Bloomberg:

- Confidence among US homebuilders fell slightly in December for the first time in three months, however the sales expectations component of the index rose again.

- Statoil ASA’s offer to buy Norsk Hydro ASA’s energy unit and Express Scripts’(ESRX) bid for Caremark Rx(CMX) led more than $75 billion of takeovers announced today, capping a record year for mergers and acquisitions.

- Crude oil fell more than $1/bbl. this morning as warmer-than-normal weather in most of the US curbed heating-fuel consumption and damped near-record speculation by investment funds.

- Natural gas is falling another 4% to the lowest in more than seven weeks in NY as near-record inventories and mild weather curb near-record speculation by investment funds.

- Biomet(BMET) agreed to be acquired for $10.9 billion by a private equity group including Blackstone Group and Goldman Sachs Capital Partners.

- Shaw Group(SGR) shares rose as much as 17% after China selected a team that included the company for the biggest international nuclear reactor contract in history.

- Home Depot(HD) said investor Ralph Whitworth wants independent directors to study “strategic alternatives” and evaluate CEO Nardelli’s performance.

- Apollo Management LP agreed to buy Realogy Corp., the owner of Century 21 and Coldwell Banker real-estate brokers, for $6.6 billion in another sign the US housing slump may have touched bottom.

- Traffickers are increasingly using Venezuela to export illegal drugs to the US, citing William Brownfield, the US ambassador to Venezuela. In the past five years, the volume of illegal drugs shipped to the US after touching Venezuelan soil has soared 1,000% to as much as 300 metric tons a year. Brownfield said Venezuela’s decision to break a drug-control accord with the US Drug Enforcement Administration led to the surge.

- World steel production surged 10% in November to 104.2 million metric tons, led by a 24% jump in China’s production, the International Iron and Steel Institute said.

- “Blood Diamond,” the new Leonardo DiCaprio movie about gems-for-weapons dealing in war-torn Sierra Leone during the 1990s, may hurt Christmas sales of diamonds, according to an author who has written a book about the issue.

- Iraq resumed pumping oil through the Kirkuk pipeline to Turkey last night, adding 300,000 bpd to production.

Wall Street Journal:

- China agreed to let Nasdaq Stock Market(NDAQ) and NYSE Group(NYX) expand their operations in the country.

- US big-truck sales may drop sharply next year because sales in 2006 have been artificially boosted by environmental regulations that will raise prices starting next month.

- Attributor Corp. started testing a system that can scan billions of Internet pages for audio, video, images and text and make it easier to find when copy is being used without authorization.

- Verizon Communications(VZ) and AT&T(T) plan high-speed cable links to Asia to handle the growing volume of intercontinental Internet and telephone traffic.

- Google’s(GOOG) earnings growth may slow as the California-based Internet-search service’s interest income drops.

- News Corp.(NWS) will say today that it’s starting a service to enable customers of Cingular Wireless LLC to view its MySpace social-networking site on their mobile phones.

NY Times:

- NBC Universal, News Corp., Viacom Inc. and possibly CBS Corp. are close to announcing a venture that would rival Google’s(GOOG) YouTube in distributing videos on the Internet.

- Air America, Piquant LLC’s bankrupt liberal talk radio network, has received a bid from a group including two original investors and an unidentified media partner.

- Comcast Corp.(CMCSK) is testing a program to supply films on demand when they’re released in DVD format.

Financial Times:

- Sony Corp.(SNE) plans to start a video downloading service for its PlayStation Portable in the first quarter of 2007, challenging Apple Computer’s(AAPL) i-Tunes downloading service for its iPod player.

Les Echos:

- The “rapid” rise of the euro is “bad for the economy,” French Finance Minister Thierry Breton said.

Containerisation International:

- The world’s shipping lines charged less to move containers in the three months ended September, as new vessels entering the fleet boosted capacity.

Donews.com:

- EBay(EBAY) will announce a merger of its China Web site with Tom Online this week.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, December 18, 2006

Current Account Deficit Widens Modestly

- The Current Account Deficit for 3Q widened to -$225.6 billion versus estimates of -$225.0 billion and -$217.1 billion in 2Q.

BOTTOM LINE: The US current-account deficit widened to $225.6 billion last quarter as the trade gap grew and the country paid more interest to overseas investors, Bloomberg reported. The US needs to attract about $2.5 billion a day to fund the deficit, which has not been a problem. International investment in long-term securities rose again in October as stocks climbed and demand for US Treasuries surged. US investors received less income on their holdings of international investments which helped widen the deficit. I expect the current account deficit to only improve modestly over the intermediate-term as the US dollar firms and overseas economic growth slows relative to US growth.

