Style Underperformer:

Sector Underperformers:

- 1) Gold & Silver -4.96% 2) Coal -2.03% 3) Steel -1.61%

Stocks Falling on Unusual Volume:

- RYN, PAGP, TWC, DY, WWAV, CMCSA, HYGS, QTWO, CHTR, GOGO, VSAT, MTZ, ERJ, LBTYK, TX, SNI, COMM, UVV, TLLP, CR, KITE, SAGE, EV, MRO, CLMT, NSM, ADTN, RYAM and RYN

Stocks With Unusual Put Option Activity:

- 1) JWN 2) COH 3) PHM 4) DHR 5) M

Stocks With Most Negative News Mentions:

- 1) GM 2) TWTR 3) TWC 4) SFY 5) AEO

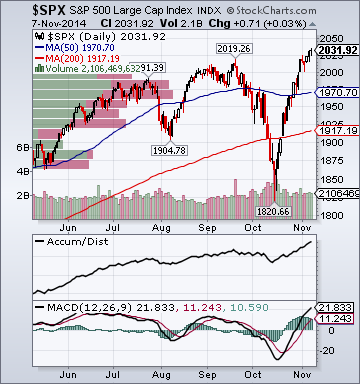

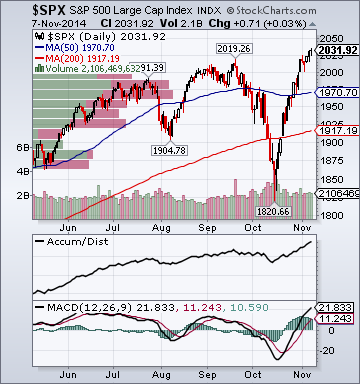

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Hospitals +2.27% 2) Homebuilders +2.07% 3) Road & Rail +1.90%

Stocks Rising on Unusual Volume:

- ACHN, DF, RGLS, WBAI, AOL, JD, DDD, MPAA and ICPT

Stocks With Unusual Call Option Activity:

- 1) LGF 2) BSX 3) PEIX 4) OREX 5) WAG

Stocks With Most Positive News Mentions:

- 1) AEP 2) RIG 3) LMT 4) YHOO 5) IBM

Charts:

Weekend Headlines

Bloomberg:

- Russia Expands Ukraine Military Presence as Rebels Killed. Ukraine

said Russia is expanding its military presence in rebel-held areas as

pro-Russian fighters attacked Ukrainian forces with artillery after as

many as 200 separatists were killed. “The war is not over yet,” Igor

Plotniskiy, the newly-elected head of the self-proclaimed Luhansk

People’s Republic said in video statement televised and posted on the

LPR website.

The LPR wants “maximal integration with Russia,” he said. Ukraine said

yesterday its forces killed the rebels at

Donetsk Airport in the biggest separatist loss since a Sept. 5 truce.

Russia sent tanks and military vehicles across the border into rebel

areas, military spokesman Andriy Lysenko said yesterday. The U.S. State Department and Pentagon, while saying

Russia is massing troops and armor on its side of the border,

said they couldn’t confirm a Russian tank incursion.

- Russia’s Military Encounters Risk Clash in Europe: Report. Russia

is engaged in “dangerous brinkmanship” toward NATO and Nordic nations

in its military moves, with almost 40 incidents of incursions and close

encounters since March, according to a European security research group. The European Leadership Network said the incidents present a “highly disturbing picture” of violations of national

airspace, emergency air-defense scrambles, narrowly avoided mid-air collisions, close encounters at sea and other dangerous

actions on a regular basis over a wide area.

- Catalan Turnout Reaches 2 Million as Mas Defies Rajoy. More than two million Catalans voted

overwhelmingly in favor of leaving Spain yesterday in a ballot

ruled illegal by the Constitutional Court, adding to pressure on

Prime Minister Mariano Rajoy to open talks on a roadmap to

independence. Eighty-one percent of voters, about 1.6 million people,

backed independence, regional vice president Joana Ortega said

early today, with 88 percent of polling stations counted. The

regional government projected overall turnout would be about 2.3

million out of a total electorate of 5.5 million.

- Reported Islamist Plot Against Queen Underscores Security Threat. A

report Queen Elizabeth II was targeted by radical Muslims underscored

today the threat facing Britain, the U.S. and their allies as they seek

to blunt Islamic State’s advance in the Middle East.

