Bloomberg:

- Crude oil is falling again below $62/bbl. on speculation that the decision by Venezuela and Nigeria to cut output will have little impact on supply.

- US researchers Andrew Fire and Craig Mello won the Nobel Prize for medicine for finding a mechanism that regulates the flow of genetic information in plants, animals, and humans.

- President Bush said the UN shouldn’t wait any longer to send peacekeepers into Sudan’s war-torn Darfur region to end the killing and deprivation there.

- Gilead Sciences(GILD), maker of the world’s best-selling AIDS medicine, will buy Myogen(MYOG) for about $2.5 billion to acquire experimental biotechnology drugs for hard-to-treat heart and lung conditions.

- Morgan Stanley(MS) is offering its top-paid traders and bankers millions of dollars of incentives to avoid defections to rival banks and attract new hires.

Wall Street Journal:

- Harrah’s Entertainment(HET) may be purchased by private-equity companies that could include Colony Capital and Texas Pacific Group.

- Though many Americans are unhappy with the perception that the rich are getting richer, they still want to be rich themselves and don’t favor political candidates who attack wealth creation. Moreover, the most recent data from the IRS shows the income share of the top 1% of Americans declined to 19.0% in 2004 from an all-time high of 20.8% in 2000.

- US corporate directors are abandoning their former club-house boardroom style and have become more assertive, after scandals such as the one at Enron Corp.

- Facebook.com and News Corp.’s MySpace.com, both social networking sites, face competition from smaller, second-tier sites including Piczo Inc. and XuQa.com.

- HJ Heinz(HNZ), Sara Lee(SLE) and other US companies are testing a variety of oils to satisfy growing demand from health groups and government regulators for food with less trans fats.

- US insurer-owned banks are becoming more profitable and now make up five of the 20 fastest-growing banks in the US.

- Rising prices for energy, and not faltering wage growth, are what most hurt the paychecks of US workers, economists Allan Hubbard and Edward Lazear wrote. At an annualized rate, nominal wage growth has been about 4% this year, about the same rate as in the late 1990s.

NY Times:

- US Representative John Murtha, a Democrat of Pennsylvania, may be best know outside Washington for his break with President Bush over the Iraq War; in the Capitol he’s best known for turning Congressional members’ pet projects, or earmarks, into power. Murtha, who is the top Democrat on the House military spending subcommittee and who announced this year a bid to become the next House Democratic leader, often tacitly trades Democrat votes with Republican leaders for earmarks for himself and his allies.

NY Post:

- Google(GOOG) will open a new 300,000 square-foot office today at 111 Eighth Avenue in NY.

Sunday Times of London:

- Mohamed Atta, leader of the Sept. 11 hijackers, smiles and jokes with another hijacker in a newly released al-Qaeda video taped in 2000.

Interfax:

- The latest talks between Russia and the US on Russia’s accession to the World Trade Organization are progressing “very constructively.”

Le Figaro:

- A French high school philosophy teacher, facing death threats from extremist groups for a critical article he wrote on Islam in Le Figaro, received support from daily newspaper Le Monde.

Kommersant:

- Declining oil prices may help slow growth of consumer prices in October, citing central bank Deputy Chairman Alexei Ulyukayev.

Asharq al-Awsat:

- MA Kharafi Group of Kuwait plans to build a $1 billion oil refinery in Egypt.

Rzeczpospolita:

- Poland may invest at least $3 billion to set up wind power plants.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, October 02, 2006

Construction Spending Rises on Commerical Boom, ISM Manufacturing Slows Slightly, Prices Paid Falls Again, Pending Home Sales Rebound

- Construction Spending for August rose .3% versus estimates of a .3% decline and a 1.0% decline in July.

- ISM Manufacturing for September fell to 52.9 versus estimates of 53.5 and a reading of 54.5 in August.

- ISM Prices Paid for September fell to 61.0 versus estimates of 67.5 and a reading of 73.0 in August.