Sunday, December 17, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- US stocks rose last week, lifting the DJIA to a record, after reports showed inflation receded last month and earnings from companies such as Bear Stearns beat analysts’ estimates.

- European Central Bank President Jean-Claude Trichet told a newspaper that he shares the opinion of the US Federal Reserve that the US economy is showing only “slight” signs of weakness.

- Metals evoke bear market as production gains, hedge funds sell. At the Pacorini Group warehouses in New Orleans, the 15,000 metric tons of copper that have accumulated since September are enough to wire about 7 million refrigerators and make every short-seller salivate.

- Prime Minister Tony Blair said the UK will go “all the way” in its support for the elected government of Iraq, suggesting UK forces stationed in the southern province of Basra may stay beyond mid-2007.

- Natural gas in NY may fall because mild weather so far this winter has crimped demand for the furnace fuel and left inventories near record highs.

- China, the US, Japan, South Korea and India, which account for almost half of global energy use, will cooperate on energy conservation and stable oil supplies, China said as the five gathered for a summit. “We want to send a message to the world that the biggest oil consumers will be pushing ahead with energy saving, increasing energy efficiency,” Ma Kai, head of China’s top economic planning body, said in Beijing.

- China picked Toshiba’s Westinghouse Electric for the biggest international nuclear reactor contract in history, trumping Areva SA for a project worth about $5.3 billion.

- The US dollar posted the biggest weekly advance against the yen since August as reports showing US retail sales rebounded and jobless claims fell allayed concern the world’s biggest economy is losing momentum.

- President Bush, calling on the new Democratic-controlled Congress to restrain spending, said his administration will propose ways to curb wasteful government programs known as “earmarks.”

- The withdrawal of foreign forces from Iraq won’t be “sudden,” Prime Minister Nuri al-Maliki said, as UK Prime Minister Tony Blair pledged continuing support tot eh establishment of democracy and stability in the nation.

- Taiwan stocks, laggards in Asias since 2001, may catch up with markets elsewhere in the region next year as new products spur demand for video-game consoles, computers and semiconductors.

- France will withdraw 200 members of its special forces deployed in Afghanistan, French Defense Minister Alliot-Marie said. After initially operating in the south of the country, they were later deployed around Jalalabad, the largest city in the east, where clashes with Taliban fighters have accelerated.

- Time Warner’s(TWX) Time magazine named Internet users behind the self-made content on sites such as YouTube and MySpace.com as its “Person of the Year,” reflecting the Web’s “digital democracy.”

- Homeowners may give he biggest Treasury rally in four years a boost as falling bond yields trigger a rush to refinance mortgages and increase demand for government debt.

Wall Street Journal:

- Washington Mutual(WM) has slowed the pace of expansion after failing to gain share in fast-growing new markets.

- The 2002 Sarbanes-Oxley Act, an anti-fraud law, is costly to the US economy and unconstitutional, Pepperdine University School of Law Dean Ken Starr wrote.

- Apollo Management LP and Texas Pacific Group are expected to win the auction for Harrah’s Entertainment(HET) with their offer of at least $909 a share.

Fortune:

- How an Apple iPhone could rock wireless.

NY Times:

- Sprint Nextel Corp.(S) CEO Forsee said the mobile-phone company may work with cable operators to provide wireless products.

- Credit Suisse Group, Deutsche Bank AG, hedge funds and billionaire Warren Buffett are spending billions of dollars to buy life insurance policies from older people.

Washington Post:

- Democrats taking over the leadership of Senate and House committees are poised to launch investigations into the conduct of the war with Iraq and allegations of prisoner abuse.

- Democratic Senator Barack Obama called his purchase of land from indicted campaign contributor Antoin Rezko a “boneheaded” mistake.

Philadelphia Inquirer:

- The Pennsylvania Gaming Control Board is expected to pick the two companies that will hold licenses to run slot machines in Philadelphia on Dec. 20.

AP:

- The Wall Street Journal tomorrow plans to announce the creation of a free, stock market tracker on the paper’s Web site.

