Market Snapshot

Detailed Market Summary

Market Internals

Movers & Shakers

IBD New America

NYSE OrderTrac

I-Watch Sector Overview

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Option Dragon

Real-time Intraday Chart/Quote

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Tuesday, April 26, 2005

Tuesday Watch

Late-Night Headlines

Bloomberg:

- Helmut Sohmen, the Hong Kong-based tycoon who controls the world's largest closely held shipping company, said oil tanker rates this year will be below the record reached in 2004 as more ships are launched.

- North Korea said it would regard any sanctions by the UN as an act of war, after Washington said it may take the issue of the communist nation's nuclear program to the UN Security Council.

- US venture-capital investments dropped 7.9% in the first quarter, as funding for biotech companies fell amid declines in biotech stocks and withdrawals of key drugs, a survey found.

Wall Street Journal:

- Microsoft and SAP AG will jointly develop and sell software that combine their two main lines of business products.

Reuters:

- North Korea may conduct a nuclear test by June 15, citing David Kay, a weapons expert who headed the US-led search for banned arms in Iraq.

Financial Times:

- The European Union's probe of Chinese textiles is discriminatory and risks damaging trade relations with China, said Cao Xinyu, vice chairman of the China Chamber of Commerce for Import & Export of Textiles.

- Merrill Lynch is leading a group negotiating with Banca Intesa SpA, to buy over $13 billion of bad loans from Italy's biggest bender by assets.

Late Buy/Sell Recommendations

Goldman Sachs:

- Reiterated Outperform on MSFT, GLK, AMLN, SBC, EBAY, TRI and SII.

- Reiterated Underperform on CR and SIRI.

Night Trading

Asian Indices are -.25% to +.75% on average.

S&P 500 indicated +.01%.

NASDAQ 100 indicated -.10%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

AKS/.54

AFL/.63

AMZN/.23

AXP/.75

BJS/.62

EAT/.57

CME/1.93

COH/.22

GLW/.16

CVTX/-1.61

ESV/.24

ESRX/1.07

HLT/.13

IMCL/.32

INSP/.37

LLL/.82

LXK/1.03

LMT/.75

MHP/.35

MHS/.56

MNST/.17

NTES/.45

OXY/1.99

OMC/.80

PCAR/1.49

SLB/.61

SLE/.31

TROW/.70

WAT/.36

WBSN/.33

Splits

None of note

Economic Releases

10:00 EST:

- Consumer Confidence for April is estimated to fall to 98.0 versus a reading of 102.4 in March.

- New Home Sales for March are estimated to fall to 1190K versus 1226K in February.

Bloomberg:

- Helmut Sohmen, the Hong Kong-based tycoon who controls the world's largest closely held shipping company, said oil tanker rates this year will be below the record reached in 2004 as more ships are launched.

- North Korea said it would regard any sanctions by the UN as an act of war, after Washington said it may take the issue of the communist nation's nuclear program to the UN Security Council.

- US venture-capital investments dropped 7.9% in the first quarter, as funding for biotech companies fell amid declines in biotech stocks and withdrawals of key drugs, a survey found.

Wall Street Journal:

- Microsoft and SAP AG will jointly develop and sell software that combine their two main lines of business products.

Reuters:

- North Korea may conduct a nuclear test by June 15, citing David Kay, a weapons expert who headed the US-led search for banned arms in Iraq.

Financial Times:

- The European Union's probe of Chinese textiles is discriminatory and risks damaging trade relations with China, said Cao Xinyu, vice chairman of the China Chamber of Commerce for Import & Export of Textiles.

- Merrill Lynch is leading a group negotiating with Banca Intesa SpA, to buy over $13 billion of bad loans from Italy's biggest bender by assets.

Late Buy/Sell Recommendations

Goldman Sachs:

- Reiterated Outperform on MSFT, GLK, AMLN, SBC, EBAY, TRI and SII.

- Reiterated Underperform on CR and SIRI.

Night Trading

Asian Indices are -.25% to +.75% on average.

S&P 500 indicated +.01%.

NASDAQ 100 indicated -.10%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

AKS/.54

AFL/.63

AMZN/.23

AXP/.75

BJS/.62

EAT/.57

CME/1.93

COH/.22

GLW/.16

CVTX/-1.61

ESV/.24

ESRX/1.07

HLT/.13

IMCL/.32

INSP/.37

LLL/.82

LXK/1.03

LMT/.75

MHP/.35

MHS/.56

MNST/.17

NTES/.45

OXY/1.99

OMC/.80

PCAR/1.49

SLB/.61

SLE/.31

TROW/.70

WAT/.36

WBSN/.33

Splits

None of note

Economic Releases

10:00 EST:

- Consumer Confidence for April is estimated to fall to 98.0 versus a reading of 102.4 in March.

- New Home Sales for March are estimated to fall to 1190K versus 1226K in February.