Four men arrested yesterday in Britain planned a knife

attack on the U.K. monarch, The Sun said today without

attribution.

- China Regions Show Economies Differ as Slowdown Deepens.

Of China’s 31 provinces and municipalities, 19 recorded a

slowdown, three posted the same pace and nine saw a pickup in

the January-September growth rate from the first half, according

to Bloomberg calculations of data released by the governments or

state media. All are missing their own expansion targets.

- China Factory-Gate Prices Decline for Record 32nd Month: Economy. China’s factory-gate prices fell for

a record 32nd month in October and consumer prices remained

subdued, raising pressure on policymakers to bolster the world’s

second-largest economy as disinflation spreads. The producer-price index dropped 2.2 percent from a year earlier, the National Bureau of Statistics said in Beijing today, compared with the median projection of a 2 percent decline in a survey of analysts by Bloomberg News. Consumer prices (CNCPIYOY) rose 1.6 percent and the rate was unchanged from the

prior month and matched economists’ estimates.

- Mexico Finds Evidence 43 Students Murdered by Drug Gangs.

Forty-three college students

kidnapped by police under orders of a mayor in southern Mexico were

probably killed by a drug gang that tried to destroy all evidence of the

crime, according to investigators. Criminal suspects rounded up in the

probe said police in

Iguala, Guerrero, handed them more than 40 people they had taken

into custody, Mexican Attorney General Jesus Murillosaid in a

news conference in the capital yesterday. The mayor and his wife

are accused of asking drug gangs to help police prevent students

from disrupting a public event held by the wife, Murillo said.

- Central Banks Warn of Possible Bumpy Ride for Markets. Global

central bankers said financial

markets could suffer a bout of turbulence -- again -- when they begin to

withdraw monetary stimulus. Janet Yellen and William C. Dudley of the

Federal Reserve, Mexico’s Agustin Carstens and Bank of England Governor

Mark Carney were among those to use a Paris conference of policy makers

yesterday to talk about potential fallout from the eventual shift from

record-low interest rates used to revive

growth since the global financial crisis in 2008.

- Corn to Soybean Price Forecasts Cut by Morgan Stanley on Supply. Morgan Stanley reduced its price

forecasts for corn, soybeans and wheat because global surpluses

are larger than expected and said rates will probably fall to a level that may curb supplies in high-cost producers like Brazil. The bank cut its estimate for corn to $3.90 a bushel in 2014-2015 from $4.35 in October and for soybeans to $9 a bushel

from $10.10, according to analysts Bennett Meier and Lee Jackson. Wheat was lowered to $5.40 a bushel from $5.75. The

latest forecasts were issued in a report dated yesterday.

- Coldest November Since 2000 Turning Gas Traders Bullish. Hedge funds almost tripled bullish

bets on natural gas as forecasts for frigid weather east of the

Rocky Mountains signaled a surge in demand for the heating fuel. Speculator net-long position across four benchmark

contracts rebounded from the lowest level since March 2012, U.S.

Commodity Futures Trading Commission data show. Short positions,

or bets on falling prices, fell by the most in more than nine

months in the report covering the week ended Nov. 4.

- Macro Funds That Lamented Boring Market Lose in October.

Hedge-fund managers Paul Tudor Jones

and Michael Novogratz said in May that calm markets made it hard

to make money. In October, investors that bet on macro-economic themes

got their desired volatility. By the end of the month, some of the

biggest managers, including Ray Dalio’s Bridgewater Associates LP,

Fortress Investment Group LLC (FIG) and Jones’ Tudor Investment Corp.,

posted losses. The strategy had its worst performance in

more than a year and two smaller firms said they were shutting.

- Paulson Event-Driven Fund Said to Plunge 14% in October. Billionaire

John Paulson posted a 14 percent loss in his firm’s event-driven hedge

fund during October, adding to declines this year, two people with

knowledge of the matter said. The monthly drop left the Paulson Advantage fund down about

25 percent in 2014, said the people, who asked not to be

identified because the information is private. Paulson Credit

Opportunities lost 6.8 percent in October, leaving it down 3.4

percent in 2014.

