Style Outperformer:

Sector Outperformers:

- 1) Airlines +2.09% 2) Homebuilders +.78% 3) Retail +.65%

Stocks Rising on Unusual Volume:

- SBGI, YPF, FOR, SSYS, THRX, BKS, MBI, SGMO and SWHC

Stocks With Unusual Call Option Activity:

- 1) MTG 2) CWH 3) NS 4) SSYS 5) MCO

Stocks With Most Positive News Mentions:

- 1) STLD 2) SCHW 3) TRB 4) CME 5) T

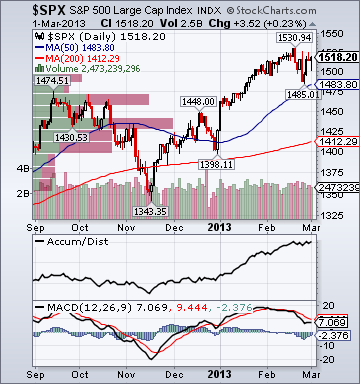

Charts:

Weekend Headlines

Bloomberg:

- Euro Leaders Demand Austerity as Italy Nears Vote. European leaders demanded that euro

members press on with budget cuts to end the debt crisis as

Italy edged closer to a new election after an anti-austerity

vote last week resulted in political deadlock. Finance ministers from the 17-member single-currency bloc

meet in Brussels today to discuss issues including a bailout for

Cyprus. In Rome, a top aide to Democratic Party leader Pier Luigi Bersani said the country may need to hold another election

this year after passing new electoral laws. “Now in Europe, after the Italian election, it seems to be

a case of either austerity and savings programs or growth, but

that’s a completely false premise,” German Chancellor Angela Merkel said at March 1 event. EU Economic and Monetary Affairs

Commissioner Olli Rehn echoed those comments this weekend,

telling Der Spiegel magazine that there’s no scope for the bloc

to let up on budget discipline.

- Bersani Insists He’ll Form New Government Without Rivals. Democratic

Party leader Pier Luigi Bersani, whose coalition won the most votes in

Italy’s inconclusive elections, insisted he would form a government on

his own without seeking an alliance with his main rivals --

Silvio Berlusconi and comic-turned-politician Beppe Grillo. “We have 460 parliamentarians, double what the right got

and triple what Grillo won,” he said in an interview last night

on state-owned RAI3 television’s “Che Tempo Che Fa” program.

“So we will have the first word.”

- ECB’s Coeure Says Europe Needs to Rebalance Its Social Contract.

European Central Bank Executive

Board member Benoit Coeure said Europe must rebalance its social

contract because the economic crisis “disproportionately affected the

more vulnerable social groups.” Workers who could “lose their

employability” if they remain jobless for too long may threaten economic

growth in the 17-nation euro region, Coeure said in a speech today

at Harvard University’s Kennedy School of Government in Cambridge,

Massachusetts. He did not discuss monetary policy. “There are signs of a growing mismatch between worker attributes and job requirements across a number of euro-area countries,”

Coeure, 43, said today at the Kennedy School’s “Europe 2.0” conference.

“Future growth depends on human capital being cultivated and expanded.”

The area’s unemployment rate climbed to a record 11.9 percent in

January as the bloc

remained mired in recession.

- Grillo Says His Party Won't Vote Confidence in Any Government.

Beppe Grillo, whose party won about 25% of Italy's popular vote, said.

His party would support specific legislation on a case-by-case basis. PD

lawmaker Francesco Boccia said in an e-mail that Grillo's party should

go to parliament to say it doesn't support Bersani's proposal. Grillo

has called for the renegotiation of Italy's debt.

- Devil Is in the Details as Swiss Vote to Curb CEO Pay. The Swiss government must figure out

how to translate some of the world’s toughest rules on executive

pay into national law and risk an exodus of big corporations

after voters overwhelmingly backed new curbs in a referendum.