- Pending Home Sales for August rose 4.3% versus estimates of unch. and a 7.0% decline in July.

- ISM Manufacturing for September fell to 52.9 versus estimates of 53.5 and a reading of 54.5 in August.

- ISM Prices Paid for September fell to 61.0 versus estimates of 67.5 and a reading of 73.0 in August.

- Pending Home Sales for August rose 4.3% versus estimates of unch. and a 7.0% decline in July.

BOTTOM LINE: Construction spending in the US unexpectedly rose in August as companies increased investment in office buildings, factories and hospitals, Bloomberg said. Booming corporate investment in new facilities is helping to offset slower residential construction. Private non-residential construction rose 3.4% and has soared 24% from year-ago levels. Private residential construction spending fell 1.5% versus a 2.1% decline the prior month. I expect construction spending to continue to slow, but remain relatively healthy over the intermediate-term.

Manufacturing in the US last month expanded at a slower pace than economists’ expected last month, Bloomberg reported. The new orders component of the index held at 54.2, while the employment component of the index fell to 49.4 from 54 the prior month. The prices paid component of the index fell to 61 and is now 31% below April 2004 highs. Business investment will grow 7.8% this year, up from 6.8% growth in 2005, according to a survey of economists by Blue Chip Economic Indicators. I expect manufacturing to continue to slow to more average levels over the intermediate-term as auto production cutbacks offset inventory rebuilding.

Contracts to buy previously owned homes in the US unexpectedly rose in August, suggesting the downturn in housing is losing steam, Bloomberg reported. Pending re-sales rose 9.2% in the West, 4% in the South, 3.6% in the Northeast and were unchanged in the Midwest. The average 30-year mortgage rate was 6.31% last week, down 49 basis points from July highs. As well, low unemployment, a rising stock market and income growth are helping to cushion the slowdown in housing. I continue to believe that housing will stabilize at relatively high levels over the coming months after modest price declines.

Sunday, October 01, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- The Dow Jones Industrial Average posted its best third quarter performance since 1995, led by telecom and technology shares.

- US Treasuries had their biggest quarterly gain in four years as the Fed paused.

- The US dollar rose the most against the yen this quarter since the final three months of 2005 as sustained US economic growth diminished speculation the Fed will cut borrowing costs before year-end.

- Congress passed legislation that tightens security at US ports, requiring radiation monitors at the 22 largest ports by the end of next year.

- Wal-Mart Stores(WMT) said September same-store-sales in the US rose about 1.8% versus estimates of a 1-3% increase.

- Amaranth Advisors LLC suspended redemptions in order to sell off its remaining assets after losses at its two main hedge funds continued in the past two weeks.

- The NYSE was up and running Saturday even though no shares changed hands as tests were conducted on a new electronic trading system designed to make the world’s biggest equity market more competitive.

- Brazilian President Luiz Inacio Lula da Silva led challenger Geraldo Alckmin in an early count of ballots from today’s election and was about 1 percentage point short of avoiding a run-off.

- Confidence among Japan’s largest manufacturers unexpectedly rose in September and companies said they plan to increase spending.

- Shares of Sony Corp.(SNE) fell on concern costs for a widening recall of its batteries used in notebook computers may be more than the company initially estimated.

- Natural gas may fall in NY for a sixth week, the longest slide in more than five years, as mild weather cuts demand and allows inventories to climb even higher, according to a survey by Bloomberg.

- Iran considers international oil prices too low and said it will support “any” OPEC” measure that helps raise them.

- Latin American bonds are posting their biggest gains in more than a year as inflation in Mexico and Brazil, which topped 6,800% in April 1990, falls below US levels.

Wall Street Journal:

- David Tepper, who overseas $4.5 billion hedge fund Appaloosa Management LP, is close to an agreement to invest billions in Delphi Corp. and may control a third of the bankrupt auto-parts maker.

Barron’s:

- US airlines may report a 9% increase in revenue per available seat per mile this year on lower cost structures, restrained capacity growth and a robust economy.