LA Times:

- Syntroleum’s(SYNM) alternative jet fuel will face cold-weather test and trials with US Air Force refueling tankers after successful runs in B-52 engines. The fuel, which has been tested on B-52 planes over the last year, is a 50-50 mix of oil-based jet fuel and a synthetic liquid made from natural gas, and could replace traditional jet fuel in military and commercial planes.

Financial Times:

- Skype Technologies SA’s founders plan to start an on-line broadband television service that allows users to personalize their content.

Daily Telegraph:

- British Airways Plc CEO Walsh wants some of the UK air passenger tax to go to renew able energy projects.

London-based Times:

- Tesco Plc plans to convert al of its 2,000 distribution trucks to use a fuel that is partly made from agricultural products, citing Tesco’s CEO.

Economic Daily News:

- Asustek Computer targets sales of $23 billion in 2007, about 40% higher than this year.

Shanghai Securities News:

- China is implementing more controls of fixed-asset investment by centrally supervising the investment budgets of all state-owned enterprises for the first time.

- China’s inflation may stay at around 1.5% this year.

Weekend Recommendations

Barron's:

- Made positive comments on (COP), (NFX) and (OVEN).

- Made negative comments on (NYB) and (HLYS).

Citigroup:

- The National Retail Federation is now projecting total retail sales to increase 5% during this holiday season versus a 10-year average of a 4.6% gain.

Night Trading

Asian indices are +.25% to +.1.0% on average.

S&P 500 indicated +.05%

NASDAQ 100 indicated -.01%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CAO)/.15

- (HOV)/1.05

- (JOYG)/.66

- (ORCL)/.22

- (SCS)/.19

Upcoming Splits

- (AEOS) 3-for2

Economic Releases

8:30 am EST

- 3Q Current Account Deficit is estimated to widen to -$225.0 billion versus -$218.4 billion in 2Q.

1:00 pm EST

- The NAHB Housing Market Index for December is estimated to rise to 34 versus 33 in November.

Bloomberg:

- US stocks rose last week, lifting the DJIA to a record, after reports showed inflation receded last month and earnings from companies such as Bear Stearns beat analysts’ estimates.

- European Central Bank President Jean-Claude Trichet told a newspaper that he shares the opinion of the US Federal Reserve that the US economy is showing only “slight” signs of weakness.

- Metals evoke bear market as production gains, hedge funds sell. At the Pacorini Group warehouses in New Orleans, the 15,000 metric tons of copper that have accumulated since September are enough to wire about 7 million refrigerators and make every short-seller salivate.

- Prime Minister Tony Blair said the UK will go “all the way” in its support for the elected government of Iraq, suggesting UK forces stationed in the southern province of Basra may stay beyond mid-2007.

- Natural gas in NY may fall because mild weather so far this winter has crimped demand for the furnace fuel and left inventories near record highs.

- China, the US, Japan, South Korea and India, which account for almost half of global energy use, will cooperate on energy conservation and stable oil supplies, China said as the five gathered for a summit. “We want to send a message to the world that the biggest oil consumers will be pushing ahead with energy saving, increasing energy efficiency,” Ma Kai, head of China’s top economic planning body, said in Beijing.

- China picked Toshiba’s Westinghouse Electric for the biggest international nuclear reactor contract in history, trumping Areva SA for a project worth about $5.3 billion.

- The US dollar posted the biggest weekly advance against the yen since August as reports showing US retail sales rebounded and jobless claims fell allayed concern the world’s biggest economy is losing momentum.

- President Bush, calling on the new Democratic-controlled Congress to restrain spending, said his administration will propose ways to curb wasteful government programs known as “earmarks.”

- The withdrawal of foreign forces from Iraq won’t be “sudden,” Prime Minister Nuri al-Maliki said, as UK Prime Minister Tony Blair pledged continuing support tot eh establishment of democracy and stability in the nation.

- Taiwan stocks, laggards in Asias since 2001, may catch up with markets elsewhere in the region next year as new products spur demand for video-game consoles, computers and semiconductors.

- France will withdraw 200 members of its special forces deployed in Afghanistan, French Defense Minister Alliot-Marie said. After initially operating in the south of the country, they were later deployed around Jalalabad, the largest city in the east, where clashes with Taliban fighters have accelerated.

- Time Warner’s(TWX) Time magazine named Internet users behind the self-made content on sites such as YouTube and MySpace.com as its “Person of the Year,” reflecting the Web’s “digital democracy.”

- Homeowners may give he biggest Treasury rally in four years a boost as falling bond yields trigger a rush to refinance mortgages and increase demand for government debt.