- Russell Indexes to Reclassify Greece as Emerging Market. Russell Investments, which advises

funds with $2.4 trillion in assets, will reclassify Greece to an

emerging from a developed market, an unprecedented step taken

after a recession reduced the nation’s economy by 20 percent.

- Euro Falls in Longest Stretch Since June on Record Unemployment. Europe’s 17-nation common currency

posted its longest stretch of weekly losses since June as demand

slumped after Italy’s election produced a hung parliament and

euro-area unemployment climbed to a record. The Dollar Index (DXY) rose to the highest level since August as investors weighed the U.S. government’s failure to avoid

automatic budget cuts. The euro fell below $1.30 for the first

time in two months as the region’s inflation rate was below the

European Central Bank’s 2 percent ceiling before a policy

meeting March 7. The Labor Department may report on March 8 that

U.S. employers added 160,000 workers last month, a Bloomberg

survey shows. “It’s a combination of Italy’s election and generally soft

economic data out of the euro zone,” Dan Dorrow, the head of

research at Faros Trading LLC in Stamford, Connecticut, said of

the euro’s decline. “We saw unemployment grinding higher.” The euro fell 1.3 percent this week to $1.3022 in New York

after dropping 3.8 percent in February, snapping a six-month

rally.

- China’s Stocks Slump as Developers Tumble Most Since June 2008. China’s

stocks fell, led by the biggest slump among developers since 2008,

after the Cabinet ordered more measures to cool property prices and

after growth in the nation’s services industries slowed. The Shanghai

Composite Index (SHCOMP) slid 2.9 percent, the most since Feb. 21, to

2,292.14 as of the city's 11:30 a.m. break. The CSI 300 Index

(SHSZ300) lost 3.8 percent to 2,568.21. China Vanke Co. led a gauge of

developers to the biggest tumble since June 2008 after the State Council

urged higher down-payments and interest rates for second-home

mortgages. China Minsheng Banking Corp. (600016) sank 4.8 percent,

pacing declines among lenders. “When there are new rules like these, it

extends far beyond property shares,” Zhang Yanbin, an analyst with

Zheshang Securities Co. in Shanghai, said by phone today. “There have

been talks of property measures in the past few weeks, leading to

declines in the market. The news over the weekend was evidence of a

detailed measure, hence the loss is much bigger.” A purchasing managers’

index released yesterday showed the

nation’s services industries expanded at the slowest pace in

five months.

- PBOC’s Yi Says China Prepared for Currency War, Xinhua Reports. China is “fully prepared” for a currency war should one happen, central bank Deputy Governor Yi Gang said in Beijing yesterday, the official Xinhua News Agency reported. “China is prepared,” Yi was quoted as saying by the

agency, which gave no further details about where he spoke. “In

terms of both monetary policies and other mechanism, China will

take into full account the quantitative easing policies

implemented by central banks of foreign countries.” China’s

foreign-exchange regulator, which is headed by Yi,

warned in a report this week that quantitative easing in developed

nations will lead to capital inflows into emerging markets and that

policy easing can’t solve all of a country’s economic problems.

- Rebar Falls to Six-Week Low Amid Rising Inventories in China.

Steel reinforcement-bar futures fell

for a second day, to the lowest level in more than six weeks as

inventories in China climbed for a ninth week, adding to concern that

the market is oversupplied. Rebar for delivery in October on the

Shanghai Futures Exchange dropped as much as 2.6 percent to 3,916 yuan ($629) a metric ton, the lowest level since Jan. 17 for a most-active

contract, and was at 3,929 at 9:41 a.m. local time. Futures fell

1.8 percent last month, the first drop since November.

Inventory jumped 79 percent this year through March 1,

according to Shanghai Steelhome Information.