NY Times:

- YouTube Inc., the video-sharing Web site, plans to replicate its deal to share advertising revenue with Warner Music Group to appease copyright challenges from studios and recording companies.

- Medicare drug insurers will offer US beneficiaries more options next year for the elderly and disabled, both in terms of the plans and the number of medicines covered.

LA Times:

- California Republican Arnold Schwarzenegger holds a commanding 50% to 33% lead over Democrat Phil Angelides in the race for governor of the most-populous US state.

NY Post:

- Billionaire Investor Eddie Lampert, chairman of Sears Holdings(SHLD), is ready to continue the retailer’s winning stock performance-by turning the retail chair into a Berkshire Hathaway-type investment vehicle.

Economist:

- While Google(GOOG) and small internet firms race ahead, Yahoo!(YHOO) seems to be standing still.

Financial Times:

- Morgan Stanley is expected to announce today it’s obtained a Chinese commercial banking license, trumping its US bank rivals, citing the bank’s CEO Mack.

Times of London:

- Man Group Plc clients have lost about $280 million from the implosion of US hedge fund manager Amaranth Advisors LLC.

- Microsoft’s(MSFT) next operating system may be in danger of delay as the company conducts its largest ever public testing program.

Liberation:

- The Lebanese army won’t seek to disarm Hezbollah militia as Israel completes its withdrawal from southern Lebanon, President Emile Lahoud said. “You would be a traitor if you wanted to take arms from the resistance” of Hezbollah, Lahoud said.

Finanz und Wirtschaft:

- BASF AG board member John Feldmann expects the price of oil to fall to $35/bbl. by 2009 as more production capacity comes on stream.

Nihon Keizai:

- Mizuho Trust & Banking, Sumitomo Trust & Banking and Resona Holdings group are among banks that may be affected by the loss of more than $6 billion at US hedge fund Amaranth Advisors LLC.

NHK Television:

- The European Union has started studying possible sanctions against North Korea for the refusal to return to six-government talks on its nuclear program.

Weekend Recommendations

Barron's:

- Made positive comments on (AAPL) and (PETM).

Citigroup:

- Reiterated Buy on (GILD), target $77.

- August SIA data for microprocessors is supportive of our recent estimate increases for Intel(INTC) and (AMD) and indicates further upside potential exists; SIA data has an 89% correlation to Intel and AMD revenues.

Night Trading

Asian indices are +.25% to +.75% on average.

S&P 500 indicated +.12%

NASDAQ 100 indicated +.03%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- (PCU) 2-for-1

- (LIHR) 2-for-1

Economic Releases

10:00 am EST

- Construction Spending for August is estimated to fall .4% versus a 1.2% decline in July.

- ISM Manufacturing for September is estimated to fall to 53.7 versus a reading of 54.5 in August.

- ISM Prices Paid for September is estimated to fall to 68.0 versus a reading of 73.0 in August.

- Pending Home Sales for August are estimated to rise .2% versus a 7.0% decline in July.

Bloomberg:

- The Dow Jones Industrial Average posted its best third quarter performance since 1995, led by telecom and technology shares.

- US Treasuries had their biggest quarterly gain in four years as the Fed paused.

- The US dollar rose the most against the yen this quarter since the final three months of 2005 as sustained US economic growth diminished speculation the Fed will cut borrowing costs before year-end.

- Congress passed legislation that tightens security at US ports, requiring radiation monitors at the 22 largest ports by the end of next year.

- Wal-Mart Stores(WMT) said September same-store-sales in the US rose about 1.8% versus estimates of a 1-3% increase.

- Amaranth Advisors LLC suspended redemptions in order to sell off its remaining assets after losses at its two main hedge funds continued in the past two weeks.

- The NYSE was up and running Saturday even though no shares changed hands as tests were conducted on a new electronic trading system designed to make the world’s biggest equity market more competitive.

- Brazilian President Luiz Inacio Lula da Silva led challenger Geraldo Alckmin in an early count of ballots from today’s election and was about 1 percentage point short of avoiding a run-off.

