The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,134.50 +1.85%

- S&P 500 High Beta 31.87 +2.12%

- Wilshire 5000 29,092.60 +1.64%

- Russell 1000 Growth 894.77 +1.84%

- Russell 1000 Value 969.48 +1.35%

- S&P 500 Consumer Staples 461.78 +1.86%

- Morgan Stanley Cyclical 1,552.05 +2.30%

- Morgan Stanley Technology 937.57 +2.26%

- Transports 8,104.57 +2.29%

- Bloomberg European Bank/Financial Services 111.09 +1.81%

- MSCI Emerging Markets 42.58 -1.08%

- HFRX Equity Hedge 1,161.83 +.84%

- HFRX Equity Market Neutral 960.64 -.48%

Sentiment/Internals

- NYSE Cumulative A/D Line 222,986 +1.52%

- Bloomberg New Highs-Lows Index 418 +274

- Bloomberg Crude Oil % Bulls 33.33 -4.17%

- CFTC Oil Net Speculative Position 423,136 +3.15%

- CFTC Oil Total Open Interest 1,635,600 +1.75%

- Total Put/Call .90 +20.0%

- OEX Put/Call 1.86 +20.78%

- ISE Sentiment 100.0 -30.07%

- Volatility(VIX) 11.40 -5.24%

- S&P 500 Implied Correlation 55.24 -3.26%

- G7 Currency Volatility (VXY) 5.93 -4.66%

- Emerging Markets Currency Volatility (EM-VXY) 6.89 -.14%

- Smart Money Flow Index 11,069.16 +.57%

- ICI Money Mkt Mutual Fund Assets $2.587 Trillion +.13%

- ICI US Equity Weekly Net New Cash Flow -$1.802 Billion

- AAII % Bulls 36.46 +19.82%

- AAII % Bears 23.30 -12.12%

Futures Spot Prices

- Reformulated Gasoline 297.19 -.62%

- Heating Oil 288.82 -2.27%

- Bloomberg Base Metals Index 196.63 +.25%

- US No. 1 Heavy Melt Scrap Steel 363.67 USD/Ton unch.

- China Iron Ore Spot 91.80 USD/Ton -5.85%

- UBS-Bloomberg Agriculture 1,489.81 -2.21%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 5.0% unch.

- Philly Fed ADS Real-Time Business Conditions Index -.0307 +37.35%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 123.96 +.22%

- Citi US Economic Surprise Index -4.8 -6.2 points

- Citi Emerging Markets Economic Surprise Index -20.40 -1.3 points

- Fed Fund Futures imply 38.0% chance of no change, 62.0% chance of 25 basis point cut on 6/18

- US Dollar Index 80.37 +.02%

- Euro/Yen Carry Return Index 144.81 -.17%

- Yield Curve 210.0 -9 basis points

- 10-Year US Treasury Yield 2.48% -5 basis points

- Federal Reserve's Balance Sheet $4.280 Trillion -.12%

- U.S. Sovereign Debt Credit Default Swap 16.76 +3.68%

- Illinois Municipal Debt Credit Default Swap 150.0 +7.56%

- Western Europe Sovereign Debt Credit Default Swap Index 34.85 -6.71%

- Asia Pacific Sovereign Debt Credit Default Swap Index 78.80 -4.88%

- Emerging Markets Sovereign Debt CDS Index 208.52 -3.57%

- Israel Sovereign Debt Credit Default Swap 80.0 -2.55%

- Russia Sovereign Debt Credit Default Swap 193.34 -2.55%

- China Blended Corporate Spread Index 328.99 -5.95%

- 10-Year TIPS Spread 2.21% -1.0 basis point

- 2-Year Swap Spread 14.0 +2.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -8.75 -1.25 basis points

- N. America Investment Grade Credit Default Swap Index 62.21 -1.57%

- European Financial Sector Credit Default Swap Index 72.79 -5.91%

- Emerging Markets Credit Default Swap Index 247.0 -5.61%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 86.0 +1.0 basis point

- M1 Money Supply $2.774 Trillion -.40%

- Commercial Paper Outstanding 1,028.0 -.90%

- 4-Week Moving Average of Jobless Claims 311,500 -11,000

- Continuing Claims Unemployment Rate 2.0% unch.