- Short Sales Fall 53% With U.S. Bull Market Starting Fifth Year. Investors

reduced bearish stock bets to the lowest level since at least 2007 as

the bull market in American equities begins its fifth year. Short sales

in the Standard & Poor’s Composite 1,500 Index fell to 5.6 percent

of shares available for trading in February, down from a record 12

percent during the credit crisis and the lowest ever in data compiled by

Bespoke Investment Group and Bloomberg starting six years ago. The

last time the number of shares borrowed and sold short approached this

level, the equity gauge lost 3.3 percent in the next three months. Bulls

say the capitulation by market bears shows the rally remains intact and

that more money will flow into stocks after individuals sent $37.9

billion to mutual funds in January, the most since 2004. It also means a

source of demand is diminishing, a traditional signal for caution in an

aging bull market. “When you look at short interest, and it’s low

like right now, it means people are very, very bullish about the

market,” Uri Landesman, president of New York-based hedge fund Platinum

Partners, which manages $1.15 billion, said in a Feb. 28 phone

interview. “When that happens, it’s a bearish sign, because if

all minds change, there’s downside, not upside.”

- Commodity Fund Outflows Reach Weekly Record of $4.23 Billion. Money managers removed a record

$4.23 billion from commodity funds in the week ended Feb. 27,

led by declines in precious-metal holdings, as raw materials

capped the biggest monthly loss since October. Investors pulled an

all-time high of $4.03 billion from gold and precious-metals funds, said

Cameron Brandt, the director of research for EPFR Global, which started

tracking the flows in 2000. The Cambridge, Massachusetts-based

researcher

said last week that total commodity outflows for the period

ended Feb. 20 reached $828 million.

The Standard & Poor’s GSCI Spot Index of 24 raw materials

fell 4 percent last month, the most since October.

- Environmentalists Step Up Opposition to Keystone Pipeline.

Opponents of TransCanada Corp. (TRP)’s Keystone XL pipeline intend to

make themselves heard by President Barack Obama after a March 1 report

helped clear a path for the White House to approve the project. The

pipeline drew a fresh wave of objections from groups including the

Sierra Club, Natural Resources Defense Council and 350.org, when the

U.S. State Department’s draft assessment said it won’t have a

significant impact on global warming. Members of 350.org will

confront Obama and Secretary of State John Kerry at all future public

events, said Daniel Kessler, a spokesman. “If they are doing something

in public, we will be

there,” Kessler said in an e-mail. “Thousands of people are

willing to get arrested to stop this project.”

- Karachi Mourns 42 Killed in Bombing as Attacks on Shiites Spread. Karachi shut schools and businesses

to mourn the 42 people killed in a car bombing that targeted the

city’s Shiite minority and extended a spree of deadly attacks on

the Islamic sect to Pakistan’s biggest city. Women and children were among the dead and more than 135 were wounded in the blast around 7:30 p.m. yesterday in a

Shiite-dominated neighborhood of the port city, Pakistan’s

financial capital.

- Celgene(CELG) Psoriasis Drug Helped Third of Patients in Study. Celgene

Corp. (CELG), the maker of the cancer drug Revlimid, said its

experimental psoriasis medicine helped quell the redness and

inflammation associated with the skin disorder in a study. The drug,

apremilast, helped one-third of patients achieve a 75 reduction of

symptoms, based on a standard Psoriasis Area and Severity Index

measurement. That compared with 5.3 percent of those on placebo with the

same score, called PASI-75, Celgene said in a statement as it presents

the data at the American Academy of Dermatology meeting in Miami Beach,

Florida, today.

Wall Street Journal:

- Student-Loan Securities Stay Hot. Investors' Hunger for Returns Is Driving Demand Even as More Borrowers Fall Behind on Their Payments. Student

loans are souring at a growing rate—and investors can't seem to get

enough. SLM Corp., the largest U.S. student lender, last week sold $1.1

billion of securities backed by private student loans. Demand for the

riskiest

bunch—those that will lose money first if the loans go bad—was 15 times

greater than the supply, people familiar with the deal said.

Marketwatch.com:

- How shipper China Cosco sailed into rough seas. One of the country’s most prominent liner shipping operators, China

COSCO Holdings Co. Ltd., is struggling to avoid being kicked out of the

Shanghai Stock Exchange five years after its debut.