Wall Street Journal:

- Washington Mutual(WM) has slowed the pace of expansion after failing to gain share in fast-growing new markets.

- The 2002 Sarbanes-Oxley Act, an anti-fraud law, is costly to the US economy and unconstitutional, Pepperdine University School of Law Dean Ken Starr wrote.

- Apollo Management LP and Texas Pacific Group are expected to win the auction for Harrah’s Entertainment(HET) with their offer of at least $909 a share.

Fortune:

- How an Apple iPhone could rock wireless.

NY Times:

- Sprint Nextel Corp.(S) CEO Forsee said the mobile-phone company may work with cable operators to provide wireless products.

- Credit Suisse Group, Deutsche Bank AG, hedge funds and billionaire Warren Buffett are spending billions of dollars to buy life insurance policies from older people.

Washington Post:

- Democrats taking over the leadership of Senate and House committees are poised to launch investigations into the conduct of the war with Iraq and allegations of prisoner abuse.

- Democratic Senator Barack Obama called his purchase of land from indicted campaign contributor Antoin Rezko a “boneheaded” mistake.

Philadelphia Inquirer:

- The Pennsylvania Gaming Control Board is expected to pick the two companies that will hold licenses to run slot machines in Philadelphia on Dec. 20.

AP:

- The Wall Street Journal tomorrow plans to announce the creation of a free, stock market tracker on the paper’s Web site.

LA Times:

- Syntroleum’s(SYNM) alternative jet fuel will face cold-weather test and trials with US Air Force refueling tankers after successful runs in B-52 engines. The fuel, which has been tested on B-52 planes over the last year, is a 50-50 mix of oil-based jet fuel and a synthetic liquid made from natural gas, and could replace traditional jet fuel in military and commercial planes.

Financial Times:

- Skype Technologies SA’s founders plan to start an on-line broadband television service that allows users to personalize their content.

Daily Telegraph:

- British Airways Plc CEO Walsh wants some of the UK air passenger tax to go to renew able energy projects.

London-based Times:

- Tesco Plc plans to convert al of its 2,000 distribution trucks to use a fuel that is partly made from agricultural products, citing Tesco’s CEO.

Economic Daily News:

- Asustek Computer targets sales of $23 billion in 2007, about 40% higher than this year.

Shanghai Securities News:

- China is implementing more controls of fixed-asset investment by centrally supervising the investment budgets of all state-owned enterprises for the first time.

- China’s inflation may stay at around 1.5% this year.

Weekend Recommendations

Barron's:

- Made positive comments on (COP), (NFX) and (OVEN).

- Made negative comments on (NYB) and (HLYS).

Citigroup:

- The National Retail Federation is now projecting total retail sales to increase 5% during this holiday season versus a 10-year average of a 4.6% gain.

Night Trading

Asian indices are +.25% to +.1.0% on average.

S&P 500 indicated +.05%

NASDAQ 100 indicated -.01%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CAO)/.15

- (HOV)/1.05

- (JOYG)/.66

- (ORCL)/.22

- (SCS)/.19

Upcoming Splits

- (AEOS) 3-for2

Economic Releases

8:30 am EST

- 3Q Current Account Deficit is estimated to widen to -$225.0 billion versus -$218.4 billion in 2Q.

1:00 pm EST

- The NAHB Housing Market Index for December is estimated to rise to 34 versus 33 in November.

BOTTOM LINE: Asian Indices are higher, boosted by automaker and technology shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are a number of economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - 3Q Current Account Balance, NAHB Housing Market Index

Tues. - Producer Price Index, Housing Starts, Building Permits

Wed. - MBA Mortgage Applications

Thur. - Final 3Q GDP, Final 3Q GDP Price Index, Final 3Q Personal Consumption, Final 3Q Core PCE, Initial Jobless Claims, Leading Indicators, Philadelphia Fed.