- Average 30-Year Mortgage Rate 4.12% -2 basis points

- Weekly Mortgage Applications 362.20 -1.17%

- Bloomberg Consumer Comfort 33.1 -.8 point

- Weekly Retail Sales +3.80% -30 basis points

- Nationwide Gas $3.66/gallon unch.

- Baltic Dry Index 940.0 -2.69%

- China (Export) Containerized Freight Index 1,103.56 +.58%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 25.0 unch.

- Rail Freight Carloads 269,444 +.89%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (12)

- PTCT, HSH, GTT, PARRE, SHLO, MDBX, BCRX, SN, MGNX, AMSG, TRNO and HPQ

Weekly High-Volume Stock Losers (8)

- DAKT, ARUN, SC, AHC, NTLS, ESI, SCVL and DSW

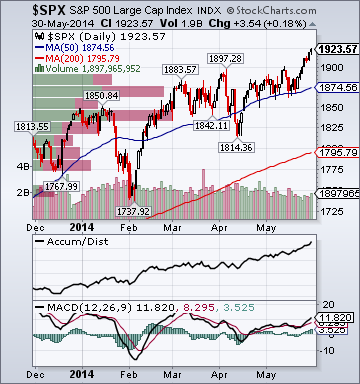

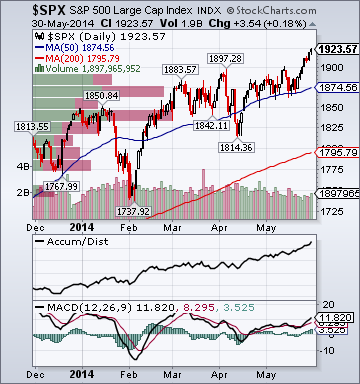

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Equity Market Tone:

- Advance/Decline Line: Lower

- Sector Performance: Most Sectors Declining

- Market Leading Stocks: Underperforming

Equity Investor Angst:

- Volatility(VIX) 11.52 -.43%

- Euro/Yen Carry Return Index 144.87 +.25%

- Emerging Markets Currency Volatility(VXY) 6.89 -.58%

- S&P 500 Implied Correlation 55.06 +1.21%

- ISE Sentiment Index 103.0 +18.39%

- Total Put/Call .88 +27.54%

Credit Investor Angst:

- North American Investment Grade CDS Index 62.32 +.18%

- European Financial Sector CDS Index 72.79 +.37%

- Western Europe Sovereign Debt CDS Index 34.85 -.01%

- Asia Pacific Sovereign Debt CDS Index 79.21 -1.14%

- Emerging Market CDS Index 246.83 +.29%

- China Blended Corporate Spread Index 328.99 -5.65%

- 2-Year Swap Spread 14.0 +1.0 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -8.75 -.5 basis point

Economic Gauges:

- 3-Month T-Bill Yield .03% unch.

- Yield Curve 210.0 +2.0 basis points

- China Import Iron Ore Spot $91.80/Metric Tonne -4.08%

- Citi US Economic Surprise Index-4.80 -1.9 points

- Citi Emerging Markets Economic Surprise Index -20.40 -1.1 points

- 10-Year TIPS Spread 2.21 -2.0 basis points

Overseas Futures:

- Nikkei Futures: Indicating +85 open in Japan

- DAX Futures: Indicating +4 open in Germany

Portfolio:

- Higher: On gains in my medical/retail sector longs and emerging markets shorts

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 25% Net Long

Bloomberg:

- Russian Forces Back Off Ukraine Border as Fighting Rages. Russia has pulled back most of its troops from the border with Ukraine,

according to a U.S. defense official, as government forces continued a

campaign to wipe out separatist rebels in the former Soviet Republic’s

east. A “majority of the Russian forces” have been withdrawn

from the Ukrainian border, Rear Admiral John Kirby, a Pentagon

spokesman, told reporters traveling to Singapore with U.S. Defense

Secretary Chuck Hagel. About seven battalions of Russian troops, or

“several thousands,” remain, he said. Russia’s

withdrawal may be marred by a gas dispute. Talks with Ukraine in Berlin

today won’t advance, Ukrainian First Deputy Energy Minister Yuri Zyukov

said yesterday.