Fox News:

- Kerry: U.S. releasing millions in aid to Egypt. Secretary of State John Kerry said Sunday the United States will give

Egypt $250 million more in aid, following President Mohammed Morsi's

pledges for political and economic reforms.

CNBC:

- Paris Seeks Alternative to 75% Tax. France's Socialist government is considering replacing its stricken 75

percent top income tax rate on earnings above 1 million euros, with a

65-66 percent rate on households earning more than 2 million euros.

Business Insider:

IBD:

Reuters:

- BOJ should not monetise public debt-governor nominee Kuroda. The Bank of Japan should not directly underwrite government bonds or take measures that would be interpreted by markets as public debt monetisation, Haruhiko

Kuroda, the government's nominee for next central bank governor, said on

Monday.

USA Today:

- Tax bills for rich families approach 30-year high. With Washington gridlocked again over whether to raise their taxes,

it turns out wealthy families already are paying some of their biggest

federal tax bills in decades even as the rest of the population

continues to pay at historically low rates. President Obama and

Democratic leaders in Congress say the wealthy must pay their fair share

if the federal government is ever going to fix its finances and reduce

the budget deficit to a manageable level. A new analysis, however,

shows that average tax bills for high-income families rarely have been

higher since the Congressional Budget Office began tracking the data in

1979. It's middle- and low-income families who aren't paying as much as

they used to.

Financial Times:

- Free lunch will come to an untidy end. Investors fear asset bubbles created by Fed policies. Seth

Klarmen, founder of hedge fund Baupost, offered a searing indictment of

the Federal Reserve’s monetary policies in his year-end letter to

investors, currently circulating in the wider hedge fund community. In

the mid-January letter, Mr Klarman describes “the real downside scenario

which involves the end of the free lunch of large deficits, zero

interest rates and relentless quantitative easing”. Along with the

European Central Bank, Fed chairman Ben Bernanke “seems intent on buying

back bonds indefinitely, whether or not their actions deliver an

economic recovery and inspite of any unpleasant

side-effects. It is clear that after four years and counting, their

efforts have not delivered. Only a zealot would continue with a plan

that is not working and massively expand it,” Mr Klarman concludes.

Telegraph:

WirtschaftsWoche:

- Regling

Doubts ESM Will Directly Recapitalize Banks. A decision to recapitalize

banks directly from ESM funds would need to be unanimous, citing

European Stability Mechanism chief Klaus Regling. Such an instrument

would also limit the money the ESM could use for countries in need of

aid, Regling said. Direct recapitalization without a cap would hurt the

ESM's rating, he said.

Focus:

- Beppe Grillo Calls for Renegotiation of Italy's Debt. Italy is

being smothered by debt and not by the euro, Grillo said. Interest

amounting to EU100m a year is killing Italy, he said. Italy should leave

the common currency and take back the Lira if the terms don't change,

Grillo said. Italy's political system will collapse within six months

under the leadership of the old parties, Grillo said.

AutomobilWoche:

- Europe's

Car Suppliers May Cut 75,000 Jobs. One in 10 of the 750,000 jobs in

western Europe's car supplier industry might disappear in 3-4 years,

citing Marcus Berret of Roland Berger, which carried out a study. Jobs will be lost in production, R&D and administration.

Europa:

- Five Spanish

regions including Catalonia need further budget cuts after missing

targets to reduce their deficits in 2012, citing an interview with Budget Minister Cristobal Montoro. Valencia, Murcia, Balears and Andalusia failed to comply as well with budget cuts so need to propose new austerity measures, Montoro says.

ORF:

- Eurogroup's

Wieser Sees No Alternative to Deficit Reduction. The timing of budget

adjustments is the only thing that can be changed, not the direction of

paying down debts, Thomas Wieser, head of the Eurogroup Working Group,

told Austrian radio station ORF. The Italian election has added to

uncertainty, Wieser said. It's not correct to say that the crisis is

back after the election since it never went away, he said in an

interview.

