Style Outperformer:

Small-cap Value (+3.53%)

Sector Outperformers:

Homebuilders (+8.38%), Steel (+7.45%) and Banks (+5.79%)

Stocks Rising on Unusual Volume:

KB, STI, CRZO, WFC, CEO, PTR, CHL, CHU, BGFV, LMDIA, JRCC, EBIX, NAFC, GMCR, SOHU, TBSI, ATLS, JRJC, HSIC, DISCA, VLCCF, HSII, NILE, RAIL, AMSC, GTLS, LOGI, EL, EMG, ASF, KND, GMR, FRO and VMC

Stocks With Unusual Call Option Activity:

1) AET 2) BDK 3) CSIQ 4) NIHD 5) ELN

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, May 04, 2009

Bull Radar

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

Chart Toppers

Real-Time Intraday Quote/Chart

HFR Global Hedge Fund Indices

Sunday, May 03, 2009

Monday Watch

Weekend Headlines

Bloomberg:

Wall Street Journal:

- Why Tech Stocks Are on a Tear.

NY Times:

- Fear of Attacks Stokes Armored Car Sales in Brazil.

Forbes.com:

CNNMoney.com:

Politico:

Zero Hedge:

Seeking Alpha:

- Global Crisis? Not for Tech Stocks.

Reuters:

Financial Times:

Die Welt:

- The German economy will continue to contract next year, citing an internal paper by the commission of the European Union, which will be published May 4th. The German economy will shrink 5.6% this year and as much as .3% next year.

Yomiuri:

- Panasonic Corp. raised its monthly output capacity for plasma panels at two plants to 940,000 units as television sales recover in

EE Times:

Weekend Recommendations

Barron's:

- Made positive comments on (SPG), (VNO), (PLD), (KIM), (MORN), (WYNN), (

Night Trading

Asian indices are +1.50% to +3.75% on avg.

S&P 500 futures +.58%.

NASDAQ 100 futures +.61%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Global Commentary

WSJ Intl Markets Performance

Commodity Futures

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (B)/.20

- (OSG)/1.05

- (ASF)/.29

- (S)/-.05

- (DISCA)/.25

- (MCK)/1.14

- (PPS)/.25

- (VMC)/-.08

- (N)/.00

- (MYGN)/.25

- (CGNX)/-.05

- (CHK)/.49

- (MGM)/-.04

- (FST)/.16

- (CKEC)/-.09

- (CNA)/.30

- (SYY)/.39

- (L)/.80

- (TSN)/-.06

- (EL)/.-.05

- (TDW)/1.96

Upcoming Splits

- None of note

Economic Releases

10:00 am EST

- Pending Home Sales for March are estimated unch. versus a 2.1% increase in February.

- Construction Spending for March is estimated to fall 1.7% versus a .9% decline in February.

Other Potential Market Movers

- The Fed’s Hoenig speaking, Fed’s Lacker speaking, (ZMH) shareholders meeting, (RIMM) Capital Markets Day, (SEE) analyst meeting, (AFL) shareholders meeting, (SHLD) shareholders meeting and the (MOT) shareholders meeting could also impact trading today.

BOTTOM LINE: Asian indices are sharply higher, boosted by technology and financial shares in the region. I expect US stocks to open modestly higher and to build on gains into the afternoon, finishing higher. The Portfolio is 75% net long heading into the week.

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are a number of economic reports of note and many significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Pending Home Sales, Construction Spending

Tues. – Weekly retail sales reports, ISM Non-Manufacturing Index

Wed. – Weekly EIA energy inventory report, weekly MBA mortgage applications report, Challenger Job Cuts, ADP Employment Change

Thur. – 1Q Non-farm Productivity, 1Q Unit Labor Costs, Initial Jobless Claims, ICSC Chain Store Sales, Consumer Credit

Fri. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Wholesale Inventories

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Administaff(ASF), Sprint Nextel(S), Mckesson(MCK), Post Properties(PPS), Vulcan Materials(VMC), Chesapeake Energy(CHK), MGM Mirage(MGM), Loews(L), Tyson Foods(TSN), Estee Lauder(EL), Tidewater(TDW)

Tues. – Automatic Data Processing(ADP), Diebold(DBD), St Joe(JOE), Weyerhaeuser(WY), Emerson Electric(EMR), Kraft Foods(KFT), Duke Energy(DUK), Walt Disney(DIS), Centex(CTX), Electronic Atrs(ERTS), Pulte Homes(PHM), CVS Caremark(CVS), Archer-Daniels-Midland(ADM), Las Vegas Sands(LVS), Avon Products(AVP), IntercontinentalExchange(ICE), Wynn Resorts(WYNN)

Wed. – News Corp.(NWS/A), Anadarko Petroleum(APC), Cisco Systems(CSCO), Symantec(SYMC)

Thur. – DR Horton(DHI), Allstate(ALL), Microchip Tech(MCHP), Nvidia(NVDA)