- Abe Offers Japan’s Support to Southeast Asia on Sea Disputes. Prime

Minister Shinzo Abe said Japan

would spare no effort in helping Southeast Asian nations secure the seas

and pledged strong support for the Philippines and Vietnam in their

maritime disputes with China. “Japan will offer its utmost support

for the efforts of the countries of Asean as they work to ensure the

security of the seas and the skies, and thoroughly maintain freedom of

navigation and freedom of overflight,” Abe said in Singapore today,

referring to the 10-member Association of Southeast Asian Nations. Abe’s

speech to defense officials at the Shangri-La security forum comes at a

time of rising tensions over China’s assertiveness in the East and

South China Sea.

- Vietnam Prepares Legal Action Against China, Prime Minister Says. Vietnam has prepared evidence for a legal suit challenging China’s claim to waters off the Vietnamese coast and is considering the best time to file it, Prime Minister Nguyen Tan Dung said yesterday in an interview. “We are prepared and ready for legal action,” Dung

said, sitting in the prime minister’s compound in Hanoi in front of a

bronze bust of Ho Chi Minh, the founder of communist Vietnam. “We are

considering the most appropriate timing to take this measure.”

- Brazil Growth Slowed in First Quarter as Investment Fell. Brazil’s economic growth slowed in

the first quarter as President Dilma Rousseff, who is up for re-election in October, struggles to rebuild confidence that led to

the biggest decline in investment in two years. Gross domestic product increased 0.2 percent in the first

quarter, the equivalent to 0.8 percent on an annual basis, down

from a revised 0.4 percent in the last three months of 2013. The

result was in line with the median estimate of 41 analysts

surveyed by Bloomberg. Investment fell 2.1 percent in the quarter.

- Vale Set for Worst Losing Streak Since 2008.

Vale SA (VALE5), the world’s largest iron-ore producer, is posting its

worst streak of monthly losses in five years as prices for the

steel-making ingredient sink. The shares fell 3.2 percent to 25.79 reais

at 11:42 a.m. in Sao Paulo today, bringing losses this month to 2.4

percent. The stock is now set for its seventh monthly drop, the longest

losing rout since 2008. Brazil’s benchmark Ibovespa gauge is up 0.2

percent this month, its third straight gain. Iron ore sank 4.1

percent today to $91.80 a dry ton and has lost 13 percent in May, a

sixth monthly retreat. That’s the longest losing run since the data

series began in November 2008. The commodity is down 32 percent this

year, entering a bear market in March as the biggest miners raised

output, spurring forecasts for a rising global surplus while slowing

growth in China capped demand. “The best way to begin to understand

Vale’s weakness is to look to China,” Lawrence Creatura, a Rochester, New York-based fund manager at Federated Investors Inc., which oversees about

$366 billion, said in a telephone interview. “If China were to

decelerate further, it’s reasonable to expect pressure on

commodities to continue.”

- European Stocks Little Changed for Seventh Weekly Gain.

European stocks were little changed,

with the Stoxx Europe 600 Index advancing for a seventh week, as a

better-than-expected report on U.S. business activity offset

consumer-confidence data that missed forecasts. Societe Generale SA

slipped 2.2 percent after Les Echos reported that the French bank’s

Russian unit posted a decline in first-quarter profit. BNP Paribas SA

fell 2.4 percent as a

person familiar with the matter said U.S. authorities are

seeking more than $10 billion from the bank to settle

investigations into dealings with sanctioned countries. Rio

Tinto Group and BHP Billiton Ltd. slid as a gauge of commodity

producers declined the most on the Stoxx 600.

The Stoxx 600 fell 0.1 percent to 344.24 at the close of

trading.

Wall Street Journal:

- Moody's Warns on EU New Banking Rules. Rating Agency Says Directive Could Leave Stakeholders Vulnerable to Banking Crises.

Moody's Investors Service Inc. has become the latest of the three big

debt rating firms to warn that new European Union rules could make

stakeholders more vulnerable to losses in any future banking crisis. In

response to the EU's so-called Bank Recovery and Resolution Directive,

under which shareholders, bondholders and some depositors may have to

stomach big losses or commit to so-called bail ins to help rescue ailing

banks, Moody's has cut its long-term rating outlook on 82 European

banks to negative. That means the...

Fox News:

- Shinseki resigns over growing VA scandal. President Obama announced Friday that embattled Veterans Affairs

Secretary Eric Shinseki would take the fall for the rapidly growing

scandal over veterans' health care, accepting his resignation under

pressure from members of both parties. The president announced that Shinseki would resign after they met at the

White House and he received an update on an internal review of the

problems at the VA. The review showed the problems were not limited to

just a few facilities, Obama said, adding: "It's totally unacceptable.