Kyodo:

Shanghai Securities News:

- China Housing Minister Says Confident in Controlling Home Prices. Authorities should strictly implement the property curb measures issued by the State Council yesterday, citing Housing Minister Jiang Weixin. China

told its central bank to raise down-payment requirements and interest

rates for second-home mortgages in cities with "excessively fast" price

gains, according to the State Council. Cities facing "relatively large"

pressure from rising house prices must further tighten home-purchase

limits.

Beijing Times:

- The time is ripe for China to impose an inheritance tax and the threshold should be 5m yuan, citing a research paper issued by Beijing Normal University.

Weekend Recommendations

Barron's:

- Bullish commentary on (COF) and (FOR).

Night Trading

- Asian indices are -1.75% to -.75% on average.

- Asia Ex-Japan Investment Grade CDS Index 109.0 +.5 basis point.

- Asia Pacific Sovereign CDS Index 85.25 +1.25 basis points.

- NASDAQ 100 futures -.54%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

Upcoming Splits

Other Potential Market Movers

- The Fed's Yellen speaking, Fed's Powell speaking, China HSBC PMI Services, Bank stress test results, Reserve Bank of Australia rate decision, Eurozone PPI, ISM New York, Deutsche Bank Media/Telecom Conference, Cowen Healthcare Conference, JPMorgan Aviation/Transport/Defense Conference and the (D) analyst meeting could also impact trading today.

BOTTOM LINE: Asian indices are lower, weighed down by real estate and commodity shares in the region. I expect US stocks to open lower and to maintain losses into the afternoon. The Portfolio is 50% net long heading into the week.

U.S. Week Ahead by MarketWatch (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on global growth fears, rising Mideast tensions, Eurozone

debt angst, profit-taking, technical selling and more shorting. My

intermediate-term trading indicators are giving neutral signals and the

Portfolio is 50% net long heading into the week.

S&P 500 1,518.20 +.17%*

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 914.73 -.16%

- Value Line Geometric(broad market) 392.96 -.43%

- Russell 1000 Growth 694.56 +.43%

- Russell 1000 Value 772.04 -.05%

- Morgan Stanley Consumer 928.01 +.33%

- Morgan Stanley Cyclical 1,122.15 +.47%

- Morgan Stanley Technology 725.72 +.21%

- Transports 5,984.90 +.69%

- Bloomberg European Bank/Financial Services 94.80 -1.53%

- MSCI Emerging Markets 43.42 -.10%

- Lyxor L/S Equity Long Bias 1,120.39 -.96%

- Lyxor L/S Equity Variable Bias 837.09 -.57%

Sentiment/Internals

- NYSE Cumulative A/D Line 174,546 +1.36%

- Bloomberg New Highs-Lows Index 281 +378

- Bloomberg Crude Oil % Bulls 32.4 +94.5%

- CFTC Oil Net Speculative Position 236,098 -8.46%

- CFTC Oil Total Open Interest 1,654,089 +.24%

- Total Put/Call 1.18 +28.26%

- OEX Put/Call 1.95 +12.72%

- ISE Sentiment 83.0 -30.83%

- Volatility(VIX) 15.36 +8.40%

- S&P 500 Implied Correlation 59.94 +2.92%

- G7 Currency Volatility (VXY) 9.64 unch.

- Smart Money Flow Index 11,176.59 -.71%

- Money Mkt Mutual Fund Assets $2.663 Trillion +.20%

Futures Spot Prices

- Reformulated Gasoline 312.86 -4.57%

- Heating Oil 293.01 -5.79%

- Bloomberg Base Metals Index 203.98 -3.33%

- US No. 1 Heavy Melt Scrap Steel 352.67 USD/Ton unch.