BOTTOM LINE: Asian indices are mixed on earnings reports in the region. I expect US equities to open modestly higher in the morning on lower energy prices and positive earnings reports. The Portfolio is 75% net long heading into tomorrow.

Monday, April 25, 2005

Monday Close

Indices

S&P 500 1,162.10 +.87%

DJIA 10,242.47 +.83%

NASDAQ 1,950.78 +.96%

Russell 2000 596.44 +1.17%

DJ Wilshire 5000 11,452.76 +.93%

S&P Barra Growth 562.26 +.80%

S&P Barra Value 595.47 +.93%

Morgan Stanley Consumer 577.20 +.49%

Morgan Stanley Cyclical 713.05 +.85%

Morgan Stanley Technology 443.75 +1.07%

Transports 3,470.80 +.89%

Utilities 369.55 +.87%

Put/Call .79 -14.13%

NYSE Arms .66 -54.09%

Volatility(VIX) 14.62 -4.94%

ISE Sentiment 161.00 +25.78%

US Dollar 83.82 +.38%

CRB 308.68 +.45%

Futures Spot Prices

Crude Oil 54.15 -.77%

Unleaded Gasoline 163.96 -.69%

Natural Gas 7.12 -.45%

Heating Oil 151.00 -.53%

Gold 436.10 +.07%

Base Metals 125.15 -1.0%

Copper 148.20 -.13%

10-year US Treasury Yield 4.24% +.05%

Leading Sectors

Homebuilders +2.19%

Gaming +1.91%

I-Banks +1.83%

Lagging Sectors

Airlines +.19%

Drugs -.03%

Papers -.29%

Evening Review

Detailed Market Summary

Market Gauges

Daily ETF Performance

Style Performance

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

PM Market Call

After-hours Movers

Real-time/After-hours Stock Quote

In Play

Afternoon Recommendations

Goldman Sachs:

- Reiterated Outperform on GD.

- Reiterated Underperform on HBAN.

Afternoon/Evening Headlines

Bloomberg:

- Microsoft named International Paper’s Christopher Liddell as CFO.

- Adelphia Communications, the bankrupt US cable-tv operator, agreed to pay about $715 million to settle a federal fraud case, the Justice Department said.

- A federal grand jury has indicted 14 members of the Chicago Mob for participating in a conspiracy that committed 18 murders, corrupted law enforcement organizations and extorted businesses, prosecutors said today.

- Billionaire Kenneth Langone said John Mack, the former CEO of CSFB, will help lead a potential offer for the NYSE.

- US Senate Democratic leaders said they may be willing to allow Senate votes on some of President Bush’s seven disputed judicial nominees to avoid a showdown that threatens to stymie legislation.

S&P 500 1,162.10 +.87%

DJIA 10,242.47 +.83%

NASDAQ 1,950.78 +.96%

Russell 2000 596.44 +1.17%

DJ Wilshire 5000 11,452.76 +.93%

S&P Barra Growth 562.26 +.80%

S&P Barra Value 595.47 +.93%

Morgan Stanley Consumer 577.20 +.49%

Morgan Stanley Cyclical 713.05 +.85%

Morgan Stanley Technology 443.75 +1.07%

Transports 3,470.80 +.89%

Utilities 369.55 +.87%

Put/Call .79 -14.13%

NYSE Arms .66 -54.09%

Volatility(VIX) 14.62 -4.94%

ISE Sentiment 161.00 +25.78%

US Dollar 83.82 +.38%

CRB 308.68 +.45%

Futures Spot Prices

Crude Oil 54.15 -.77%

Unleaded Gasoline 163.96 -.69%

Natural Gas 7.12 -.45%

Heating Oil 151.00 -.53%

Gold 436.10 +.07%

Base Metals 125.15 -1.0%

Copper 148.20 -.13%

10-year US Treasury Yield 4.24% +.05%

Leading Sectors

Homebuilders +2.19%

Gaming +1.91%

I-Banks +1.83%

Lagging Sectors

Airlines +.19%

Drugs -.03%

Papers -.29%

Evening Review

Detailed Market Summary

Market Gauges

Daily ETF Performance

Style Performance

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

PM Market Call

After-hours Movers

Real-time/After-hours Stock Quote

In Play

Afternoon Recommendations

Goldman Sachs:

- Reiterated Outperform on GD.

- Reiterated Underperform on HBAN.

Afternoon/Evening Headlines

Bloomberg:

- Microsoft named International Paper’s Christopher Liddell as CFO.

- Adelphia Communications, the bankrupt US cable-tv operator, agreed to pay about $715 million to settle a federal fraud case, the Justice Department said.

- A federal grand jury has indicted 14 members of the Chicago Mob for participating in a conspiracy that committed 18 murders, corrupted law enforcement organizations and extorted businesses, prosecutors said today.

- Billionaire Kenneth Langone said John Mack, the former CEO of CSFB, will help lead a potential offer for the NYSE.

- US Senate Democratic leaders said they may be willing to allow Senate votes on some of President Bush’s seven disputed judicial nominees to avoid a showdown that threatens to stymie legislation.