Our veterans deserve the best."

CNBC:

- Fast food CEO: Minimum wage hikes closing locations. CKE Restaurants' roots began in

California roughly seven decades ago, but you won't see the parent

company of Carl's Jr. and Hardee's expanding there much anymore. What's causing what company CEO Andy Puzder describes as "very little growth" in the state? In part it's because "the minimum wage is so high

so it's harder to come up with profitable business models," Puzder said

in an interview. The state's minimum wage is set to rise to $9 in July,

making it among the nation's highest, and $10 by January 2016.

ZeroHedge:

Business Insider:

meps:

- Steel Price Hike in U.S. Heightens Import Threat from China. US

flat product producers have successfully implemented at least a

proportion of their latest round of proposed increases. However, the

upward movements now appear to have stalled. Local supply is slowly

returning to normal and the recent hikes, together with expanding

domestic delivery lead times, have spurred an interest in imported

material.

Business Recorder:

- Real Slides on Swaps; Bovespa Suffers with GDP. Brazil's real fell the most among Latin American currencies on Friday as

investors tried to curb losses related to the expiration of currency

swaps next week, while Brazilian stocks suffered with weak economic data

and a fall in iron-ore prices.

Valor:

- Brazil Vehicle Sales Fall 11% Y/Y in May.

Xinhua:

- China's Instant Messaging Cos. to Crack Down on Rumors. Tencent's

WeChat, NetEase's Yixin and other 5 instant messaging applications

vowed to clean up illegal contents after the nation's public security

ministry started to crack down on spreading rumors or information of

violence, terrorism, pornography and fraud from May 27, citing the

companies.

Sina:

- CBRC Official Says China Property Loan Risk Controllable. China

will not relax or offer discounts for property development loans or

mortgages, citing an official at China Banking Regulatory Commission.

China must "strictly" control risks from property loans, CBRC says in

its 2013 annual report issued today.

Style Underperformer:

Sector Underperformers:

- 1) Steel -2.67% 2) Disk Drives -2.21% 3) Alt Energy -2.01%

Stocks Falling on Unusual Volume:

- BLOX, BNNY, CSTE, NMBL, EXPR, SPLK, RCAP, LGF, VEEV, GES, QSII, MTZ, AFSI, RNET, DISCK, RIO, AERI, NRP, REX, AFOP, ENS, TWTR, AVA, HQL, USLV, NRP and QSII

Stocks With Unusual Put Option Activity:

- 1) JNPR 2) XLU 3) FFIV 4) XLY 5) COG

Stocks With Most Negative News Mentions:

- 1) NFLX 2) LGF 3) CLI 4) JD 5) VALE

Charts:

Style Outperformer:

Sector Outperformers:

- 1) REITs +.36% 2) Retail +.35% 3) Utilities +.29%

Stocks Rising on Unusual Volume:

- OVTI, RTRX, NPSP, BIG, NLNK, DKS, ANN, PANW and PCYC

Stocks With Unusual Call Option Activity:

- 1) CL 2) OVTI 3) NPSP 4) SPLK 5) PEP

Stocks With Most Positive News Mentions:

- 1) BIG 2) OVTI 3) AAPL 4) MNKD 5) NOC

Charts:

Evening Headlines

Bloomberg:

- Investing for a China Crisis. China's growing list of problems, including a slowing economy, rising

militarism, messy corruption crackdown and increasingly troubled shadow

banking sector, could provoke a major financial crisis. In the "never

waste a crisis" spirit, a number of investment opportunities present

themselves: -- Short Chinese stocks. The Shanghai Composite Index is down 67 percent from its October 2007 peak. Even though Chinese stocks may seem inexpensive -- the price-to-earnings ratio for the Shanghai index over the last 12 months is 9.8, compared with 17.3 for the far more costly S&P 500 -- there is no obvious floor. If China has a financial crisis, the risk to Chinese equities is considerable. Bank stocks may be especially

vulnerable. Investors who lack direct access to mainland Chinese stocks

can use Hong Kong-listed equities and exchange-traded funds. --

Sell commodities. Industrial and agricultural commodity prices

took off

in 2002, right after China joined the World Trade Organization. As

manufacturers in Europe and North America shifted production to China,

its thirst for commodities kept growing. Many producers of industrial

materials, including base metals, iron ore and coal, also increased

capacity as prices leaped.

