Scoreboard*

Indices

S&P 500 1,411.63 -4.39%

DJIA 12,800.18 -4.19%

NASDAQ 2,504.65 -6.43%

Russell 2000 721.60 -6.71%

Wilshire 5000 14,154.51 -4.56%

Russell 1000 Growth 585.92 -4.87%

Russell 1000 Value 767.30 -3.98%

Morgan Stanley Consumer 712.75 -4.07%

Morgan Stanley Cyclical 939.56 -6.03%

Morgan Stanley Technology 583.50 -7.20%

Transports 4,260.39 -7.78%

Utilities 532.08 -.17%

MSCI Emerging Markets 147.41 -3.36%

Sentiment/Internals

NYSE Cumulative A/D Line 59,948 -3.63%

Bloomberg New Highs-Lows Index -545

Bloomberg Crude Oil % Bulls 52.0 +26.8%

CFTC Oil Large Speculative Longs 238,361 +8.65%

Total Put/Call +1.12 +16.7%

NYSE Arms 4.33 +93.3%

Volatility(VIX) 23.94 +18.16%

ISE Sentiment 93.0 -23.8%

AAII % Bulls 25.7 -14.3%

AAII % Bears 55.2 +10.5%

Futures Spot Prices

Crude Oil 97.69 +.96%

Reformulated Gasoline 251.0 -.73%

Natural Gas 7.84 +9.48%

Heating Oil 268.35 +.17%

Gold 862.50 +4.1%

Base Metals 225.79 +5.2%

Copper 313.30 +1.0%

Economy

10-year US Treasury Yield 3.87% -21 basis points

4-Wk MA of Jobless Claims 343,800 -.2%

Average 30-year Mortgage Rate 6.07% -10 basis points

Weekly Mortgage Applications 533,900 -11.6%

Weekly Retail Sales +1.4%

Nationwide Gas $3.07/gallon +.03/gallon

US Heating Demand Next 7 Days 33.0% below normal

ECRI Weekly Leading Economic Index 135.10 +.07%

US Dollar Index 75.92 -1.06%

CRB Index 366.22 +1.79%

Best Performing Style

Large-cap Value -3.98%

Worst Performing Style

Small-cap Value -7.06%

Leading Sectors

Utilities -.17%

HMOs -.65%

Oil Service -1.57%

Construction -1.58%

Foods -1.91%

Lagging Sectors

Retail -9.17%

Semis -9.36%

Computer Hardware -9.94%

Airlines -10.62%

Homebuilders -10.94%

Stocks Sharply Lower into Final Hour on Spike in Economic Pessimism, Profit-taking

Bearish Sentiment Still Exceeds Levels Seen at Lows of 2000-2003 Bear Market

The AAII percentage of bulls dropped to 25.71% this week from 30.0% the prior week. This reading remains at depressed levels. The AAII percentage of bears rose to 55.24% this week from 50.0% the prior week. This reading remains at an elevated level. Moreover, the 10-week moving average of the percentage of bears is currently at 47.4%, a very elevated level. It has only been higher one other period in its history, which was September 1990-December 1990. Moreover, the 10-week moving average of the percentage of bears peaked at 43.0% right near the major bear market low during 2002. It is astonishing that the 10-week moving average of the % bears is currently greater than at any time during the bubble bursting meltdown of 2000-2003, which was arguably the worst stock market decline since the Great Depression.

Furthermore, the 50-week moving average of the percentage of bears is currently 39.1%, also a very elevated level seen during only one other period since tracking began in the 80s. That period was October 1990-July 1991, right near another major stock market bottom. The extreme reading of the 50-week moving average of the percentage of bears during that period peaked at 41.6% on Jan. 31, 1991. The current reading of 39.1% is above the peak during the 2000-2003 bear market, which was 38.1% on April 10, 2003. I find this even more astonishing, notwithstanding the recent pullback, given that the S&P 500 is currently 96.9% higher from the October 2002 major bear market lows and 8.6% off its recent record high.

Individual investor pessimism towards US stocks is currently deep-seated and historical in nature. This is just more evidence of the current “Fewer Jobs Created Than Expected, Unemployment Rises, Average Hourly Earnings Very Healthy, ISM Non-Manufacturing Better Than Estimates

- The Change in Non-farm Payrolls for December was 18K versus estimates of 70K and an upwardly revised 115K in November.

- The Unemployment Rate in December rose to 5.0% versus estimates of 4.8% and a reading of 4.7% in November.

- Average Hourly Earnings for November rose .4% versus estimates of a .3% increase and a .4% gain in November.

- ISM Non-Manufacturing for December fell to 53.9 versus estimates of 53.5 and a reading of 54.1 in November.

BOTTOM LINE: Hiring in the

Bull Radar

Style Outperformer:

Large-cap Value(-1.0%)

Sector Outperformers:

HMOs (-.11%), Telecom (-.45%) and Drugs (-.48%)

Stocks Rising on Unusual Volume: