Style Outperformer:

Small-Cap Value (+.25%)

Sector Outperformers:

Disk Drives (+3.34%), Gaming (+1.87%) and Banks (+1.41%)

Stocks Rising on Unusual Volume:

AIG, SGY, DB, CHL, GEOY, ELON, CHDX, SATS, JRJC, PCLN, COHR, VARI, DISH, BAGL, CFSG, CATY, VOCS, RNST, FRED, PWRD, BJRI, LEAP, NUAN, IPCM, HMIN, BKS, MPS, NPO, SWM, WIT, HRL and GBX

Stocks With Unusual Call Option Activity:

1) FRE 2) YRCW 3) PCLN 4) ENER 5) DISH

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, August 10, 2009

Bull Radar

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

Chart Toppers

Real-Time Intraday Quote/Chart

HFR Global Hedge Fund Indices

Sunday, August 09, 2009

Monday Watch

Weekend Headlines

Bloomberg:

- Metals prices are looking “frothy” after surging 70% this year and investors in aluminum, nickel and zinc producers should reduce their holdings, according to Goldman Sachs JBWere Pty. Goldman said gains in

Wall Street Journal:

NY Times:

CNNMoney.com:

Business Week:

- The SEC Speeds Up Its Enforcement Arm.

LA Times:

Lloyd’s List:

Politico:

Rasmussen Reports:

Reuters:

Financial Times:

Telegraph:

SonntagsZeitung:

- Peter Bofinger, a member of German Chancellor Angela Merkel’s council of economic advisers, said while the economic slump has bottomed out there are no signs of recovery yet, citing an interview. “A turnaround hasn’t emerged yet,” Bofinger was quoted as saying. There are no “hard facts” suggesting an upswing, especially in export-oriented counties like

Euro am Sonntag:

-

arabianBusiness.com:

Weekend Recommendations

Barron's:

- Made positive comments on (AAPL), (DRIV), (GOLD), (FRED), (C), (GRS) and (GSIC).

- Made negative comments on (PCL), (PCH), (ALGT) and (WY).

Night Trading

Asian indices are +.25% to +1.50% on avg.

S&P 500 futures -.03%.

NASDAQ 100 futures -.12%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Global Commentary

WSJ Intl Markets Performance

Commodity Futures

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (KWK)/.19

- (DISH)/.65

- (SYY)/.49

- (PCLN)/1.79

- (DYN)/-.04

- (NUAN)/.25

- (FLR)/.91

- (MDR)/.37

Upcoming Splits

- None of note

Economic Releases

- None of note

Other Potential Market Movers

- The Pacific Crest Tech Forum could also impact trading today.

BOTTOM LINE: Asian indices are higher, boosted by technology and financial stocks in the region. I expect

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for Stocks to Watch Monday by MarketWatch.

There are several economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Weekly retail sales reports, Preliminary 2Q Non-farm Productivity, Preliminary 2Q Unit Labor Costs, Wholesale Inventories, IDB/TIPP Economic Optimism, ABC Consumer Confidence

Wed. – Bloomberg Global Confidence Index, Weekly MBA Mortgage Applications report, Weekly EIA energy inventory report, Trade Deficit, Monthly Budget Statement, FOMC rate decision

Thur. – Import Price Index, Advance Retail Sales, Initial Jobless Claims, Business Inventories

Fri. – Consumer Price Index, Industrial Production, Capacity Utilization,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Dish Network(DISH), Sysco Corp.(SYY), priceline.com(PCLN), Dynegy(DYN), Flour Corp.(FLR), McDermott(MDR)

Tues. – Bob Evans(BOBE), Warnaco Group(WRC), Fossil(FOSL), Dendreon(DNDN), Applied Materials(AMAT)

Wed. – Liz Claiborne(LIZ), Advance Auto Parts(AAP), Macy’s(M), Sara Lee(SLE), Ethan Allen(ETH)

Thur. – Royal Gold(RGLD), Urban Outfitters(URBN), Dr Pepper Snapple(DPS), Wal-Mart(WMT), Kohl’s(KSS), Nordstrom(JWN), Estee Lauder(EL), DeVry(DV), Autodesk(ADSK)

Fri. – Abercrombie & Fitch(ANF), JCPenney(JCP)

Other events that have market-moving potential this week include:

Mon. – Pacific Crest Tech Forum

Tue. – Pacific Crest Tech Forum, CanaccordAdams Growth Conference, Oppenheimer Communications/Tech/Internet Conference, Morgan Keegan Security/Safety/Defense Conference, Morgan Keegan Tech Conference, Jeffries Industrial Summit

Wed. – CanaccordAdams Growth Conference, Oppenheimer Communications/Tech/Internet Conference, Jeffries Industrial

Thur. – (ERIC) investor relations forum, (ATV) general meeting, CanaccordAdams Growth Conference, UBS Engineering & Construction Conference, (MF) shareholders meeting, (MDCI) shareholders meeting, (RHT) shareholders meeting, (QSII) shareholders meeting

Fri. – None of note

Friday, August 07, 2009

Weekly Scoreboard*

Indices

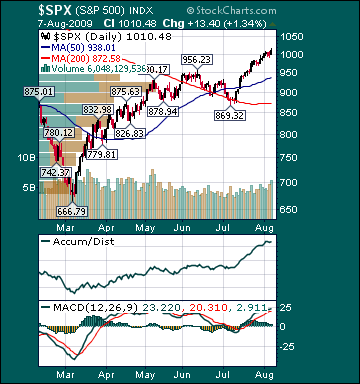

S&P 500 1,010.48 +2.33%

DJIA 9,370.07 +2.16%

NASDAQ 2,000.25 +1.10%

Russell 2000 572.40 +2.82%

Wilshire 5000 10,320.97 +2.60%

Russell 1000 Growth 443.53 +1.08%

Russell 1000 Value 522.39 +4.0%

Morgan Stanley Consumer 597.17 +2.23%

Morgan Stanley Cyclical 721.85 +5.66%

Morgan Stanley Technology 498.78 +1.15%

Transports 3,749.58 +4.74%

Utilities 371.22 +.47%

MSCI Emerging Markets 36.43 +1.36%

Sentiment/Internals

NYSE Cumulative A/D Line +49,328 +7.26%

Bloomberg New Highs-Lows Index +135 -42.06%

Bloomberg Crude Oil % Bulls 22.0 +57.14%

CFTC Oil Net Speculative Position +34,145 +646.18%

CFTC Oil Total Open Interest 1,202,598 +2.47%

Total Put/Call .73 -9.88%

OEX Put/Call 1.61 -18.69%

ISE Sentiment 133.0 -6.34%

NYSE Arms .85 +10.39%

Volatility(VIX) 24.76 -4.47%

G7 Currency Volatility (VXY) 13.41 +4.85%

Smart Money Flow Index 8,676.95 +.96%

AAII % Bulls 50.0 +4.89%

AAII % Bears 35.16 +11.97%

Futures Spot Prices

CRB Index 264.77 +2.84%

Crude Oil 70.93 +2.06%

Reformulated Gasoline 200.81 -.19%

Natural Gas 3.67 +.68%

Heating Oil 191.22 +4.58%

Gold 959.50 +.27%

Base Metals 178.61 +4.49%

Copper 278.55 +5.97%

US No. 1 Heavy Melt Scrap Steel 221.67 USD/Ton unch.

China Hot Rolled Domestic Steel Sheet 4,420 +5.74%

Agriculture 306.63 +.60 %

Economy

ECRI Weekly Leading Economic Index 121.80 +1.92%

Citi US Economic Surprise Index +55.50 +79.61%

Fed Fund Futures imply 55.0% chance of no change, 45.0% chance of 25 basis point cut on 8/12

US Dollar Index 78.98 +.80%

Yield Curve 255.0 +18 basis points

10-year US Treasury Yield 3.85% +37 basis points

U.S. Sovereign Debt Credit Default Swap 28.0 -6.67%

10-year TIPS Spread 2.01% +24 basis points

TED Spread 29.0 -1 basis points

N. Amer. Investment Grade Credit Default Swap Index 106.81 -3.33%

Euro Financial Sector Credit Default Swap Index 80.31 +9.77%

Emerging Markets Credit Default Swap Index 298.10 -9.17%

CMBS Super Senior AAA 10-year Treasury Spread 477.0 -8.97%

Business Loans 730.40 -.99%

4-Wk MA of Jobless Claims 555,300 -.80%

Continuing Claims Unemployment Rate 4.7% unch.

Average 30-year Mortgage Rate 5.22% -3 basis points

Weekly Mortgage Applications 517,300 +4.42%

ABC Consumer Confidence -49 -4.26%

Weekly Retail Sales -5.60%

Nationwide Gas $2.63 /gallon +.11/gallon

US Cooling Demand Next 7 Days 22.0% above normal

Baltic Dry Index 2,907 -15.62%

Oil Tanker Rate(Arabian Gulf to US Gulf Coast) 27.0 unch.

Rail Freight Carloads 193,684 +.18%

Iraqi 2028 Govt Bonds 68.67 +2.02%

Best Performing Style

Mid-cap Value +5.51%

Worst Performing Style

Small-cap Growth +.87%

Leading Sectors

REITs +15.73%

Banks +12.39%

Airlines +11.34%

Homebuilders +8.83%

Steel +8.30%

Lagging Sectors

Oil Service -.73%

HMOs -1.68%

Telecom -2.08%

Semis -2.14%

Biotech -2.30%