Fri. - Personal Income, Personal Spending, PCE Deflator, Durable Goods Orders, Final Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - CSK Auto(CAO), Hovnanian Enterprises(HOV), Joy Global(JOYG), Oracle Corp.(ORCL), Steelcase(SCS)

Tues. - Chaparral Steel(CHAP), Christopher & Banks(CBK), Cintas(CTAS), Circuit City(CC), Darden Restaurants(DRI), Factset Research(FDS), FuelCell Energy(FCEL), Lennar Corp.(LEN), Morgan Stanley(MS), Palm Inc.(PALM), Scholastic Corp.(SCHL)

Wed. - 3Com Corp.(COMS), Accenture Ltd(ACN), Actuant Corp.(ATU), Bed, Bath & Beyond(BBBY), Biomet(BMET), Carmax(KMX), Family Dollar(FDO), FedEx Corp.(FDX), Finish Line(FINL), Herman Miller(MLHR), Nike Inc.(NKE), Paychex(PAYX)

Thur. - AG Edwards(AGE), American Greeting(AM), Carnival Corp.(CCL), Commercial Metal(CMC), ConAgra Foods(CAG), General Mills(IS), Micron Tech(MU), Red Hat(RHAT), Resources Connection(RECN), Rite Aid(RAD), Shuffle Master(SHFL), Solectron(SLR), Worthington Industries(WOR)

Fri. - None of note

Other events that have market-moving potential this week include:

Mon. - None of note

Tue. - None of note

Wed. - None of note

Thur. - The Fed’s Lacker speaks

Fri. - None of note

There are a number of economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - 3Q Current Account Balance, NAHB Housing Market Index

Tues. - Producer Price Index, Housing Starts, Building Permits

Wed. - MBA Mortgage Applications

Thur. - Final 3Q GDP, Final 3Q GDP Price Index, Final 3Q Personal Consumption, Final 3Q Core PCE, Initial Jobless Claims, Leading Indicators, Philadelphia Fed.

Fri. - Personal Income, Personal Spending, PCE Deflator, Durable Goods Orders, Final Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - CSK Auto(CAO), Hovnanian Enterprises(HOV), Joy Global(JOYG), Oracle Corp.(ORCL), Steelcase(SCS)

Tues. - Chaparral Steel(CHAP), Christopher & Banks(CBK), Cintas(CTAS), Circuit City(CC), Darden Restaurants(DRI), Factset Research(FDS), FuelCell Energy(FCEL), Lennar Corp.(LEN), Morgan Stanley(MS), Palm Inc.(PALM), Scholastic Corp.(SCHL)

Wed. - 3Com Corp.(COMS), Accenture Ltd(ACN), Actuant Corp.(ATU), Bed, Bath & Beyond(BBBY), Biomet(BMET), Carmax(KMX), Family Dollar(FDO), FedEx Corp.(FDX), Finish Line(FINL), Herman Miller(MLHR), Nike Inc.(NKE), Paychex(PAYX)

Thur. - AG Edwards(AGE), American Greeting(AM), Carnival Corp.(CCL), Commercial Metal(CMC), ConAgra Foods(CAG), General Mills(IS), Micron Tech(MU), Red Hat(RHAT), Resources Connection(RECN), Rite Aid(RAD), Shuffle Master(SHFL), Solectron(SLR), Worthington Industries(WOR)

Fri. - None of note

Other events that have market-moving potential this week include:

Mon. - None of note

Tue. - None of note

Wed. - None of note

Thur. - The Fed’s Lacker speaks

Fri. - None of note

BOTTOM LINE: I expect US stocks to finish the week modestly higher on mostly positive economic data, lower energy prices, seasonal strength, strong corporate profits, bargain-hunting, investment manager performance anxiety and short-covering. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.

Saturday, December 16, 2006

Market Week in Review

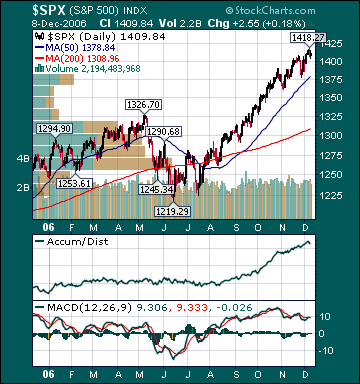

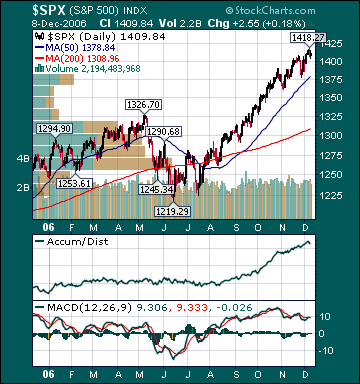

S&P 500 1,427.09 +1.22%

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was bullish. The advance/decline line rose, almost every sector gained and volume was above average on the week. Measures of investor anxiety were mostly lower. The AAII percentage of Bulls rose to 41.33% this week from 38.94% the prior week. This reading is still below above-average levels. The AAII percentage of Bears fell to 38.0% this week from 41.59% the prior week. This reading is still well above average levels. The 10-week moving average of the percentage of Bears is currently 36.1%, an above-average level. The 10-week moving average of the percentage of Bears was 43.0% at the major bear market low during 2002. Moreover, the 50-week moving average of the percentage of Bears is 36.50%, a very high level seen during only two other periods in U.S. history.