- Confidence among Japan’s largest manufacturers unexpectedly rose in September and companies said they plan to increase spending.

- Shares of Sony Corp.(SNE) fell on concern costs for a widening recall of its batteries used in notebook computers may be more than the company initially estimated.

- Natural gas may fall in NY for a sixth week, the longest slide in more than five years, as mild weather cuts demand and allows inventories to climb even higher, according to a survey by Bloomberg.

- Iran considers international oil prices too low and said it will support “any” OPEC” measure that helps raise them.

- Latin American bonds are posting their biggest gains in more than a year as inflation in Mexico and Brazil, which topped 6,800% in April 1990, falls below US levels.

Wall Street Journal:

- David Tepper, who overseas $4.5 billion hedge fund Appaloosa Management LP, is close to an agreement to invest billions in Delphi Corp. and may control a third of the bankrupt auto-parts maker.

Barron’s:

- US airlines may report a 9% increase in revenue per available seat per mile this year on lower cost structures, restrained capacity growth and a robust economy.

NY Times:

- YouTube Inc., the video-sharing Web site, plans to replicate its deal to share advertising revenue with Warner Music Group to appease copyright challenges from studios and recording companies.

- Medicare drug insurers will offer US beneficiaries more options next year for the elderly and disabled, both in terms of the plans and the number of medicines covered.

LA Times:

- California Republican Arnold Schwarzenegger holds a commanding 50% to 33% lead over Democrat Phil Angelides in the race for governor of the most-populous US state.

NY Post:

- Billionaire Investor Eddie Lampert, chairman of Sears Holdings(SHLD), is ready to continue the retailer’s winning stock performance-by turning the retail chair into a Berkshire Hathaway-type investment vehicle.

Economist:

- While Google(GOOG) and small internet firms race ahead, Yahoo!(YHOO) seems to be standing still.

Financial Times:

- Morgan Stanley is expected to announce today it’s obtained a Chinese commercial banking license, trumping its US bank rivals, citing the bank’s CEO Mack.

Times of London:

- Man Group Plc clients have lost about $280 million from the implosion of US hedge fund manager Amaranth Advisors LLC.

- Microsoft’s(MSFT) next operating system may be in danger of delay as the company conducts its largest ever public testing program.

Liberation:

- The Lebanese army won’t seek to disarm Hezbollah militia as Israel completes its withdrawal from southern Lebanon, President Emile Lahoud said. “You would be a traitor if you wanted to take arms from the resistance” of Hezbollah, Lahoud said.

Finanz und Wirtschaft:

- BASF AG board member John Feldmann expects the price of oil to fall to $35/bbl. by 2009 as more production capacity comes on stream.

Nihon Keizai:

- Mizuho Trust & Banking, Sumitomo Trust & Banking and Resona Holdings group are among banks that may be affected by the loss of more than $6 billion at US hedge fund Amaranth Advisors LLC.

NHK Television:

- The European Union has started studying possible sanctions against North Korea for the refusal to return to six-government talks on its nuclear program.

Weekend Recommendations

Barron's:

- Made positive comments on (AAPL) and (PETM).

Citigroup:

- Reiterated Buy on (GILD), target $77.

- August SIA data for microprocessors is supportive of our recent estimate increases for Intel(INTC) and (AMD) and indicates further upside potential exists; SIA data has an 89% correlation to Intel and AMD revenues.

Night Trading

Asian indices are +.25% to +.75% on average.

S&P 500 indicated +.12%

NASDAQ 100 indicated +.03%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- (PCU) 2-for-1

- (LIHR) 2-for-1

Economic Releases

10:00 am EST

- Construction Spending for August is estimated to fall .4% versus a 1.2% decline in July.

- ISM Manufacturing for September is estimated to fall to 53.7 versus a reading of 54.5 in August.

- ISM Prices Paid for September is estimated to fall to 68.0 versus a reading of 73.0 in August.