- Asian Stocks Rise on Faster Japan Inflation, U.S. Outlook.

Asian stocks rose, with the regional benchmark index heading for its

biggest monthly advance since September, as a report showed Japanese

inflation accelerated and investors speculated the U.S. economy is

recovering from its first contraction in three years. Toyota Motor Corp.

(7203), the world’s biggest carmaker, added 1.1 percent in Tokyo.

Envestra Ltd. gained 1.1 percent in Sydney as billionaire Li Ka-shing’s

Cheung Kong Group agreed to buy the Australian gas supplier for A$2.4

billion ($2.2 billion). Lynas Corp., which spent $930 million on a

rare-earths processing plant in Malaysia, tumbled 16 percent in Sydney

after completing a share placement and as debt-restructuring talks

continue. The MSCI Asia Pacific Index (MXAP) added 0.2 percent to 142.35 as

of 10:04 a.m. in Hong Kong, heading for its highest close since

November.

- Iron Ore Heads for Record Losing Streak as Goldman Eyes Supply.

Iron ore is heading for a sixth straight monthly decline in the longest

losing streak on record as increasing supplies from Australia and

Brazil spur a global surplus just as demand growth in China slows. Ore

with 62 percent content delivered to Tianjin was at $95.70 a dry ton

yesterday, 9.2 percent lower this month, according to data from The

Steel Index Ltd. The steel-making raw material, which is at a 20-month

low, has dropped every month since December in the longest run of

monthly losses since the

data series began in November 2008.

- Food Replacing Oil as China M&A Commodity of Choice: Commodities. After spending the past decade and

more than $200 billion acquiring mines and oilfields from Australia to Argentina, China’s attention is turning to food. The world’s most populous nation is confronting a harsh reality: For every additional bushel of wheat or pound of beef

the world produces, China will need almost half of that to keep

its citizens fed.

- Beware of Exotic ETFs Bearing Credit-Default Swaps. If you’ve always wanted to bet your savings on risky credit derivatives,

now’s the time. In May regulators signed off on a plan to allow trading

in eight exchange-traded funds (ETFs) created by ProShares that will

hold credit-default swaps—the derivatives that helped bring on the

global credit crisis in 2008.

Wall Street Journal:

- China Hacking Is Deep and Diverse, Experts Say. Intruders Often Work As Hackers For Hire, According to Officials. China's Internet espionage capabilities are deeper and more widely

dispersed than the U.S. indictment of five army officers last week

suggests, former top government officials say, extending to a sprawling

hacking-industrial complex that shields the Chinese government but also

sometimes backfires on Beijing. Some of the most sophisticated

intruders observed by U.S. officials and private-sector security firms

work as hackers for hire and at makeshift defense contractors, not the

government, and aren't among those named in...

- Borrowers Tap Their Homes at a Hot Clip. Helocs Jumped 8% in the First Quarter. A rebound in house prices and near-record-low interest rates are prompting homeowners to borrow against their properties, marking the return of a practice that was all the rage before the financial crisis. Home-equity lines of credit, or Helocs, and home-equity loans jumped 8% in the first quarter from a year earlier, industry newsletter Inside Mortgage Finance said Thursday. The $13 billion extended was the most for the start of a...

- The VA Scandal Is a Crisis of Leadership. Obama's inattention to managing the government may kill the progressive project. The Veterans Administration scandal involves charges of manipulation

and falsification of medical waiting lists and systemwide rigging to

hide delayed or inadequate treatment, which may have caused the deaths

of some of those waiting for care. There are whistle-blowers,

allegations of local coverups, and the possibility of criminal charges.

Also becoming clearer are two motives for those involved in what appears

to have been a racket: their compensation and their career

trajectories. This scandal won't go away as others...

CNBC:

Zero Hedge:

Business Insider:

- Michael Bloomberg Blasts Ivy League For Liberal 'Censorship'. Former New York City Mayor Michael Bloomberg accused the entire Ivy

League of liberal political bias during a particularly fiery

commencement address at Harvard University Thursday. "It is just a modern form of McCarthyism," Bloomberg said of

university "censorship" of conservatives. "Think about the irony: In the

1950s, the right wing was attempting to repress left wing ideas. Today,

on many college campuses, it is liberals trying to repress conservative

ideas even as conservative faculty members are at risk of becoming an

endangered species" "And that is probably nowhere more true than it is here in the Ivy League," declared Bloomberg.