I continue to believe steadfastly high bearish sentiment in many quarters is mind-boggling, considering the S&P 500's 17.7% rise in less than six months, one of the best August/September/October runs in U.S. history, the fact that the Dow made another all-time high today and that we are in the early stages of what is historically a very strong period for U.S. stocks after a mid-term election. Despite recent gains, the forward P/E on the S&P 500 is a very reasonable 16.2 due to the historic run of double-digit profit growth increases, which are poised to continue this quarter. Bears still remain stunningly complacent, in my opinion. As I have said many times over the last few months, every pullback is seen as a major top and every move higher is just another shorting/selling opportunity.

As well, there are many other indicators registering high levels of investor skepticism regarding recent stock market gains. The 50-day moving average of the ISE Sentiment Index just recently crossed above the 200-day moving average for the first time since November 2005. Nasdaq and NYSE short interests are just off record highs. Moreover, public short interest continues to soar to records, and U.S. stock mutual funds have seen outflows for most of the year, according to AMG Data Services. Finally, investment blogger bullish sentiment just hit another new low. There is still a high wall of worry for stocks to climb substantially from current levels as the public remains very skeptical of this bull market.

I continue to believe this is a direct result of the strong belief by the herd that the U.S. is in a long-term trading range or secular bear environment. There is still overwhelming evidence that investment sentiment by the general public regarding U.S. stocks has never been this poor in history, with the Dow registering all-time highs almost weekly. I still expect the herd to finally embrace the current bull market next year, which should result in another meaningful move higher in the major averages as the S&P 500 breaks out to an all-time high to join the Dow and Russell 2000. I continue to believe the coming bullish shift in long-term sentiment with respect to U.S. stocks will result in the "mother of all short-covering rallies."

The average 30-year mortgage rate rose 1 basis point to 6.12%, which is 68 basis points below July highs. I still believe housing is in the process of stabilizing at relatively high levels. Former Fed Chairman Alan Greenspan, current Fed Chairman Ben Bernanke and several current Fed members reiterated there belief recently that the “worst may well be over” for the housing slowdown. Mortgage applications surged 11.4% this week and continue to trend higher with the decline in mortgage rates. This is the second time in less than three months that mortgage applications have seen weekly double-digit percentage gains. The last time this happened was mid-2004. Moreover, the Mortgage Bankers Association said this week that the US housing market will “fully regain its footing” by the middle of 2007.

As well, housing inventories have been trending lower and homebuilding equities have been moving higher. The Housing Index(HGX) has risen 25.4% from July lows. The Case-Schiller housing futures have improved recently and are now projecting a 2.9% decline in the average home price over the next 6 months, up from projections of a 5.2% decline a couple of months ago. Considering the median house has appreciated over 50% during the last few years with record high US home ownership, this would be considered a “soft landing.” The overall negative effects of housing on the US economy and the potential for significant price drops are still being exaggerated by the bears in hopes of dissuading buyers from stepping in, in my opinion. Housing and home equity extractions have been slowing substantially for well over a year and have been mostly offset by many other very positive aspects of the US economy.

Home values are more important than stock prices to the average American, but the median home has barely declined in value after a record run-up, while the S&P 500 has risen 14.8% over the last year and 92.4% since the Oct. 4, 2002 low. Americans’ median net worth is still very close to or at record high levels, a fact that is generally unrecognized or minimized by the record number of market participants that feel it is in their financial and/or political interests to paint a bleak picture of America. Moreover, energy prices are down significantly, consumer spending remains healthy, unemployment is low by historic standards, interest rates are very low, inflation is below average rates, stocks are surging and wages are rising. The economy has created 644,000 jobs in the last four months. Challenger, Gray & Christmas reported recently that November job cuts were 22.7% lower than year-ago levels. As well, the Monster Employment Index hit another record high in November. The unemployment rate is a historically low 4.5%, down from 5.1% in September 2005, notwithstanding fewer real estate-related jobs and significant auto production cutbacks. Retail Sales ex autos for November rose the most since January. Consumer spending is still above long-term average levels and looks poised to remain healthy over the intermediate-term.