- Pending Home Sales for August are estimated to rise .2% versus a 7.0% decline in July.

BOTTOM LINE: Asian Indices are higher, boosted by financial and automaking shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are some economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Construction Spending, ISM Manufacturing, ISM Prices Paid, Pending Home Sales

Tues. - Total Vehicle Sales

Wed. - ADP Employment Change, ISM Non-manufacturing, Factory Orders

Thur. - Initial Jobless Claims, Continuing Claims

Fri. - Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Consumer Credit

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - None of note

Tues. - None of note

Wed. - Arrow Intl.(ARRO), Copart Inc.(CPRT), Stage Stores(SSI), Veritas DGC(VTS)

Thur. - Acuity Brands(AYI), Constellation Brands(STZ), Solectron(SLR)

Fri. - Power Integration(POWI), Schnitzer Steel(SCHN)

Other events that have market-moving potential this week include:

Mon. - None of note

Tue. - Citigroup Ethanol Conference, Fed’s Hoenig speaks

Wed. - Deutsche Bank High Yield Conference, Fed’s Bernanke speaks, Fed’s Geithner speaks, Fed’s Bies speaks, Fed’s Kohn speaks

Thur. - Retail Monthly Same-store-sales, Fed’s Moskow speaks, Fed’s Plosser speaks, Fed’s Pinalto speaks

Fri. - Fed’s Fisher speaks

There are some economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Construction Spending, ISM Manufacturing, ISM Prices Paid, Pending Home Sales

Tues. - Total Vehicle Sales

Wed. - ADP Employment Change, ISM Non-manufacturing, Factory Orders

Thur. - Initial Jobless Claims, Continuing Claims

Fri. - Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Consumer Credit

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - None of note

Tues. - None of note

Wed. - Arrow Intl.(ARRO), Copart Inc.(CPRT), Stage Stores(SSI), Veritas DGC(VTS)

Thur. - Acuity Brands(AYI), Constellation Brands(STZ), Solectron(SLR)

Fri. - Power Integration(POWI), Schnitzer Steel(SCHN)

Other events that have market-moving potential this week include:

Mon. - None of note

Tue. - Citigroup Ethanol Conference, Fed’s Hoenig speaks

Wed. - Deutsche Bank High Yield Conference, Fed’s Bernanke speaks, Fed’s Geithner speaks, Fed’s Bies speaks, Fed’s Kohn speaks

Thur. - Retail Monthly Same-store-sales, Fed’s Moskow speaks, Fed’s Plosser speaks, Fed’s Pinalto speaks

Fri. - Fed’s Fisher speaks

BOTTOM LINE: I expect US stocks to finish the week modestly higher on lower energy prices, short-covering, bargain hunting, mostly positive economic reports and less pessimism. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.

Saturday, September 30, 2006

Market Week in Review

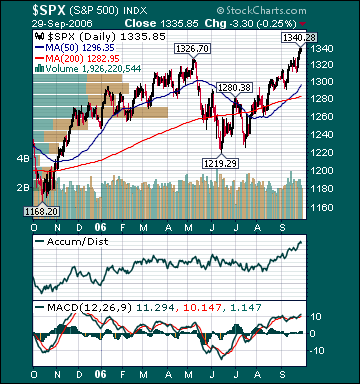

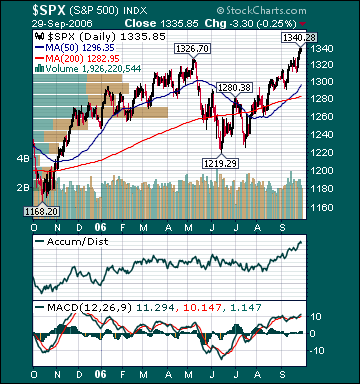

S&P 500 1,335.85 +1.60%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was bullish. The advance/decline line rose, most sectors rose and volume was above average on the week. Measures of investor anxiety were mostly lower. The AAII % Bulls rose to 51.32% this week from 47.75% the prior week. This reading is above average levels. The AAII % Bears fell to 32.89% this week from 34.23% the prior week. This reading is still above average levels.