Reuters:

- Japan consumer spending, factory output skid after sales tax hike. Japan's household spending in

April fell at the fastest rate in three years in a sign that

consumption could be slow to recover from an increase in the

nationwide sales tax, raising questions over the pace of

economic recovery. Japanese household spending fell 4.6 percent in April from a

year ago, more than the median market forecast for a 3.2 percent

annual decline. That marked the fastest annual decline since

March 2011, when an exceptionally powerful earthquake triggered

a nuclear disaster. Compared to the previous month, spending tumbled by a record

13.3 percent in April, more than the 13.0 percent decline

expected by economists. Government data published with the new figures show that

household spending fell further after the April 1 sales tax hike

than it did after the 3 percent sales tax in was imposed in

1989, and when it raised the tax to 5 percent in 1997.

Financial Times:

- IMF warns ‘rising’ African nations on sovereign debt risks. The International Monetary Fund has warned African nations issuing billions of dollars in sovereign bonds

that they could overload their economies with too much debt and derail

the best economic period for the region in a generation.

Telegraph:

Evening Recommendations

Night Trading

- Asian equity indices are -.50% to unch. on average.

- Asia Ex-Japan Investment Grade CDS Index 110.0 -.5 basis point.

- Asia Pacific Sovereign CDS Index 80.25 unch.

- NASDAQ 100 futures -.11%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

8:30 am EST

- Personal Income for April is estimated to rise +.3% versus a +.5% gain in March.

- Personal Spending for April is estimated to rise +.2% versus a +.9% gain in March.

- The PCE Core for April is estimated to rise +.2% versus a +.2% gain in March.

9:00 am EST

- The ISM Milwaukee for May is estimated to rise to 52.0 versus 47.26 in April.

9:45 am EST

- The Chicago Purchasing Manager for May is estimated to fall to 61.0 versus 63.0 in April.

9:55 am EST

- Final Univ. of Mich. Consumer Confidence for May is estimated to rise to 82.5 versus a prior estimate of 81.8.

Upcoming Splits

Other Potential Market Movers

- The

Fed's Plosser speaking, Fed's Lacker speaking, Fed's Pianalto speaking,

Canada gdp report and the ASCO Meeting could impact trading today.

BOTTOM LINE: Asian

indices are mostly lower, weighed down by industrial and technology

shares in the region. I expect US stocks to open mixed and to weaken into the afternoon, finishing modestly lower. The Portfolio is 50% net long heading into the day.

Broad Equity Market Tone:

- Advance/Decline Line: Modestly Higher

- Sector Performance: Most Sectors Rising

- Market Leading Stocks: Underperforming

Equity Investor Angst:

- Volatility(VIX) 11.76 +.68%

- Euro/Yen Carry Return Index 144.41 -.05%

- Emerging Markets Currency Volatility(VXY) 6.97 -1.27%

- S&P 500 Implied Correlation 55.34 +.31%

- ISE Sentiment Index 99.0 -2.94%

- Total Put/Call .68 -24.44%

Credit Investor Angst:

- North American Investment Grade CDS Index 62.21 -1.13%

- European Financial Sector CDS Index 72.52 -.32%

- Western Europe Sovereign Debt CDS Index 34.86 -.56%

- Asia Pacific Sovereign Debt CDS Index 79.72 -.75%

- Emerging Market CDS Index 246.32 -2.30%

- China Blended Corporate Spread Index 348.68 +.77%

- 2-Year Swap Spread 13.0 +.5 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -8.25 +.25 basis point

Economic Gauges:

- 3-Month T-Bill Yield .03% unch.

- Yield Curve 208.0 +1.0 basis point

- China Import Iron Ore Spot $95.70/Metric Tonne -1.14%

- Citi US Economic Surprise Index-2.90 -4.0 points

- Citi Emerging Markets Economic Surprise Index -19.30 unch.