Fri. – Priceline.com(PCLN),

Other events that have market-moving potential this week include:

Mon. – The Fed’s Hoenig speaking, Fed’s Lacker speaking, (ZMH) shareholders meeting, (RIMM) Capital Markets Day, (SEE) analyst meeting, (AFL) shareholders meeting, (SHLD) shareholders meeting, (MOT) shareholders meeting

Tue. – The Fed’s Rosengren speaking, Fed Chairman Bernanke’s testimony on economy, Fed’s Hilton speaking, Fed’s Stern speaking, Fed’s Yellen speaking, (D) shareholders meeting, (BMY) shareholders meeting

Wed. – The Fed’s Stern speaking, Fed’s Yellen speaking, (FWLT) shareholders meeting, (PEP) shareholders meeting, (HOT) shareholders meeting, (GILD) stockholders meeting

Thur. – The Fed’s Evans speaking, Fed’s Bernanke speaking, (POT) shareholders meeting, (VZ) shareholders meeting, (BTU) shareholders meeting

Fri. – The Fed’s Evans speaking, Fed’s Lacker speaking, (AA) shareholders meeting, (GS) shareholders meeting

Friday, May 01, 2009

Weekly Scoreboard*

Indices

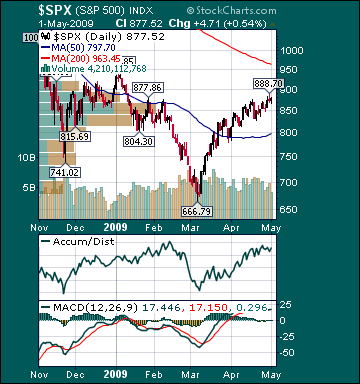

S&P 500 877.52 +1.30%

DJIA 8,212.41 +1.69%

NASDAQ 1,719.20 +1.47%

Russell 2000 486.98 +1.72%

Wilshire 5000 8,916.07 +1.51%

Russell 1000 Growth 389.83 +1.55%

Russell 1000 Value 445.82 +1.25%

Morgan Stanley Consumer 537.53 +2.54%

Morgan Stanley Cyclical 532.55 +3.34%

Morgan Stanley Technology 422.73 +.27%

Transports 3,152.39 +.47%

Utilities 343.03 +4.92%

MSCI Emerging Markets 28.99 +4.19%

Sentiment/Internals

NYSE Cumulative A/D Line 27,504 +12.1%

Bloomberg New Highs-Lows Index -54 +60.29%

Bloomberg Crude Oil % Bulls 35.0 +52.17%

CFTC Oil Large Speculative Longs 174,308 -3.37%

Total Put/Call .77 -4.94%

OEX Put/Call .93 -40.38%

ISE Sentiment 130.0 -2.26%

NYSE Arms 1.26 +20.0%

Volatility(VIX) 35.30 -4.12%

G7 Currency Volatility (VXY) 13.84 -3.28%

Smart Money Flow Index 8,092.97 -.07%

AAII % Bulls 36.09 +13.42%

AAII % Bears 43.61 +12.86%

Futures Spot Prices

Crude Oil 52.77 +2.64%

Reformulated Gasoline 151.0 +4.37%

Natural Gas 3.54 +5.11%

Heating Oil 137.95 -.47%

Gold 885.70 -3.11%

Base Metals 132.56 +3.13%

Copper 211.60 +3.29%

Agriculture 320.63 +5.49%

Economy

10-year US Treasury Yield 3.16% +17 basis points

10-year TIPS Spread 1.40% -10 basis points

TED Spread 86.0 -12 basis points

N. Amer. Investment Grade Credit Default Swap Index 164.65 -7.21%

Emerging Markets Credit Default Swap Index 489.70 -3.17%

Citi US Economic Surprise Index +18.30 -23.11%

Fed Fund Futures imply 88.0% chance of no change, 12.0% chance of 25 basis point cut on 6/24

Iraqi 2028 Govt Bonds 54.34 -.19%

4-Wk MA of Jobless Claims 637,300 -1.7%

Average 30-year Mortgage Rate 4.78% -2 basis points

Weekly Mortgage Applications 960,600 -18.05%

Weekly Retail Sales +.60%

Nationwide Gas $2.05/gallon -.01/gallon

US Cooling Demand Next 7 Days 19.0% above normal

ECRI Weekly Leading Economic Index 107.70 +.47%

US Dollar Index 84.55 -.20%

Baltic Dry Index 1,786.0 -5.85%

CRB Index 229.04 +2.77%

Best Performing Style

Small-cap Growth +2.57%

Worst Performing Style

Small-cap Value +.88%

Leading Sectors

Hospitals +13.03%

Gaming +7.54%

Alternative Energy +6.0%

Networking +5.48%

Utilities +4.92%

Lagging Sectors

Homebuilders -4.16%

Gold -4.32%

REITs -5.56%

Banks -7.0%

Airlines -8.98%