The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,173.23 +.21%

- S&P 500 High Beta 34.43 +.18%

- Wilshire 5000 21,463.11 +.68%

- Russell 1000 Growth 972.69 +1.32%

- Russell 1000 Value 1,024.03 +.09%

- S&P 500 Consumer Staples 506.50 +2.04%

- Solactive US Cyclical 143.37 -.08%

- Morgan Stanley Technology 1,019.24 +2.67%

- Transports 9,198.20 +1.60%

- Bloomberg European Bank/Financial Services 108.05 +2.43%

- MSCI Emerging Markets 41.73 +1.33%

- HFRX Equity Hedge 1,186.23 +.95%

- HFRX Equity Market Neutral 984.45 +.22%

Sentiment/Internals

- NYSE Cumulative A/D Line 231,815 +1.57%

- Bloomberg New Highs-Lows Index 25 +110

- Bloomberg Crude Oil % Bulls 22.73 -29.74%

- CFTC Oil Net Speculative Position 255,363 n/a

- CFTC Oil Total Open Interest 1,459,175 n/a

- OEX Put/Call 7.80 +622.22%

- ISE Sentiment 74.0 -10.84%

- Volatility(VIX) 13.33 -1.84%

- S&P 500 Implied Correlation 68.53 (new maturities)

- G7 Currency Volatility (VXY) 8.77 +.92%

- Emerging Markets Currency Volatility (EM-VXY) 8.03 +3.35%

- Smart Money Flow Index 17,547.81 +.16%

- ICI Money Mkt Mutual Fund Assets $2.662 Trillion +.32%

- ICI US Equity Weekly Net New Cash Flow -$3.622 Billion

Futures Spot Prices

- Reformulated Gasoline 182.76 -9.88%

- Heating Oil 216.12 -9.67%

- Bloomberg Base Metals Index 191.91 -2.50%

- US No. 1 Heavy Melt Scrap Steel 339.0 USD/Ton -8.9%

- China Iron Ore Spot 71.32 USD/Ton +1.44%

- UBS-Bloomberg Agriculture 1,239.63 -.63%

Economy

- ECRI Weekly Leading Economic Index Growth Rate -2.3% +10 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.1719 +.116%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 127.58 +.04%

- Citi US Economic Surprise Index 6.10 -13.8 points

- Citi Eurozone Economic Surprise Index -21.50 +14.5 points

- Citi Emerging Markets Economic Surprise Index -.9 +.1 point

- Fed Fund Futures imply 44.0% chance of no change, 56.0% chance of 25 basis point cut on 12/17

- US Dollar Index 88.36 +.09%

- Euro/Yen Carry Return Index 154.20 +1.17%

- Yield Curve 170.0 -11.0 basis points

- 10-Year US Treasury Yield 2.16% -17.0 basis points

- Federal Reserve's Balance Sheet $4.446 Trillion -.15%

- U.S. Sovereign Debt Credit Default Swap 16.47 -1.29%

- Illinois Municipal Debt Credit Default Swap 176.0 +1.82%

- Western Europe Sovereign Debt Credit Default Swap Index 28.11 -8.43%

- Asia Pacific Sovereign Debt Credit Default Swap Index 62.35 -2.41%

- Emerging Markets Sovereign Debt CDS Index 250.11 +2.51%

- Israel Sovereign Debt Credit Default Swap 76.33 -5.57%

- Iraq Sovereign Debt Credit Default Swap 340.72 -3.16%

- Russia Sovereign Debt Credit Default Swap 314.31 +11.07%

- China Blended Corporate Spread Index 323.87 -.50%

- 10-Year TIPS Spread 1.80% -7.0 basis points

- TED Spread 22.0 -1.25 basis points

- 2-Year Swap Spread 20.75 -1.0 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -11.25 -1.75 basis points

- N. America Investment Grade Credit Default Swap Index 61.47 -3.77%

- European Financial Sector Credit Default Swap Index 59.42 -7.63%

- Emerging Markets Credit Default Swap Index 273.58 +1.35%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 87.0 +1.0 basis point

- M1 Money Supply $2.841 Trillion -.51%

- Commercial Paper Outstanding 1,090.70 unch.

