Weekend Headlines

Bloomberg:

Wall Street Journal:

NY Times:

- Russian Reporter Kanev Covers Crime, Defies Threats.

- The Obama administration has made a serious proposal to regulate derivatives — the multitrillion-dollar market in financial contracts that malfunctioned so disastrously last year. The plan goes further than many thought politically possible, especially in its call for federal oversight of all large derivatives dealers. But it does not go far enough. Those dealers — including big banks like JPMorgan Chase, Goldman Sachs and Morgan Stanley — trade derivatives mainly as one-to-one private contracts, largely without any regulation. The plan would allow regulators to impose rules on dealers and track their activities and presumably put a timely halt to abuses. But it does not demand the full transparency that would come from trading all derivatives on exchanges, like stocks.

Business Week:

- A new study says rising Chinese mainland wages and higher shipping costs, among other things, make Mexico a better choice for manufacturing.

Politico:

Rasmussen Reports:

LA Times:

Denverpost.com:

Reuters:

Financial Times:

Telegraph:

Yonhap News:

Nikkei English News:

- Hitachi Ltd., Toshiba Corp. and Fuji Electric Holdings Co. are among a group of Japanese companies expected to build a smart grid in the

Haaretz.com:

Aswat al-Iraq:

-

Al-Hayat

- Saudi King Abdullah urged US President Barack Obama to “impose a solution” to achieve peace in the

Weekend Recommendations

Barron's:

- Made positive comments on (AAPL), (CORE), (CYBS), (VPRT), (EPIQ), (UNG), (HD), (ALL) and (FCX).

- Made negative comments on (AAPL).

Citigroup:

- Reiterated Buy on (ORCL), raised target to $25.

Night Trading

Asian indices are -1.0% to +.50% on avg.

S&P 500 futures -.55%.

NASDAQ 100 futures -.59%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Global Commentary

WSJ Intl Markets Performance

Commodity Futures

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (PLL)/.42

- (ZQK)/.06

Upcoming Splits

- None of note

Economic Releases

- None of note

Other Potential Market Movers

- The Fed’s Tarullo speaking, UBS Tech & Service Conference and the Merrill Lynch Samurai Conference could also impact trading today.

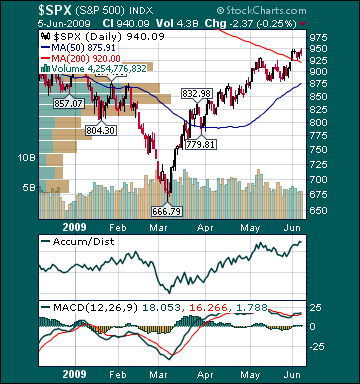

BOTTOM LINE: Asian indices are most lower, weighed down by technology and commodity stocks in the region. I expect US stocks to open mixed and to weaken into the afternoon, finishing modestly lower. The Portfolio is 100% net long heading into the week.