Broad Market Tone: - Advance/Decline Line: Sharply Lower

- Sector Performance: Almost Every Sector Declining

- Volume: Below Average

- Market Leading Stocks: Performing In Line

Equity Investor Angst: - VIX 21.03 +12.88%

- ISE Sentiment Index 61.0 -47.86%

- Total Put/Call 1.08 +24.14%

- NYSE Arms 1.29 +45.53%

Credit Investor Angst:- North American Investment Grade CDS Index 98.08 +4.02%

- European Financial Sector CDS Index 180.21 +7.96%

- Western Europe Sovereign Debt CDS Index 332.25 +1.96%

- Emerging Market CDS Index 265.11 +2.96%

- 2-Year Swap Spread 28.0 +1.0 bp

- TED Spread 42.50 +.25 bp

- 3-Month EUR/USD Cross-Currency Basis Swap -72.75 -5.25 bps

Economic Gauges:- 3-Month T-Bill Yield .08% unch.

- Yield Curve 169.0 -8 bps

- China Import Iron Ore Spot $142.70/Metric Tonne -.07%

- Citi US Economic Surprise Index 73.30 -3.3 points

- 10-Year TIPS Spread 2.22 +3 bps

Overseas Futures: - Nikkei Futures: Indicating -50 open in Japan

- DAX Futures: Indicating -16 open in Germany

Portfolio:

- Slightly Lower: On losses in my Biotech, Tech and Retail sector longs

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges and added to my (EEM) short

- Market Exposure: Moved to 50% Net Long

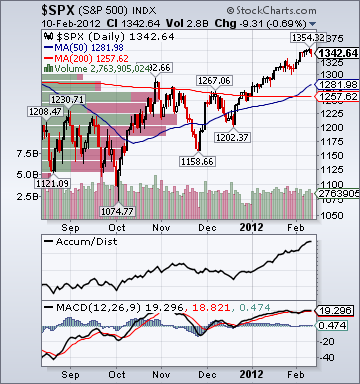

BOTTOM LINE: Today's overall market action is bearish, as the S&P 500 trades near session lows on rising Eurozone debt angst, rising global growth fears, less financial sector optimism, profit-taking, technical selling and more shorting. On the positive side, Networking, Hospital and HMO shares are flat-to-higher on the day. Oil is falling -1.0%, Lumber is gaining +.25%, Gold is down -.55% and the UBS-Bloomberg Ag Spot Index is down -.68%. Oil continues to trade poorly given the stock rally, euro rally, rising interest from speculators, falling euro debt angst, subsiding emerging market hard-landing fears, improving US data and rising Mid-east tensions over the last few weeks. The Portugal sovereign cds is falling -4.6% to 1,141.02 bps. On the negative side, Coal, Alt Energy, Oil Tanker, Steel, Disk Drive, Semi and Homebuliding shares are

under meaningful pressure, falling more than -2.0%. The Financials and Transports continue to underperform

. Copper is falling -3.25%. The Germany sovereign cds is gaining +2.96% to 85.11 bps, the France sovereign cds is gaining +8.65% to 176.67 bps, the Spain sovereign cds is gaining +4.35% to 363.28 bps, the Italy sovereign cds is gaining +6.5% to 393.67 bps, the Japan sovereign cds is jumping +7.2% to 125.96 bps, the Belgium sovereign cds is gaining +3.9% to 224.33 bps, the UK sovereign cds is gaining +3.7% to 75.33 bps and the Brazil sovereign cds is rising +3.0% to 141.17 bps. This is the first meaningful uptick in sovereign cds since the beginning of January.

Lumber is flat since its Dec. 29th high despite the better US economic data, more dovish Fed commentary, improving sentiment towards homebuilders, equity rally and decline in eurozone debt angst. Moreover, the weekly MBA Purchase Applications Index has been around the same level since May 2010. The Baltic Dry Index has plunged over -60.0% from its Oct. 14th high and is now down over -50.0% ytd. The 10Y T-Note Yield is dropping -7 bps to 1.96% today, which remains a concern considering the recent stock rally, falling Eurozone debt angst and improvement in US economic data.

The Philly Fed’s ADS Real-Time Business Conditions Index has stalled over the last month after showing meaningful improvement from mid-Nov. through year-end.

The Western Europe Sovereign CDS Index is still fairly close to its Jan. 9th all-time high. The TED spread, 2Y Euro Swap Spread, 3M Euribor-OIS spread and Libor-OIS spread have improved, but are still at stressed levels. China Iron Ore Spot has plunged -20.0% since Sept. 7th of last year. Shanghai Copper Inventories are up +546.0% ytd to the highest level since March of last year and approaching their April 2010 record.

The -19.0% m/m decline in China copper imports for January likely indicates a meaningful softening in demand rather than intentional hoarding. Copper futures are near session lows on volume. Major Asian indices fell around -.75% overnight, led lower by a -1.1% decline in Hong Kong shares on disappointing China import/export data. Major European indices are falling around -1.25%, led lower by a -1.5% decline in Italian shares. The Bloomberg European Bank/Financial Services Index is dropping -2.4%. Animosity towards Germany is building in Greece. While Greece will very likely succumb to demands, it is highly unlikely they will meet these demands over the intermediate-term.

I still see little evidence to suggest that Europe's debt crisis won't flare up again in an even more intense fashion down the road. The major averages are rallying off the morning lows, as usual, with the tech sector once again providing leadership as one of my longs, market leader Apple(AAPL), hits another new high. I expect the tech sector to continue to provide leadership over the intermediate-term. The financial sector has begun to lag again and I suspect its recent outperformance has run its course. As well, technical action in the Transports is a short-term concern. For an intermediate-term equity advance from current levels, I would still expect to see further European credit gauge improvement, subsiding hard-landing fears in key emerging markets, a rising 10-year yield, better volume, stable-to-lower energy prices and higher-quality stock market leadership. I expect US stocks to trade modestly lower into the close from current levels on rising Eurozone debt angst, rising global growth fears, less financial sector optimism, technical selling, profit-taking and more shorting.