- 4-Week Moving Average of Jobless Claims 294,000 +6,500

- Continuing Claims Unemployment Rate 1.7% -10 basis points

- Average 30-Year Mortgage Rate 3.97% -2 basis points

- Weekly Mortgage Applications 374.50 -4.29%

- Bloomberg Consumer Comfort 40.7 +2.2 points

- Weekly Retail Sales +4.0% +20 basis points

- Nationwide Gas $2.79/gallon -.05/gallon

- Baltic Dry Index 1,187 -10.35%

- China (Export) Containerized Freight Index 1,047.04 -.75%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 32.50 +8.33%

- Rail Freight Carloads 269,373 -1.58%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (23)

- FPRX, KIRK, VEEV, EIGI, BWS, NGVC, CVTI, CBPX, POST, ZAYO, BLOX,

PANW, HIBB, BERY, OUTR, AVID, AERI, LORL, LQ, FIVE, CTRN, MTSI and SCAI

Weekly High-Volume Stock Losers (7)

- LQDT, LOCO, DCI, GMCR, ARUN, GME and WAIR

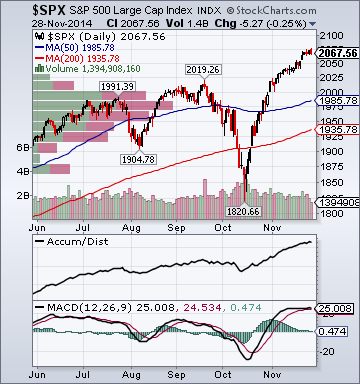

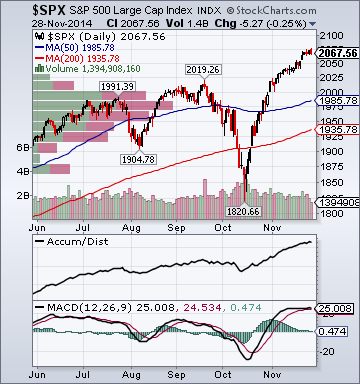

Weekly Charts

ETFs

Stocks

*5-Day Change

Evening Headlines

Bloomberg:

- Russian Recession Risk Seen at Record as Oil Saps Economy. Russia

will sink into recession at a Urals price of $80 a barrel, seven years

after its economy grew 8.5 percent when its chief export oil blend

averaged near $70, according to a Bloomberg survey of analysts. Urals at $80, or about $3 cheaper than its average in the month through November 15, will tip Russia into a contraction,

according to the median estimate of 32 economists. The

probability of a recession in the next 12 months rose to 75

percent, the highest since the first such survey more than two

years ago, according to another poll.

- Abe Tested by Weak Retail Sales as Japan Election Looms: Economy. Japan’s inflation slowed for a third month and retail sales fell more than forecast, showing the economy continues to struggle from a sales-tax

increase as Prime Minister Shinzo Abe heads into an election next month. The Bank of Japan’s key price gauge increased 2.9 percent in

October from a year earlier, equivalent to a 0.9 percent gain when the

effects of April’s tax bump are excluded. Retail sales dropped 1.4

percent from September, more than a 0.5 percent decline forecast in a

Bloomberg News survey.

- Kuroda’s Easing ‘Incomprehensible’ to Ex-BOJ Chief Economist.

Prime Minister Shinzo Abe has tied the Bank of Japan’s hands with a

delay in a sales-tax increase that’s hurt confidence in the nation’s

finances, a former chief economist at the central bank said. Damaged trust in Abe’s pledge to cut the deficit will make

it “extremely difficult” for the BOJ to exit record stimulus

without risking a bond yield surge, Hideo Hayakawa said in an

interview yesterday. More easing would also be tough because

Governor Haruhiko Kuroda effectively has made fiscal improvement

a premise for further monetary stimulus, he said.

- Record China Downgrades Test PBOC as More Defaults Seen. Rating companies say defaults in China will spread as the central

bank’s interest rate cut will do little to stop a wave of maturities

from worsening record debt downgrades. Chinese credit assessors

slashed grades on 83 firms this year, already matching the record number

in all of 2013, according to data compiled by Shenzhen-based China

Investment Securities Co. Companies must repay 2.1 trillion yuan ($342

billion) in the first six months of 2015, the most for any half, data

compiled by Bloomberg show.

- Cameron to Set Out Plan to Cut Migration, Raising EU Exit Threat. David

Cameron will raise the prospect of Britain leaving the European Union

if fellow leaders don’t agree to let him restrict access to welfare

payments for migrants. In a speech in central England today, the

prime minister will demand that Europeans arriving in the U.K. receive

no welfare payments or state housing until they’ve been resident for

four years. He’ll say they shouldn’t receive unemployment benefits and

should be removed from the country if they don’t

find work within six months.

- Commodities Slump to Five-Year Low as Crude Oil Drops on OPEC. Commodities retreated to a five-year

low as crude oil tumbled after OPEC refrained from cutting

output to ease a global glut. Gold and copper also declined. The

Bloomberg Commodity Index (BCOM) of 22 raw materials dropped as much as

1.9 percent to 115.2838, the lowest since July 2009, before trading at

115.29 by 1:26 p.m in Singapore. The index resumed trading today

after the U.S. Thanksgiving holiday yesterday when Brent crude dropped

6.7 percent after a meeting of the Organization of Petroleum Exporting

Countries in Vienna

took no action to relieve the supply glut.

Zero Hedge:

Business Insider:

Evening Recommendations

Night Trading

- Asian equity indices are -.50% to +.50% on average.

- Asia Ex-Japan Investment Grade CDS Index 101.0 -1.5 basis points.

- Asia Pacific Sovereign CDS Index 62.50 unch.

- NASDAQ 100 futures +.28%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

Upcoming Splits

Other Potential Market Movers

- The Eurozone CPI report could also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by consumer and industrial shares in the region. I expect US stocks to open modestly higher and to weaken into the early close, finishing mixed. The Portfolio is 50% net long heading into the day.

Broad Equity Market Tone:

- Advance/Decline Line: Modestly Higher

- Sector Performance: Mixed

- Market Leading Stocks: Outperforming

Equity Investor Angst:

- Volatility(VIX) 12.o7 -1.47%

- Euro/Yen Carry Return Index 153.65 -.02%

- Emerging Markets Currency Volatility(VXY) 7.63 +.66%

- S&P 500 Implied Correlation 30.38 n/a

- ISE Sentiment Index 114.0 +2.70%

- Total Put/Call .84 -13.40%

Credit Investor Angst:

- North American Investment Grade CDS Index 60.30 -.71%

- European Financial Sector CDS Index 62.25 -.60%

- Western Europe Sovereign Debt CDS Index 29.79 +2.87%

- Asia Pacific Sovereign Debt CDS Index 62.63 +.16%

- Emerging Market CDS Index 269.75 +.42%

- China Blended Corporate Spread Index 323.88 +.34%

- 2-Year Swap Spread 20.25 +1.0 basis point

- TED Spread 22.0 -.75 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -9.0 -1.0 basis point

Economic Gauges:

- 3-Month T-Bill Yield .01% -1 basis point

- Yield Curve 173.0 -2.0 basis points

- China Import Iron Ore Spot $68.49/Metric Tonne -1.57%

- Citi US Economic Surprise Index 6.20 -10.2 points

- Citi Eurozone Economic Surprise Index -22.90 +.8 point

- Citi Emerging Markets Economic Surprise Index .8 +.5 point

- 10-Year TIPS Spread 1.84 -2.0 basis points

Overseas Futures:

- Nikkei Futures: Indicating -28 open in Japan

- DAX Futures: Indicating +3 open in Germany

Portfolio:

- Higher: On gains in my tech/biotech/medical sector longs

- Market Exposure: 50% Net Long

Style Outperformer:

Sector Outperformers:

- 1) Semis +1.12% 2) Telecom +.51% 3) Defense +.37%

Stocks Rising on Unusual Volume:

Stocks With Unusual Call Option Activity:

- 1) TMUS 2) TASR 3) PBI 4) TIBX 5) ASHR

Stocks With Most Positive News Mentions:

- 1) TASR 2) ADI 3) BDX 4) PEP 5) BLOX

Charts:

Evening Headlines

Bloomberg:

- Japan Is Running Out of Options by William Pesek. Minutes from the central bank's Oct. 31 board meeting, at which

officials surprised the world by expanding an already massive

quantitative-easing program, show that Kuroda now has a budding mutiny

on his hands. Many of his staffers think the central bank has already

gone too far to weaken the yen and buy virtually every bond in sight.

That's a problem for Kuroda and Abe in two ways.