The 10-week moving average of the % Bears is currently a high 39.1%. The 10-week moving-average of % Bears was 43.0% at the major bear market lows during 2002. The only other times it was higher than these levels, since record keeping began in 1987, were the significant market bottom during the 1990 recession/Gulf War and in October 1992. The persistent negative sentiment towards US equities is amazing and, considering the DJIA is only 71 points from an all-time high, still provides a wall of worry for stocks to climb. As well, there are many other indicators registering high levels of investor skepticism regarding recent stock market gains.

Short interest on the NYSE and Nasdaq is at all-time highs. The ISE Sentiment Index has bounced around depressed levels for months. The OEX Put/Call ratio has been elevated during this time, as well. Domestic stock mutual funds are still seeing outflows. I have heard a number of pundits recently state that investor complacency is high and used anecdotal evidence to back up their view. I strongly disagree. I doubt investor sentiment has ever been this poor in U.S. history with the DJIA about to break to new record highs. This bodes very well for a continuation of the recent rally.

The average 30-year mortgage rate fell another 9 basis points to 6.31%, which is 49 basis points below July highs. I still believe housing is in the process of slowing to more healthy sustainable levels. Mortgage rates have likely begun an intermediate-term move lower, which should help stabilize housing at relatively high levels over the next few months. The Case-Shiller housing futures are still projecting a 5% decline in the average home price over the next 9 months. Considering the average house has appreciated over 50% during the last few years, this would be considered a “soft landing.” The overall negative effects of housing on the US economy are currently being exaggerated, in my opinion. Housing has been slowing substantially for 14 months and has been mostly offset by many other very positive aspects of the economy. Americans’ median net worth is still very close to or at record high levels, unemployment is low, interest rates are low, stocks are rising and most measures of income growth are almost twice the inflation rate, just to name a few.

The benchmark 10-year T-note yield rose 4 basis points on the week on profit taking and diminishing economic growth concerns. In my opinion, investors’ continuing fears over an economic “hard landing” are misplaced. Consumer spending is very important to the health of the US economy. Spending is poised to remain strong on plunging energy prices, low long-term interest rates, a rising stock market, healthy job market, decelerating inflation and more consumer optimism. The CRB Commodities Index, the main source of inflation fears, has now declined 8.7% over the last 12 months and is down 16.4% from May highs, approaching bear market territory. The average commodity hedge fund is down 13.8% for the year. I believe inflation fears have peaked for this cycle as global economic growth moderates to around average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose substantially more than expectations even as refinery utilization fell. U.S. gasoline supplies are now at the highest level since 1991 for this time of the year. Unleaded Gasoline futures bounced for the week, but are still 46.6% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. Gasoline demand rose .6% this week and is estimated to rise .8% this year versus a 20-year average of 1.7% demand growth. Moreover, distillate stocks are 18% above the five-year average for this time of the year as we head into the winter heating season. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 9% from 36% late last year. The still elevated level of gas prices related to crude oil production disruption speculation is further dampening fuel demand, which will send gas prices back to more reasonable levels.

US oil inventories have only been higher during one other period over the last 7 years. Since December 2003, global oil demand is only up .7%, while global supplies have increased 4.8%, according to the Energy Intelligence Group. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. The Amaranth Advisors hedge fund blow-up is a prime example of the extent to which many investment funds have been speculating on ever higher energy prices through futures contracts, thus driving the price of the underlying commodity to absurd levels. Amaranth, a multi-strategy hedge fund, lost about $6.5 billion of its $9.5 billion under management in less than two months speculating on higher natural gas prices. I suspect a number of other funds will experience similar fates over the coming months, which will further pressure energy prices as these funds unwind their leveraged positions to meet investor redemptions.

