Bloomberg:

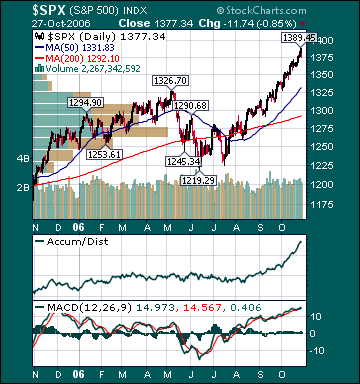

- US stocks had their biggest monthly gain of the year with the S&P 500 rising 3.2% in October, a typically weak month for equities, on strong corporate profits, falling interest rates and declining energy prices.

- President Bush accused Massachusetts Democratic Senator John Kerry of insulting US troops in Iraq and called on him to apologize. While campaigning in California yesterday for gubernatorial candidate Phil Angelides, Kerry said: “Education, if you make the most of it, you study hard, you do your homework and you make an effort to be smart, you can do well. And if you don’t, you get stuck in Iraq.” House Republican Majority Leader John Boehner of Ohio and Republican Senator John McCain of Arizona were among those who also criticized Kerry’s comments on the troops. Senator Kerry refused to apologize, saying it was “a botched joke.”

- The US needs to re-examine the Sarbanes-Oxley Act that tightened regulation of US companies, Democratic Senator Charles Schumer and NYC Republican Mayor Michael Bloomberg said in a joint editorial in the Wall Street Journal to be published tomorrow.

- Altria Group’s(MO) Philip Morris and other US cigarette makers won a delay of a court-imposed ban on the marketing of “light” cigarettes the industry claimed would cost it hundreds of millions of dollars.

- Jack Welch, former CEO of GE(GE) said he’s interested in buying the Boston Globe from the New York Times(NYT).

- China’s new sense of urgency about thwarting North Korea’s nuclear ambitions was decisive in pressuring Kim Jong Il’s government to return to multinational talks, experts and US officials said.

- R.R. Donnelley & Sons(RRD), North America’s largest printer, agreed to acquire Banta Corp. for about $1.3 billion in cash to gain sales to publishing, catalog and direct-marketing customers.

- Hedge funds are turning to a new outpost in the drive to boost sagging returns: Mongolia. Rapid economic growth, driven by copper and gold mining, is attracting investors willing to tolerate corruption and unpredictable regulation. Fund managers are taking on greater risk in small emerging markets once considered exotic as returns lag behind those of stock indices.

- The NYSE(NYX) plans to close one of its trading floor’s five rooms over the next 18 months as more shares change hands electronically.

- Romanian stocks may already be done rising in anticipation of the country’s entry into the European Union, and Bulgarian shares may be next.

Efe:

- Venezuelan trade with Cuba is expected to almost double this year to about $2.3 billion, citing an interview with Venezuela’s Integration and Foreign Trade Minister.

South China Morning Post:

- Aluminum Corp. of China(ACH) plans to cut the spot price of alumina by 15.3% effective today.

Late Buy/Sell Recommendations

Citigroup:

- Reiterated Buy on (CBG), raised target to $37.

- Upgraded (CHTR) to Buy, target $3.25.

- Reiterated Buy on (MOS), raised target to $23.

Night Trading

Asian Indices are unch. to +.75% on average.

S&P 500 indicated +.06%.

NASDAQ 100 indicated +.07%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

- (ASF)/.39

- (AGN)/.94

- (DOX)/.49

- (BEC)/.66

- (CI)/2.17

- (CNO)/.41

- (COCO)/.03

- (DVN)/1.52

- (D)/1.56

- (EDS)/.20

- (FIC)/.57

- (GRMN)/.50

- (GES)/.72

- (INSP)/-.08

- (IN)/.03

- (LVS)/.29

- (LAZ)/.46

- (MMC)/.35

- (MA)/1.07

- (MXIM)/.33

- (MYL)/.32

- (NEM)/.43

- (NBL)/1.25

- (PMTC)/.36

- (PTEN)/1.08

- (PRU)/1.48

- (REY)/.41

- (COL)/.76

- (RUTH)/.13

- (SPW)/.84

- (SUN)/2.19

- (TK)/.98

- (VCLK)/.14

- (TWX)/.20

- (TWP)/.36

- (WYN)/.54

- (ZBRA)/.33

- (WCG)/.95

Upcoming Splits

- (ACAP) 3-for-2

Economic Releases

8:15 am EST

- The ADP Employment Change for October is estimated at 108K versus 78K in September.

10:00 am EST

- Construction Spending for September is estimated to remain unchanged versus a .3% rise in August.

- The ISM Manufacturing Index for October is estimated to rise to 53.0 versus a reading of 52.9 in September.

- The ISM Prices Paid Index for October is estimated to fall to 58.0 versus a reading of 61.0 in September.

- Pending Home Sales for September are estimated to fall .9% versus a 4.3% gain in August.

10:30 am EST:

- Bloomberg consensus estimates call for a weekly crude oil build of 2,600,000 barrels versus a 3,205,000 barrel drawdown the prior week. Gasoline supplies are expected to fall 925,000 barrels versus a 2,759,000 decline the prior week. Distillate inventories are estimated to fall by 1,175,000 barrels versus a 1,418,000 decline the prior week. Finally, Refinery Utilization is expected to rise .73% versus a .10% decline the prior week.

Afternoon:

- Total Vehicle Sales for October are estimated to fall to 16.2M versus 16.6M in September.

- Domestic Vehicle Sales for October are estimated to fall to 12.6M versus 12.9M in September.

BOTTOM LINE: Asian indices are higher, boosted by commodity and technology shares in the region. I expect US equities to open modestly higher and to weaken into the afternoon, finishing mixed. The Portfolio is 75% net long heading into the day.