Wall Street Journal:

- Revenue Softness Worries Stock Investors. Third-Quarter Earnings Reports Show Solid Profits but Also Possible Warning Signs. While profit gains have generally been solid, many blue-chip companies

are posting weak sales growth or outright year-over-year revenue

declines, causing worries about their long-term growth prospects. Others

are reporting earnings increases driven by factors that don’t reflect

sustainable improvements in their business, such as share buybacks and

cost-cutting efforts.

Reuters:

- China Oct trade data shows signs of manipulation, hot money inflows - state newspaper. China's exports and large trade

surplus in October pointed to signs of manipulation and inflows

of speculative hot money, the official Shanghai Securities News

said on Monday, suggesting that firms continue to over-invoice

trade deals to avoid capital controls.

"There are signs that faked trade deals have raised their

head of late," the newspaper said in a report, quoting

economists.

Financial Times:

- European banks’ riskier debt deals nearly double. European

financial institutions have nearly doubled volumes of riskier debt

deals as yield-starved investors are prepared to snap up racier assets

in their struggle to generate a return. Issuance of subordinated debt – which would suffer losses

during a default before senior debt in a bank’s capital hierarchy – have

risen by 80 per cent year on year to $122.4bn so far in 2014 according

to Dealogic, the data provider.

Telegraph:

Welt:

- German Economist Warns Against More European Integration.

Economist Michael Huether of the Cologne Institute for Business Research

says Europe doesn't automatically need to become a federal state,

citing interview. Such a move would impose excessive demands on the

continent. Unrealistic to think that Europe can continually change, he

said. Proposals to create a European finance minister or follow the

Swiss model have no practical relevance since no one in Europe and no

national parliament will accept a financial policy decided on in

Brussels. Says terms and conditions of European club agreed on in 1957

aren't immutable.

Night Trading

- Asian indices are -.25% to +1.25% on average.

- Asia Ex-Japan Investment Grade CDS Index 108.0 +1.0 basis point.

- Asia Pacific Sovereign CDS Index 64.5 +1.0 basis point.

- NASDAQ 100 futures +.18%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

Upcoming Splits

Other Potential Market Movers

- The

Fed's Rosengren speaking, Japan trade data, USDA's WASDE report, 3Y

$26B T-Note auction, RBC Capital Tech/Internet/Media/Telecom Conference,

Labor Market Conditions Index for October, Robert Baird Industrial

Conference, CSFB Healthcare Conference, (LUV) investor day, (HES)

investor day and the (ICPT) investor meeting could

also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by real estate and technology shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing mixed. The Portfolio is 50% net long heading into the week.

Week Ahead by Bloomberg.

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on global

growth worries, Russia/Ukraine tensions, rising European/Emerging

Markets debt angst, technical selling, more shorting and profit-taking.

My intermediate-term trading indicators are giving neutral signals and

the Portfolio is 50% net long heading into the week.

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,173.32 -.02%

- S&P 500 High Beta 34.07 +.18%

- Wilshire 5000 21,124.40 +.60%

- Russell 1000 Growth 948.34 +.41%

- Russell 1000 Value 1,014.83 +.88%

- S&P 500 Consumer Staples 491.08 +2.12%

- Solactive US Cyclical 139.11 +1.42%

- Morgan Stanley Technology 979.45 +.31%

- Transports 8,949.11 +2.21%

- Bloomberg European Bank/Financial Services 103.52 -3.14%

- MSCI Emerging Markets 41.13 -2.46%

- HFRX Equity Hedge 1,174.18 +.75%

- HFRX Equity Market Neutral 984.59 -.04%

Sentiment/Internals

- NYSE Cumulative A/D Line 227,972 +.86%

- Bloomberg New Highs-Lows Index -40 +37

- Bloomberg Crude Oil % Bulls 47.06 +28.33%

- CFTC Oil Net Speculative Position 268,532 +.46%

- CFTC Oil Total Open Interest 1,498,736 +1.52%

- Total Put/Call .95 +25.0%

- OEX Put/Call 1.72 +191.53%

- ISE Sentiment 112.0 +30.23%

- Volatility(VIX) 13.12 -6.49%

- S&P 500 Implied Correlation 41.63 -22.71%

- G7 Currency Volatility (VXY) 8.20 +4.46%

- Emerging Markets Currency Volatility (EM-VXY) 8.52 +10.22%

- Smart Money Flow Index 17,308.36 +.97%

- ICI Money Mkt Mutual Fund Assets $2.634 Trillion +.23%

- ICI US Equity Weekly Net New Cash Flow +$1.120 Billion

Futures Spot Prices

- Reformulated Gasoline 213.52 -.80%

- Bloomberg Base Metals Index 193.60 -1.34%

- US No. 1 Heavy Melt Scrap Steel 341.33 USD/Ton unch.