Oil has clearly broken its uptrend, notwithstanding that this is the seasonally strong period for the commodity. A major top in oil is likely already in place. However, a Gulf hurricane or OPEC production cut could lead to a temporary bounce higher in price over the next couple of weeks, accelerating demand destruction, resulting in a complete technical breakdown in crude. Demand destruction is already pervasive globally. Moreover, many Americans already feel as though they are helping fund terrorism or hurting the environment everytime they fill up their gas tanks. I do not believe we will ever again see the demand for gas-guzzling vehicles that we saw in recent years, even if gas prices continue to plunge. An OPEC production cut with oil above $60 per barrel and weakening global growth would only further deepen resentment towards the cartel and result in even greater long-term demand destruction. Finally, as the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should continue heading meaningfully lower over the intermediate-term, notwithstanding OPEC production cuts.

Natural gas inventories rose less than expectations this week, however prices for the commodity fell again. Supplies are now 12.2% above the 5-year average, a record high level for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have collapsed 64.4% since December 2005 highs. It is very likely US natural gas storage will become full sometime this month, creating the distinct possibility of a “no-bid” situation for the physical commodity. Colorado State recently reduced its forecast from three to two major hurricanes for this season versus seven last year. The peak of hurricane season was September 10. Natural gas made new cycle lows again this week despite the fact that the commodity is in its seasonally strong period.

Gold rose slightly on the week on short-covering and a bounce in oil. The US dollar rose on diminishing worries over slowing economic growth. I continue to believe there is very little chance of another Fed rate hike anytime soon. An eventual cut is more likely at this point as inflation continues to decelerate.

Energy stocks outperformed for the week on quarter-end short-covering. Airline stocks underperformed on the bounce in oil and profit-taking. S&P 500 profit growth for the second quarter came in a strong 16.3% versus a long-term historical average of 7%, according to Thomson Financial. This is the 16th straight quarter of double-digit profit growth, the best streak since recording keeping began in 1936. Moreover, another double-digit gain is likely in the third quarter. Earnings pre-announcements are running below average levels so far. Despite a 79.3% total return for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 15.3. The 20-year average p/e for the S&P 500 is 24.4. The S&P 500 is now up 8.5% and the Russell 2000 Index is up 8.7% year-to-date. The DJIA is only 71 points away from its all-time high reached on January 14, 2000. I expect the Dow to breach this level convincingly during the fourth quarter.

Current stock prices are still providing longer-term investors very attractive opportunities in many equities that have been punished indiscriminately during the latest correction. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A recent CSFB report confirmed this view. The report concluded that on a price-to-cash flow basis growth stocks are now cheaper than value stocks for the first time since at least 1977. Almost the entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is attributable to growth stock multiple contraction. The p/e on value stocks is back near high levels. I still expect the most overvalued economically sensitive and emerging market stocks to continue underperforming over the intermediate-term as the manias for those shares subside and global growth slows to more average rates. I continue to believe a chain reaction of events has begun that will result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels. One of the characteristics of the current “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated and promptly priced in to stock prices. Furthermore, this “irrational pessimism” by investors is resulting in a dramatic decrease in the supply of stock as companies buy back shares, IPOs are pulled and secondary stock offerings are canceled. Commodity and emerging market funds, which have received huge capital infusions this year, will likely see significant outflows at year-end. As well, how many times earlier in the year did we hear investment managers talk about the mid-term election cycle decline they expected and that they were already positioned for it? Historically, the average bottom for mid-term election cycle lows is Sept. 30. There is massive bull firepower available at a time when the supply of stock is contracting.

Over the coming months, an end to the Fed rate hikes, lower commodity prices, seasonal strength, the November election, decelerating inflation readings, lower long-term rates, increased consumer/investor confidence, rising demand for US stocks and the realization that economic growth is only slowing to around average levels should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I still expect the S&P 500 to return a total of at least 15% for the year. The ECRI Weekly Leading Index fell this week and is forecasting healthy, but decelerating US economic activity.

*5-day % Change

Subscribe to:

Comments (Atom)