- Asian Stocks Rise for Fourth Day as Materials Shares Lead Gains.

Asian stocks rose, with the regional benchmark index heading for a

fourth day of gains, as materials and health-care shares advanced,

countering a decline in Japan’s Topix (TPX) index amid a stronger yen. The

MSCI Asia Pacific Index (MXAP) added 0.1 percent to 140.90 as of 9:03

a.m. in Tokyo after rising 1.1 percent the past three trading days.

Japan’s Topix slid 0.3 percent as the yen gained

0.1 percent to 117.81 per dollar after advancing 0.3 percent

yesterday.

- Oil Bust of 1986 Reminds U.S. Drillers of Price War Risks.

The last time that U.S. oil drillers got caught up in a price war

orchestrated by Saudi Arabia, it ended badly for the Americans. In

1986, the Saudis opened the spigot and sparked a four-month, 67 percent

plunge that left oil just above $10 a barrel. The U.S. industry

collapsed, triggering almost a quarter-century of production declines,

and the Saudis regained their leading

role in the world’s oil market.

- RBA’s Lowe Sees Aussie Dollar Falling With Commodity Prices. Australia’s

dollar is likely to drop in line with commodity export prices, central

bank Deputy Governor Philip Lowe said, as the currency hit a four-year

low. “If the exchange rate is to play its important stabilizing

role, it needs to go down when the terms of trade and investment are

declining,” Lowe said in a speech in Sydney late yesterday.

“We have seen some adjustment, but if our assessment of the

fundamentals is correct we would expect to see more in time."

Wall Street Journal:

Fox News:

MarketWatch.com:

- Two mini–flash crashes rock stock market Tuesday.

In two separate instances Tuesday, stocks plummeted sharply for a brief period before returning to normal. At

around roughly 10:18 a.m. Eastern, 88 stocks fell or rose by 1% or

more. Eric Hunsader, founder of Nanex LLC, pointed out the changes on

his Twitter feed.

Zero Hedge:

Business Insider:

Reuters:

Evening Recommendations

Night Trading

- Asian equity indices are unch. to +.75% on average.

- Asia Ex-Japan Investment Grade CDS Index 102.50 +.5 basis point.

- Asia Pacific Sovereign CDS Index 62.50 +.5 basis point.

- NASDAQ 100 futures +.16%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

8:30 am EST

- Durable Goods Orders for October are estimated to fall -.6% versus a -1.3% decline in September.

- Durables Ex Transports for October are estimated to rise +.5% versus a -.2% decline in September.

- Cap Goods Orders Non-Defense Ex Air for October are estimated to rise +1.0% versus a -1.7% decline in September.

- Initial Jobless Claims are estimated to fall to 288K versus 291K the prior week.

- Continuing Claims are estimated to rise to 2350K versus 2330K prior.

- Personal Income for October is estimated to rise +.4% versus a +.2% gain in September.

- Personal Spending for October is estimated to rise +.3% versus a -.2% decline in September.

- The PCE Core for October is estimated to rise +.2% versus a +.1% gain in September.

9:45 am EST

- Chicago Purchasing Manager for November is estimated to fall to 63.0 versus 66.2 in October.

9:55 am EST

- Final Univ. of Mich. Consumer Confidence for November is estimated to rise to 90.0 versus a prior estimate of 89.4.

10:00 am EST

- Pending Home Sales for October are estimated to rise +.5% versus a +.3% gain in September.

- New Home Sales for October are estimated to rise to 470K versus 467K in September.

10:30 am EST

- Bloomberg

consensus estimates call for a weekly crude oil inventory build of

+220,000 barrels versus a +2,608,000 barrel increase the prior week.

Gasoline supplies are estimated to rise by +1,363,640 barrels versus a

+1,034,000 barrel gain the prior week. Distillate supplies are estimated

to fall by -436,360 barrels versus a -2,056,000 barrel decline the

prior week. Finally, Refinery Utilization is estimated to rise by +.3%

versus a +1.1% gain prior.

Upcoming Splits

Other Potential Market Movers

- The

UK GDP report, $29B 7Y T-Note auction, weekly Bloomberg Consumer

Comfort Index and weekly MBA mortgage applications report could also

impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by metals/mining and industrial shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing mixed. The Portfolio is 50% net long heading into the day.