The Consumer Price Index for November rose 2.0% year-over-year, down from a 4.7% increase in September of 2005. This is substantially below the long-term average of around 3%. Moreover, the CPI has only been lower during 4 other periods since the mid-1960s. Many other measures of inflation have recently shown substantial deceleration. The Producer Price Index for October matched the largest decline in US history, falling 1.6% year-over-year. Most measures of Americans’ income growth are now more than twice the rate of inflation.

The benchmark 10-year T-note yield rose 4 basis points on the week on stronger economic data and diminishing recession worries. In my opinion, investors’ continuing fears over an economic “hard landing” are still misplaced, notwithstanding recent weak manufacturing data. Moreover, the ISM’s semi-annual forecast was released this week and gave an upbeat assessment expected manufacturing activity next year. The ISM Non-Manufacturing Index, which accounts for the vast majority of U.S. economic growth, rose to a very healthy 58.9 in November. Manufacturing accounts for roughly 12% of US economic growth, while consumer spending accounts for about 70% of growth. U.S. GDP growth came in at 1.1% and 0.7% during the first two quarters of 1995. The ISM Manufacturing Index fell below 50, which signals a contraction in activity, during May 1995. It stayed below 50, reaching a low of 45.5, until August 1996. During that period, the S&P 500 soared 31% as the P/E multiple expanded from 16.0 to 17.2. This was well before the stock market bubble began to inflate. As well, manufacturing was more important to US growth at that time. Stocks can and will rise as P/E multiples expand, even with more average economic and earnings growth. As I have said many times before, P/E multiple expansion is the bears' worst nightmare.

Weekly retail sales rose an above-average 3.2% for the week. Spending is poised to remain strong on lower energy prices, very low long-term interest rates, a rising stock market, healthy job market, decelerating inflation and more optimism. The current conditions component of the December Univ. of Mich. Consumer Confidence Index, which gauges whether or not consumers feel it is a good time to buy big-ticket items, rose to its highest level since March ahead of the holidays.

The CRB Commodities Index, the main source of inflation fears, has declined 4.65% over the last 12 months and is down 14.2% from May highs despite a historic flood of capital into commodity funds and numerous potential upside catalysts. Oil has declined $15/bbl from July highs. The average commodity hedge fund is down substantially for the year. I continue to believe inflation fears have peaked for this cycle as global economic growth stabilizes around average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies fell more than expectations as refinery utilization fell. U.S. gasoline supplies are still at high levels for this time of the year. Gasoline futures fell for the week and have plunged 41.4% from September 2005 highs even as some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. Gasoline demand is estimated to rise .8% this year versus a 20-year average of 1.7% demand growth. The still very elevated level of gas prices, related to crude oil production disruption speculation by investment funds, will further dampen global fuel demand, sending gas prices still lower over the intermediate-term.

US oil inventories are still near 7-year highs. Since December 2003, global oil demand is only up .7%, despite booming global growth, while global supplies have increased 6.3%, according to the Energy Intelligence Group. OPEC said recently that crude oil supply would exceed demand by 100 million barrels by the second quarter of next year. Moreover, worldwide oil inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. The Amaranth Advisors hedge fund blow-up is a prime example of the extent to which many investment funds have been speculating on ever higher energy prices through futures contracts, thus driving the price of the underlying commodity to absurd levels. Amaranth, a multi-strategy hedge fund, lost about $6.5 billion of its $9.5 billion under management in less than two months speculating mostly on higher natural gas prices. I continue to believe a number of other funds will experience similar fates over the coming months after managers “press their bets” in hopes of making up for poor performance, which will further pressure energy prices as these funds unwind their leveraged long positions to meet investor redemptions.

Recently, Cambridge Energy Research, one of the most respected energy research firms in the world, put out a report that drills gaping holes in the belief by most investors of imminent "peak oil" production. Cambridge said that its analysis indicates that the remaining global oil base is actually 3.74 trillion barrels, three times greater than "peak oil" theory proponents say and that the "peak oil" theory is based on faulty analysis. I suspect the contango that currently exists in energy futures, which encourages hoarding, will begin to reverse over the coming months as more investors come to the realization that the "peak oil" theory is hugely flawed, global storage fills, and Chinese/US demand slows.