- 10-Year TIPS Spread 2.23 +2.0 basis points

Overseas Futures:

- Nikkei Futures: Indicating +49 open in Japan

- DAX Futures: Indicating +11 open in Germany

Portfolio:

- Higher: On gains in my medical/biotech/tech/retail sector longs

- Disclosed Trades: Covered some of my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 75% Net Long

Bloomberg:

- Rebels Kill 14 Downing Ukraine Chopper as Russia Sees War. Pro-Russian

rebels downed a military helicopter in eastern Ukraine, killing 13

troops and a general, as an adviser to President Vladimir Putin accused

the U.S. of pushing the world toward war through proxies in Kiev.

Insurgents shot down an Mi-8 transport chopper with a shoulder-fired

missile amid

heavy fighting in Slovyansk, 100 miles (160 kilometers) from the Russian

border, Speaker Oleksandr Turchynov told parliament today. They also

attacked a military base near Luhansk, according to the National Guard. Russia

demanded Ukraine halt its “fratricidal war” and withdraw troops from

the mainly Russian-speaking regions of the east after separatists

suffered the heaviest casualties of their campaign. Western countries

should use their influence to stop Ukraine from “sliding into a national

catastrophe,” the Foreign Ministry in Moscow said on its website.

- Russia Sanctions Threat Seen Abating Amid Recession Risk. Russia is less likely to face further

sanctions from the U.S. and the European Union as the government

is sending conciliatory signals toward Ukraine, a Bloomberg

survey of economists showed. The U.S. will refrain from escalating punitive measures,

according to 66 percent of respondents in a survey of 32

economists, compared with 28 percent last month. The EU will

hold off on sanctions according to 84 percent, up from 78

percent in April. The probability of the Russian economy

slipping into recession in the next 12 months remained at 50

percent, according to the median forecast in a separate survey.

- China Threatens Further Action Against U.S. Over Hacking Dispute. China

said it will take further action against the U.S. for prosecuting five

of its military officers for alleged hacking, saying it has evidence its

companies have also been hacked. Online attacks from a “specific

country” have targeted Chinese companies, its military and important

websites, Ministry of National Defense spokesman Geng Yansheng said.

Geng didn’t specify the country in remarks posted on the ministry’s

website

today in response to a question about the indictment.

- Bond Surge Worldwide Drives Index Yield to One-Year Low. A worldwide bond-market surge pushed

yields to the lowest levels in a year on growing evidence

central banks can keep stimulating economic growth without

igniting inflation. Treasury 10-year note yields fell to the least

since June.

A rally yesterday drove the yield on the Bloomberg Global Developed

Sovereign Bond Index to 1.28 percent, the lowest since May 2013.

Australia’s (GACGB10) 10-year yield dropped to an 11-month low, Japan’s

slid to the least in 12 months, while European bond yields were close to

the lowest since the formation of the region’s shared currency. The U.S. sold $29 billion of seven-year notes at the lowest yield since October.

- Copper Drops From 11-Week High AMid Demand Concerns.

Copper fell from an 11-week high in

London on signs of slowing economic growth in China and the U.S., the

biggest users of the metal. U.S. gross domestic product fell at a 1

percent annualized rate in the first quarter, a bigger drop than

economists surveyed by Bloomberg projected, government figures showed

today. A purchasing managers index due later this week may show

little acceleration this month in Chinese manufacturing after

the gauge grew less than estimated in April. Copper has lost 6.4

percent this year amid signs of slowing economies.

- Obama Seeks Climate Legacy as Coal-State Democrats Cringe.

Obama now is set to release new limits on greenhouse gas emissions by

power plants as early as next week. That comes atop the unveiling of a

National Climate Assessment in May and executive actions including

promoting

renewable fuels and building better defenses against extreme weather. Liberated from re-election politics, he’s freer to speak about the

challenges of a warming planet and is using his bully pulpit to create

urgency on an issue that most Americans rank as a low priority, the

aides said. The expansive action is alarming some in the business community, who say the administration’s policies will hurt the economy. “This administration is setting up the next energy crisis in this

country,” said Laura Sheehan, a spokeswoman for the American Coalition

for Clean Coal Electricity in Washington. “They’re not looking at the

long-term consequences.” Obama also faces push-back from some

within his own party, who warn that tighter regulations could hamper

Democratic candidates in areas where coal is a major source of jobs.

Democrats in Kentucky and West Virginia already are distancing

themselves from the president’s energy policies, highlighting their

opposition to a “war on coal” on the campaign trail.