BOTTOM LINE: US stocks finished higher today on merger activity, lower energy prices and a bounce from Friday’s sell-off. The Portfolio finished higher today on gains in my Internet, Homebuilding and Computer longs. I did not trade in the afternoon, thus leaving the Portfolio 75% net long. The tone of the market remained modestly positive into the afternoon as the advance/decline finished modestly higher, almost every sector rose and volume was very light. Measures of investor anxiety were lower. Overall, today’s market action was slightly positive, considering the news. I would like to see stocks rise on better breadth and volume before becoming more optimistic on the near-term.

Mid-day Scoreboard

Indices

S&P 500 1,160.37 +.72%

DJIA 10,231.74 +.73%

NASDAQ 1,945.40 +.68%

Russell 2000 594.11 +.78%

DJ Wilshire 5000 11,433.25 +.76%

S&P Barra Growth 561.50 +.67%

S&P Barra Value 594.68 +.79%

Morgan Stanley Consumer 576.48 +.36%

Morgan Stanley Cyclical 712.10 +.72%

Morgan Stanley Technology 442.37 +.76%

Transports 3,469.94 +.87%

Utilities 368.42 +.57%

Put/Call .78 -15.22%

NYSE Arms .71 -50.82%

Volatility(VIX) 15.05 -2.08%

ISE Sentiment 158.00 +23.44%

US Dollar 83.83 +.41%

CRB 309.61 +.75%

Futures Spot Prices

Crude Oil 55.15 -.43%

Unleaded Gasoline 167.40 +1.31%

Natural Gas 7.25 +.76%

Heating Oil 153.40 -.72%

Gold 435.90 +.07%

Base Metals 125.15 -1.0%

Copper 148.50 +.07%

10-year US Treasury Yield 4.24% unch.

Leading Sectors

Homebuilders +2.17%

I-Banks +1.53%

Gaming +1.48%

Lagging Sectors

Biotech -.13%

Drugs -.19%

Gold & Silver -.38%

S&P 500 1,160.37 +.72%

DJIA 10,231.74 +.73%

NASDAQ 1,945.40 +.68%

Russell 2000 594.11 +.78%

DJ Wilshire 5000 11,433.25 +.76%

S&P Barra Growth 561.50 +.67%

S&P Barra Value 594.68 +.79%

Morgan Stanley Consumer 576.48 +.36%

Morgan Stanley Cyclical 712.10 +.72%

Morgan Stanley Technology 442.37 +.76%

Transports 3,469.94 +.87%

Utilities 368.42 +.57%

Put/Call .78 -15.22%

NYSE Arms .71 -50.82%

Volatility(VIX) 15.05 -2.08%

ISE Sentiment 158.00 +23.44%

US Dollar 83.83 +.41%

CRB 309.61 +.75%

Futures Spot Prices

Crude Oil 55.15 -.43%

Unleaded Gasoline 167.40 +1.31%

Natural Gas 7.25 +.76%

Heating Oil 153.40 -.72%

Gold 435.90 +.07%

Base Metals 125.15 -1.0%

Copper 148.50 +.07%

10-year US Treasury Yield 4.24% unch.

Leading Sectors

Homebuilders +2.17%

I-Banks +1.53%

Gaming +1.48%

Lagging Sectors

Biotech -.13%

Drugs -.19%

Gold & Silver -.38%

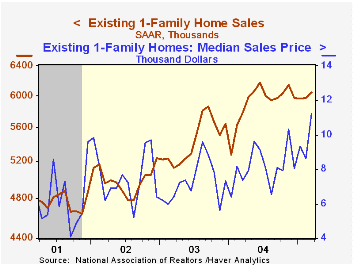

BOTTOM LINE: US stocks are higher mid-day on a bounce after Friday’s sell-off and a strong home sales report. The Portfolio is higher on gains in my Homebuilding, Networking and Internet longs. I exited a few shorts this morning and added a few new homebuilding and tech longs, thus leaving the Portfolio 75% net long. One of my new longs is BZH and I am using a $45 stop-loss on this position. The tone of the market is positive as the advance/decline line is higher, almost every sector is rising and volume is very light. Measures of investor anxiety are lower. Today’s overall market action is modestly positive, considering Friday’s sell-off, stabilizing energy prices, a rising US dollar and merger activity. Banc of America made positive comments on the homebuilders this morning:

1. Inventories of homes for sale decreased 0.2% in March, the first decline since December.

2. Inventories represent just 4.0 months supply, substantially below the six-month level that NAR (National Association of Realtors) says is a balanced market.

3. The months' supply remains just above the record low of 3.8 set in January 2005.

4. February inventories were revised 2.0% lower.

5. Absolute inventories are 3.7% below year-ago levels.

I expect US stocks to trade modestly higher into the close on short-covering, lower energy prices and bargain-hunting.

Subscribe to:

Posts (Atom)