A major top in oil is likely already in place as global crude oil storage capacity utilization is running around 97%. Recent OPEC production cuts will likely result in a complete technical breakdown in crude. Demand destruction is already pervasive globally and will only intensify over the coming years as alternative energy projects come to the fore. Moreover, many Americans feel as though they are helping fund terrorism or hurting the environment every time they fill up their gas tanks. I do not believe we will ever again see the demand for gas-guzzling vehicles that we saw in recent years, even if gas prices plunge from current levels, as I expect. OPEC production cuts, with oil still at very high levels and weakening global growth, only further deepens resentment towards the cartel and will result in even greater long-term demand destruction. Finally, as the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should continue heading meaningfully lower over the intermediate-term, notwithstanding OPEC production cuts. Oil will likely begin another significant downturn before year-end. Finally, I suspect crude will eventually fall to levels that most investors deemed unimaginable just a few months ago during the next significant global economic downturn.

Natural gas inventories fell more than expectations this week. However, prices for the commodity declined as record investment fund speculation continues to subside with supplies now 7.5% above the 5-year average and near all-time high levels for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have collapsed 53.0% since December 2005 highs.

Gold fell again on the week as the US dollar rose. Gold, natural gas and copper all look both fundamentally and technically weak. The US dollar gained on stronger economic data and short-covering. I continue to believe there is very little chance of another Fed rate hike anytime soon. An eventual cut is likely next year as inflation continues to decelerate substantially. A Fed rate cut should actually boost the dollar as currency speculators anticipate faster US growth. Moreover, this month’s net long-term TIC flows report showed foreign investors’ demand for US securities remains very strong.

Paper stocks outperformed for the week on investment bank upgrades. Steel stocks underperformed as fundamentals continue to weaken for the group and buyout speculation subsides. S&P 500 profit growth for the third quarter came in around 20% versus a long-term historical average of 7%, according to Thomson Financial. This marks the 17th straight quarter of double-digit profit growth, the best streak since recording keeping began in 1936. Moreover, another double-digit gain is likely in the fourth quarter. Just a few months ago many investors expected profit growth to fall to the low single digits this year. Despite an 92.4% total return(which is equivalent to a 16.9% average annual return) for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 16.2. The 20-year average p/e for the S&P 500 is 24.4. The S&P 500 is now up 16.4% and the Russell 2000 Index is up 19.1% year-to-date. Historically, if the S&P 500 is up at least 10% going into the final two months of the year, which it was, it continues to climb the last two months 84% of the time.

Current stock prices are still providing longer-term investors very attractive opportunities, in my opinion. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A CSFB report earlier this year confirmed this view. The report concluded that on a price-to-cash flow basis growth stocks are cheaper than value stocks for the first time since at least 1977. The entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is attributable to growth stock multiple contraction. I still expect the most overvalued economically sensitive and emerging market stocks to continue underperforming over the intermediate-term as the manias for those shares subside and global growth slows to more average rates. I continue to believe a chain reaction of events has begun that will result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels, notwithstanding recent gains. One of the characteristics of the current “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated, trumpeted and promptly priced in to stock prices. Furthermore, this “irrational pessimism” by investors has resulted in a dramatic decrease in the supply of stock this year as companies bought back shares, IPOs were pulled and secondary stock offerings canceled. Booming merger and acquisition activity is also greatly constricting the supply of stock. Many commodity funds, which have received huge capital infusions this year, will likely see significant outflows at year-end. Some of this capital will likely find its way back to US stocks. As well, money market funds are brimming with cash. I continue to believe there is massive bull firepower available on the sidelines for US equities at a time when the supply of stock has contracted.

Rising optimism for a Fed rate cut, a stronger US dollar, lower commodity prices, seasonal strength, decelerating inflation readings, a strong holiday shopping season, lower long-term rates, increased consumer/investor confidence, short-covering, investment manager performance anxiety, rising demand for US stocks and the realization that economic growth is only slowing to around average levels should provide the catalysts for another substantial push higher in the major averages over the intermediate-term as p/e multiples expand further. The S&P 500 has now met my early year prediction of a 15% total return for the year. However, further gains are possible through year-end even as the bears and many bulls continue to position for an imminent pullback after recent sharp gains. Another strong performance by US equities is likely next year. Finally, the ECRI Weekly Leading Index surged this week to new cycle highs and is forecasting a modest acceleration in US economic activity.

*5-day % Change

Subscribe to:

Comments (Atom)