- China Iron Ore Spot 150.60 USD/Ton -1.95%

- UBS-Bloomberg Agriculture 1,530.40 +.06%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 6.8% -80 basis points

- Philly Fed ADS Real-Time Business Conditions Index .0969 n/a

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 113.88 +.28%

- Citi US Economic Surprise Index 7.70 +12.5 points

- Fed Fund Futures imply 56.0% chance of no change, 44.0% chance of 25 basis point cut on 3/20

- US Dollar Index 82.31 +1.05%

- Yield Curve 160.0 -11 basis points

- 10-Year US Treasury Yield 1.84% -12 basis points

- Federal Reserve's Balance Sheet $3.072 Trillion -.14%

- U.S. Sovereign Debt Credit Default Swap 39.50 +1.28%

- Illinois Municipal Debt Credit Default Swap 144.0 -1.19%

- Western Europe Sovereign Debt Credit Default Swap Index 102.83 +2.26%

- Emerging Markets Sovereign Debt CDS Index 180.12 +2.63%

- Israel Sovereign Debt Credit Default Swap 123.54 +.31%

- Iraq Sovereign Debt Credit Default Swap 446.09 +2.54%

- China Blended Corporate Spread Index 397.0 +18 basis points

- 10-Year TIPS Spread 2.54% unch.

- TED Spread 18.25 +1.5 basis points

- 2-Year Swap Spread 13.75 -.75 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -20.25 -.5 basis point

- N. America Investment Grade Credit Default Swap Index 87.08 -.51%

- European Financial Sector Credit Default Swap Index 163.62 +9.07%

- Emerging Markets Credit Default Swap Index 243.93 +4.0%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 129.50 +5.5 basis points

- M1 Money Supply $2.459 Trillion -.92%

- Commercial Paper Outstanding 1,063.10 unch.

- 4-Week Moving Average of Jobless Claims 355,000 -5,800

- Continuing Claims Unemployment Rate 2.4% unch.

- Average 30-Year Mortgage Rate 3.51% -5 basis points

- Weekly Mortgage Applications 753.0 -3.76%

- Bloomberg Consumer Comfort -32.8 +.6 point

- Weekly Retail Sales +2.7% -10 basis points

- Nationwide Gas $3.77/gallon -.01/gallon

- Baltic Dry Index 757.0 +2.30%

- China (Export) Containerized Freight Index 1,134.82 -1.53%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 17.50 unch.

- Rail Freight Carloads 238,083 -5.2%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (25)

- CWH, SLCA, WBMD, FIRE, BKS, ALC, HPQ, SSTK, GWRE, COG, CRZO, CCXI, CBRL, PANW, FRGI, BLOX, WMGI, SIR, AHS, B, TSRO, RPAI, BCPC, IMGN and BIO

Weekly High-Volume Stock Losers (15)

- NDSN, ARCP, DDS, CEC, PZZA, ECPG, KRA, CHMT, LO, TRAK, VOLC, MMSI, TRLA, VSI and BSFT

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Market Tone:

- Advance/Decline Line: Slightly Higher

- Sector Performance: Mixed

- Market Leading Stocks: Performing In Line

Equity Investor Angst:

- ISE Sentiment Index 78.0 -19.59%

- Total Put/Call 1.24 +29.17%

Credit Investor Angst:

- North American Investment Grade CDS Index 86.47 -1.71%

- European Financial Sector CDS Index 163.68 +4.21%

- Western Europe Sovereign Debt CDS Index 102.83 -.81%

- Emerging Market CDS Index 243.62 -.60%

- 2-Year Swap Spread 13.75 -.25 bp

- 3-Month EUR/USD Cross-Currency Basis Swap -20.25 unch.

Economic Gauges:

- 3-Month T-Bill Yield .10% unch.

- China Import Iron Ore Spot $150.60/Metric Tonne -.73%

- Citi US Economic Surprise Index 7.70 +4.9 points

- 10-Year TIPS Spread 2.54 -1 bp

Overseas Futures:

- Nikkei Futures: Indicating +96 open in Japan

- DAX Futures: Indicating +2 open in Germany

Portfolio:

- Slightly Higher: On gains in my tech/medical/biotech sector longs

- Disclosed Trades: None

- Market Exposure: 50% Net Long