- China Iron Ore Spot 75.84 USD/Ton -4.71%

- UBS-Bloomberg Agriculture 1,230.44 -1.88%

Economy

- ECRI Weekly Leading Economic Index Growth Rate -1.2% unch.

- Philly Fed ADS Real-Time Business Conditions Index .1899 -3.75%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 127.52 -.05%

- Citi US Economic Surprise Index 15.0 -3.0 points

- Citi Eurozone Economic Surprise Index -32.40 unch.

- Citi Emerging Markets Economic Surprise Index -13.30 +4.0 points

- Fed Fund Futures imply 38.0% chance of no change, 62.0% chance of 25 basis point cut on 12/17

- US Dollar Index 87.64 +.84%

- Euro/Yen Carry Return Index 149.08 +1.49%

- Yield Curve 180.0 -4.0 basis points

- 10-Year US Treasury Yield 2.30% -4.0 basis points

- Federal Reserve's Balance Sheet $4.446 Trillion +.01%

- U.S. Sovereign Debt Credit Default Swap 16.54 -12.27%

- Illinois Municipal Debt Credit Default Swap 170.0 -.94%

- Western Europe Sovereign Debt Credit Default Swap Index 31.89 -1.79%

- Asia Pacific Sovereign Debt Credit Default Swap Index 64.46 +.72%

- Emerging Markets Sovereign Debt CDS Index 235.61 +6.45%

- Israel Sovereign Debt Credit Default Swap 77.50 unch.

- Iraq Sovereign Debt Credit Default Swap 362.47 +2.22%

- Russia Sovereign Debt Credit Default Swap 281.66 +15.2%

- China Blended Corporate Spread Index 323.42 -1.06%

- 10-Year TIPS Spread 1.94% +1.0 basis point

- TED Spread 21.25 -2.0 basis points

- 2-Year Swap Spread 21.75 -.25 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -11.0 -1.75 basis points

- N. America Investment Grade Credit Default Swap Index 65.69 +2.65%

- European Financial Sector Credit Default Swap Index 67.55 +.69%

- Emerging Markets Credit Default Swap Index 269.37 +13.32%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 87.0 +2.0 basis points

- M1 Money Supply $2.848 Trillion -.51%

- Commercial Paper Outstanding 1,073.10 +.80%

- 4-Week Moving Average of Jobless Claims 279,000 -2,000

- Continuing Claims Unemployment Rate 1.8% unch.

- Average 30-Year Mortgage Rate 4.02% +4 basis points

- Weekly Mortgage Applications 376.10 -2.59%

- Bloomberg Consumer Comfort 38.1 +.9 point

- Weekly Retail Sales +4.0% -10 basis points

- Nationwide Gas $2.95/gallon -.05/gallon

- Baltic Dry Index 1,436 +.56%

- China (Export) Containerized Freight Index 1,018.25 unch.

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 30.0 -7.69%

- Rail Freight Carloads 279,819 +.38%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (33)

- SAPE, ANIP, WETF, IMPV, CVD, PPO, RRGB, UVE, BSFT, OPLK, RP, COUP, BLMN, WFM, CALD, KATE, HVB, CLNY, SAM, CEVA, LNKD, COTY, KTWO, AVIV, CTRL, ACAS, NXTM, ZEN, CLDN, BWC, CLI, NTRI and AMRE

Weekly High-Volume Stock Losers (35)

- GNRC, TPX, DGI, THC, TNDM, NCMI, MWIV, PNK, TMH, DISCA, QCOM, TRMB, KELYA, BCOR, CKEC, AWAY, SGM, EPZM, TRIP, TNGO, TESO, TPUB, EPAY, ZU, HLF, CSOD, WAC, WWWW, FNHC, CHUY, SALE, AMRI, RCAP and AEGR

Weekly Charts

ETFs

Stocks

*5-Day Change