- Consumer Comfort in U.S. Falls to Lowest Level Since November. Consumer confidence declined last week to the lowest level

since November as Americans’ views of their finances and the buying

climate weakened. The Bloomberg Consumer Comfort Index fell to

33.3 in the period ended May 25 from 34.1 the prior week. A measure of

personal finances retreated for the third time in four weeks, and a

gauge of whether this is a good time to buy goods and services dropped

to the lowest point since mid-February.

- Credit Trader’s Shift to Rates Shows Where Anxieties Lie. Rate derivatives have become more popular than ever for wagering on

whether borrowing costs will rise or fall as the Federal Reserve scales

back its unprecedented stimulus. The amount of over-the-counter

interest-rate swaps has swelled 30 percent since the end of 2009, to a record notional $584.4 trillion as of December, according to a May 23 CME Group Inc. (CME) report. At

the same time, the volume of privately negotiated credit-default swaps

has plunged to a notional $21 trillion, 64 percent below the peak of

$58.2 trillion in December 2007.

Wall Street Journal:

- DOJ Opened At Least 10 Probes into Bank Processing Activities. 'Operation Choke Point' Disclosed in Government Memo. The U.S. Department of Justice has opened at

least 10 civil and criminal investigations into whether banks and

payment processing firms helped enable fraudulent activity, according to

an internal Justice Department memo viewed by The Wall Street Journal. More

than 850 pages of internal documents on the DOJ's probe of alleged

fraud in the financial industry were obtained by the House Oversight and

Government Reform Committee. Ms. Frimpong, in her memo, wrote that the government had the opened

civil investigations into 10 banks and payment processors and was in

settlement talks with three of them.

- Doctors' War Stories From VA Hospitals. Administrators limited operating time so that work stopped by 3 p.m. With the recent revelations about the disgraceful treatment of patients

by the Veterans Affairs hospitals, the public is discovering what the

majority of doctors in this country have long known: The VA health-care

system is a disaster.

- Justice Dept. Seeks More Than $10 Billion Penalty From BNP Paribas. French Bank Faces Criminal Probe of Alleged Sanctions Violations.

- Tyson(TSN) Enters Bidding for Hillshire Brands With $6.1 Billion Offer. Proposal Tops Offer Made by JBS's Pilgrim's Pride, Setting Up Meatpacker Slugfest.

MarketWatch.com:

- Hedge fund assets to hit $5.8 trillion by 2018: Citi survey. The

hedge fund industry will double its assets in the next four years to

nearly $6 trillion by diversifying products and giving retail investors

more access, according to a new survey. Traditional hedge fund

clients are high-net-worth individuals, but more and more retail

investors will have access to the asset class, according to the latest

Citi Investor Services Survey.

Fox News:

- Obama under bipartisan pressure to oust Shinseki on heels of IG report. President Obama is coming under heavy pressure from both sides of the

aisle following a scathing inspector general report to tackle the

problems at the Department of Veterans Affairs head-on -- first, by

relieving VA Secretary Eric Shinseki of his command. More than a half-dozen Democratic senators are now calling for

Shinseki's resignation, since the Office of Inspector General released

an interim report on Wednesday finding "systemic" problems with clinics

lying about patient wait times.

CNBC:

ZeroHedge:

ValueWalk:

- 500 Largest Hedge Fund Managers Control 90% Of AUM. Preqin

Research highlights the 505 hedge fund managers with more than $1bn in

AUM currently manage $2.39tn of the industry’s $2.66tn total assets, but

account for just 11% of active firms.

- Derivatives Worldwide Hit 710 Trillion, According To BIS Study.

The Bank for International. Settlements (BIS) just published a

statistical study on the amount of derivatives worldwide at the end of

2013, and they reach the astronomical amount of $710 Trillions

($710,000,000,000,000). For comparison purposes, the United States GDP in 2013 amounts to $16

Billion, or 44 times less. And this mass of derivatives beats by 20% the

preceding record, dating just before the 2008 crisis… We hear a lot

about bubbles these days, in the stock market, the bond market or in the

commodities market, but this one is without a doubt the greatest one.

Reuters:

Folha de S.Paulo:

- Brazil

Govt Sees Possibility of 2014 GDP Growth Below 2%. Economic growth has

become main concern for govt, citing President Dilma Rousseff's aides it

didn't identify. Govt sees possibility of trade deficit this year.

Investments may be below 2013 level. Govt sees no room for fiscal

expansion to stimulate economy; inflation still high.